- Ethereum has historically soared in the first quarter, often doubling returns

- However, with growth slowing, the stakes are now higher

Do you remember election night last year? Well, Ethereum recorded its longest green candlestick in three months at the time, rising 12% in one day to close at $2,721. Fast forward to January 19 and now it is down 20% from the $4,015 peak from that rally.

With so much going on right now, the coming week will put ETH’s history of bullish Q1 to the test: will it pay off?

History matters in crypto

Ethereum has historically done well in the first quarter, often doubling or even tripling returns over the past four years. In 2023, ETH rose 54%, reaching $1,800 by the end of the quarter. However, 2021 remains the high point, with ETH surging 160% to $1,920 in just three months.

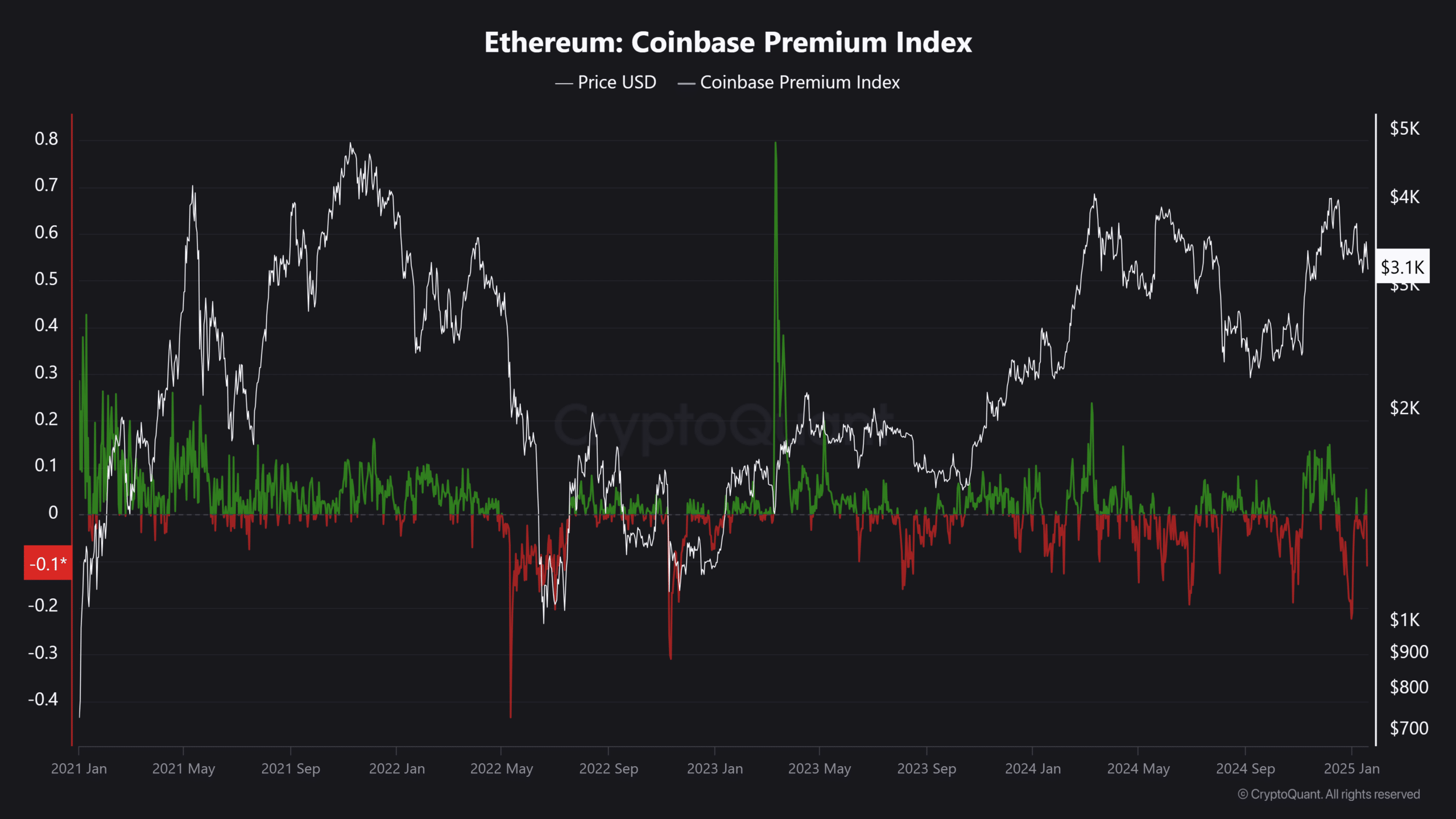

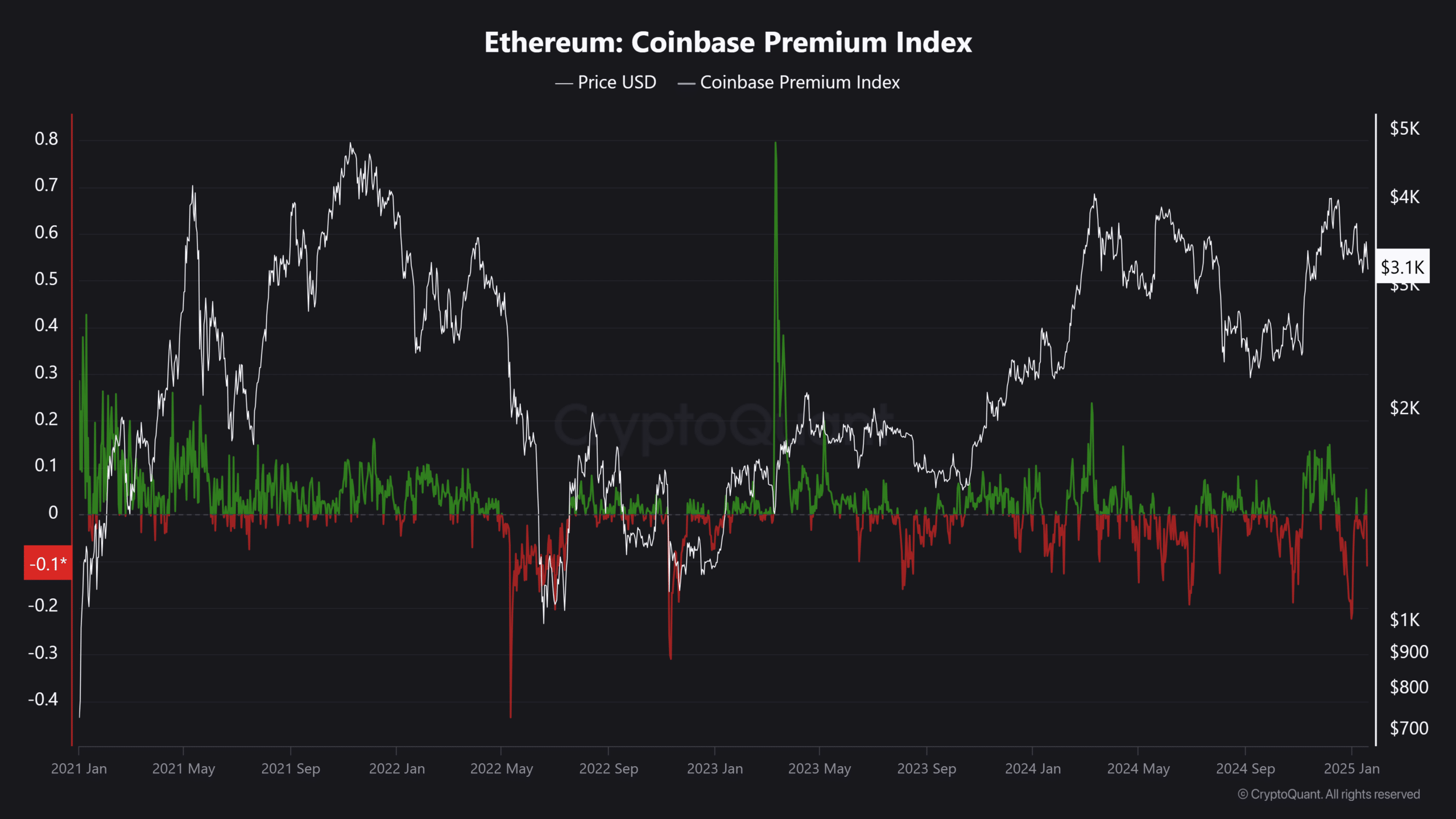

Clearly, growth has slowed since then and annualized returns are also declining, creating a dilemma for HODLers. This shift in sentiment is visible in the Coinbase Premium Index (CPI), which underlined a cooling of buying momentum.

Even as the crypto market cap reached an all-time high of $3.70 trillion during last year’s post-election rally, the ETH buying frenzy among US investors barely moved the CPI. This indicated declining enthusiasm across the board.

Source: CryptoQuant

Four years ago, Ethereum’s market capitalization even reached $500 billion, while its price rose to $4.76k. Fast forward to today, it is down 22% and trading at $3.2k at the time of writing. With quarterly returns cooling, HODLers’ patience is now being tested as ETH struggles to move past its key psychological levels.

Despite the market-wide recovery, ETH’s inability to break $4k stands in stark contrast to XRP, which is already up 53% in the first quarter. Investors are clearly looking for higher returns, and other high-caps are doing their best to make this happen.

Ethereum is in danger of being left behind

Zooming in, XRP’s market cap has risen to a new all-time high of $180 billion, now half that of Ethereum. Meanwhile, ETH is down 3% since the start of the year. At this rate, XRP could soon overtake Ethereum – faster than anyone expects.

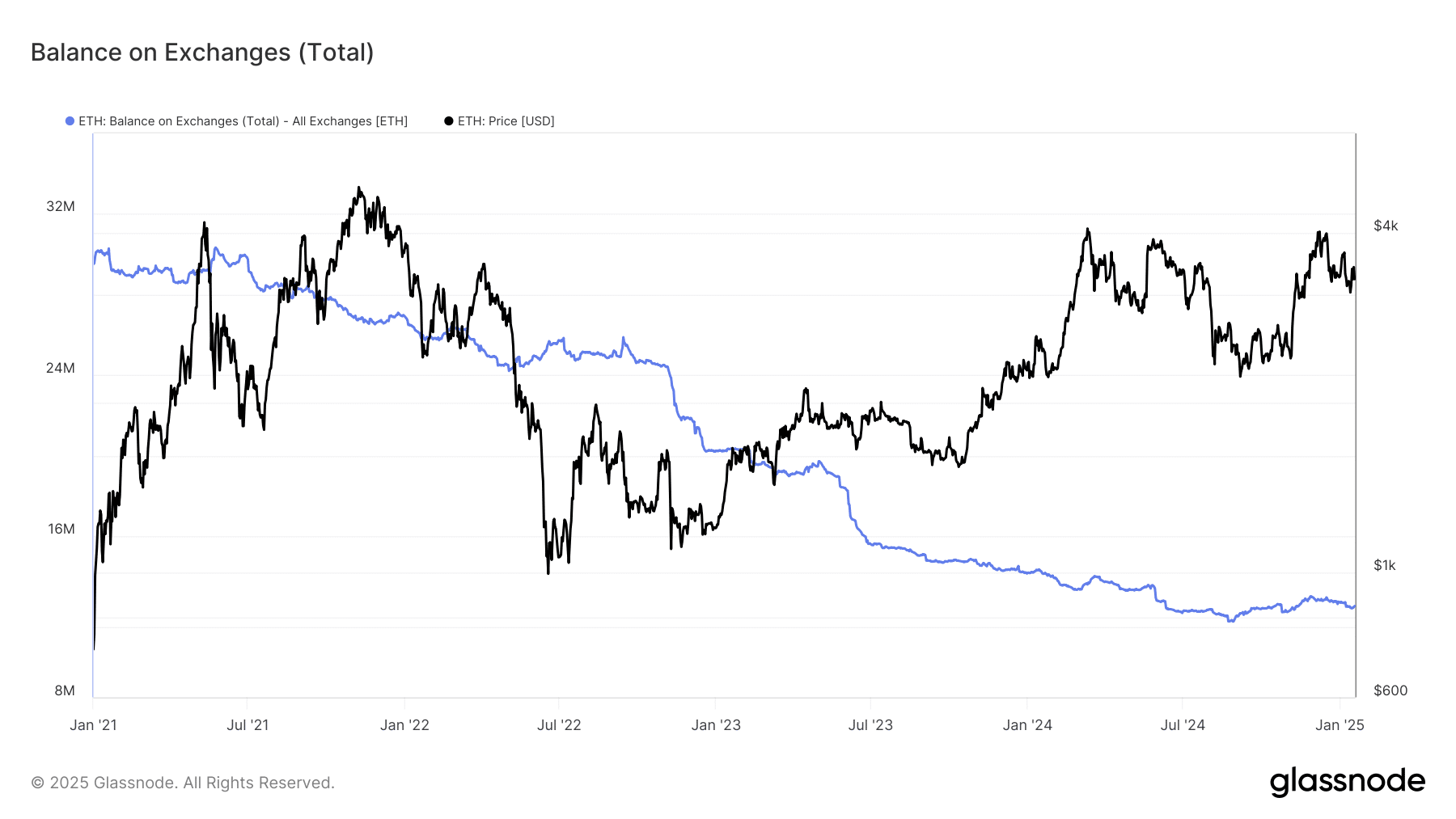

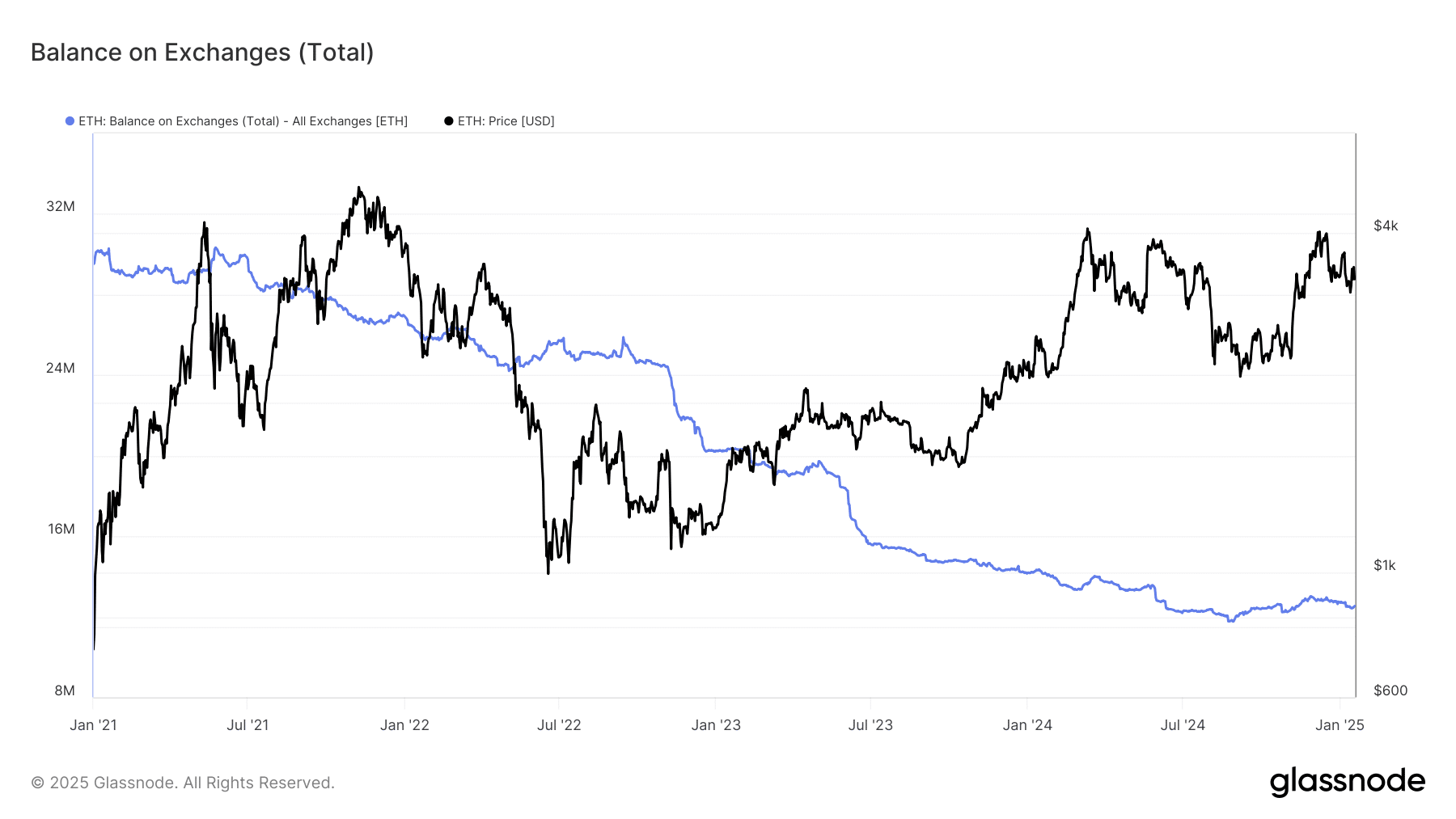

Even though there is 540k ETH withdrawn and $1.84 billion in fresh capital flowing into the market, Ethereum has still seen a 2% decline over the past month. In fact, the stock market balance also reached a new low. Here, the The lack of bullish movement is also evident, putting Ethereum’s long-term prospects at risk.

Source: Glassnode

Read Ethereum’s [ETH] Price forecast 2025–2026

What’s more worrying? Long-term holders (LTHs) have increased their holdings by 75% in the past year.

However, with yields falling short, these LTHs could disappear soon, making the $4k level a critical test for ETH in the coming days.