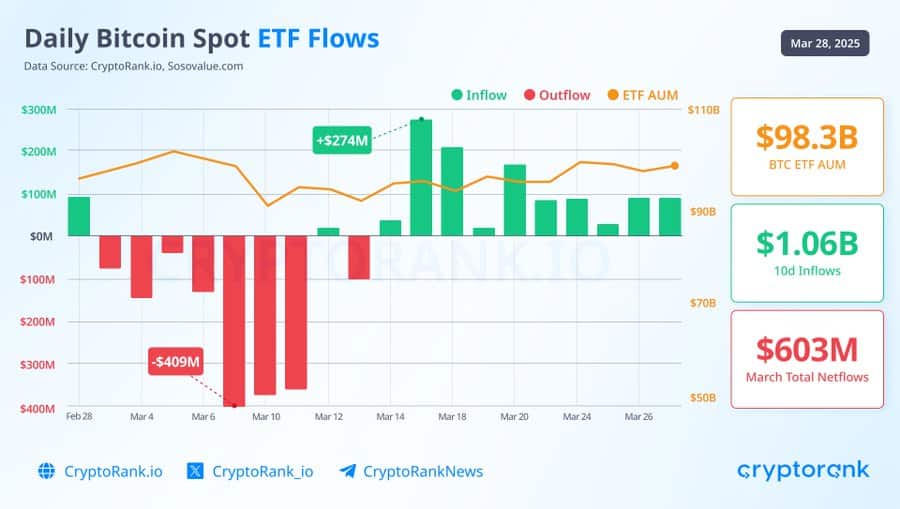

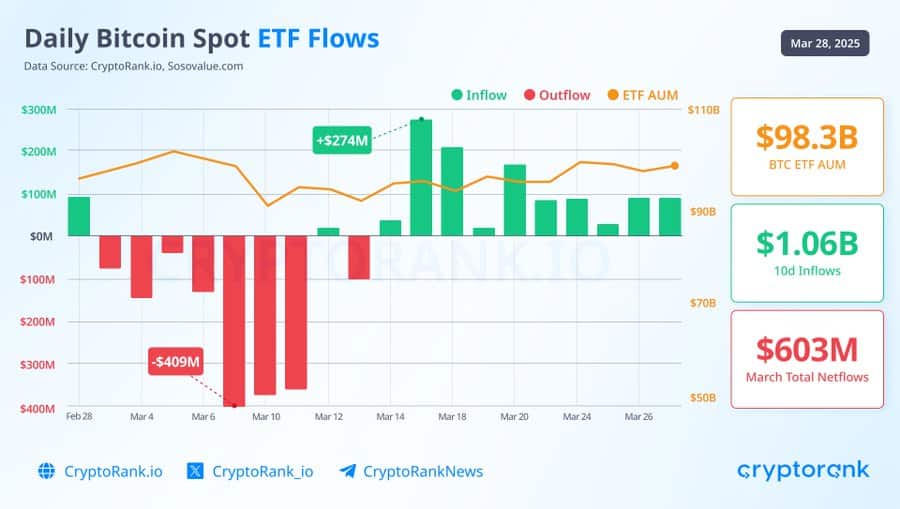

- Bitcoin ETF inflow has been $ 1.06 billion in the last 10 days, and returned the outflow of the early March

- Assets in management [AUM] Climbed from $ 88 billion to $ 98.3 billion when the question stabilized in crypto ETFs

Bitcoin ETFs are again in the spotlight today after a strong line of the inflow reversed the sentiment that was seen earlier in March. Institutional investors lean back in BTC with rising AUM and persistent demand.

Here is a breakdown of the latest ETF trends and what they can mean for the market.

Persistent inflow offers short -term lighting for Bitcoin ETFs

Bitcoin ETFs have had a Unbroken 10-day streak From inflow of a total of $ 1.06 billion. This, after a considerable recovery after a rough start of the month. In fact, on March 6, they only took up $ 409 million on 6 March.

The Turnaround in Sentiment has pushed the total managed power [AUM] From $ 88 billion on March 10 to $ 98.3 billion before March 28.

Source: Cryptorank

This series of green days comes at a critical moment because institutional investors regain confidence in the midst of improving the macro conditions and a healing cryptomarkt.

If the trend persists, it could serve as a strong wind wind for Bitcoin’s price process.

March is still on schedule for enormous net outflows

Despite the recent intake streak, March will remain on its way to becoming the second worst month for Bitcoin ETF Netflows. With the total number of net outflows that have been affected $ 603 million so far, it surpasses $ 345 million from April 2024, although it still follows the record month of February.

The mixed performance shows how investor behavior remains divided, with short -term optimism in balance against caution in the longer term.

Although the recent recovery in currents at the momentum hinted, it has not been enough to compensate for earlier losses in the month.

Compare BTC and ETH ETF streams

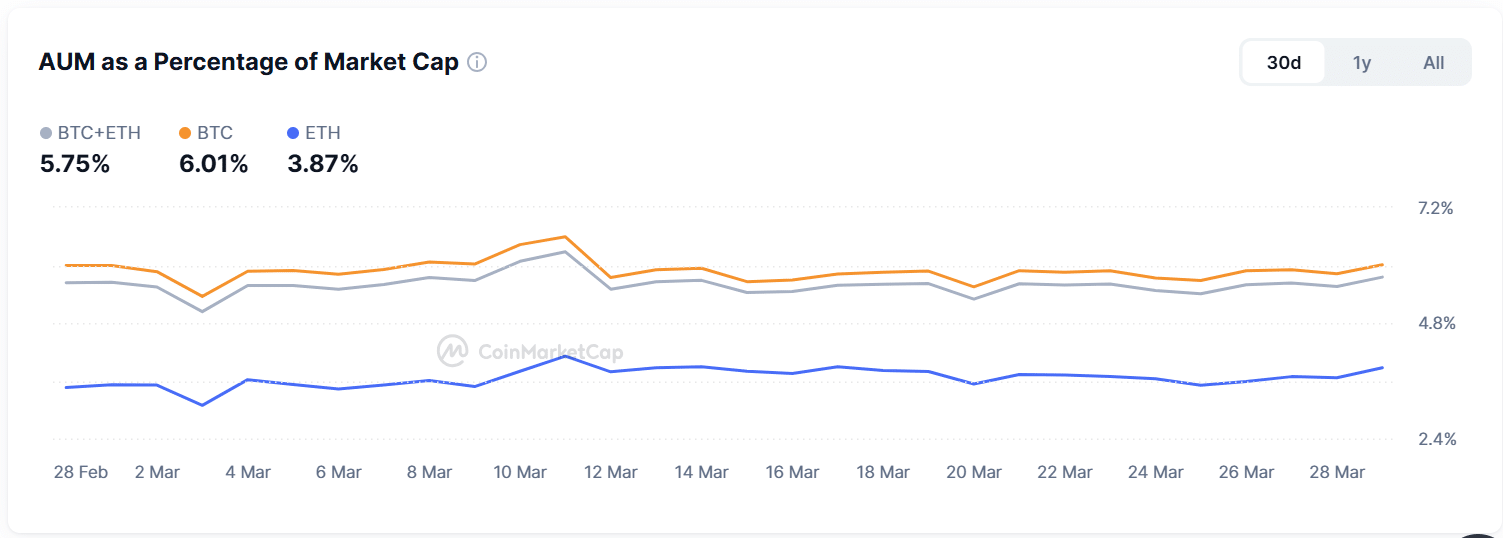

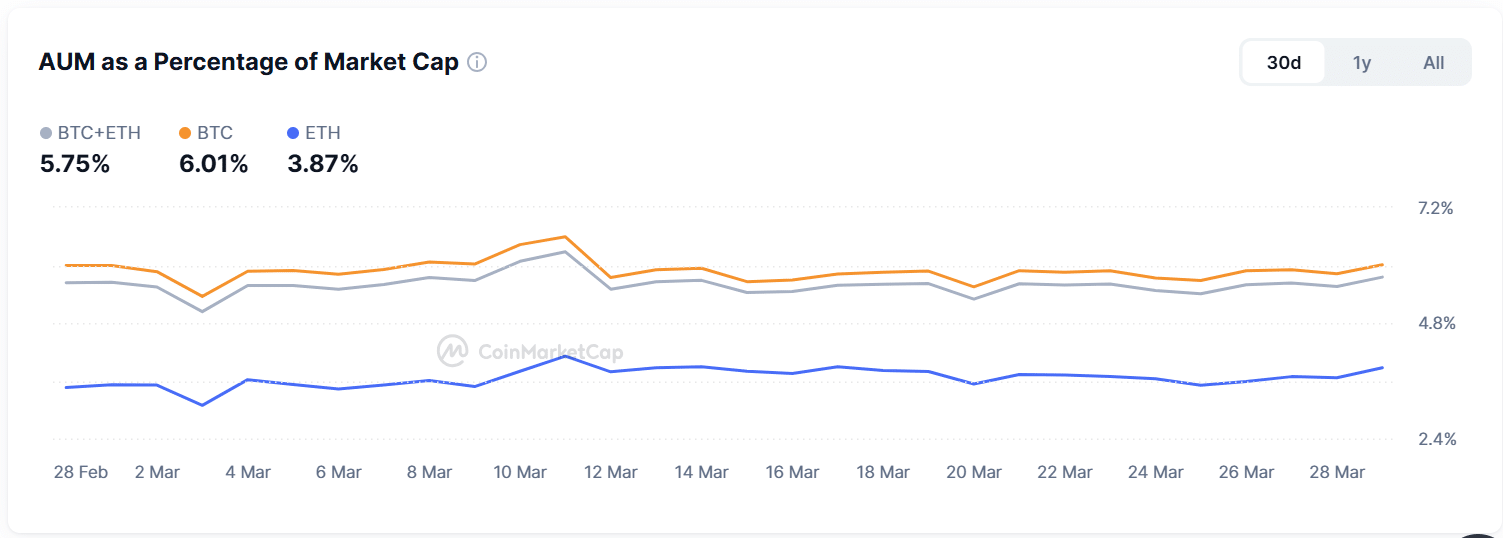

Data of Mint market cap Although Bitcoin ETFs have seen the net outflows of $ 93 million in the last 30 days, Ethereum ETFs have placed a modest $ 5 million in inflow. The stable but small instruments of ETH could indicate a growing base of long -term holders, although the volume is still fading compared to BTCs.

Moreover, Ethereum is far behind in terms of ETF traction, where the total AUM only contributes 3.87% to the market capitalization of ETH, compared to Bitcoin ETFs with 6.01% of the CAP of BTC.

Combined, BTC and ETFs are currently 5.75% of the total crypto market capitalization.

Source: Coinmarketcap

Continuation or reversal in Bitcoin ETF current?

If BTC ETF inflow continues until April, this can mark a broader institutional rotation in Crypto -exposure. However, investors must remain careful, because the outflow of the month to date still reflect the ongoing volatility in sentiment.

A persistent increase in AUM and a reduction in daily outsource would probably support the bullish price action. Until that time, ETF inflow can offer support in the short term, but not a complete reversal of broader risk-off trends.