- Strategy acquired an extra 3.4k BTC for $ 285 million collected by the sale of MSTR districts

- Company still has a capital increasing capacity of $ 37 billion to be used for BTC purchases

On April 14, Michael Saylor, founder of Strategy (formerly MicroSstratey), announced that the company has acquired an extra 3,459 bitcoin [BTC] For $ 285.8 million.

Strategy, the pioneer in BTC Corporate Treasury, now has 531,644 BTC. However, the update was not surprising, especially after the recent Van Saylor plagues – “No rate on orange dots.”

What is the next step for BTC?

The last acquisition was facilitated by the sale of MSTR shares, according to a 8-K Archiving With the sec.

Based on the company’s acquisition plan 21/21 ($ 21 billion due to debts and $ 21 billion capital increase by issuing shares), there is a capital increase of $ 37.6 billion capacity Still to explore.

Analysts actually have pointed Out of offering that strategy could have been responsible for last week’s BTC price campaign.

“That explains the relative power of last week. Was all just Saylor.”

BTC came up with 7% last week and tapped $ 86k. At the time of press BTC was appreciated at $ 85k and under the bull aid of the 200dma (simply progressive average daily).

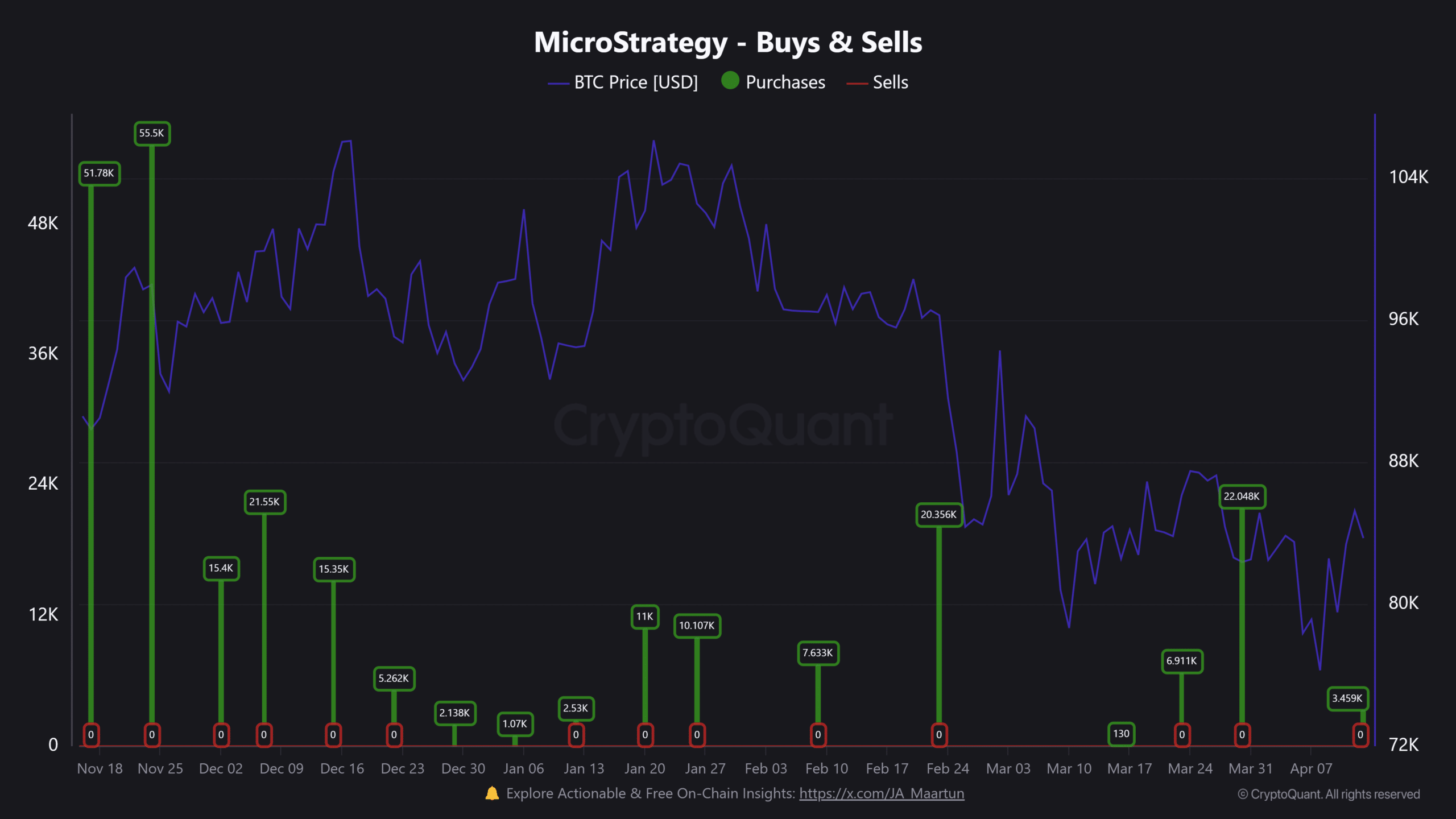

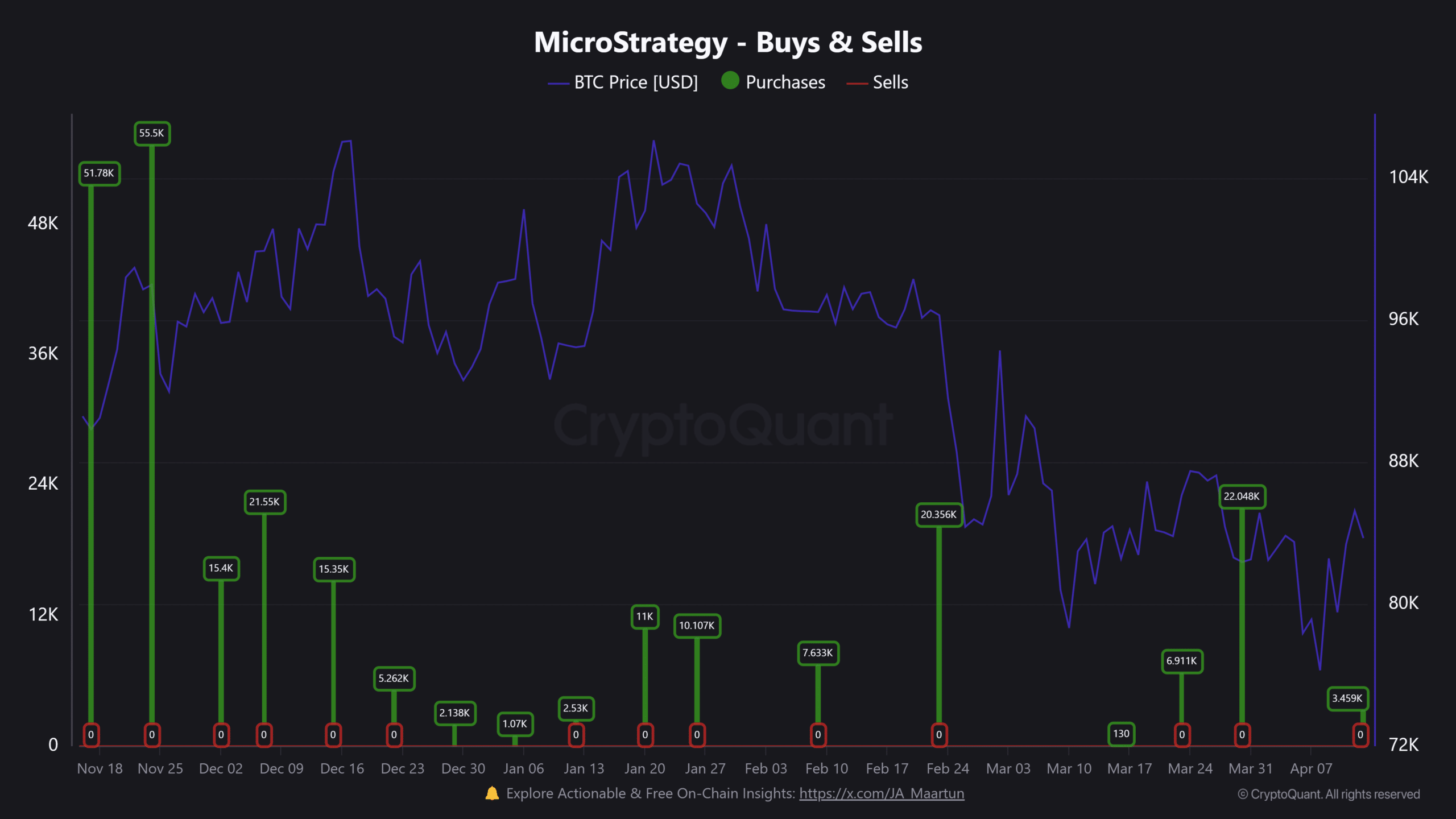

That said, the purchases of 2025 have been less massive Compared to the end of 2024. In the same period, the price of Bitcoin fell from $ 109k to as low as $ 74k before it stabilized above $ 70k.

Source: Cryptuquant

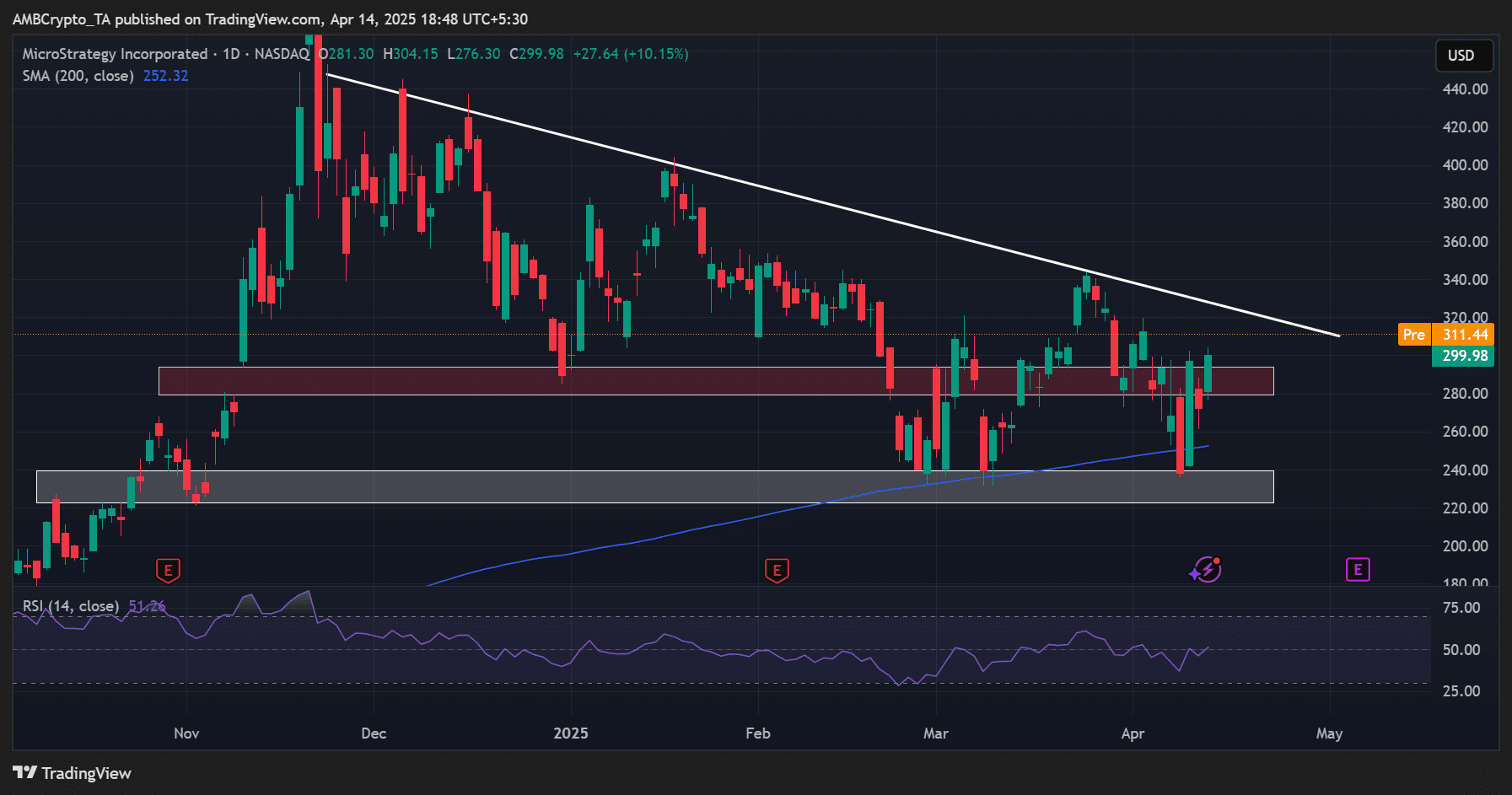

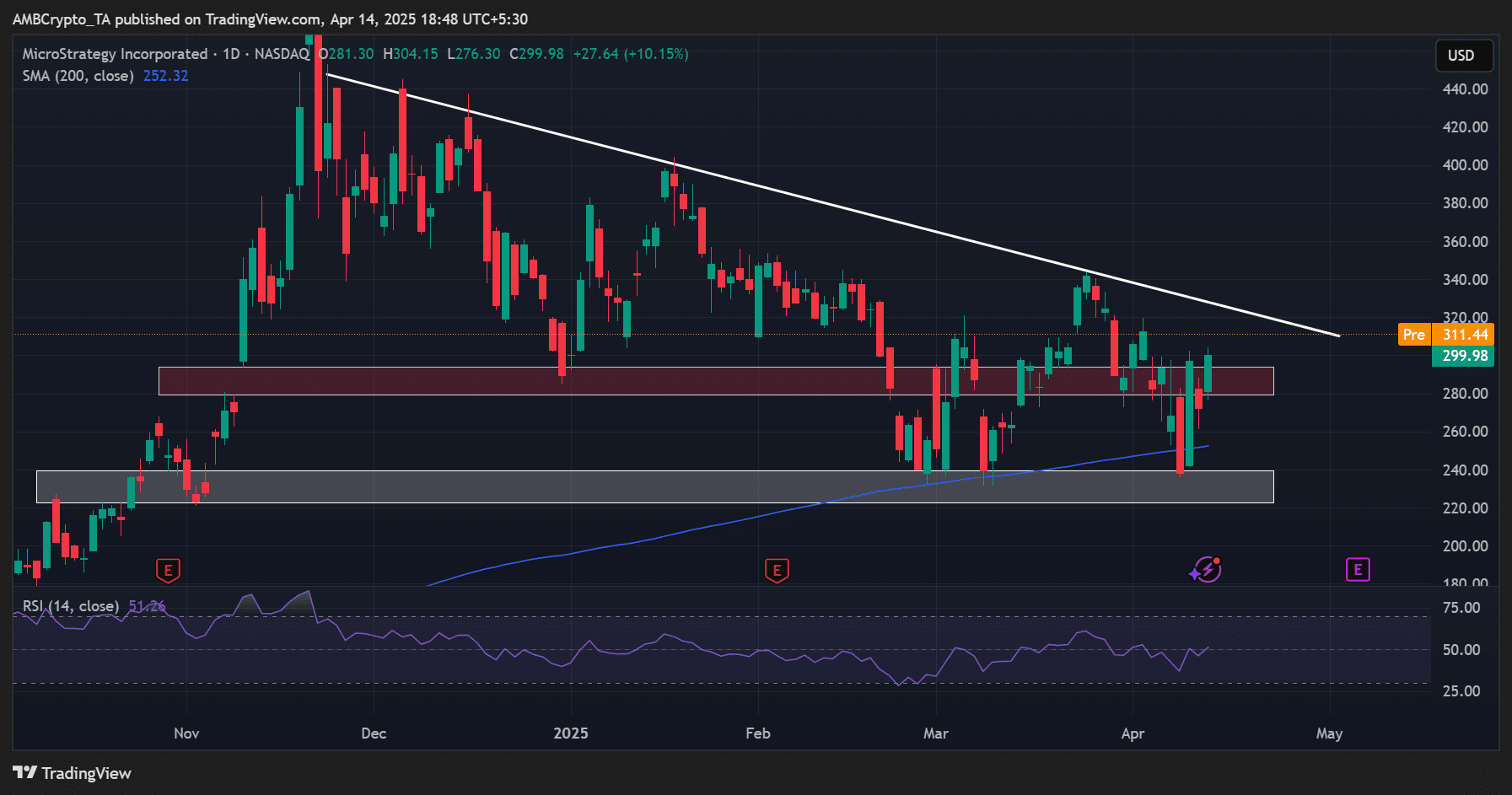

As a result, the non -realized profit of the strategy have shrunk from around $ 19 billion to $ 9 billion – about a loss of $ 10 billion. The price fluctuations of BTC fell to MSTR. The stock of the strategy has decreased since November.

In the past two months, however, it marked a local soil on the 200dma (blue), which hurled between $ 230 and $ 330. A persistent rally above the trend line resistance can enable bulls to push higher.

Source: MSTR, TradingView