- The market responded quickly to rumors, with large indices and Bitcoin rise.

- Recession fears to rise, but analysts remain optimistic about the resilience of crypto about traditional markets.

The wider market has been rattled by the tariff plan of President Donald Trump and the Cryptomarkt has also felt the impact.

In the midst of this turbulence, recent rumors led to a potential 90-day break in rates a spark of hope for market recovery.

Trump considers a break in rates – fake or real?

On April 7, A (now deleted) after On X (formerly Twitter) the “Walter Bloomberg” account brought this speculation. De Post mentioned an interview with Kevin Hassett, an economic adviser from Trump. Read the message:

“Hassett: Trump is considering a 90-day break in rates for all countries except China.”

Although the news had turned out to be false later, it underlined the potential impact that such a step could have on the market sentiment. If it happened, this could cause a rebound of the market.

How did the market react?

Unexpectedly, the markets responded quickly to the now Debunk news about a potential rate break of 90 days.

For those who were not aware, the S&P 500 rose by more than 8%, the Nasdaq climbed with 9.5%and the Dow Jones won 7%, so that trillions added the value of the stock market in just a few minutes.

Bitcoin [BTC] Followed, spiked with 6.5% and a discount on $ 80,000 before withdrawing.

However, the excitement was of short duration, because the “fast answer” account of the White House, however rejected The claim as fake news, activating a market sales.

In addition, Walter Bloomberg, the source of the misleading post, later confirmed The story was incorrect, making the markets again calibrate.

“White house says that 90 -day break in rates is ‘fake news’ -cnbc”

How did the community react to fake news?

Although the rumor was quickly invalidated, Crypto Youtuber Lark Davis emphasized some important market insights during the episode.

He emphasized that the market eagerly embraces extensive Chinese trade negotiations, as long as a resolution seems likely.

Davis also pointed to the sensitivity of the market and noticed how even a small rate delay of 90 days caused an increase in shares and cryptocurrencies.

He said,

“Imagine that dozens of deals happen with top players such as India, Canada and the UK. Shit tons of money waiting on the sidelines, ready to monkey in an instant.”

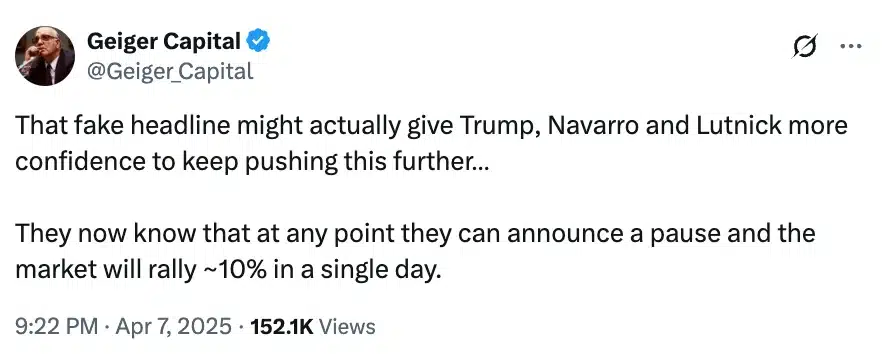

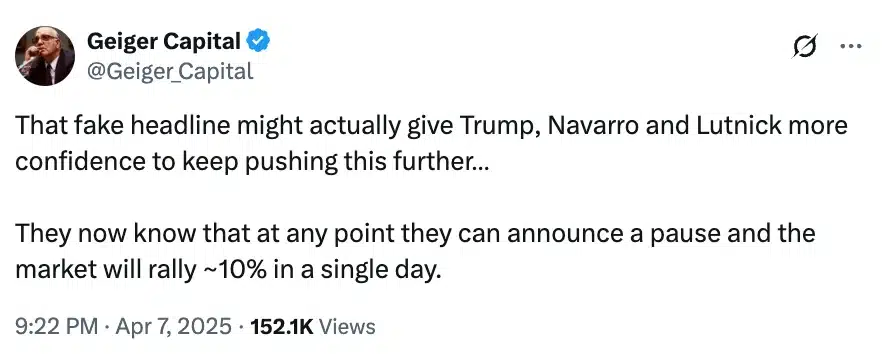

Add to the battle, another X user, Geiger Capital, noticed,

Source: Geiger Capital/X

Nasleep from the fake news

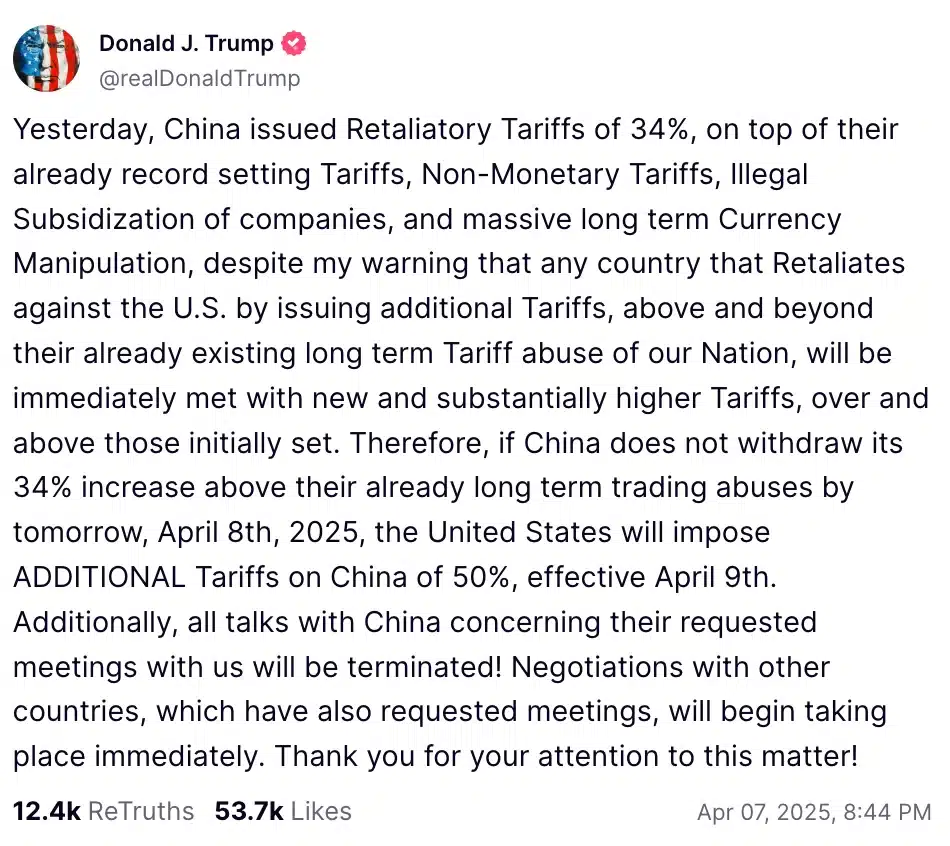

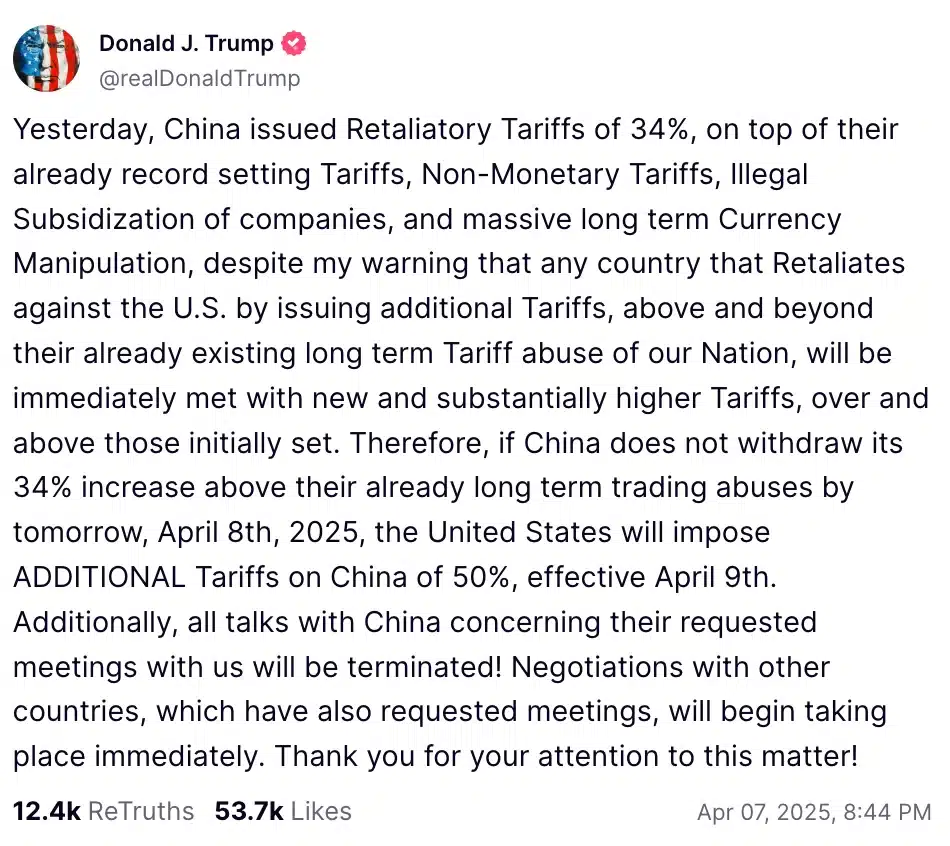

Shortly after the 90-day tariff break rumor was withdrawn, Trump took social to truth, warning China for potential extra rates.

He said,

Source: Truth Social

In the midst of this, analyst Eric Weiss optimism about Bitcoin, which emphasizes its potential despite the constant uncertainty.

“While the tariff war escalates and bleeding supplies, Wall St will eventually realize that there is an alternative: Bitcoin.”

Recession -fears rise, with prediction markets that show increased concerns. The chance of an American recession in 2025 reached 64% Kalshi and 61% on PolymarkeT.

These figures are an important jump of 20% earlier this year.

Despite economic uncertainty and escalating trade tensions, optimism continues to exist. Analysts such as Kevin Capital suggest that the crypto market could be more resilient than traditional shares.