Tuur Demeester, a Bitcoin OG and researcher for Adamant Research, shared his bullish outlook for Bitcoin via X (formerly Twitter), anticipating expectations that the price could escalate to between $200,000 and $600,000 by 2026. Demeester’s prediction is based on the inflow of trillions of dollars through the global market. bailouts and stimulus measures, which he believes will significantly boost Bitcoin’s valuation.

He noted via X (formerly Twitter): “In ’21, bitcoin peaked at $69,000. I’m targeting $200-$600,000 by 2026. Fueled by $trillions in global bailouts/stimulus,” indicating strong conviction in the cryptocurrency’s future amid expansionary monetary policy.

In ’21, Bitcoin peaked at $69,000. I’m targeting $200-$600,000 by 2026. Fueled by $trillions in global bailouts/stimulus. https://t.co/ULslIMgzee

— Tuur Demeester (@TuurDemeester) February 12, 2024

When asked if the Bitcoin price will peak in 2025 or 2026, Demeester added: “It’s hard to say. We may have a two-part bull cycle like 2013, which could extend the cycle.”

Demeester’s track record lends weight to his predictions. Notably, in September 2019, he accurately anticipated the momentum of the previous bull run, suggesting that Bitcoin could reach $50,000 to $100,000. Reality exceeded expectations when Bitcoin peaked above $69,000 in November 2021, confirming the top end of its forecast range.

Why the Bitcoin Rally is Far From Over

To add depth to his latest prediction, Demeester pointed to Google’s trend data, which often serves as a barometer of retail investor interest in Bitcoin. Despite Bitcoin hitting $50,000 yesterday, Yassine Elmandjra, a researcher at Ark Invest, highlighted that Google search volumes relative to Bitcoin’s price are at an all-time low, indicating a lack of widespread retail frenzy at this stage.

Bitcoin reached $50,000.

Meanwhile, Google’s search volumes are consistently low relative to price.

This is a new era. pic.twitter.com/8DnsadIclt

— Yassine Elmandjra (@yassineARK) February 12, 2024

This observation led Demeester to suggest: “I expect the retail industry to wake up soon. Remember, there is no fever like Bitcoin fever,” indicating that he expects retail engagement to increase once Bitcoin price momentum increases.

Demeester also shared sage advice for investors, warning of the dangers of debt and overexposure given Bitcoin’s notorious volatility. He emphasized the psychological resilience required to ‘HODL’ through market turbulence, stating: “The HODL attitude requires psychological and emotional work. The unprepared investor cannot sit still, only the one who has worked to imagine the market would mercilessly slap him in the face.”

In response to questions about Bitcoin’s future trajectory, Demeester expressed uncertainty about the continuation of the four-year cycle pattern, suggesting that market dynamics are too complex for such predictable cycles to continue indefinitely. “I don’t know if the four-year cycle will last. That sounds too good to be true tbh. All patterns seem to break eventually,” he noted, highlighting the unpredictable nature of the markets.

On the topic of the expected economic bailouts, Demeester clarified his position, pointing to the unsustainable fiscal practices of banks and governments as a catalyst for monetary expansion.

“From banks and governments. For example, the US government today already spends more on interest payments than on their military. The only way to continue is to print an ocean of money,” he explained, providing a bleak view on the financial stability of major institutions and the potential for BTC to benefit from these conditions.

Printing money = numbers go up

To understand Demeester’s claims, it is essential to understand the broader economic dynamics at play. Economic stimulus packages and bailouts, especially in response to crises, inject liquidity into financial markets, potentially devaluing fiat currencies through inflation.

Hard assets like Bitcoin, with their limited supply, contrast with potential inflationary pressures and provide a hedge against currency devaluation. This dynamic, coupled with increasing institutional adoption of spot ETFs and Bitcoin’s growing recognition as a “digital gold,” could send BTC’s value to unprecedented heights, in line with Demeester’s projections.

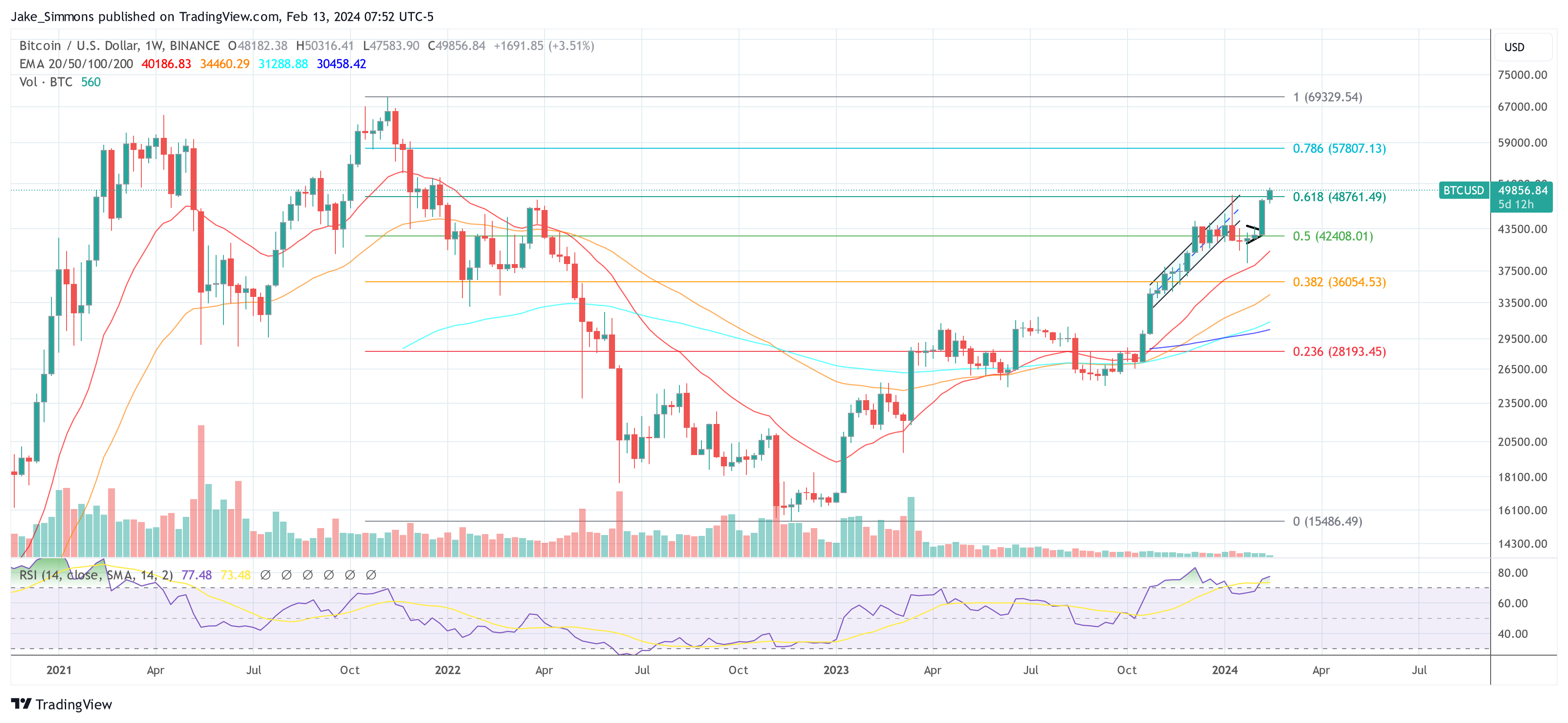

At the time of writing, BTC was trading at $49,856.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is for educational purposes only. It does not represent NewsBTC’s views on buying, selling or holding investments and of course investing involves risks. You are advised to conduct your own research before making any investment decisions. Use the information on this website entirely at your own risk.