- Stablecoins on the Ethereum network have just reached a new all-time high, in line with the global number of stablecoins

- Assessing the coming regulatory headwinds and the potential impact on liquidity will be critical

The global market capitalization of stablecoins just hit a new all-time high, with Ethereum also accounting for the lion’s share of that growth. But what does this mean for the network in terms of liquidity and growth?

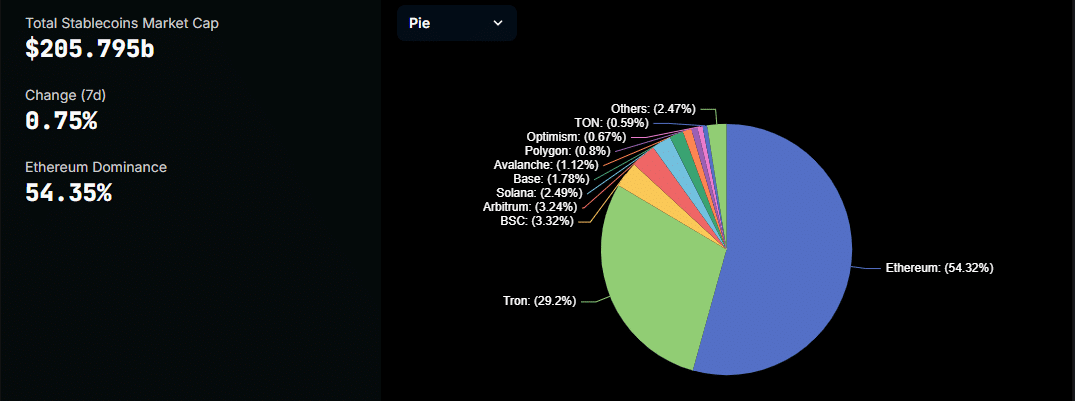

The total market capitalization of stablecoins at the time of writing was $205.79 billion, most of which was in Ethereum. According to DeFiLlama, Ethereum’s market cap at the time of writing was $117.39 billion. In fact, this seemed to equal 54.32% of the total market capitalization.

Source: DeFiLlama

These figures for Ethereum’s stablecoin market cap marked a new ATH for the network. It surpassed the previous ATH level reached in February 2022, thanks to robust stablecoin inflows over the past two months.

While the new Ethereum stablecoin market cap has helped cement stablecoin dominance, it also underlines growing liquidity. This should technically mean more investor confidence and potentially signal nascent network growth.

However, Ethereum’s total locked value could not continue.

Source: DeFiLlama

Can Ethereum support healthy growth?

Although Ethereum’s stablecoin market cap is currently on a positive trajectory, its TVL has been declining for a while. This is largely due to ETH price fluctuations, but this trend could also be exacerbated by a recent IRS development.

According to the American tax authority IRS tax on wagering rewards will be based on unrealized profits. The possible implication is that this could discourage investors from staking their cryptocurrencies – an outcome that could potentially trigger a TVL outflow.

There is already a lawsuit challenging the IRS’s position on the matter. The prospects of a TVL outflow were not the only concern arising from these regulatory hurdles. There has been a sharp rise in USDT-related FUD over the past 24 hours. This is due to concerns about possible USDT deleted in Great Britain for non-compliance.

This development could potentially cause a huge outflow of USDT, especially in lieu of the fact that Britain is one of the largest global markets. Meanwhile, USDT is the most dominant stablecoin on the Ethereum network at 64.63%.

Delisting USDT from European exchanges could therefore have a significant impact on Ethereum’s growth. However, the potential impact on ETH remains unknown for now. This is because stablecoin outflows will reduce organic activity, but on the other hand, stablecoin holders can potentially use ETH as a safe haven.

However, current concerns about stablecoins in Britain are likely only short-term headwinds. Clear regulations should clear things up and set the market up for long-term recovery.