CryptoCon, a figure in the crypto analytics community, has presented a detailed report graphic that expects the next Bitcoin cycle peak to be near $130,000. According to the analyst, the date for the next cycle high will be November 28, 2025, with a possible deviation of 21 days. This projection is based on the Halving Cycles Theory, which aligns Bitcoin’s price movement with the dates of the halving events.

Bitcoin halving cycle theory

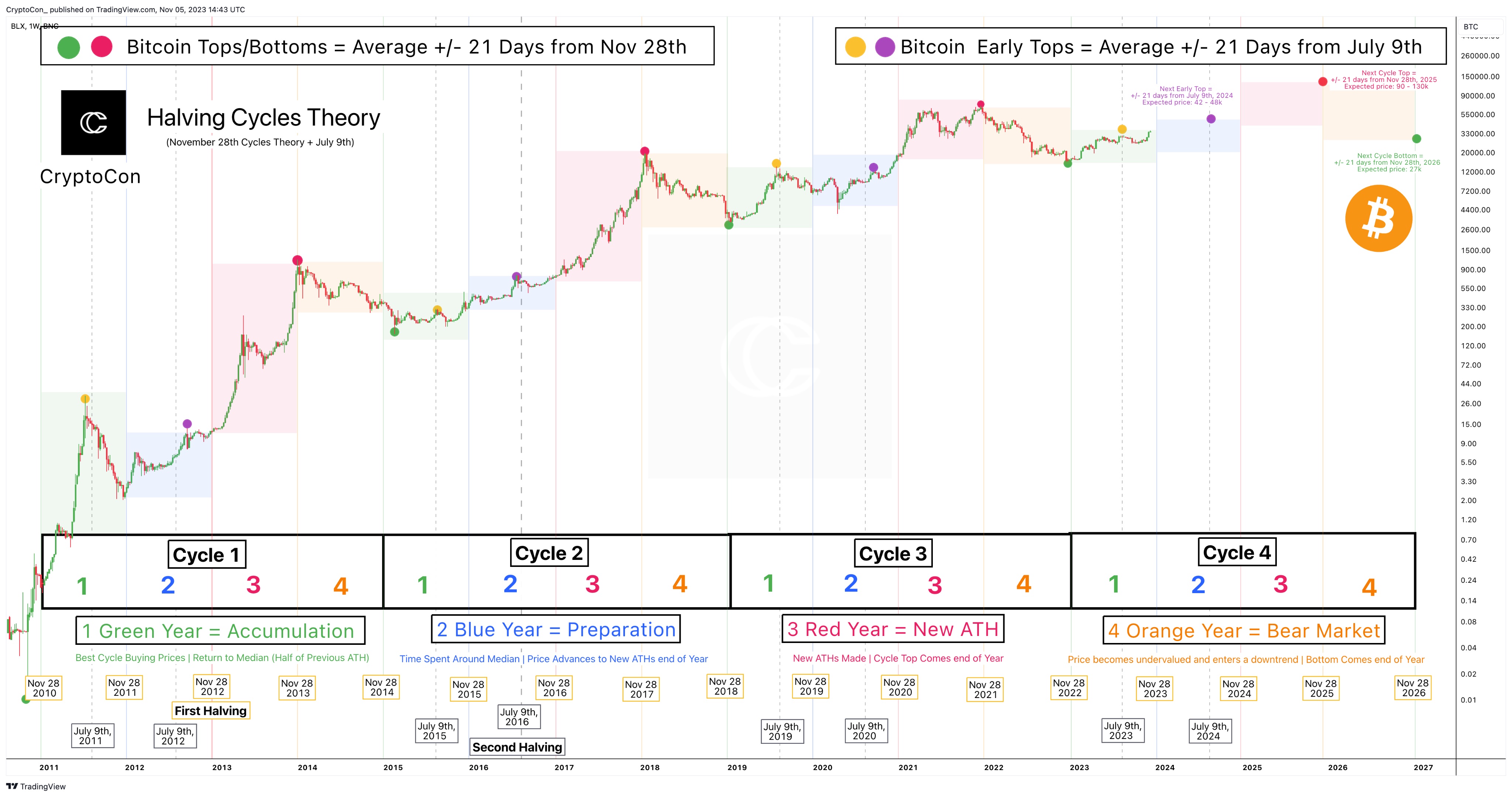

The chart outlines Bitcoin’s historical and expected price trajectory over four color-coded cycles, each representing a different market phase, postulated by CryptoCon. The “Green Year” indicates periods of accumulation, with the best cycle buying prices and a return to the median, which is half the previous all-time high (ATH).

The “Blue Year” is seen as a preliminary phase in which the price moves around the median before rising to new ATHs at the end of the year. The “Red Year” heralds new ATHs, while the “Orange Year” indicates a bear market where the price becomes undervalued and bottoms out at the end of the year.

CryptoCon’s theory is based on the historical patterns observed around Bitcoin’s halving events – the first on November 28, 2012 and the second on July 9, 2016. The analyst claims: “Every prediction from this model has stayed right on track since the creation of it in Jan this year.”

Despite criticism over the exact timing of previous cycle peaks, CryptoCon maintains confidence in the model, stating: “The biggest criticism I have seen of this model is that the technical peak came in April 2021 and not November. But you can’t argue with the numbers, the price was higher.”

Early top, top and bottom for the next BTC cycle

The analyst’s approach combines several price experiments and a trend pattern price model, leading to a consensus target of €130,000. The shared chart also indicates that Bitcoin is on the cusp of a ‘blue year’. According to CryptoCon, the next early top for Bitcoin is expected to occur within a 21-day period around July 9, 2024, with an expected price range of $42,000 to $48,000.

The chart analysis continues by predicting the next cycle top, which is expected to fall within a similar 21-day range around November 28, 2025. The expected price range for this peak is noticeably bullish, with the target between $90,000 and $130,000.

CryptoCon’s tweet underlines this prediction, saying: “Nothing has changed to my timeframe or expected price for the next Bitcoin cycle top. 90 – 130k +/- 21 days from November 28, 2025.”

It is notable that Cryptocon also provides insight into the next cycle bottom. His forecast suggests a price bottom of around $27,000, again within a 21-day period from November 28, 2026. This corresponds to the model’s ‘Orange Year’, which is typically characterized as a bear market period in which the price is expected to bottom . at the end of the year.

At the time of writing, BTC was trading at $35,229.

Featured image from iStock, chart from TradingView.com