According to the latest survey from the Financial Conduct Authority (FCA), published on November 26, ownership of cryptocurrencies in Britain has increased to 12% of adults, up from 10%. Awareness about cryptocurrencies also grew, reaching 93% of the adult population.

The FCA’s research found that the average value of crypto holdings per person rose from £1,595 to £1,842. Family and friends emerged as the most common source of information for those who have never purchased digital assets, while only one in ten buyers admitted to not doing any research before investing.

Around a third of respondents believed that if they had any problems they could complain to the FCA and seek redress or financial protection. However, digital assets remain largely unregulated in Britain and are considered high risk; investors are warned that they could lose all their money without any legal guarantee.

FCA crypto approach hinders progress

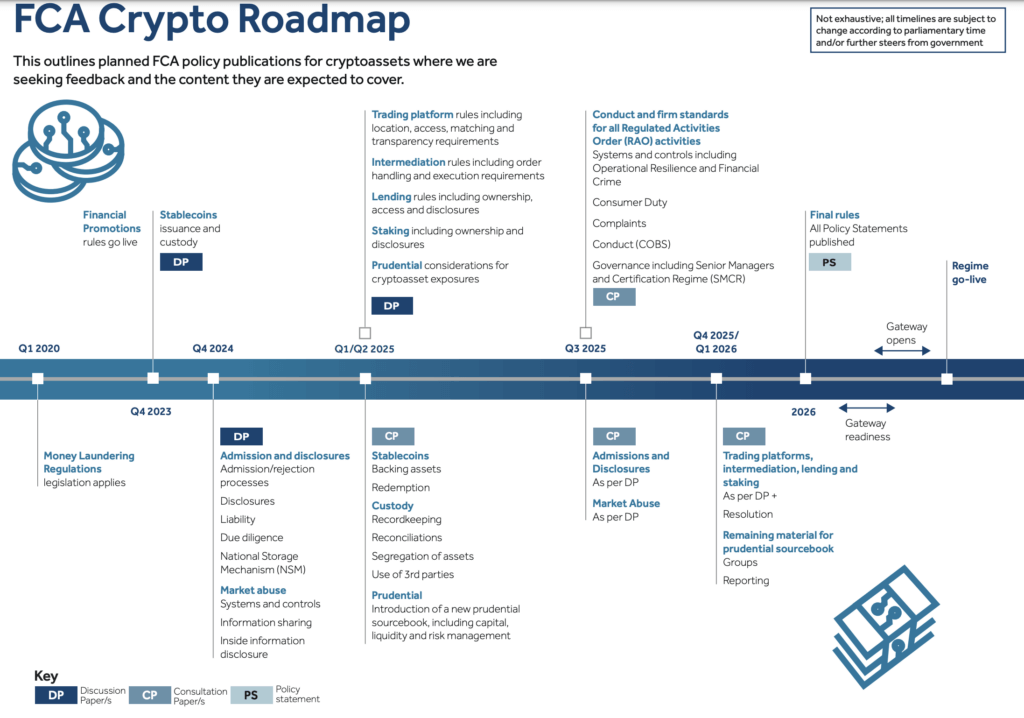

The FCA has started to set out its approach to regulating digital assets and has published an indicative roadmap setting out key dates for the development and introduction of the UK crypto regulatory regime. The roadmap sets out a series of targeted consultations aimed at promoting transparency and involvement in policy development.

Arun Srivastava, fintech and regulatory partner at Paul Hastings, says CryptoSlate

“The UK was in danger of becoming an outlier, with the EU’s MiCA regulations coming into full effect at the end of this year and the change in US administration heralding a fresh and crypto-friendly approach in the US.

The new rules will materially change the current regulatory framework in Britain, which operates under anti-money laundering legislation targeting financial crime.”

The research also points to shifts in consumer behavior. More and more people are considering crypto as part of a broader investment portfolio, with the influence of friends and family cited as the main reason for purchase by 20% of participants. Using long-term savings to buy crypto has risen from 19% in 2022 to 26% in 2024, while buying with credit cards or overdrafts has risen from 6% to 14% over the same period.

The FCA’s analysis shows that recent events have impacted consumer demand for digital assets, including the 2022 crypto market crash, the cost of living crisis, criminal charges against CEOs of major exchanges and rising crypto valuations since end of 2023.

It is striking that 26% of non-crypto users indicated that they would be more likely to invest if the market and activities were regulated. The FCA recognizes that regulation can influence consumer behavior and considers how to mitigate the risks associated with digital assets through its policy work.

FCA crypto roadmap by 2026

According to the FCA’s roadmap, the planned regulatory framework for digital assets includes multiple phases, ranging from 2023 to 2026. Key milestones include implementing financial promotion rules, regulating the issuance and custody of stablecoins, introducing prudential standards and establishing comprehensive rules for trading platforms, intermediation and lending. , and turn it off.

Matthew Long, director of payments and digital assets at the FCA, said:

“Our research findings highlight the need for clear regulations that support a secure, competitive and sustainable crypto sector in the UK. We want to develop a sector that embraces innovation and is underpinned by market integrity and consumer trust.”

Due to changes in the law, the FCA has been responsible for regulating the promotion of digital assets since October 2023. In the first year under this regime, the FCA has issued 1,702 warnings, taken down more than 900 fraudulent crypto websites and removed more than 50 apps to combat illegal cryptocurrencies. promotions aimed at British consumers.