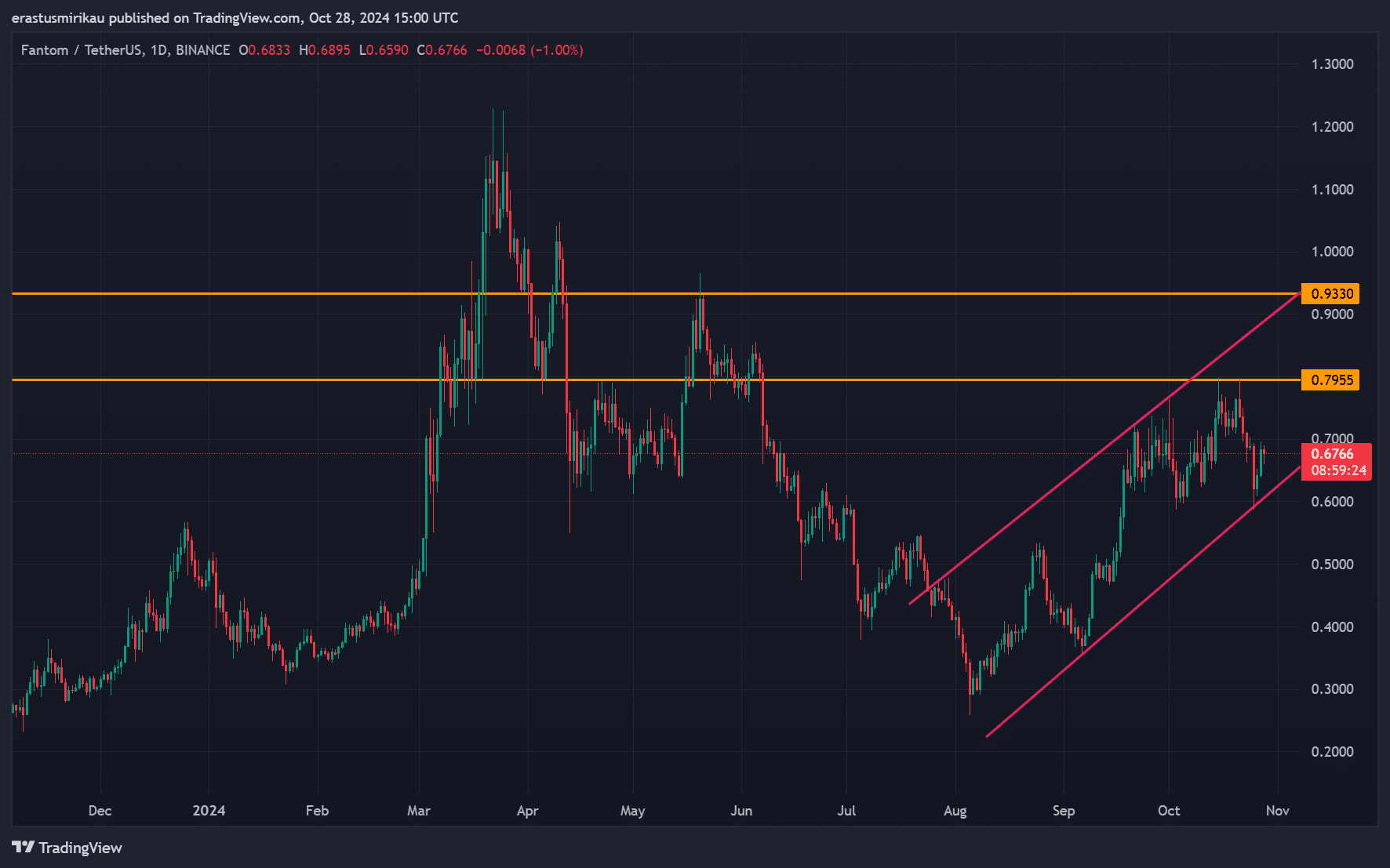

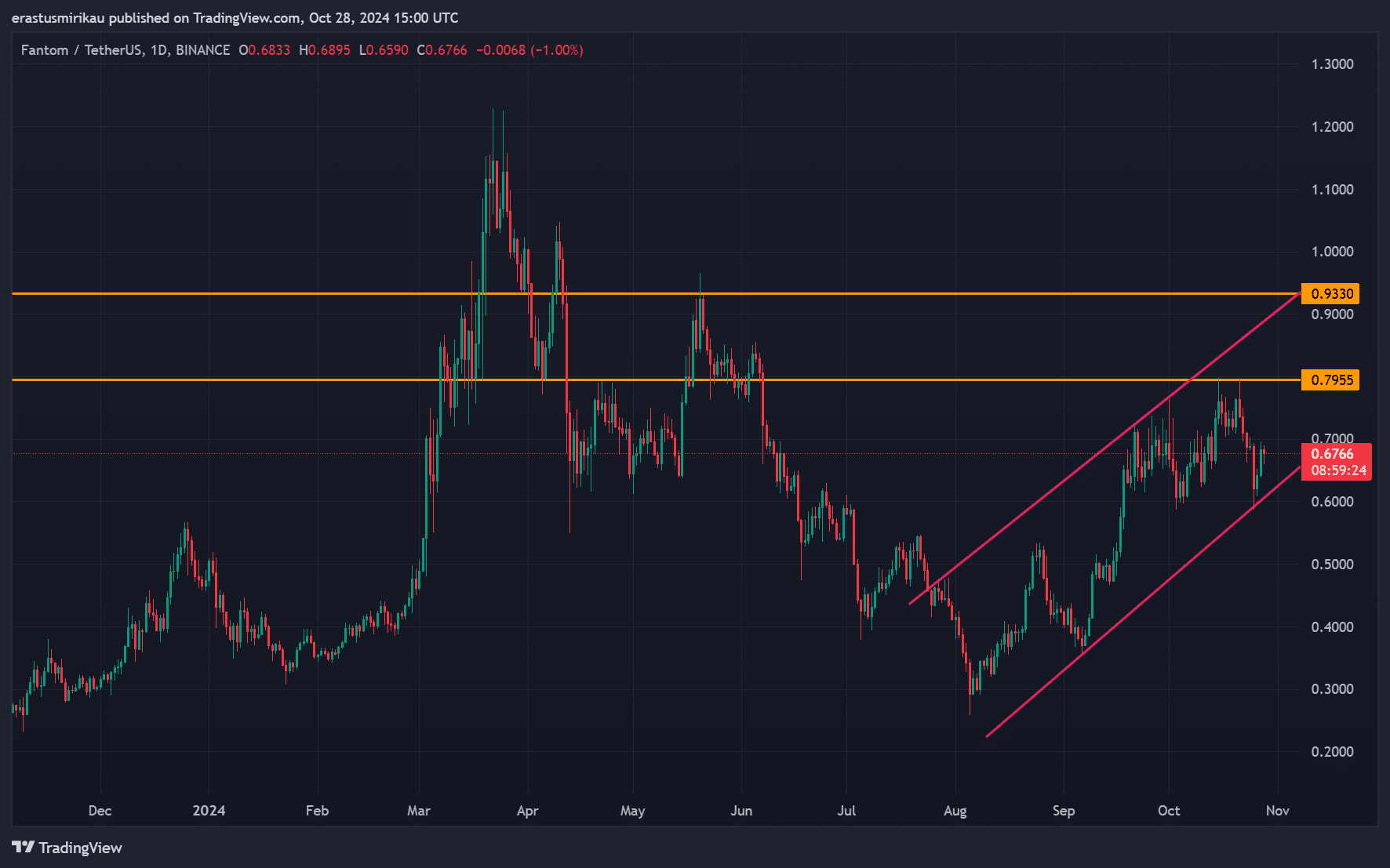

- FTM’s bullish trend continued in an ascending channel, with key resistance at $0.7955

- Mixed signals within the chain underlined the cautious optimism as liquidations had their say

Fantoms [FTM] The price rose 6.31% in the last 24 hours and was trading at $0.6786 at the time of writing. It had a market capitalization of $1.90 billion, alongside a 24-hour volume increase of 68.26%, to $142.91 million.

The altcoin’s prevailing price action keeps FTM within an ascending channel, eyeing resistance levels at $0.7955 and $0.9330. Therefore, in light of increasing market momentum, investors should ask themselves: Can Fantom (FTM) maintain this bullish trend?

Rising Channel Analysis – Will This Support Hold?

FTM’s trajectory within the ascending channel showed a clear bullish trend. The structure of the channel suggested that FTM could maintain upward momentum, if it respects the support and resistance boundaries.

Furthermore, breaking the USD 0.7955 resistance would strengthen bullish sentiment, potentially pushing the price towards the next level at USD 0.9330.

Source: TradingView

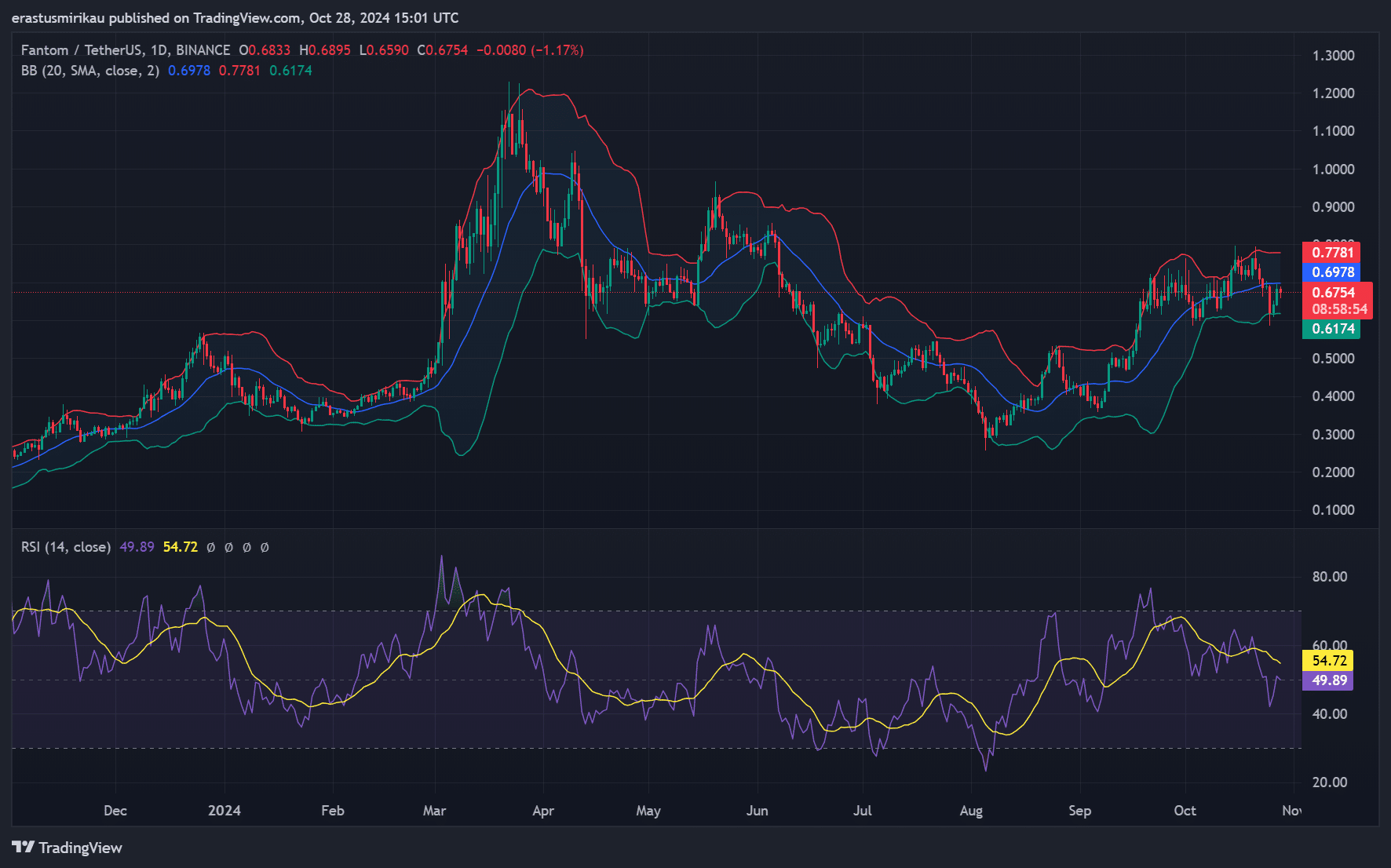

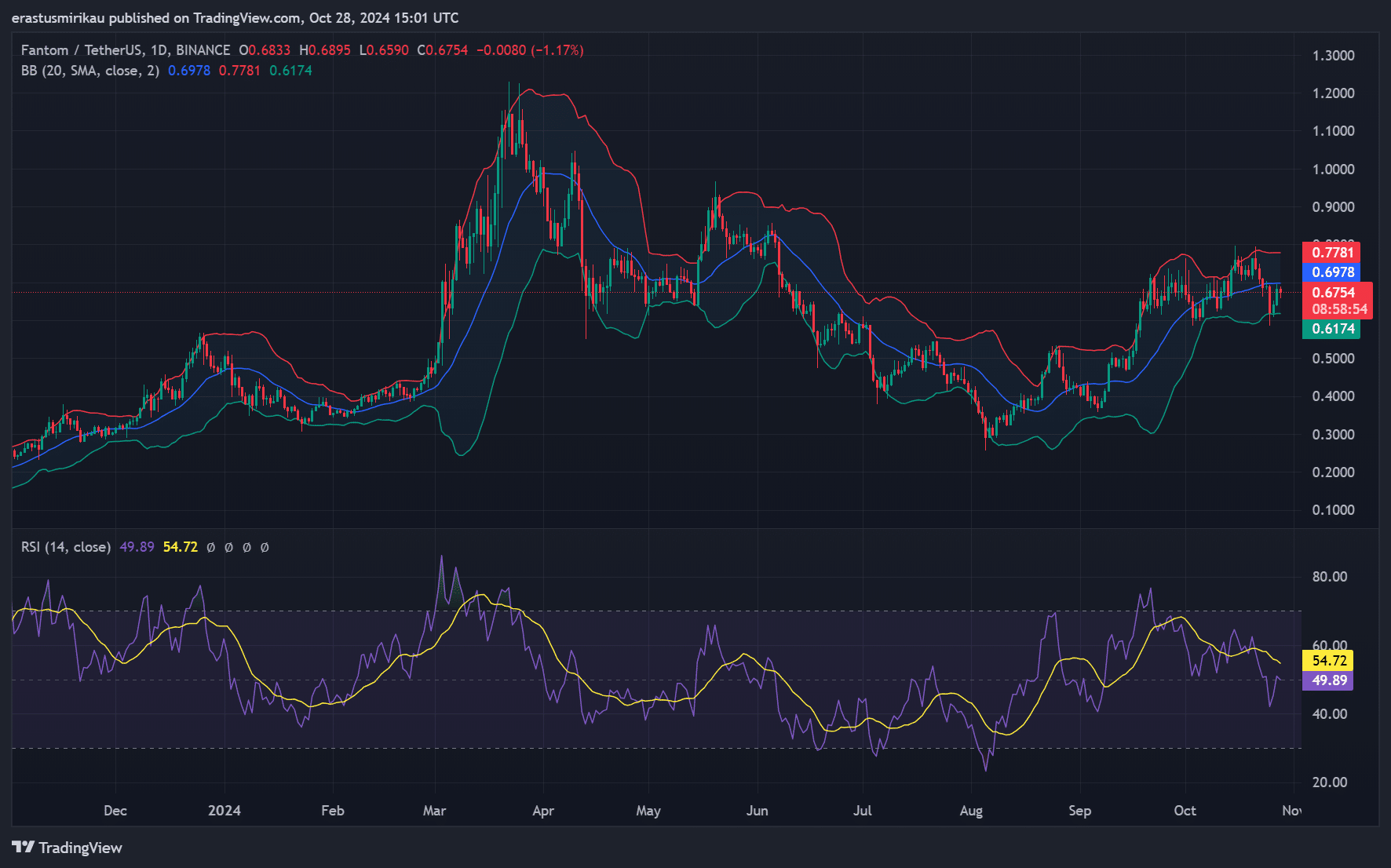

Bollinger bands and the findings of RSI

At the time of writing, the Bollinger Bands appeared to be widening, indicating a sharp increase in volatility as the FTM approached the higher band. Such expansion usually means that buyers dominate the trend. Therefore, if the price continues to track the upper band, it indicates a possible breakout to new highs.

The Relative Strength Index (RSI), with a value of almost 54.72 at the time of writing, remained in the neutral zone. This suggested that FTM has further room to rise without facing overbought conditions. Simply put, the RSI level at the time of writing supported the possibility of additional gains if buying volume continues.

Source: TradingView

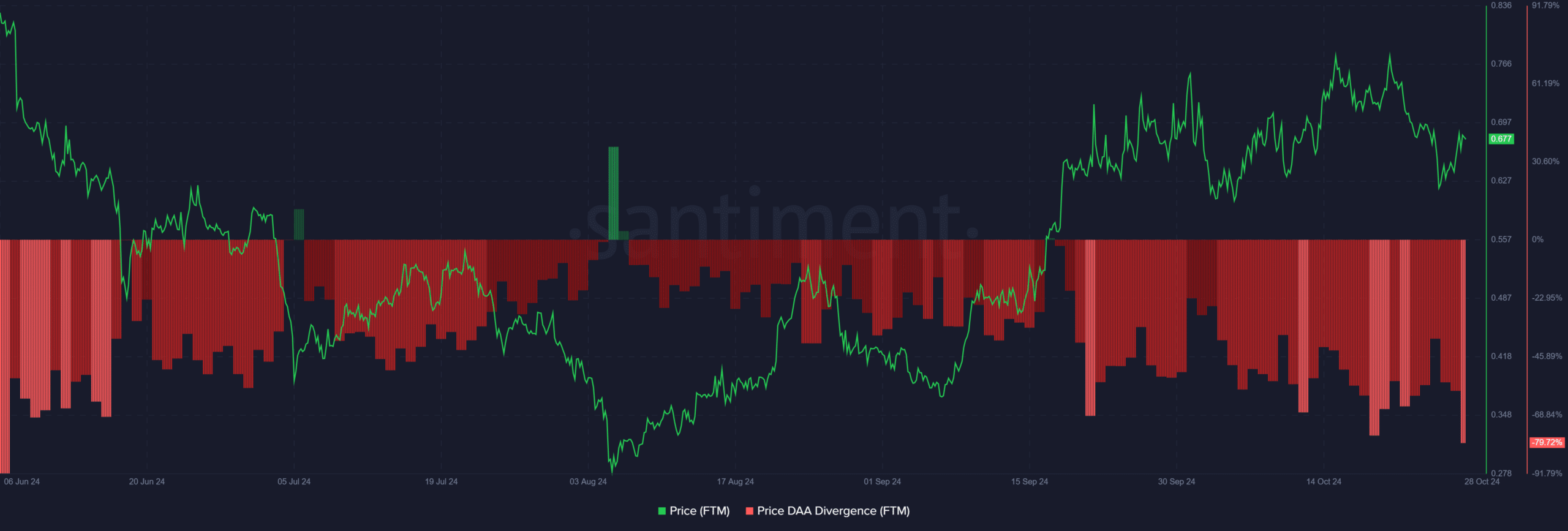

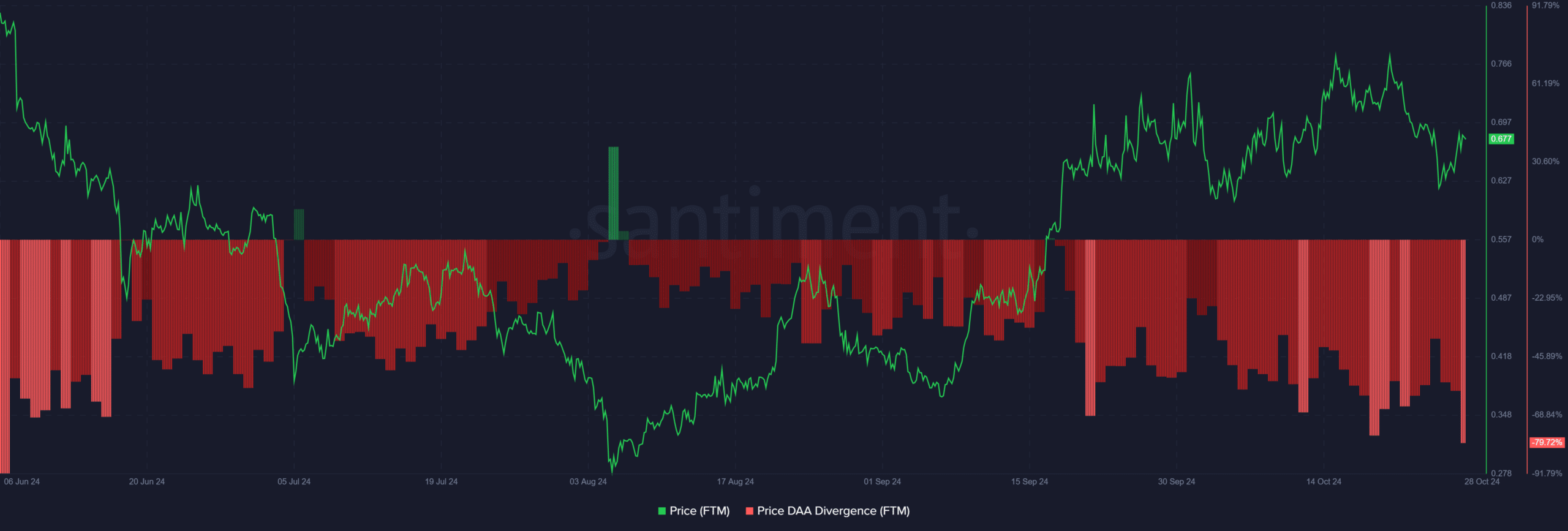

Price-DAA divergence – a potential red flag?

The Price DAA (Daily Active Addresses) Divergence underlined a worrying -79.72% reading, indicating fewer active addresses despite recent price increases. This discrepancy also revealed a lack of underlying network growth – often a sign of reduced rally sustainability.

Furthermore, less active addresses can weaken FTM’s foundation under greater selling pressure. This could also prompt traders to watch for a potential pullback if address activity does not recover.

Source: Santiment

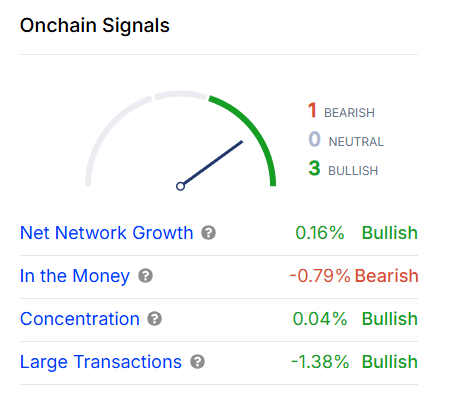

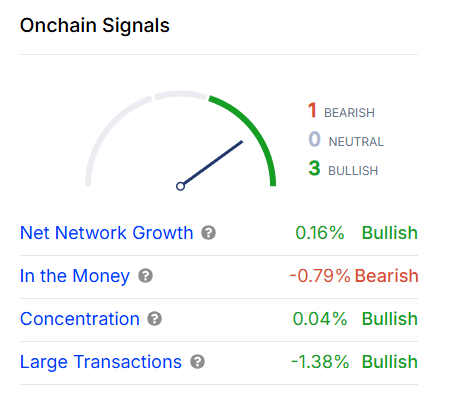

FTM On-chain Signals – Mixed Sentiment?

Fantom’s on-chain data presented mixed signals. Net network growth was a modest 0.16%, indicating gradual adoption. Meanwhile, large investor concentration rose 0.04%, showing that large investors are not unwinding their positions – typically a bullish indicator. Large Transactions also saw a decline of 1.38%, indicating that whale selling pressure is easing.

However, the ‘In the Money’ measure showed a slight bearish tilt of -0.79%, indicating a small decline in profitable positions. Consequently, these mixed signals across the chain reflected cautious optimism, with investors keeping a close eye on shifts in market sentiment.

Source: IntoTheBlock

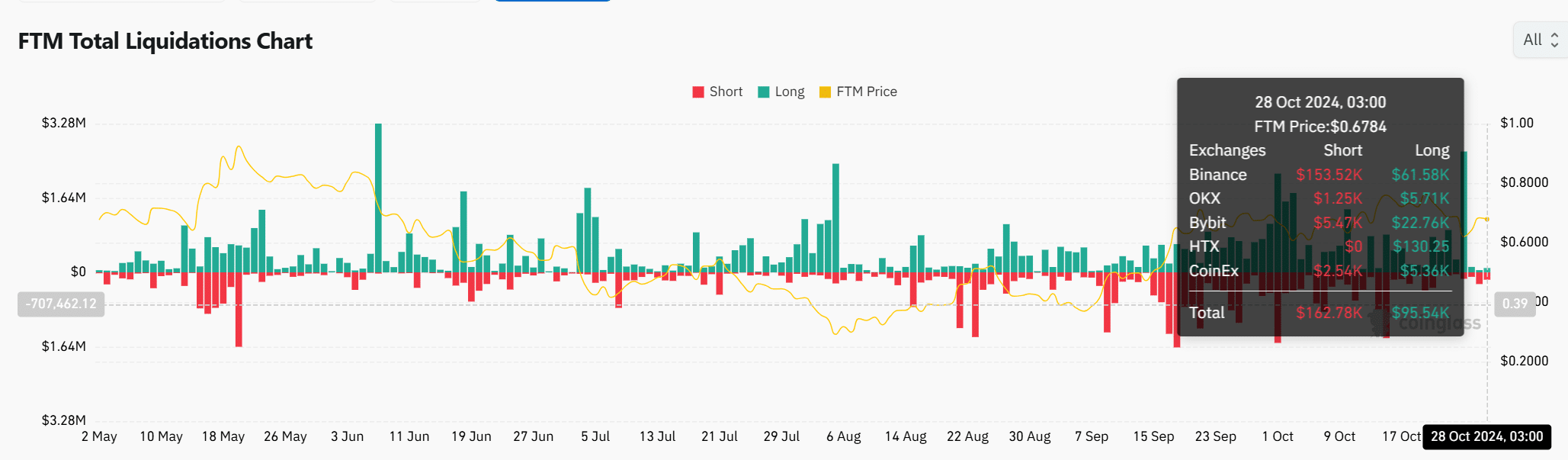

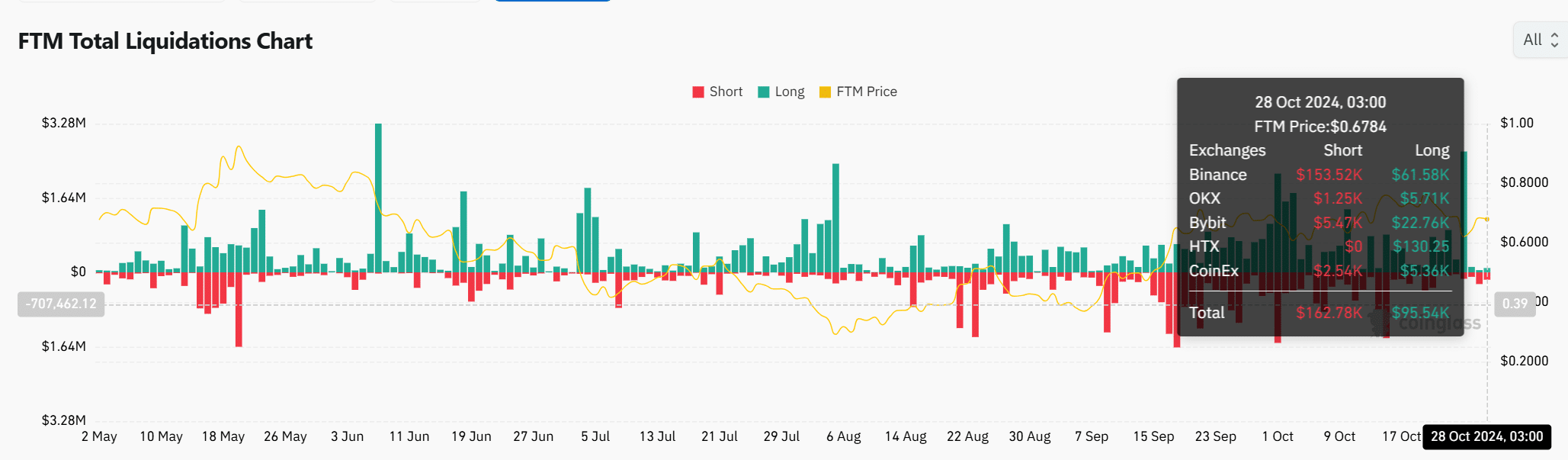

FTM Liquidations – Short Traders Face Pressure

Finally, FTM liquidation data showed that short positions recorded significant liquidations of $162.78k, while long liquidations came in lower at $95.54k.

Consequently, this pattern projected bearish sentiment among short traders, causing price movement to be misjudged. If FTM maintains strength above $0.67, further short liquidations could drive the price higher.

Source: Coinglass

Read Fantom’s [FTM] Price forecast 2024-25

Fantom’s momentum, combined with supportive technical indicators and a balanced view of the chain, provided a positive outlook for the altcoin.

However, the price-DAA divergence and the somewhat bearish ‘In the Money’ measure implied caution. If FTM clears the resistance at $0.7955 with continued volume, it could continue its rally to new highs within the channel.