Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

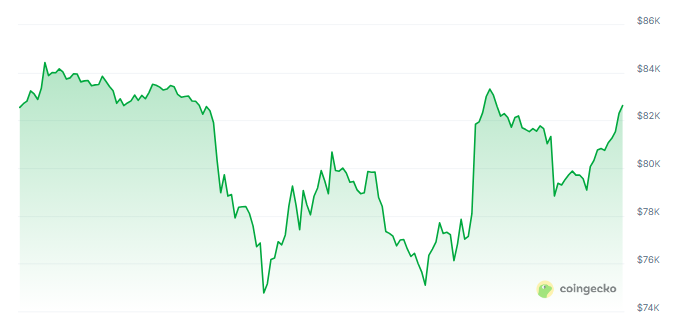

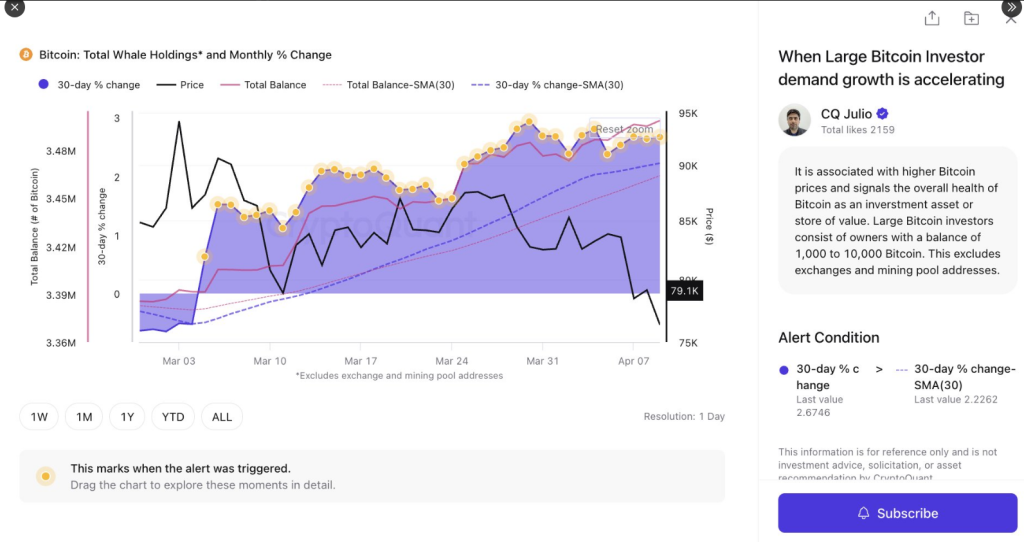

The price of Bitcoin restored above $ 82,000 Friday after a decrease of less than $ 75,000 in recent days, because investors with large portfolios bought more of the digital active. Market trends publish portfolios between 1,000 and 10,000 bitcoin with a speed higher than the average of 30 days, Cryptoquant reports.

Related lecture

Great investors show a lot of faith in Bitcoin

The increase in the number of large crypto holders indicates increasing trust in the future of the cryptocurrency. These investors, usually no exchanges or mining pools, are important when maintaining the value of Bitcoin. Their increasing interest Comes as the market capitalization of Bitcoin $ 1.58 trillion, with dominance on other cryptocurrencies with more than 60%.

Bitcoin recently hit $ 83,400 before he corrected something to settle above $ 80,000. The increase in this high wallet -baldi is consistent with the recent price profits of Bitcoin, which indicates market strength despite external pressure.

Large investor question to Bitcoin accelerates.

Baldi of portfolios with 1k-10k BTC rise faster than their 30-day average.

Typically bullish, signals strong investor confidence. pic.twitter.com/hr5rumj6a6

– Cryptoquant.com (@Cryptoquant_Com) April 10, 2025

Analysts look at price gap patterns for future projections

Some market observers have offered their predictions in which direction the upper digital active act can then. An X (formerly Twitter) analyst with the name Enzy Bitcoin says that Bitcoin usually goes up after filling in price Verhoven. The analyst called the last gap between $ 70,000 and $ 75,000, which Bitcoin can reach $ 130,000 in the near future based on historical trends.

Source: CryptoQuant

Another analyst, Bitbull, equaled Bitcoin’s stability to be recently Volatility at US stock markets. Because the traditional markets with volatility are struggling, Bitcoin is captured above $ 80,000. Prices below $ 100,000 can still be acceptable access points for investors, some experts say.

BTC in the long term target of extremely positive

Further looking at the road, other market observers only recently placed a very favorable prognosis for the future of Bitcoin, with the emphasis on the importance of the knowledge of market cycles, in particular during the prices of fluctuations such as in a hog tray.

The projection of the analysts reads as an unusual bullish, that Bitcoin can reach a whopping $ 250,000 price tag. This vision also predicts meaningful growth for major alternative cryptocurrencies.

Market capitalization hits $ 1.58 trillion while recovery remains strength

The last prize Bounceback of the Crypto flagship has fallen its total market value to $ 1.58 trillion when this report was made. This follows its appreciation of more than $ 8,000 from recent lows, which demonstrates the capacity of the cryptocurrency to quickly bounce back from temporary decreases.

Related lecture

The market dominance of the cryptocurrency has also grown and is currently on more than 60% of the total crypto market capitalization. The dominance indicates that Bitcoin is the most popular cryptocurrency and continues to attract investors who want growth and a storage of value.

Although Bitcoin has not enforced his short increase to $ 83,500, maintaining more than $ 81,000 resilience shows in the prevailing market environment. The fact that buying continues from whale Indicates that such investors believe that prices will rise in the coming months.

Featured image of Betanews, Graph of TradingView