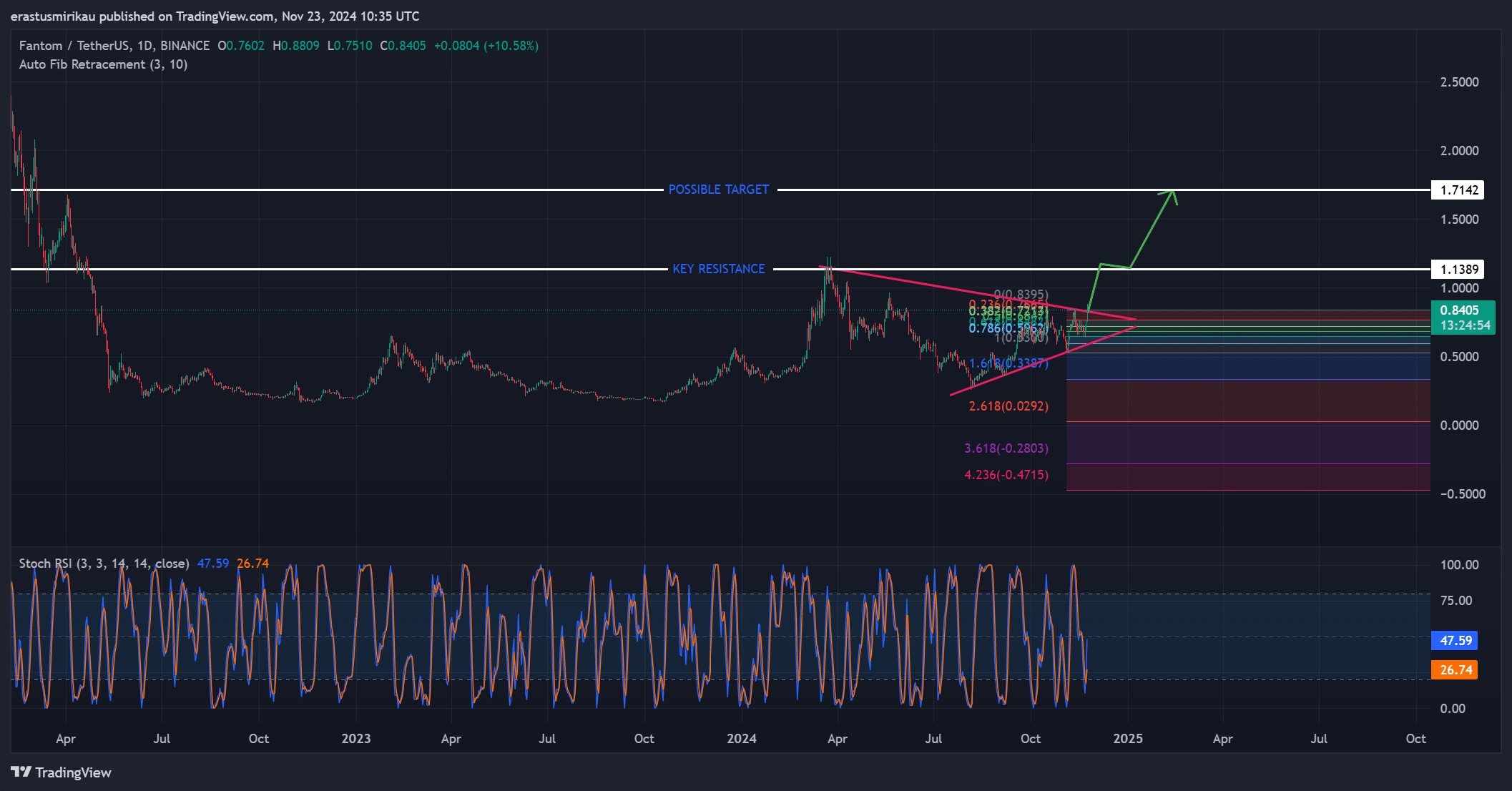

- Fantom’s breakout from the consolidation was in line with bullish technical indicators, targeting $1.14 and $1.71.

- On-chain metrics and a $9 billion TVL milestone boosted investor confidence in sustainable growth.

Phantom [FTM] is making waves in the crypto market and is up over 20% in the last 24 hours to trade at $0.8563 at the time of writing.

This breakout follows weeks of consolidation, fueling speculation that FTM is gearing up for a significant rally.

With key resistance and technical signals aligned, could Fantom be heading towards its next target of $1.71?

A bullish rally is taking shape

Fantom has successfully broken the descending triangle pattern, a classic bullish structure that often precedes a strong upward move.

As a result, the price has risen past previous resistance zones, highlighting renewed buying interest.

The immediate focus now shifts to the $1.14 resistance level, which could act as a pivotal point for FTM’s trajectory.

If this level is breached, Fantom could rise further towards $1.71, a price last seen during previous bullish cycles.

Moreover, the Fibonacci retracement levels provided further validation of the uptrend. FTM comfortably climbed past the 0.618 retracement level, a strong bullish indicator.

Moreover, the Stochastic RSI indicated that Fantom still has room to rise as its momentum remained intact and has not yet reached overbought territory.

However, traders should remain cautious near resistance levels, where profit-taking could temporarily halt the rally.

Source: TradingView

Fantom TVL milestone increases confidence

FTM’s bullish sentiment was also driven by the rising Total Value Locked (TVL), which recently surpassed $9 billion.

This increase in TVL highlighted the growing activity and confidence in Fantom’s ecosystem, especially within decentralized finance (DeFi) platforms.

Therefore, this milestone reinforces the story of long-term growth potential for FTM.

Source: DeFiLlama

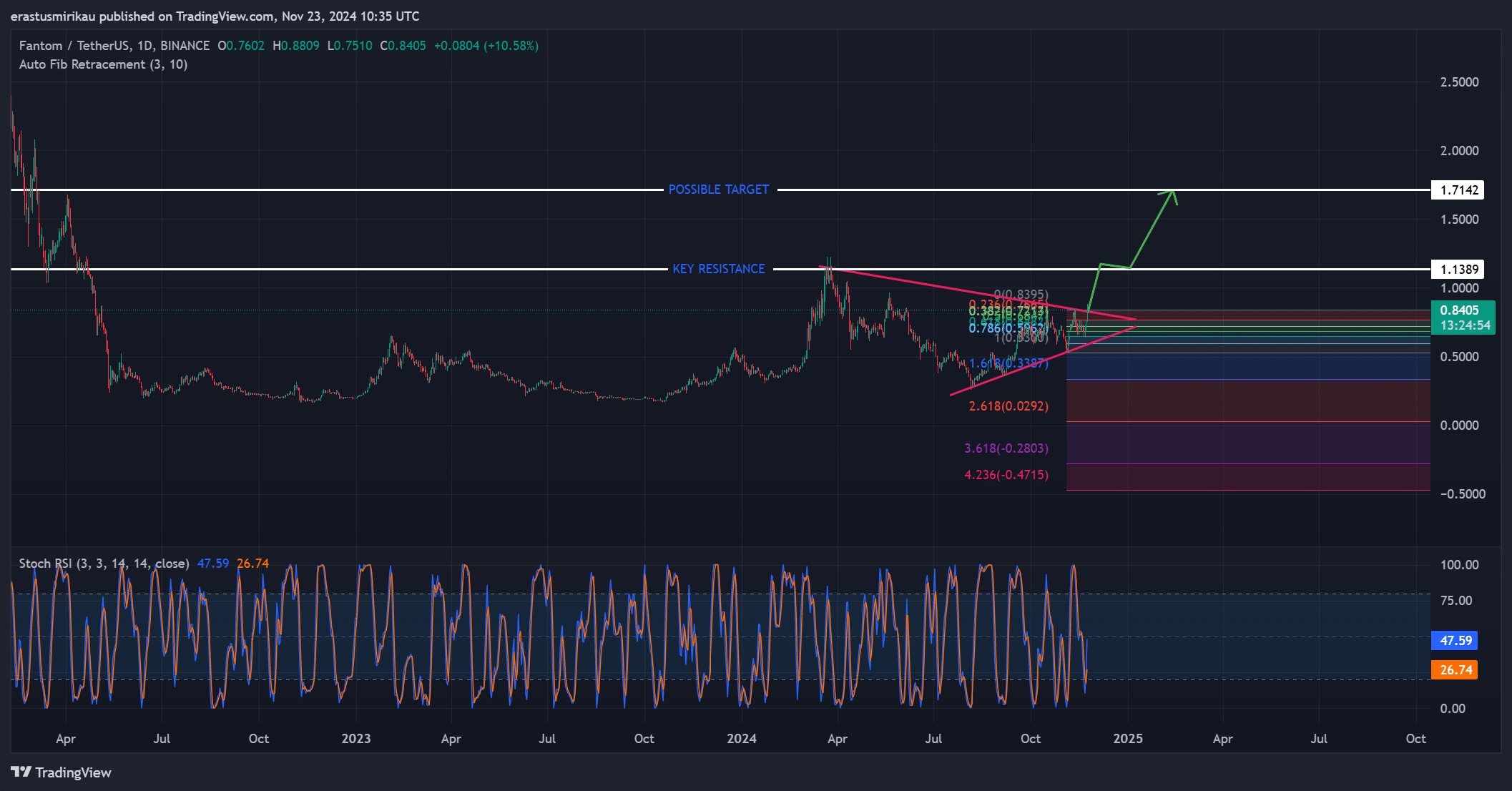

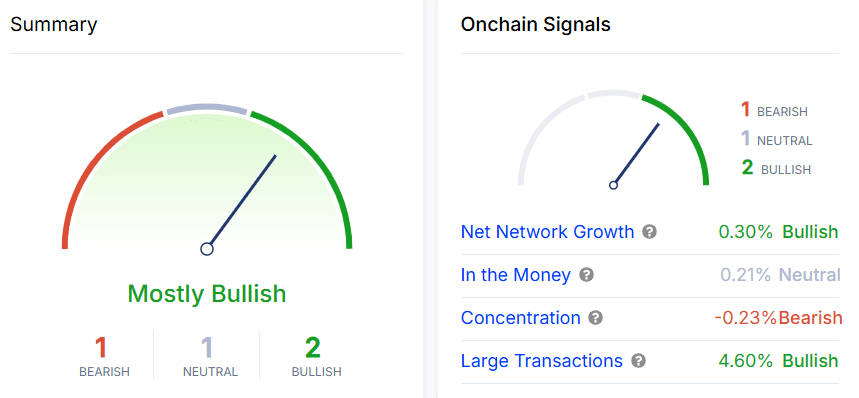

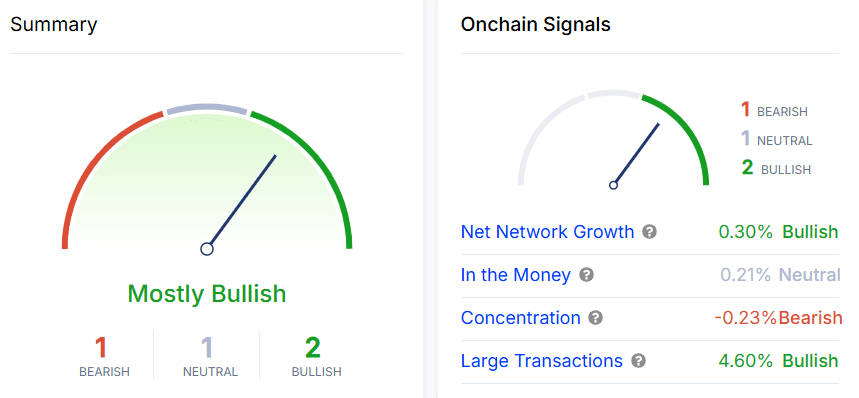

FTM’s on-chain activity indicated optimism

On-chain metrics further strengthened Fantom’s positive outlook. For example, net network growth has increased slightly, indicating gradual adoption. In addition, large transactions increased by 4.6%.

This indicated that institutional players or whales are engaging with the network.

While the concentration metric shows mild bearish activity, this is offset by the strong positive signals overall.

Source: IntoTheBlock

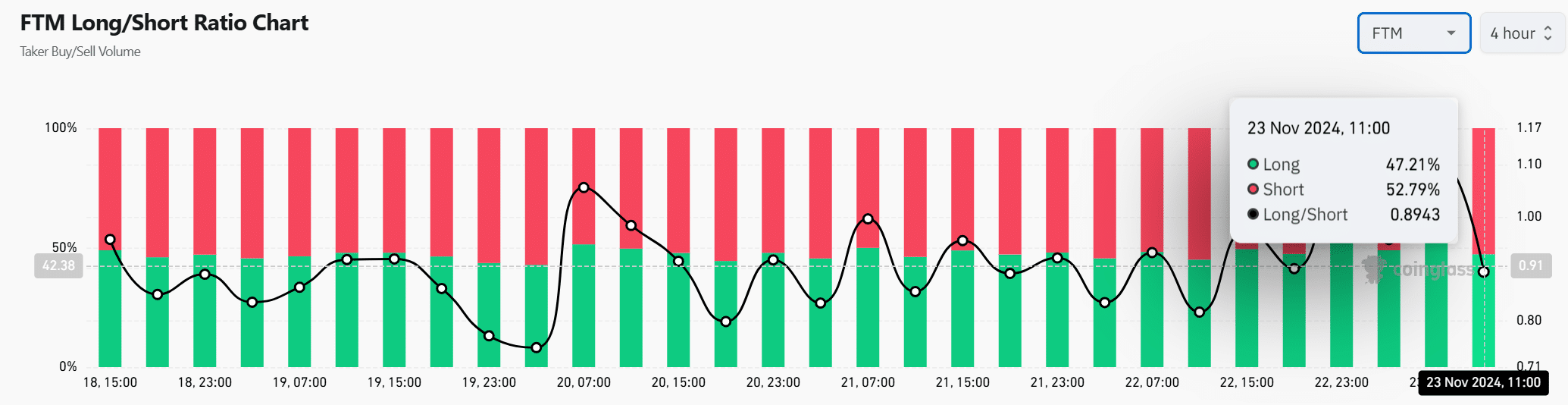

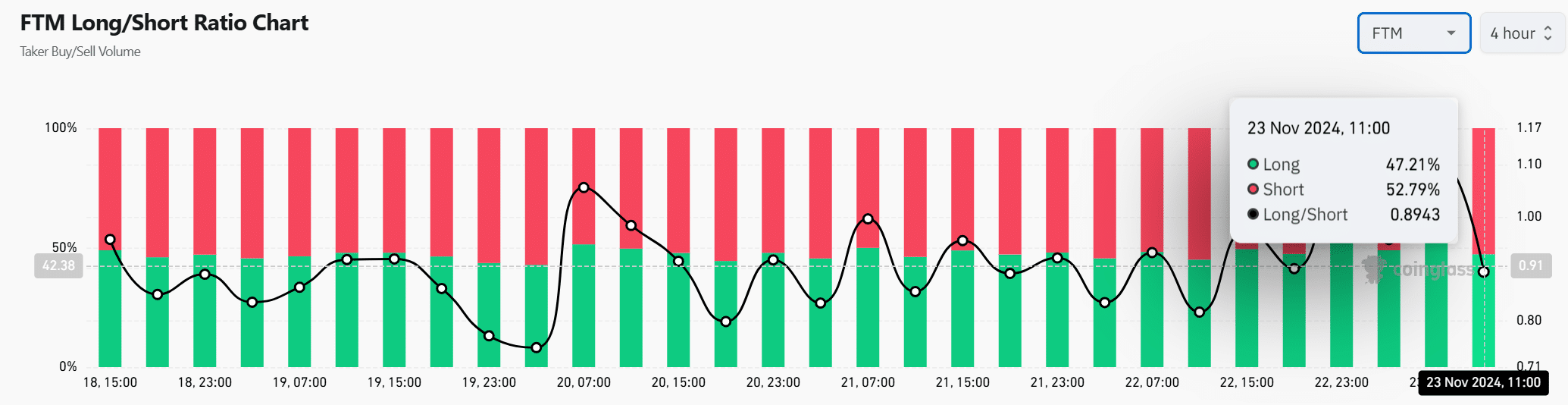

The Long/Short ratio shows mixed sentiment

Interestingly, the Long/Short ratio for Fantom showed a cautious market. While 52.79% of positions are short, long traders still account for 47.21%, reflecting a delicate balance.

Consequently, volatility could increase near resistance levels as opposing strategies collide.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024-25

CFTM likely to reach $1.71 if…

Fantom’s breakout momentum, coupled with bullish on-chain activity and technical signals, indicates a strong possibility of further gains.

If FTM finally breaks through $1.14, a rally to $1.71 seems feasible. However, traders should keep a close eye on the price action as resistance levels are tested.