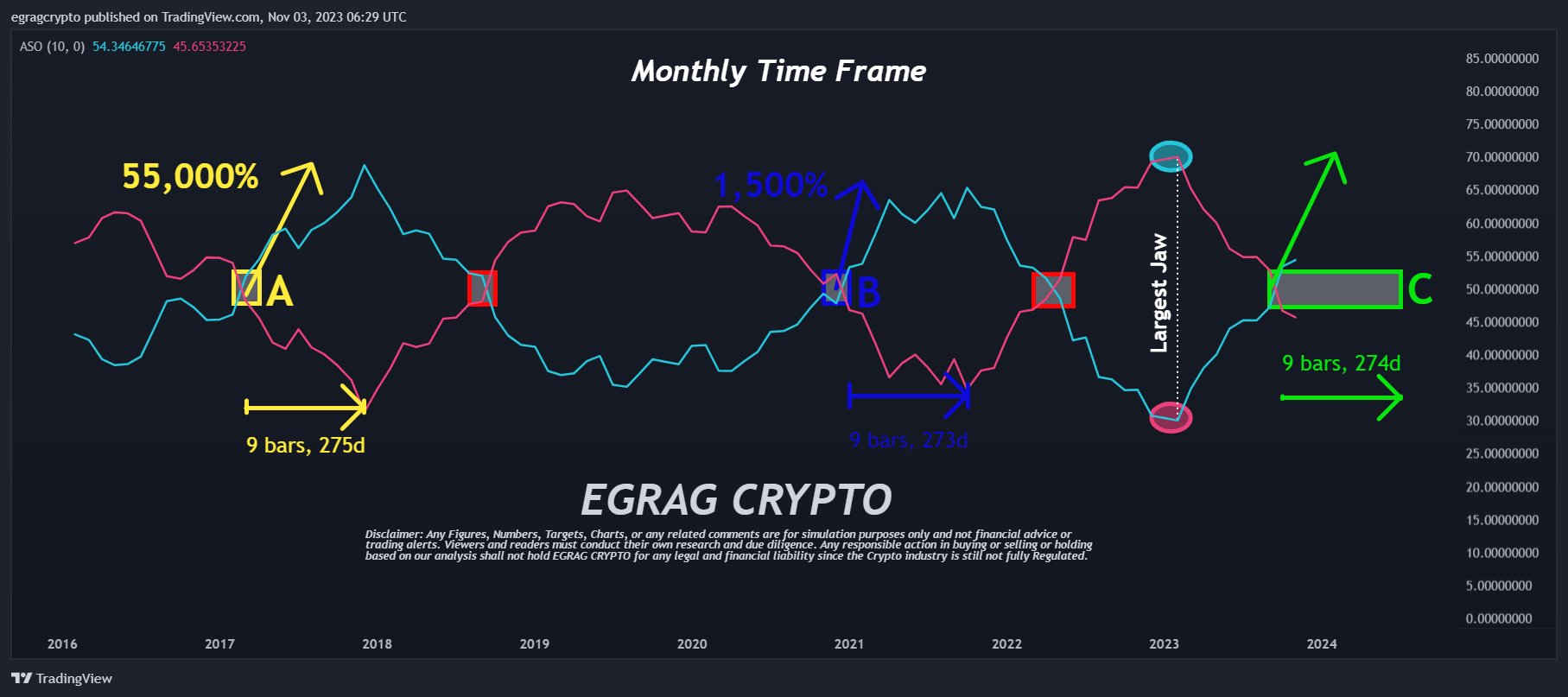

Crypto analyst Egrag recently dug into the XRP price charts and highlighted signals that a potential rally of over 1,500% is in store. The focus of this analysis is the ASO (Average Sentiment Oscillator), a measure that traders use to determine market sentiment.

XRP Price Rally of 1,500%+ Ahead?

Egrag’s monthly XRP/USD chart shows the convergence of the blue line, which symbolizes bulls, and the red line, which represents bears. A month ago, Egrag had marked a yellow box on his chart, predicting that the bullish crossover would occur between the end of 2023 or the beginning of the second half of 2024.

Today Egrag noted: “XRP ASO Update: The Journey Only Goes UP! I have been eagerly awaiting the ASO bullish crossover since February 2023. Guess what? The time has finally come!” Should XRP mimic its historical patterns, and if Egrag’s predictions are correct, the XRP price could see some significant price movements in the coming months.

Historically, the cryptocurrency has experienced this bullish crossover twice before. The 2017 event led to a staggering 55,000% increase in the price of XRP, while the one from late 2020 to April 2021 resulted in a 1,500% increase. Considering the “biggest jaw” ever seen on the chart, Egrag has sparked debate suggesting that the coming rally could even surpass its predecessors.

Connecting the dots from the historical data and the recent crossover, Egrag elaborated: “Looking at historical data, we can see that it typically takes about 275 days to reach the peak after this event. ” If XRP follows its historical trends as Egrag suggests, the XRP price could prepare for substantial price action in the next seven to ten months.

Egrag ended his tweet with a call to the massive community of supporters commonly referred to as the “XRP Army,” encouraging Egrag to: STAY STABLE and keep wearing your spacesuit.

To provide further context, the ASO acts as a momentum oscillator, displaying average percentages of bull/bear sentiment. It is particularly powerful at distinguishing sentiment during specific candle periods, helping to identify trends or pinpoint entry/exit points. The tool was invented by Benjamin Joshua Nash and adapted from the MT4 version. The design of the oscillator, which shows Bulls % with a blue line and Bears % with a red line, highlights the prevailing sentiment in the market.

At the time of writing, XRP was trading at $0.5990. When looking at the 1-day chart, it is clear that XRP price suffered a second rejection at the 0.382 Fibonacci retracement level, which stands at $0.625.

Although the RSI has stabilized somewhat, it remains in the overbought zone high at 71. This suggests that the price could be gearing up for another attempt to overcome this resistance. However, if this fails, a return to the Fibonacci retracement level of 0.236, priced at $0.553, could be on the horizon. On the upside, the Fibonacci retracement level of 0.5, pegged at $0.683, represents the next potential price target.

Featured image from Shutterstock, chart from TradingView.com