This article is available in Spanish.

The Fed’s interest rate cuts have boosted Bitcoin investor confidence, with whales purchasing up to 1.6 billion BTC since the macro decision. With such a bullish outlook, there is a possibility that the flagship crypto could soon reaching $70,000.

Fed rate cuts spark buying frenzy among Bitcoin whales

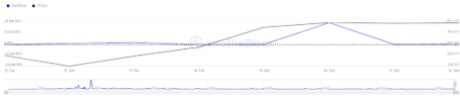

The Fed’s interest rate cuts have led to a buying wave Bitcoin whales. These investors bought more than 1.6 billion worth of Bitcoin after the September 18 macro decision. Data from the market information platform InTheBlok shows that these whales have purchased 25,510 BTC since September 19.

Related reading

This accumulation trend is not surprising as the 50 basis point rate cut has provided a bullish outlook for risky assets including Bitcoin. The flagship crypto is expected to see a significant price increase as more liquidity flows into its ecosystem as investors gain access to more money following the Federal Reserve’s quantitative easing (QE).

With Bitcoin expected to make massive upside moves, a rise to $70,000 is possible soon enough. Already the flagship crypto reversed the $60,000 price level as support after the Fed’s interest rate cuts and remains well above that level. As expected, more liquidity is already flowing into the BTC ecosystem, as evidenced by the $1.6 billion purchase by these whales.

Therefore, it should not take long enough for the crypto to reach the $70,000 price level. It is important that Bitcoin reaches this level because it could pave the way for BTC to reach a point new all-time record (ATH). The $70,000 price level has acted as strong resistance since the crypto fell below this level after rising to its current ATH of $73,000 earlier in March.

However, Bitcoin could easily break above this resistance this time as it has more bullish momentum thanks to the Fed’s rate cuts.

History could repeat itself

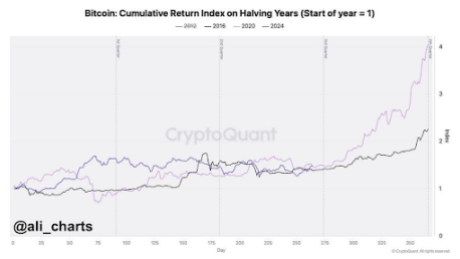

In addition to the Fed’s rate cuts, Bitcoin’s historical trend provides a bullish outlook for the flagship crypto and suggests a rise to $70,000 should happen soon enough. Crypto analyst Ali Martinez recently noted that Bitcoin saw a 61% and 171% price increase in 2016 and 2020, respectively. These years were both halving of years.

Related reading

The analyst further revealed that Bitcoin’s price action this year is reflective of 2016 and 2020. As such, history could repeat itself, and the flagship crypto could see gains on par with previous years.

Moreover, Q4 of every year Historically, this is the time when Bitcoin achieves the greatest returns. Therefore, BTC should see significant price gains in the last quarter of this year. In the meantime, the rally after the halving is also imminent, which could give rise to this price increase to $70,000.

At the time of writing, Bitcoin is trading around $63,900, up more than 1% in the past 24 hours. facts from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com