Bitcoin (BTC), the world’s largest cryptocurrency, could see a significant price increase in the coming weeks. according to to experts at Matrixport, a leading cryptocurrency financial services provider. The company has projected a $36,000 goal for Bitcoin, based on a technical breakthrough signaling a strong rally amid positive market outlook fueled by stock buybacks and meme coins.

Bitcoin is going to rise with strong technical breakthrough and meme coin frenzy

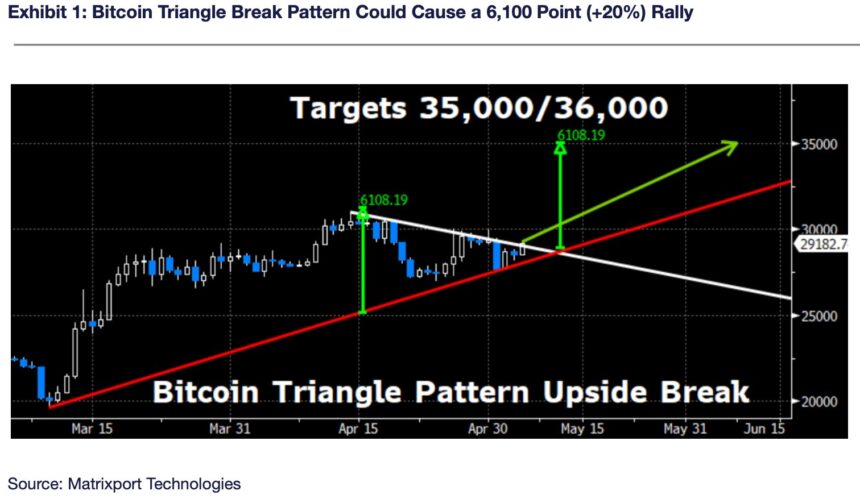

Matrixport’s analysis shows that Bitcoin is currently trading in an ever-narrowing triangle formation, about to break upwards. This could potentially project an increase of about 6,100 points, which would push Bitcoin’s price towards the expected target of $36,000.

The positive market outlook for Bitcoin is driven in part by the popularity of meme coins, which have received huge interest from retail investors. In addition, share buybacks by major companies have boosted the broader market, which has spilled over into the cryptocurrency space.

In addition, according to Matrixport, Bitcoin could see a significant price increase of up to 20% from current levels. This would set a target of $35,000 to $36,000 for Bitcoin, driven by a potential breakout in the market.

Matrixport’s analysis shows that a breakthrough for Bitcoin is imminent, which could lead to significant gains for the cryptocurrency. In addition, the recent 25 basis point rate hike by the Federal Reserve could be the last of this cycle, potentially sending the market into another strong rally.

In addition, despite a recent drop in trading volume, Matrixport notes that Bitcoin’s path higher has met with only limited resistance, with transactions on the network hitting new all-time highs and the number of active addresses remaining strong.

Another interesting trend highlighted by Matrixport is the increasing popularity of meme coins such as DinoLFG, Pepe, Wojak, ChadCoin, and IgnoreFud. While these meme coins may be small, their trading activity is worth noting as it signals a shift in market sentiment towards a more positive outlook.

BTC’s MVRV Ratio Breaks Key Threshold, Signaling Bull Run Ahead

According to a recent analysis by CryptoQuant’s researcher, “Onchained”, In January 2023 Bitcoin’s market value-to-realized value (MVRV) ratio broke the 1st level in an upward direction, indicating a substantial increase in price due to significant accumulation in both the and derivatives markets.

The MVRV ratio has revealed that the 1.5 level is of great importance and serves as a crucial threshold for Bitcoin to enter its bull run. Currently, Bitcoin’s MVRV has fluctuated between 1.55 and 1.45 this month, with major investors keeping a close eye on the indicator to take advantage of Bitcoin dips and collect discounted BTC to line their coffers.

In addition, according to Onchained’s analysis, the MVRV ratio experiences a trend change when it breaks through its 365-day simple moving average (365DSMA). If the ratio breaks this moving average in an upward trend, it signals the start of a bull market, with the MVRV ratio changing direction to reach high levels, typically between 2 and 3.75 or more.

Conversely, if the MVRV ratio breaches the 365DSMA in a downtrend, it signals the start of a bear market, with the ratio changing direction to reach lows of 1 or less. These patterns are visible in the graph.

Onchained’s analysis found that when the MVRV ratio breaks through the 1.5 level, the 365DSMA flattens out before changing direction. Currently, it seems that BTC is experiencing this trend as the MVRV ratio fluctuates in the range of 1.5 values. If Bitcoin breaks the USD 30,000 level, a rapid change in the MVRV ratio is expected, which is likely to shift to a range of values between 1.8 and 2.

Featured image from iStock, chart from TradingView.com