- The eToro trading platform will limit US crypto transactions to Bitcoin, Ethereum and Bitcoin Cash following a settlement with the SEC.

- The SEC has fined eToro $1.5 million for operating as an unregistered crypto broker and clearing organization.

The eToro trading platform has reached a settlement with the US Securities and Exchange Commission (SEC), which agreed to halt most cryptocurrency offerings to its US customers.

For context, the SEC accused eToro of providing access to crypto assets considered securities since 2020 without adhering to federal securities registration requirements.

As part of the settlementeToro will pay a $1.5 million fine for operating as an unregistered broker and clearing agency in connection with its crypto services.

Executives weigh in

eToro co-founder and CEO Yoni Assia made the same comment, saying in a statement that the settlement allows the company to:

“Focus on delivering innovative and relevant products across our diversified US operations. As an early adopter and global pioneer in crypto assets and a major player in regulated securities, it is important for us to be compliant and work closely with regulators around the world.”

Needless to say, Assia wasn’t the only one to respond to the situation. Several industry experts also gave their opinions.

For example, Lowell Ness, a partner at Perkins Coie, added his perspective, saying:

“It is interesting to see parties agreeing to these types of drastic settlements when viewed against federal court rulings that programmatic transactions are not securities transactions. This settlement highlights the enormous rift that could develop between regulators and some of the early court rulings.”

What else is going on?

That said, eToro will limit its US customers to trading Bitcoin only [BTC]Bitcoin cash [BCH]and Ethereum [ETH] on its platform.

For all other cryptocurrencies, users have a 180-day period to sell their holdings, after which those tokens will no longer be available for trading.

This decision marks a significant shift in the platform’s crypto offering in response to regulatory challenges. However, this move received significant criticism, with many viewing it as an overstep by the SEC.

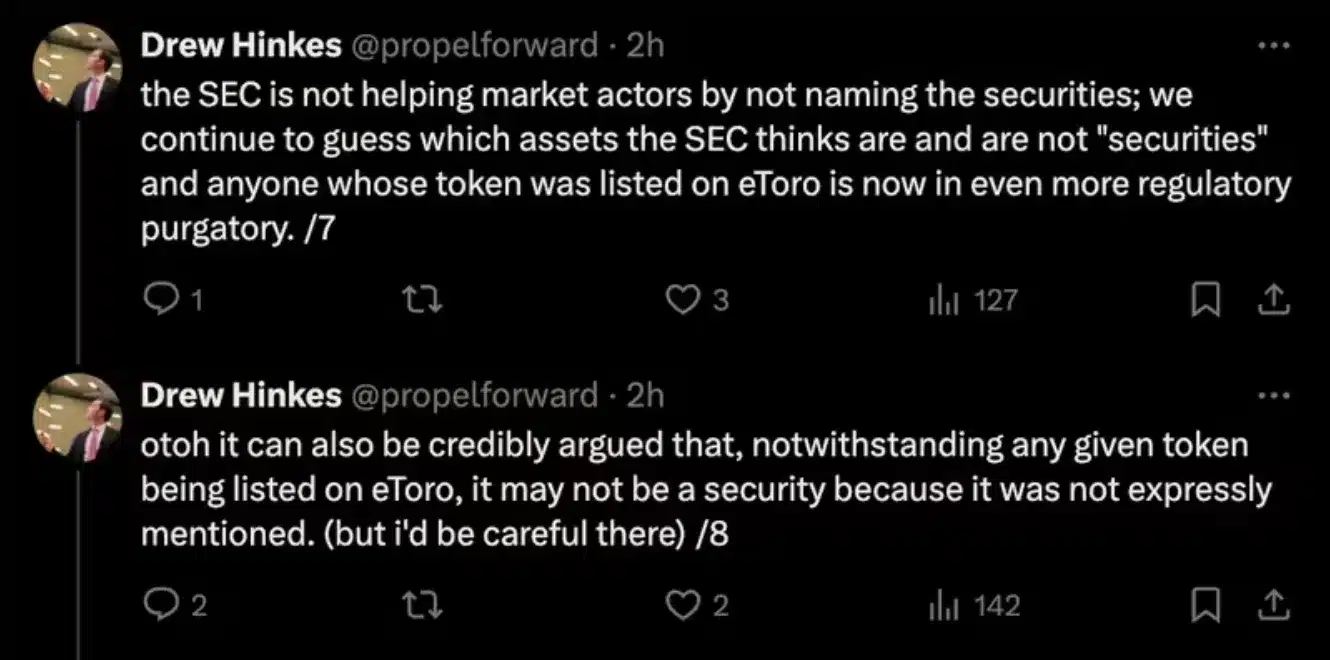

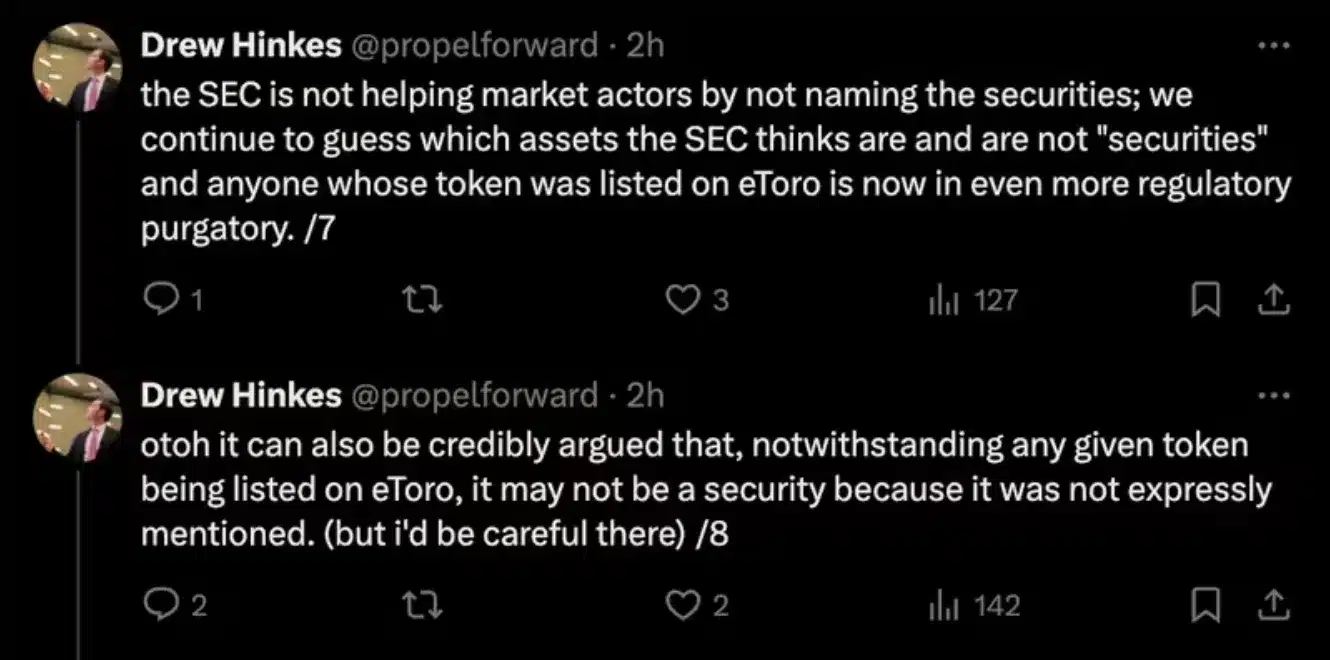

In response to the issue said Drew HinkesPartner at K&L Gates, shared his thoughts on

Source: Drew Hinkes/X

This situation at eToro is not isolated, as numerous major crypto platforms such as Coinbase, Kraken, Binance and Uniswap [UNI] have also faced legal challenges at the SEC.

While some of these battles are still ongoing, others have ended with the SEC winning.

SEC Fines Report Unveiled

In fact, a recent report shows that the SEC imposed significant fines on prominent crypto companies between 2013 and 2024, highlighting significant cases and the nature of these companies’ regulatory violations.

According to the report,

“Since 2013, the SEC has levied more than $7.42 billion in fines on crypto companies and individuals, with 63% of the fine amount, i.e. $4.68 billion, coming in 2024 alone.”

Since 2022, the SEC has stepped up efforts to regulate the cryptocurrency space, levying fines on companies and holding executives accountable to emphasize stricter oversight.