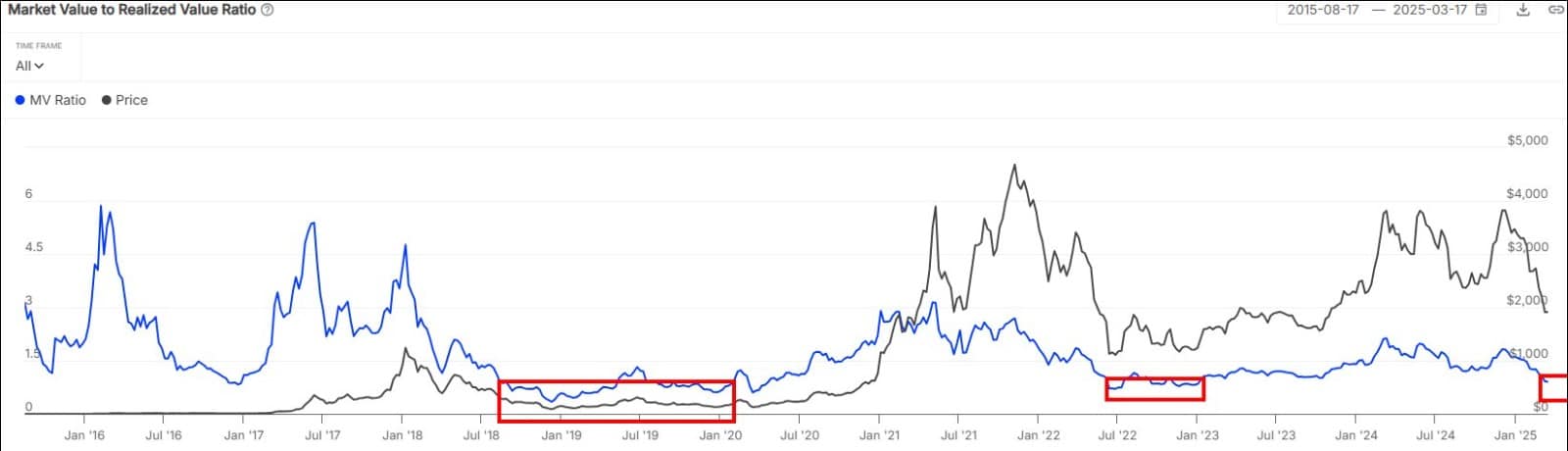

- The MVRV ratio of Ethereum indicates an undervalued market.

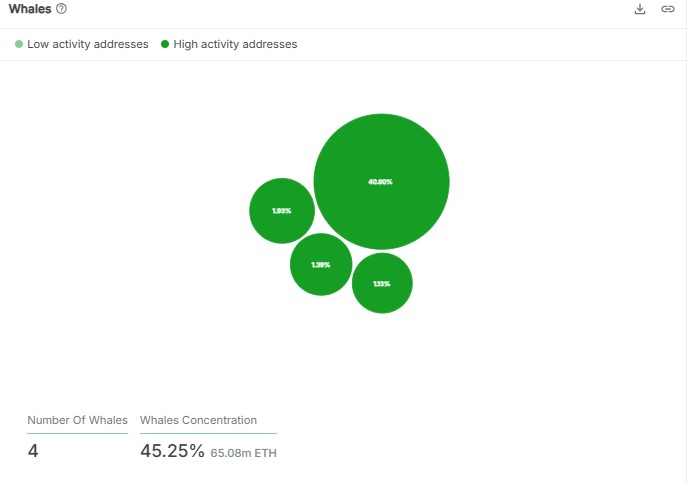

- The whale activity has increased, with 44% of the addresses that control the market.

Ethereum’s [ETH] Market value to realized value (MVRV) ratio was 0.9 at the time of the press. For non -ingwrden, the formation of new highlights usually precedes such low MVRV levels.

Historically, MVRV ratios were under 1 excellent access points for ETH investors. NOw that the ratio shows undervaluation, everything seems to be present for a potential bullish reversal.

Source: X

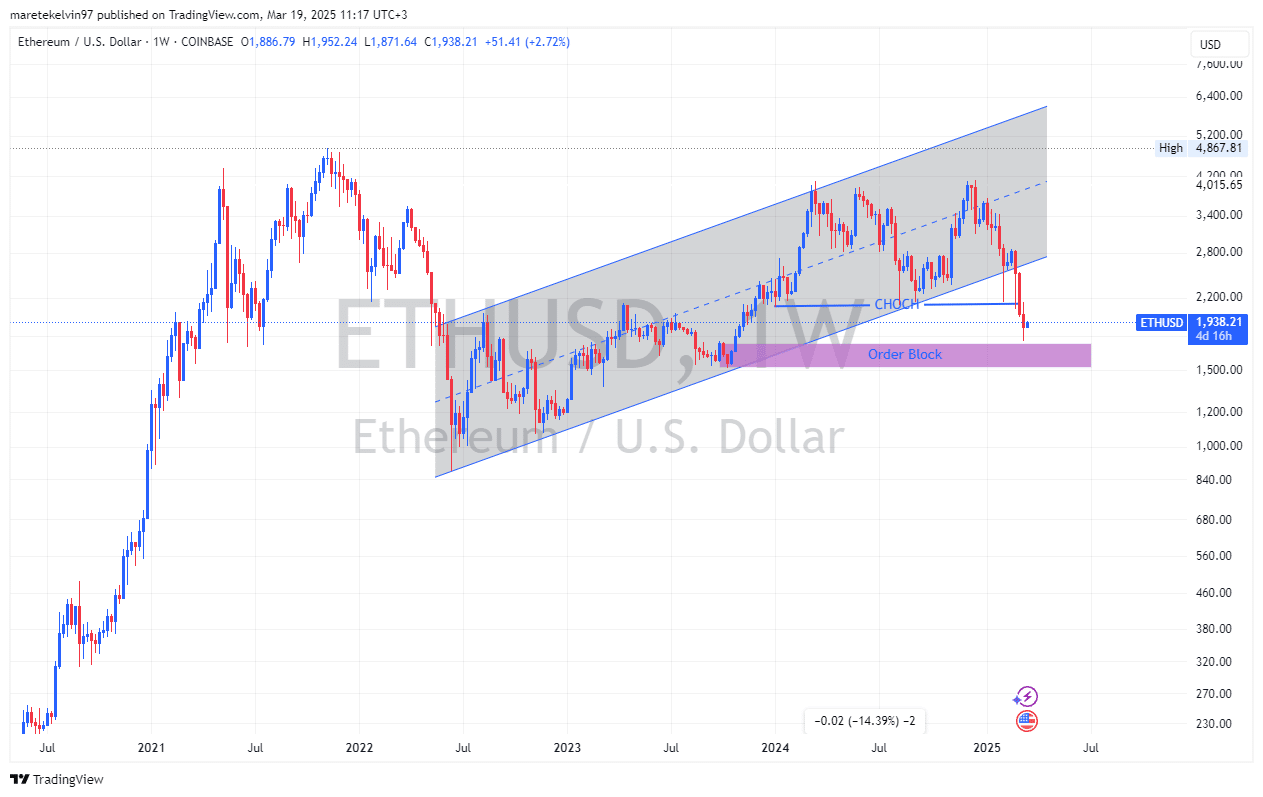

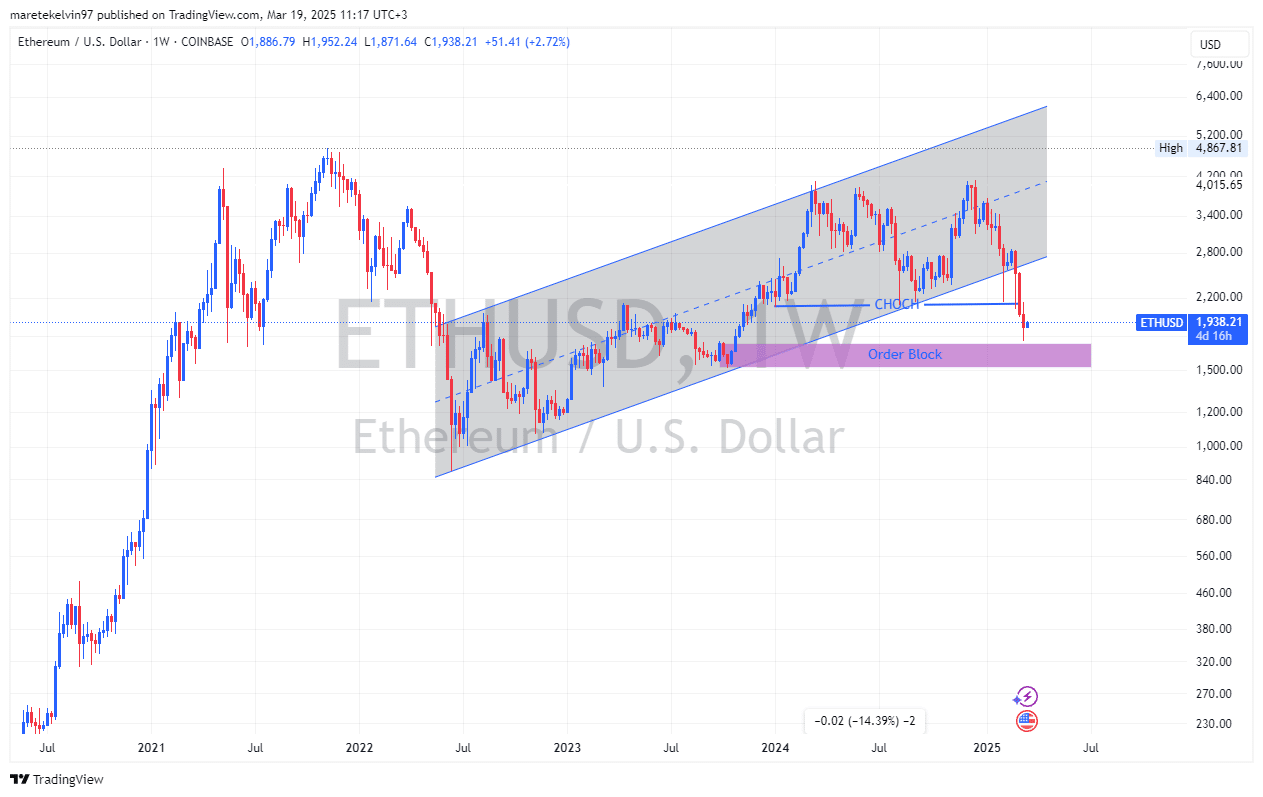

ETH -price promotion leans Bullish

ETH prices are currently testing an important demand zone on the weekly graph with around $ 1.6k. With the recent trend change in Beerarish, this price level can be crucial when determining the next step.

On Shorter time frames, the King Altcoin shows signs of a bullish reversal, which further feeds optimism.

Ethereum has in fact already risen by 2.57% at the time of the press, which performs better than most of the top ten cryptocurrencies. This upward momentum is a strong technical indicator for dip buyers and whales to come in.

Source: TradingView

Whale activity points to potential rally

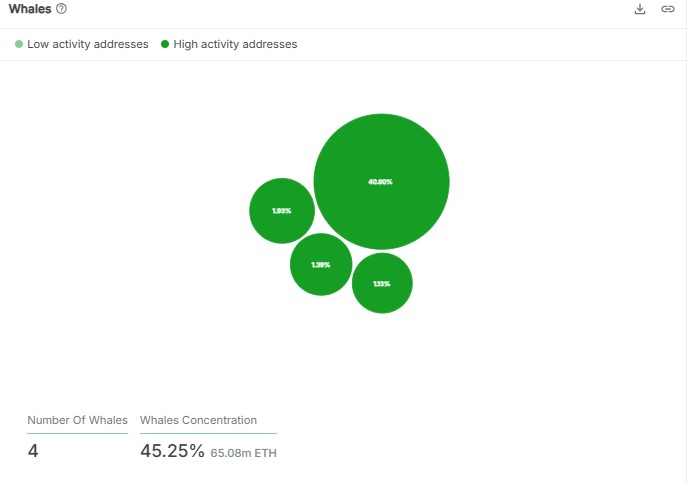

Consequently, the activity concentration data of IntotheLlock indicated that 44% of the addresses push the market activity on the whales push.

With increasing generally Whale activity, ETH prize rally to test the flag pattern, seems inevitable. Whales are often seen as market movers, and their increased participation suggests trust in the short -term potential of ETH.

Source: Intotheblock

ETH’s converging low MVRV ratio and bullish whale event presents an intriguing bullish setup for short-term valuation in the short term.

These confluencing developments are important precedents for large price collections, making the current arrangement particularly remarkable among the market participants.

Because Ethereum tests a considerable demand zone and whales that increase their activity, it is all ready for an imminent bullish rally.

For investors this can be a golden chance to take advantage of the ETH.