As the US heads into the next election year, crypto concerns are starting to filter into mainstream US politics – particularly the terrifying prospect of a US central bank digital currency (CBDC).

American politicians such as Ted Cruz, Tom Emmer, Robert F. Kennedy Jr. and Ron DeSantis have all suggested, explicitly or through proposed legislation, that the Federal Reserve System should be stopped from developing, issuing, or even researching CBDCs as a drug. matter of policy. The implication, reinforced by voices on social media, is that the Federal Reserve is actively working to develop a CBDC as a tool for state control.

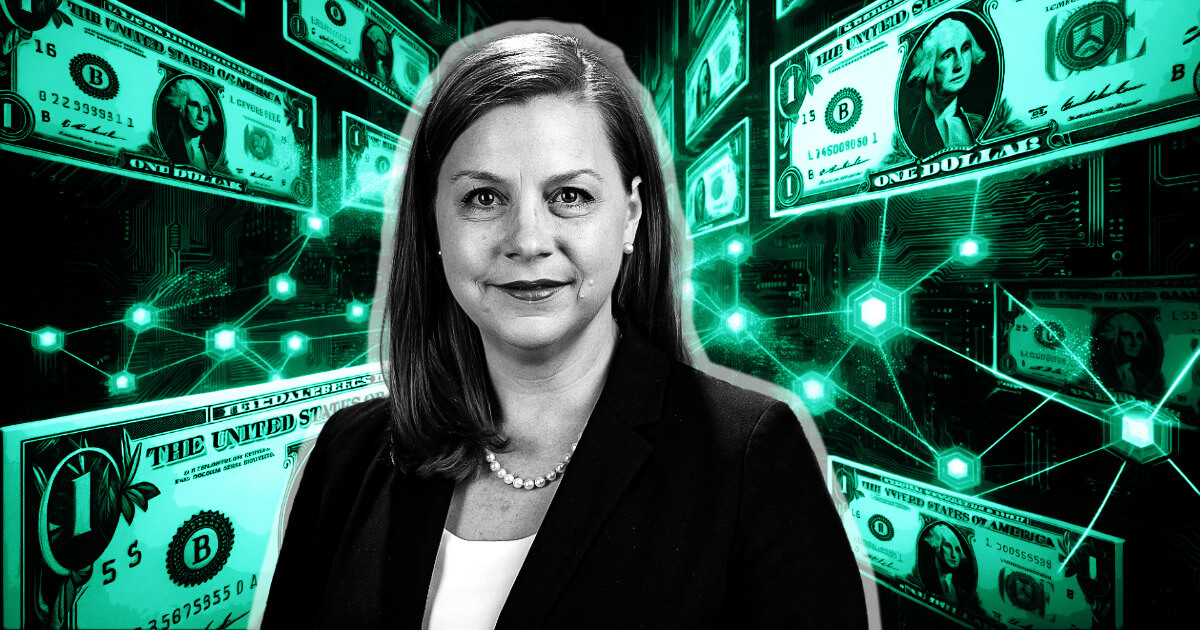

However, the documented reality shows that the Fed is anything but enthusiastic about introducing CBDCs into the US monetary system. During a roundtable discussion in Washington, DC this morning, Fed Governor Michell Bowman reiterated the Fed’s reluctance to embrace CBDC technology and criticized its ability to solve real problems in global finance.

Not a convincing argument

Bowman’s speech focused on the continued interest in digital assets, including crypto assets, stablecoins, CBDCs and programmable payment platforms. She specifically criticized the idea of a US CBDC, questioning whether it could solve financial problems more effectively or efficiently than existing solutions.

Governor Bowman emphasized the importance of responsible innovation in money and payments and underscored the need to address friction within the payments system, promote financial inclusion and provide the public with access to secure central bank money. However, she is not convinced that a central bank digital currency is suitable for this task, saying:

These are all important issues. I have yet to see a compelling argument that a US CBDC could solve all of these problems more effectively or efficiently than alternatives, or with less downside risks to consumers and to the economy.

She further noted that the U.S. payments system continues to evolve with innovations such as FedNow, the Federal Reserve’s new interbank system for instant payments. This system allows participating banks, businesses and consumers to make and receive instant payments, with funds immediately available at all times.

Governor Bowman also emphasized that the introduction of a CBDC could pose significant risks and trade-offs to the financial system, including significant consumer privacy concerns. She argued that the U.S. banking model, in which commercial banks provide credit to consumers and institutions while simultaneously managing reserves through the Federal Reserve System, would be the most appropriate model for future financial innovation. A CBDC could disrupt this system, potentially harming consumers and businesses while posing broader risks to financial stability.

The Fed and the Web3

The Federal Reserve’s active involvement in the nuances of the crypto asset landscape, including innovations like stablecoins, CBDCs, DeFi, and tokenization, not only shows that it takes the industry seriously, but that it shares some of the same concerns.

However, it does not mean that the Fed is heading for digital dollar dominance. While the idea of an impending US CBDC is troubling in theory, it has become the subject of largely unfounded concerns, not least because it simply would not be in the interest of the Fed – or even that of the United States. may be able to do this.

As market participants, commentators, advocates, lobbyists, and politicians continue to work their way toward a workable, comprehensive crypto policy framework, it is important to remember that our collective focus should be on constructive dialogue and collaboration rather than sowing seeds of unfounded fear and uncertainty. , and doubt.

The post in which Fed Governor Michelle Bowman expresses the central bank’s skepticism toward CBDCs first appeared on CryptoSlate.