- FET is consolidating near $1.33 as traders see a break above $1.38.

- Activity on the chain is rising, while technical indicators and liquidations point to potential bullish momentum.

Alliance for Artificial Super Intelligence [FET] is attracting significant attention as it approaches a potential trendline break that could spark a 20-30% rally. At the time of writing, FET is trading at $1.33, reflecting a slight decline of 1.19% in the last 24 hours.

However, growing activity on the chain and strong technical indicators indicate that bullish momentum may soon take hold. Will FET live up to these expectations and organize a remarkable rally?

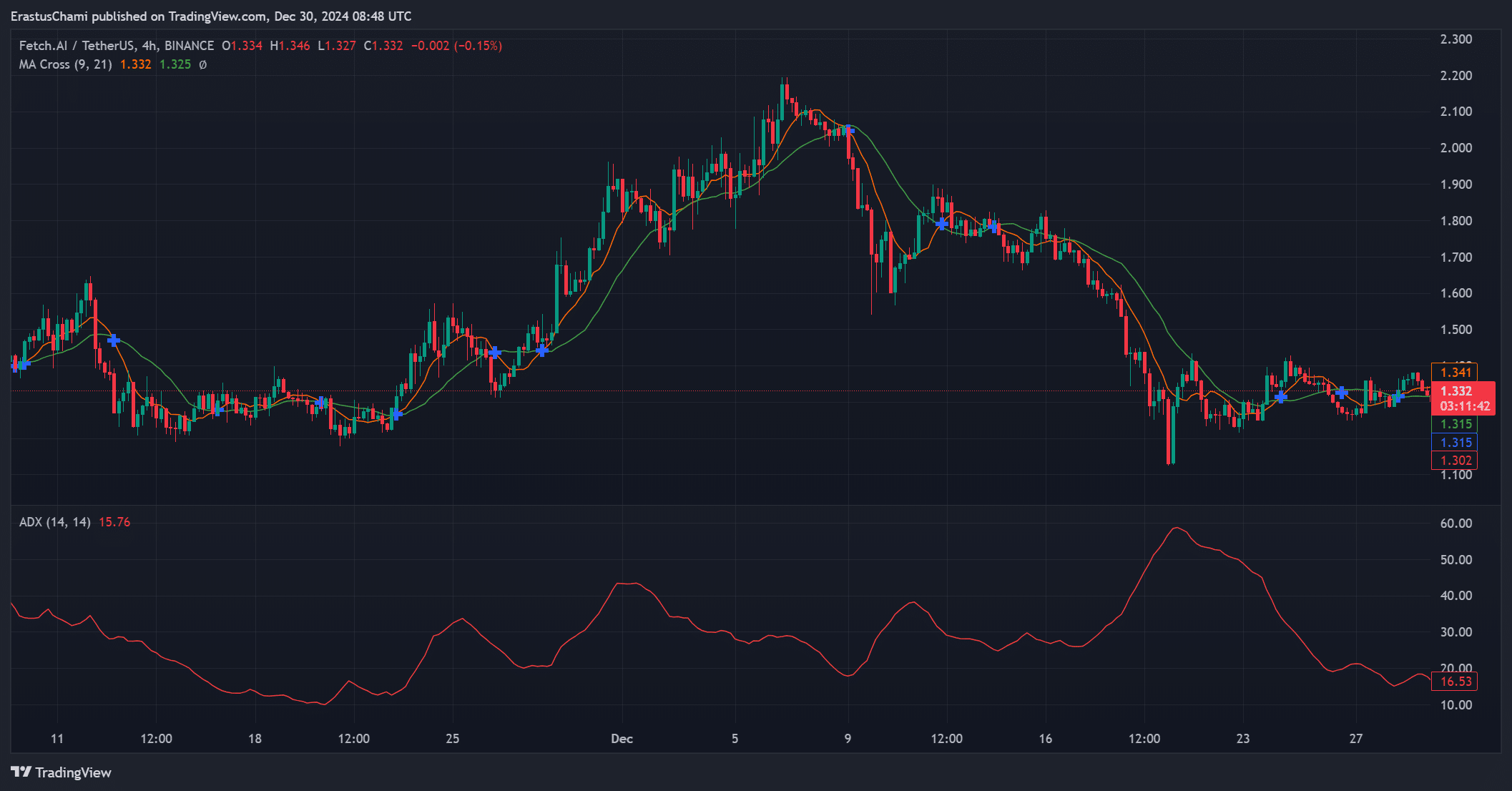

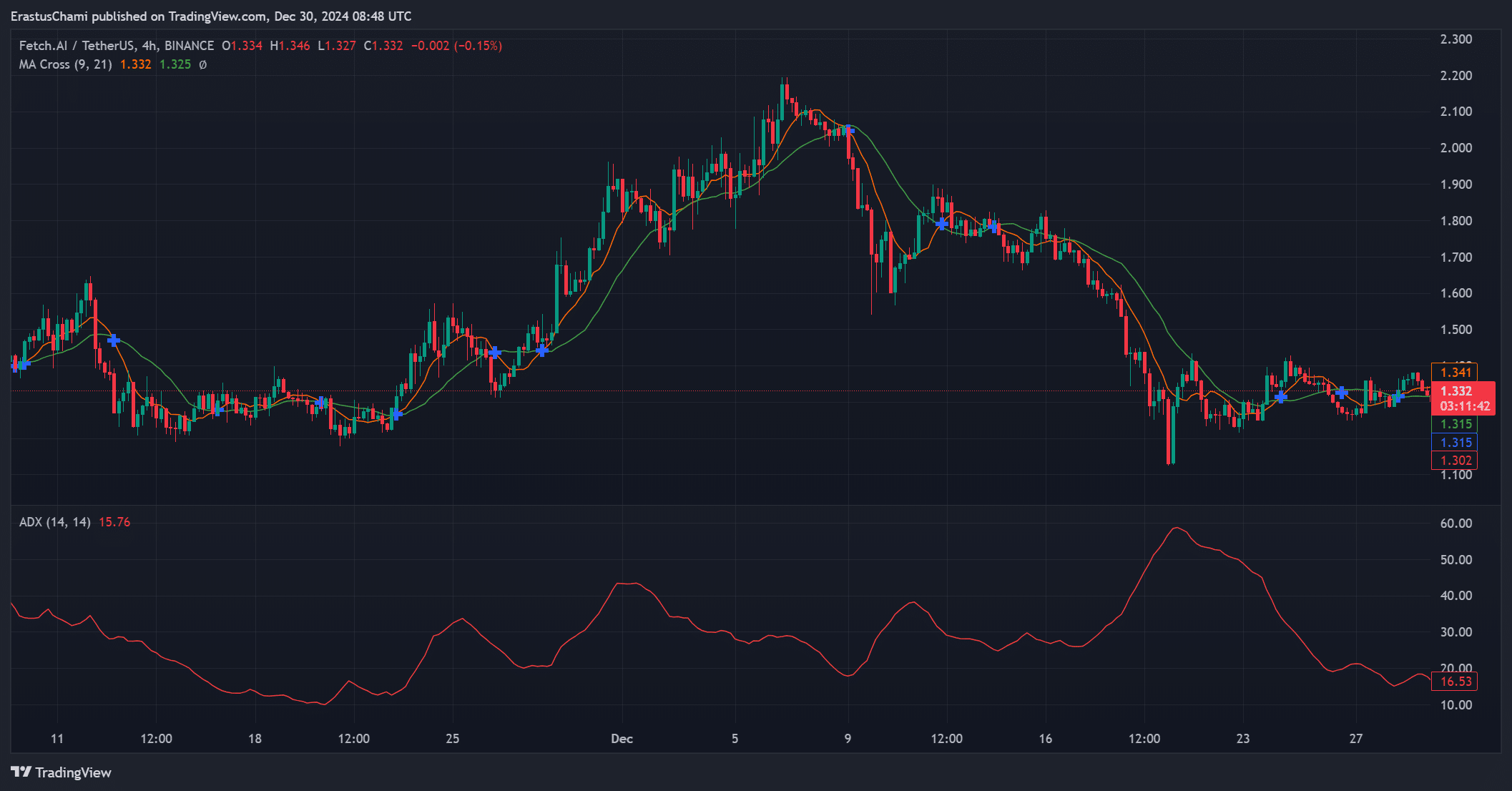

Is there a breakout above $1.38 on the horizon?

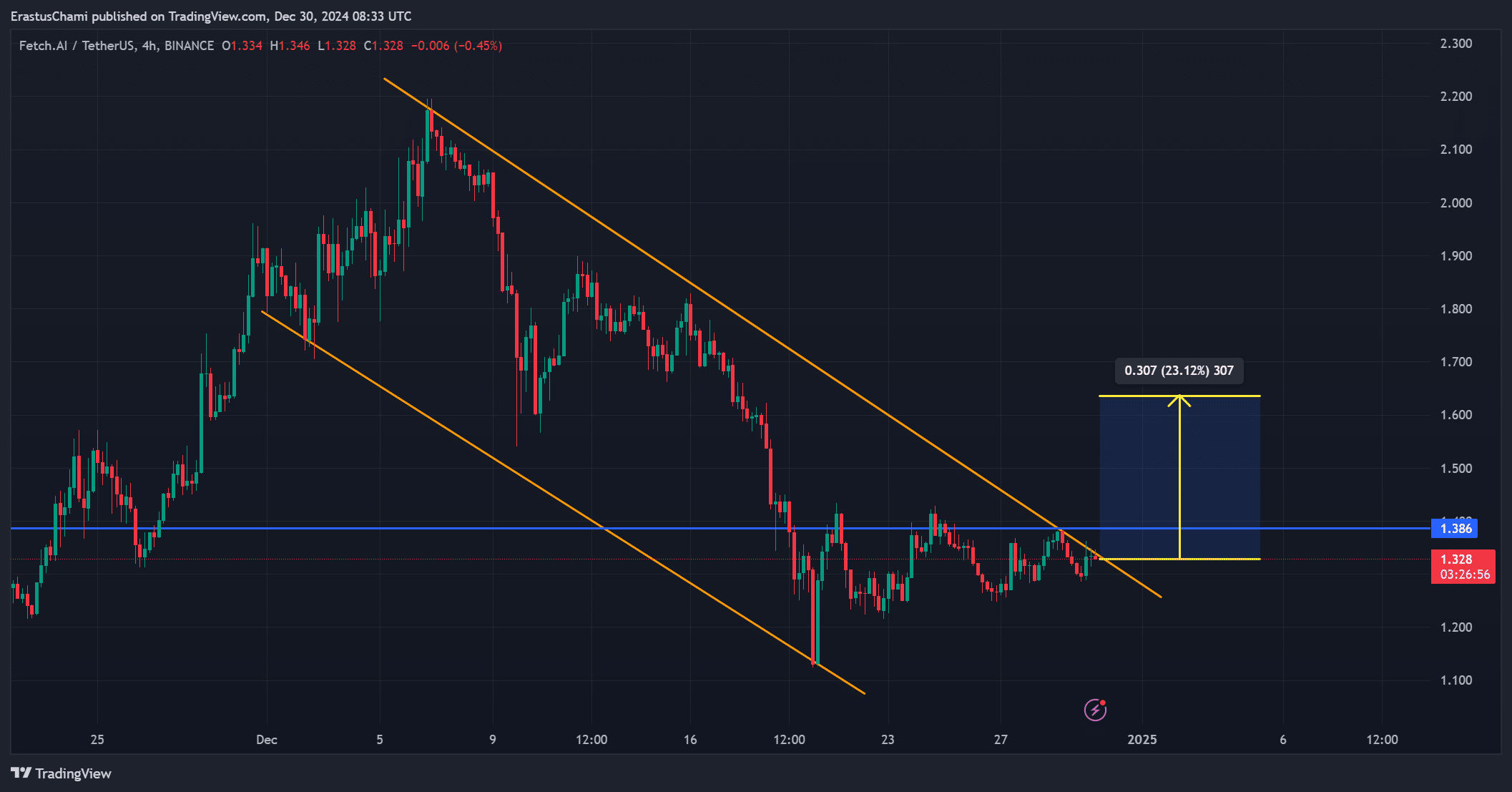

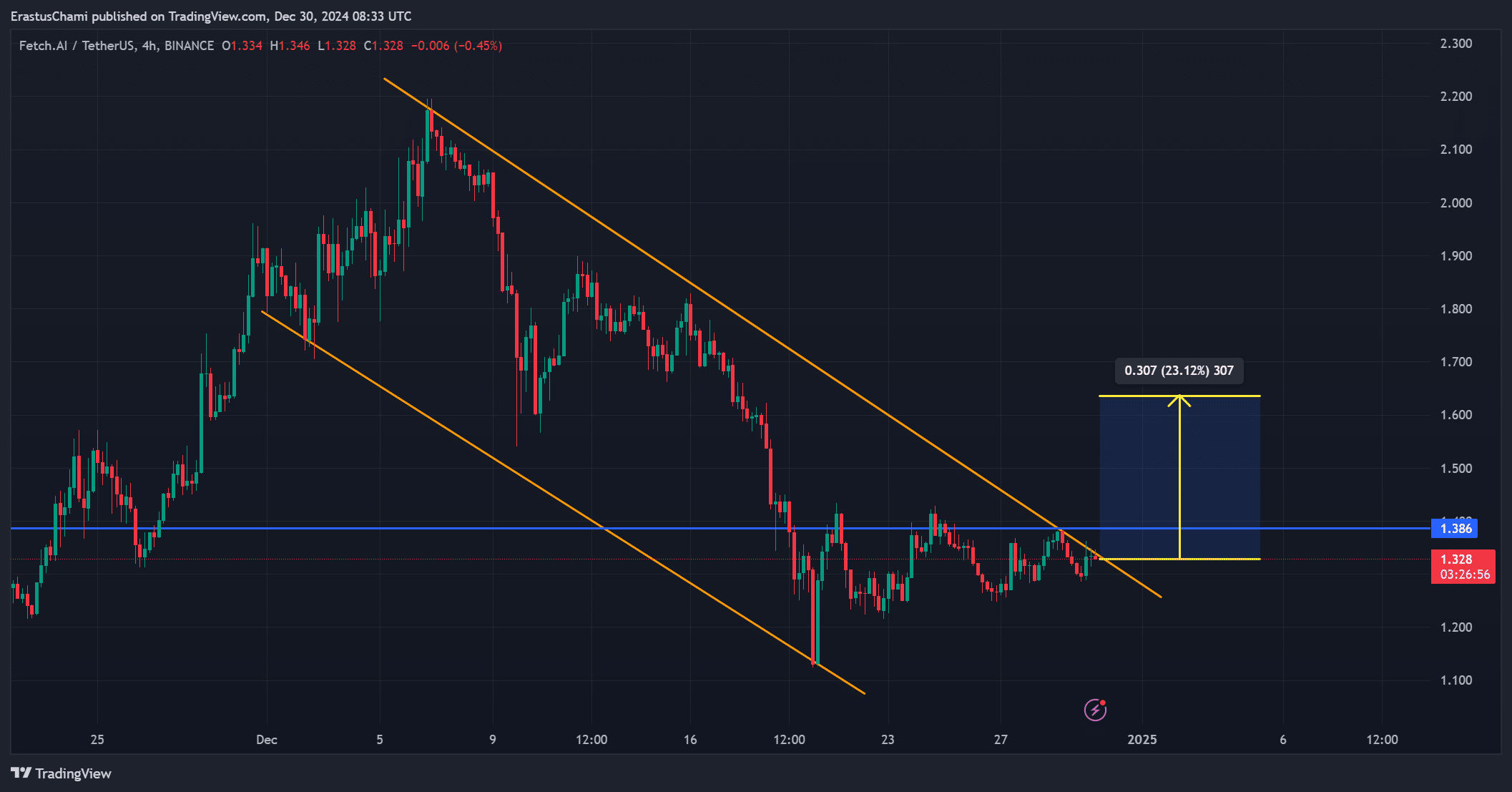

FET price is currently trading in a descending channel, with $1.38 serving as a critical resistance level for a bullish breakout.

A move past this threshold could push the price towards $1.60, which represents the expected 20-30% upside.

Historical price patterns show that FET has successfully broken out of similar setups in the past. However, sustained volume and bullish momentum are essential to confirm this scenario and generate further investor interest.

Source: TradingView

The activities in the chain show growing involvement

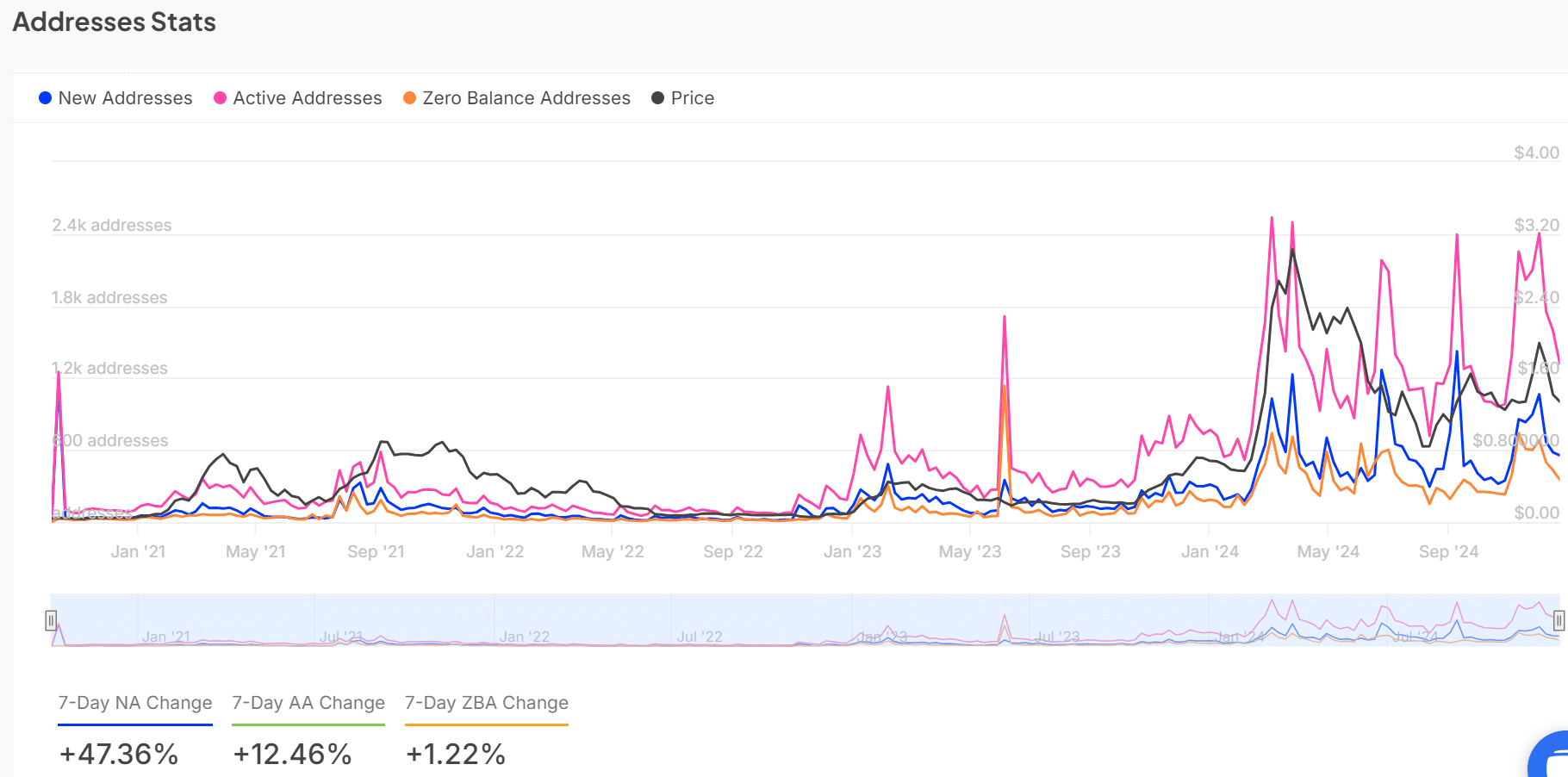

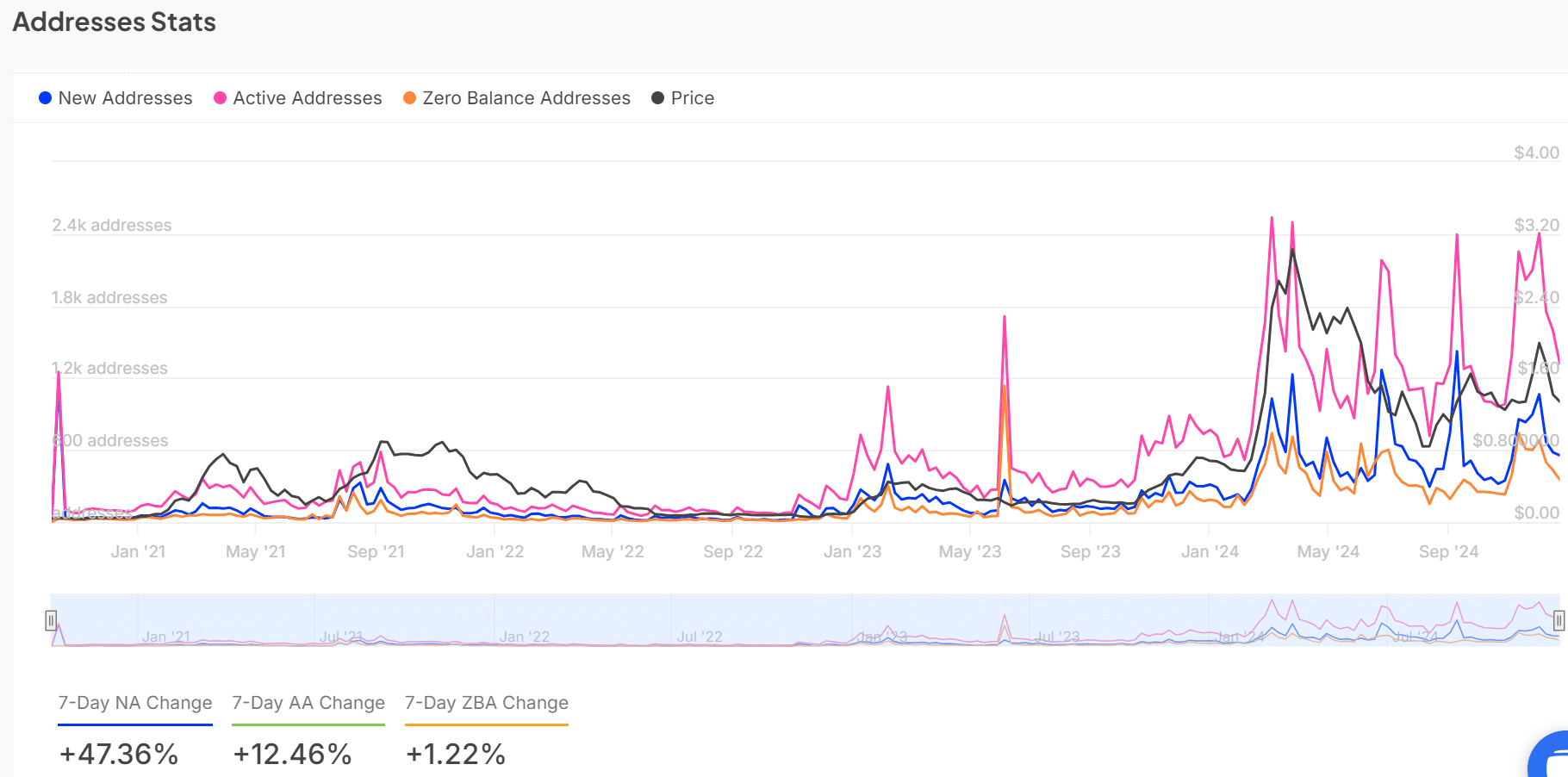

Fetch.AI is seeing an increase in network activity, with new addresses up 47.36% and active addresses up 12.46% over the past week.

These impressive numbers reflect the increased interest in FET and the growing adoption within its ecosystem.

Furthermore, this increased activity signals investor confidence, which often precedes significant price movements.

Source: IntoTheBlock

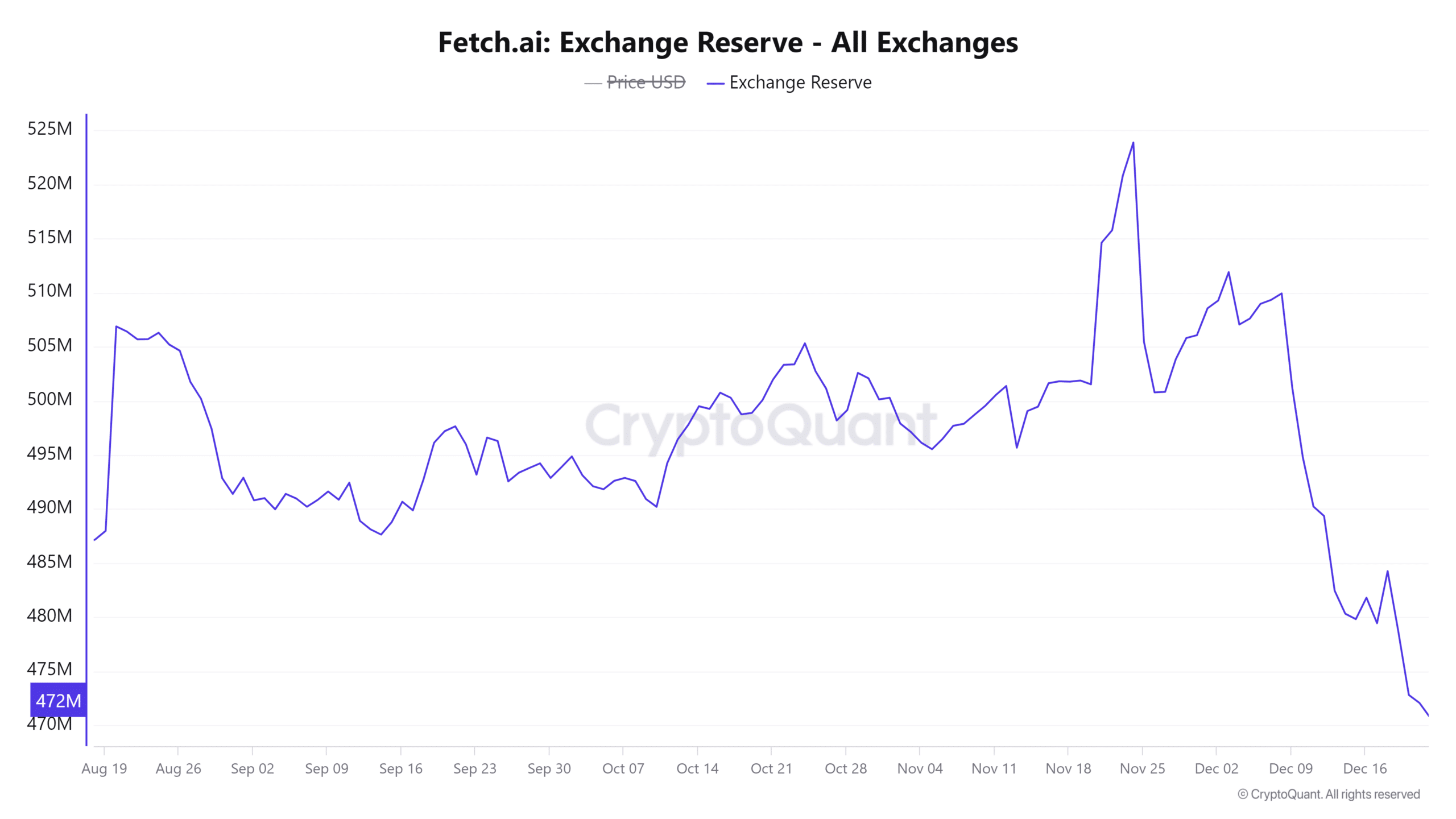

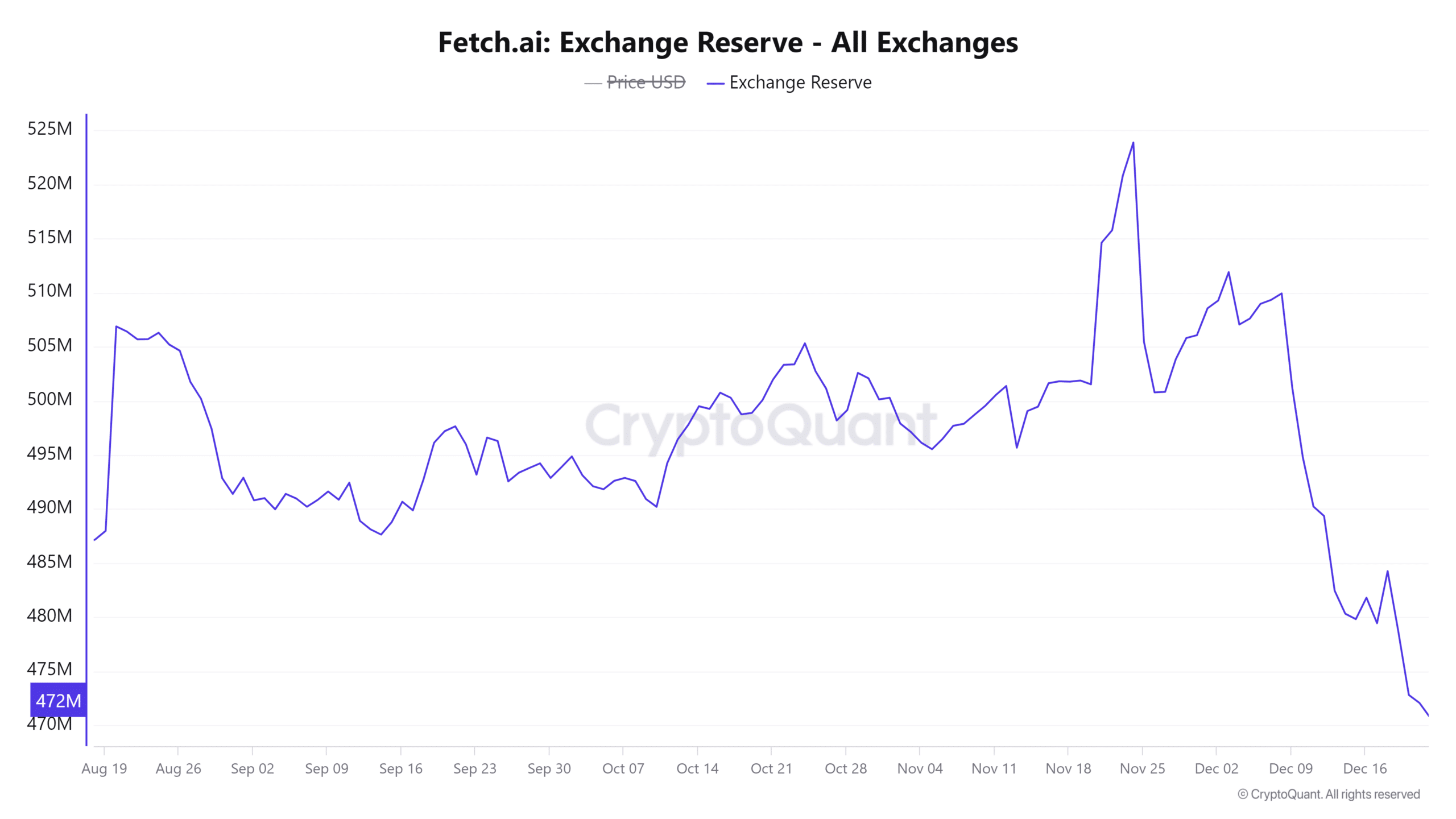

How currency reserves signal market sentiment

Currency reserves rose slightly by 0.12% to 471.4 million FET, indicating that traders are cautiously holding coins on exchanges.

However, a shift to lower reserves could indicate accumulation, creating upward price pressure.

Therefore, keeping a close eye on this measure is crucial for identifying sentiment changes and potential bullish signals.

Source: CryptoQuant

FET technical indicators indicate possible momentum

Technical indicators for FET paint a mixed picture. The moving average (MA) is crossing a possible upward trajectory, adding to the bullish hope.

However, the Average Directional Index (ADX) of 15.76 indicates weak trend strength, requiring confirmation from price action and volume. This makes traders eagerly await stronger signals.

Source: TradingView

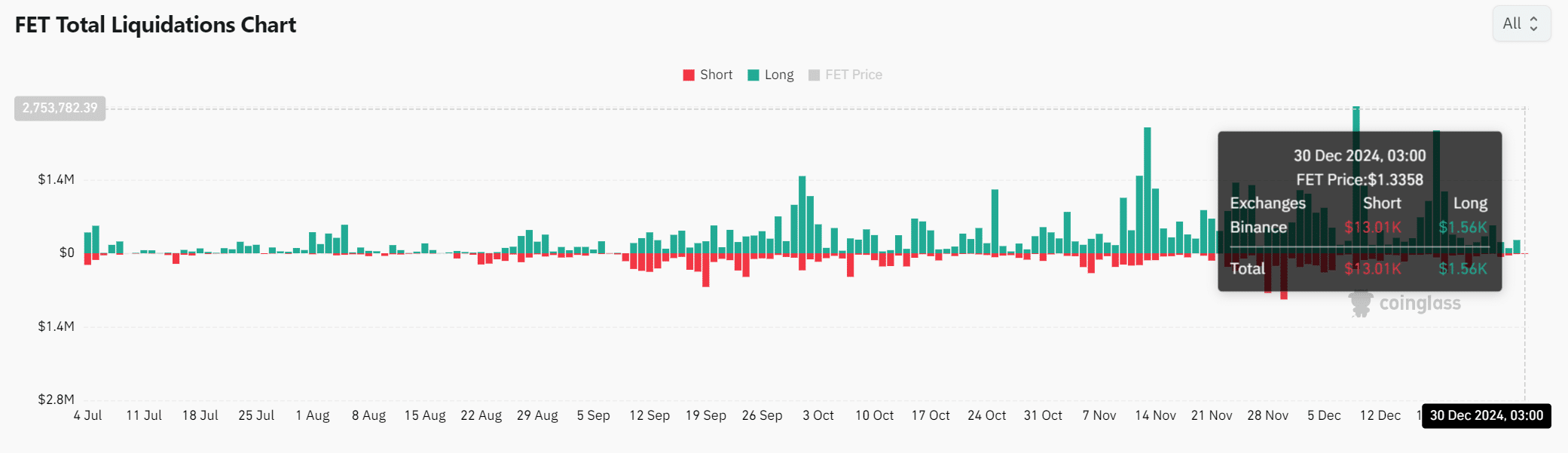

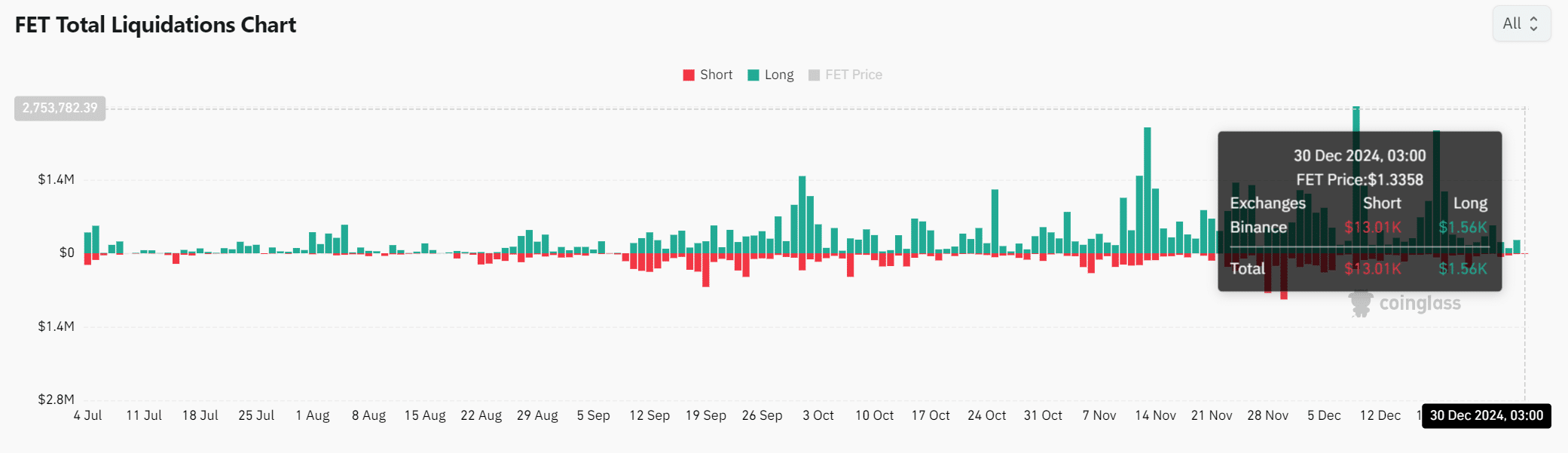

Liquidations could fuel bullish momentum

Liquidation data shows $13K in short liquidations compared to $1.56K in longs, highlighting bearish dominance in the short term.

HHowever, a breakout above $1.38 could lead to significant short liquidations, potentially leading to a sharp price increase. Such a scenario could reinforce bullish sentiment and create substantial upside momentum.

Source: Coinglass

Read Artificial Superintelligence Alliance [FET] Price forecast 2024-25

Fetch.AI has all the elements in place for a 20-30% rally if it breaks above the $1.38 resistance level.

Increasing network activity, favorable technical signals and potential liquidations indicate a strong bullish setup. Therefore, FET seems poised to deliver on its rally expectations in the near future.