- FTM price rose 85% after a successful reversal from the $0.64 support level

- Statistics pointed to a short-term correction before a possible rally to $1.68

Fantom (FTM) has experienced a strong bullish run after breaking a key bullish pennant pattern on the weekly chart. In fact, after recovering from the pennant’s support level at $0.64, FTM recorded an impressive 85% increase in price at the time of writing.

This rally also pushed the altcoin past its critical weekly resistance level of $1.08 – a sign of growing market confidence.

Source: TradingView

FTM breaks barriers on the daily chart

On the daily chart, FTM extended its gains by breaking the recent resistance level at $1.20.

Immediate resistance beyond that is now at the weekly resistance level of $1.68. This target is a critical zone for further gains given the recent momentum in the broader market.

Source: TradingView

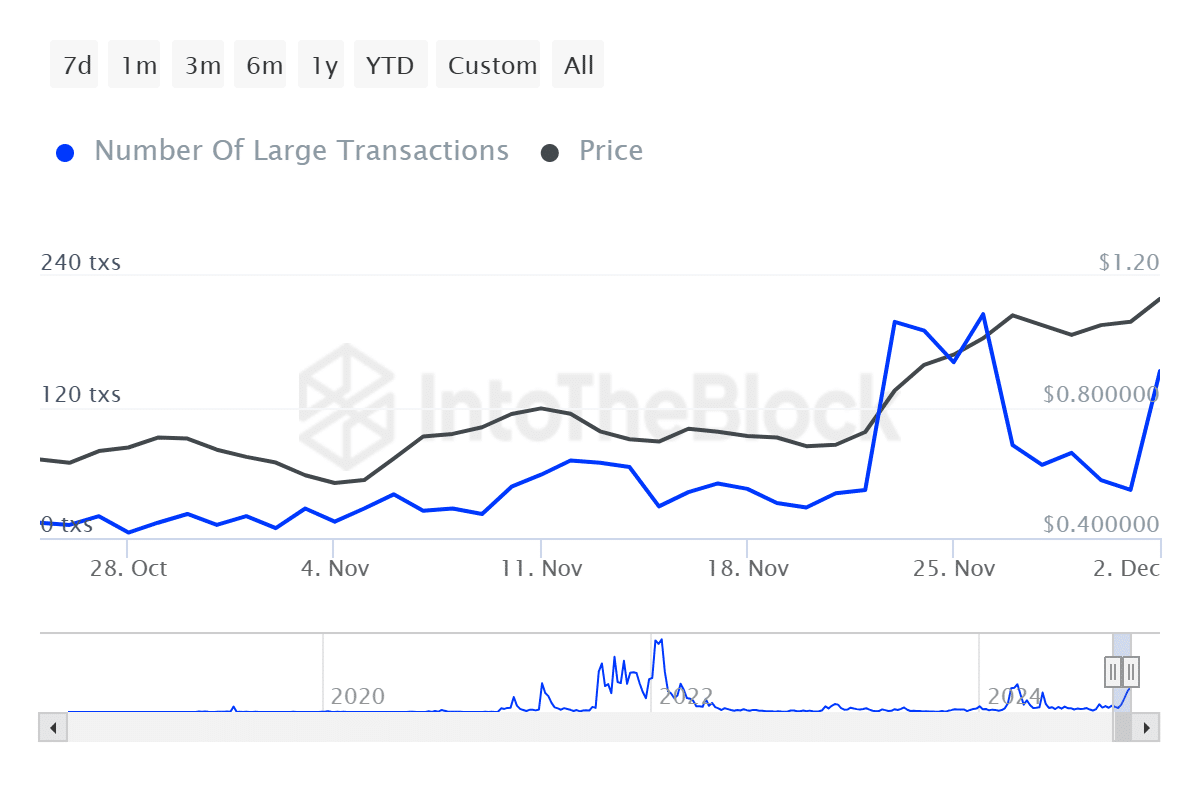

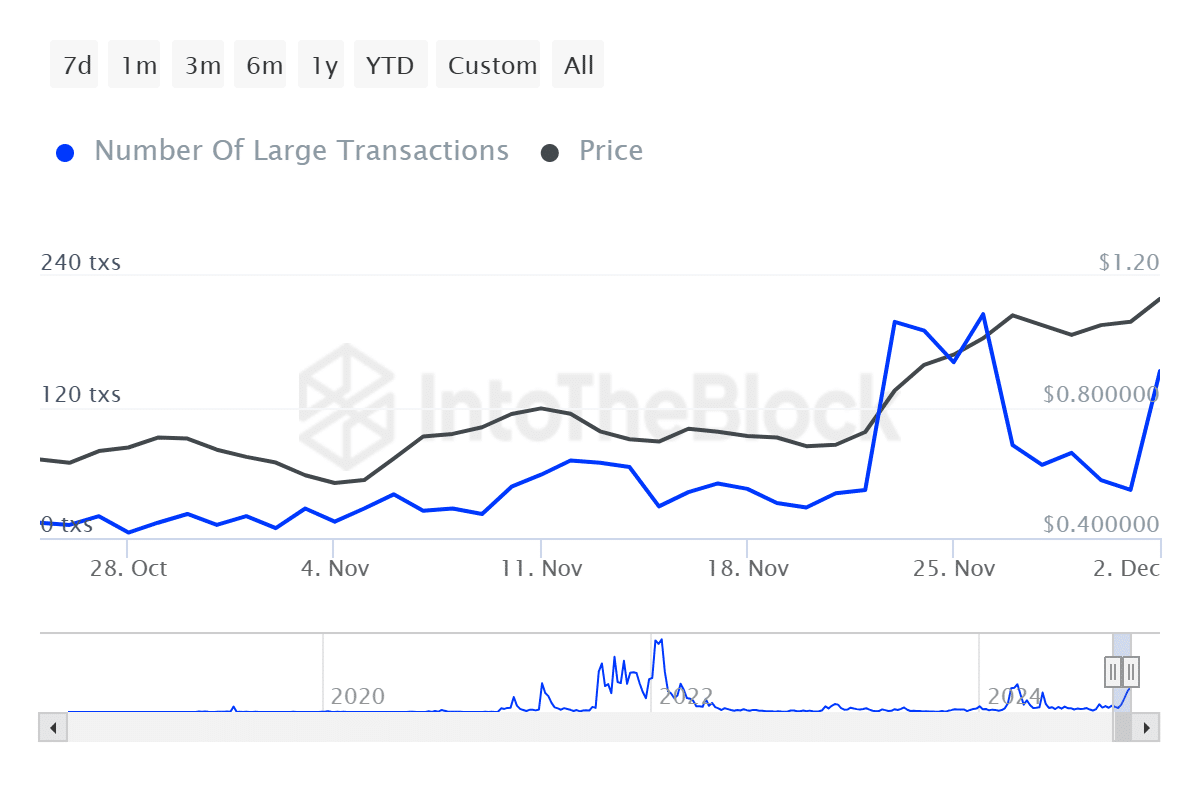

FTM whales make moves as currency outflows slow

Fantom’s meeting coincided with an increase in whale activity. According to data from IntoTheBlock, large transactions have increased by 500% in the past 24 hours – a sign of growing interest from wealthy investors.

Source: IntoTheBlock

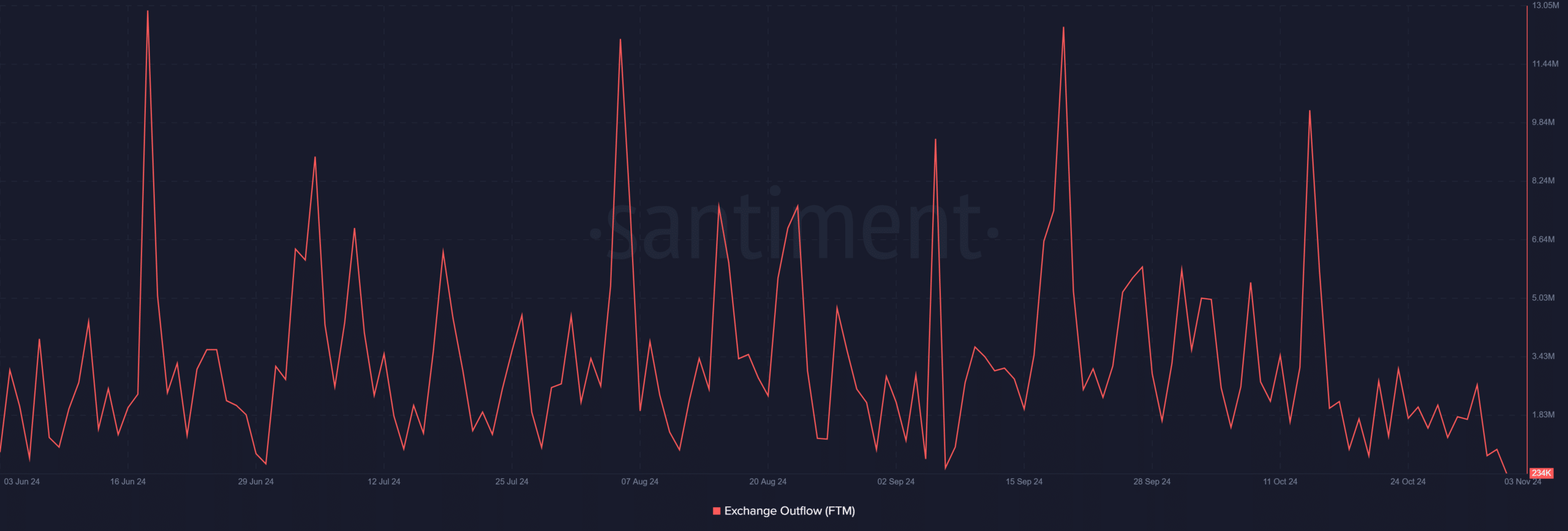

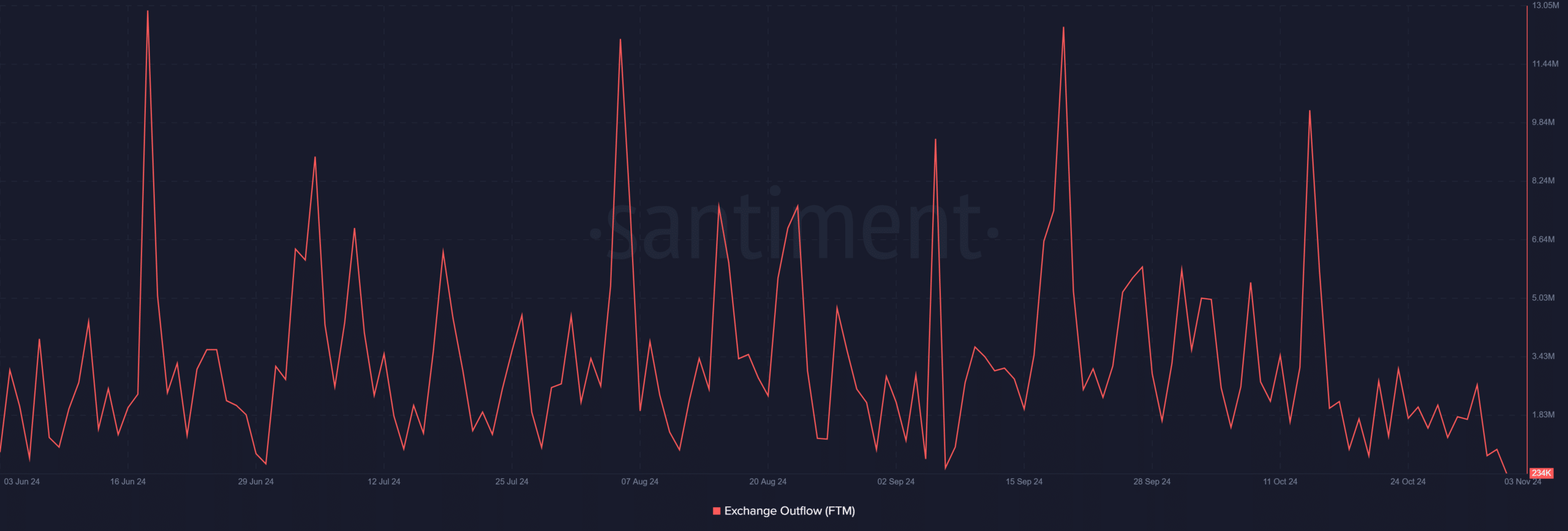

On the other hand, currency outflows fell to the lowest level since June 3. FTM’s outflow indicated higher demand, which would likely push the price higher on the charts.

Source: Santiment

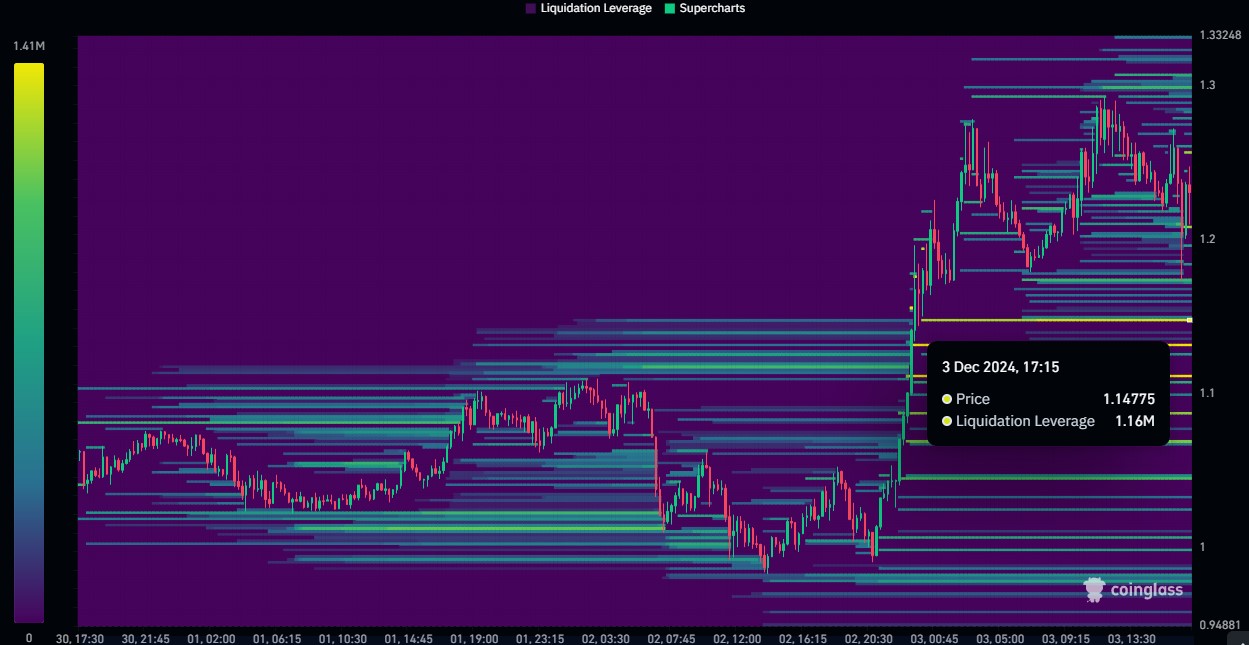

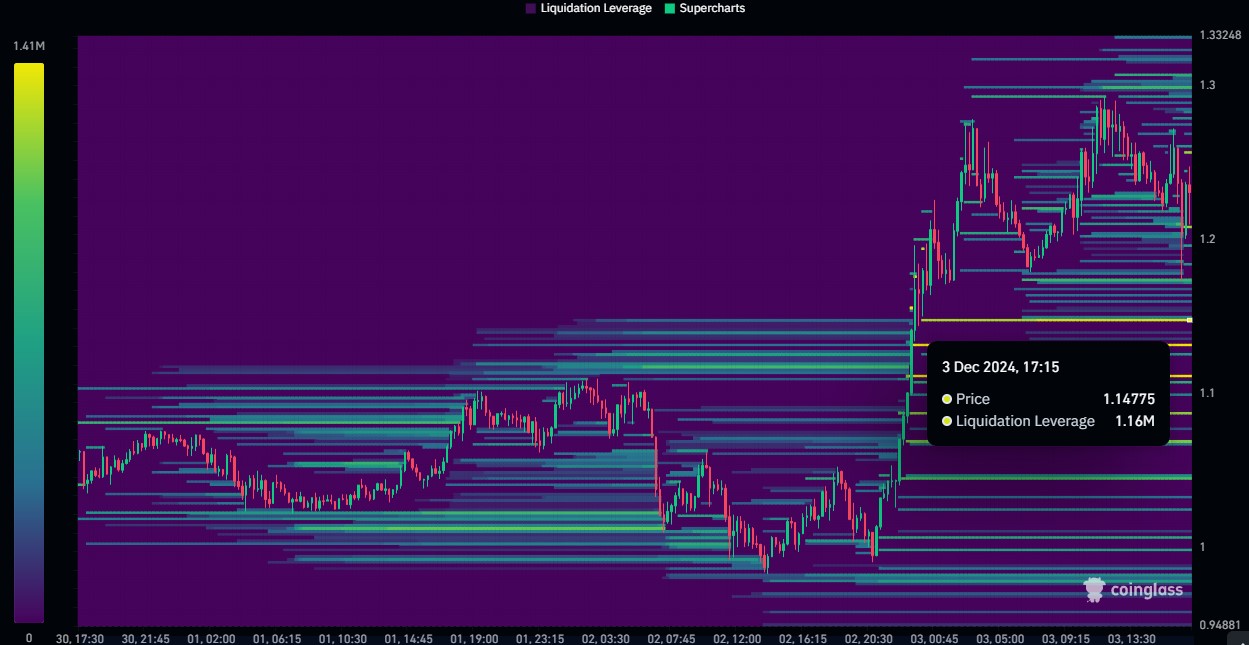

Liquidity data points to a short-term correction

Finally, AMBCrypto’s analysis of Coinglass’s liquidity data revealed interesting insights into short-term price dynamics. A liquidation pool of 1.14 million at a psychological level of $1.15 suggested that FTM could face a near-term pullback before resuming its upward rally.

This seemed to be in line with the broader market trend, especially as small corrections often precede extended rallies.

Source: Coinglass

FTM’s break above several resistances and the resulting rise in whale activity have reinforced the bullish situation. However, the price could see a potential correction near the USD 1.15 level before the altcoin targets the USD 1.68 resistance zone.

In light of interesting liquidity levels, supported by a rise in investor interest, FTM’s upward trend could continue in the coming weeks, barring any unforeseen market shifts.