- Ethereum’s funding rate signals a potential recovery for ETH.

- ETH is down 16.48% over the past seven days.

Since reaching $4109, Ethereum [ETH] has experienced strong downward pressure. As such, the altcoin has fallen to a low of $3095 over the past week, down 16.48%.

Despite the recent dip, Ethereum appears positioned for a comeback to $3,300. This is because Ethereum’s funding rate has cooled since the two $4k rejections.

Ethereum futures market cools after $4k rejection

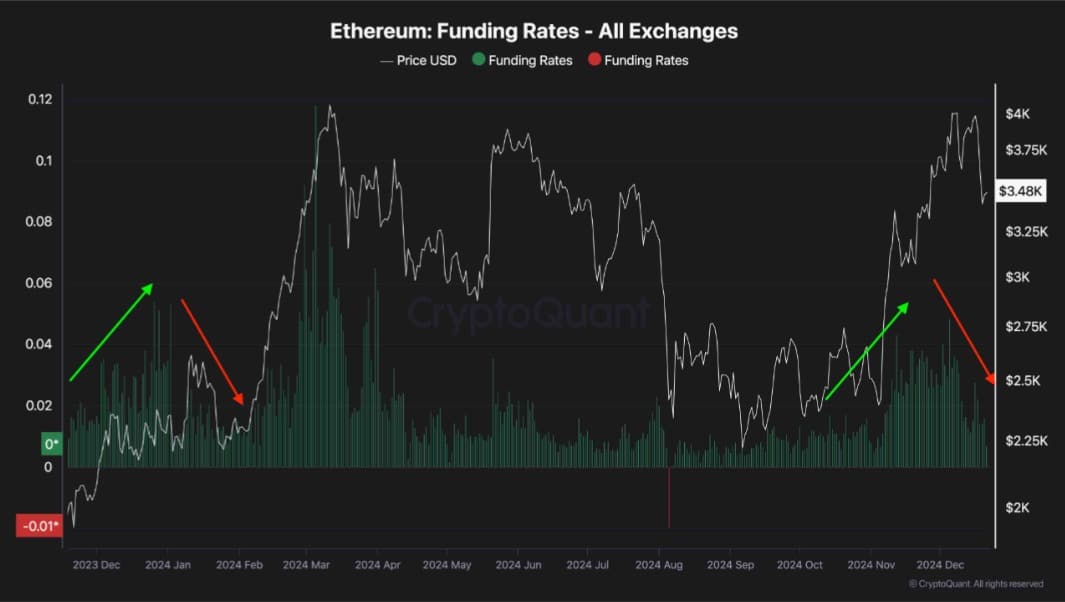

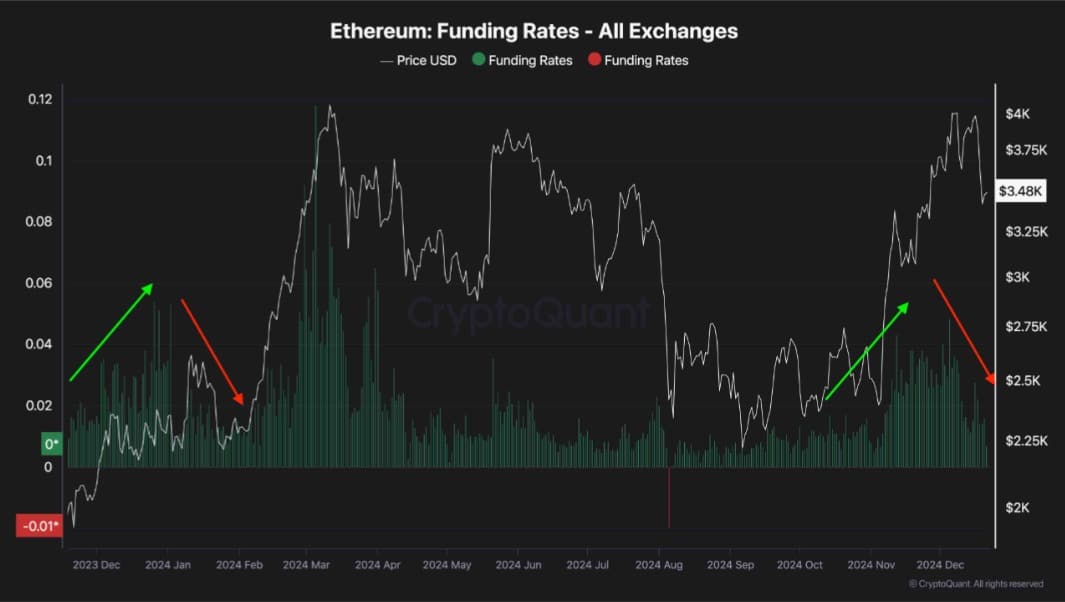

According to CryptoquantEthereum’s inability to reclaim the $4k resistance resulted in massive liquidations in the futures markets.

Source: Cryptoquant

This resulted in a massive market crash where ETH hit rock bottom. While ETH’s funding rate soared last week, the altcoin’s inability to hold above $4,000 brought its funding rate back to healthy levels. These levels are very suitable for a bullish trend.

Therefore, the cooling effect of this could potentially pave the way for a more sustainable rally in the coming weeks.

Historically, such a pattern occurred in January 2024, when the drop in funding rates cooled the futures market, causing ETH to have a major uptrend.

During this rally, Ethereum rose from $2169 to $4091. This historical precedent indicates that the current market reset could mark the beginning of a new bullish phase.

What ETH charts suggest

Although Ethereum has experienced strong downward pressure over the past week, prevailing market conditions point to a recovery.

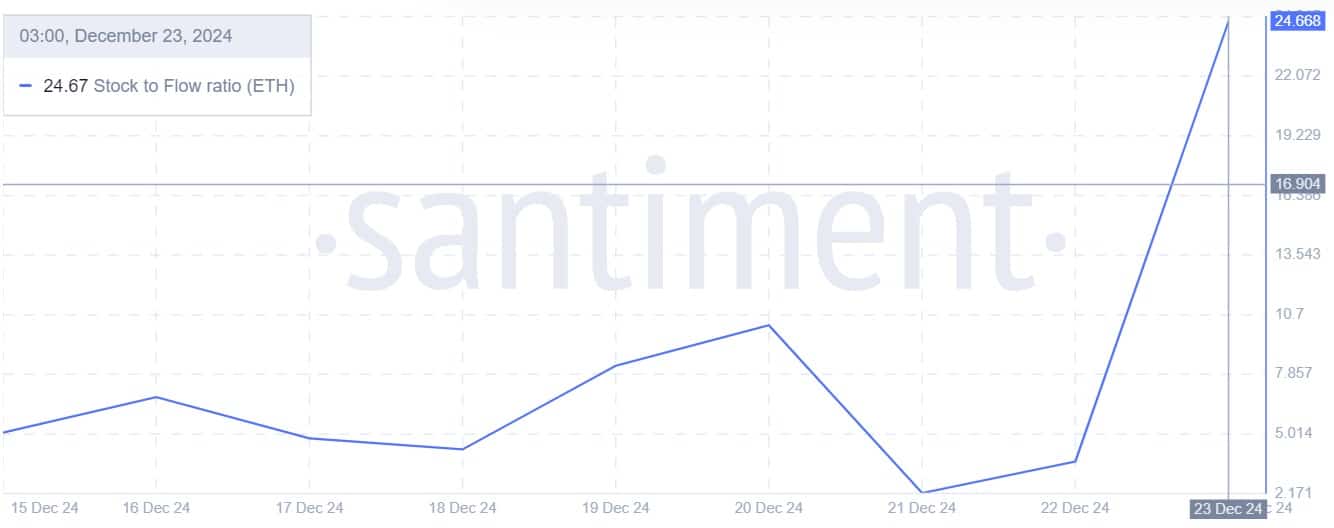

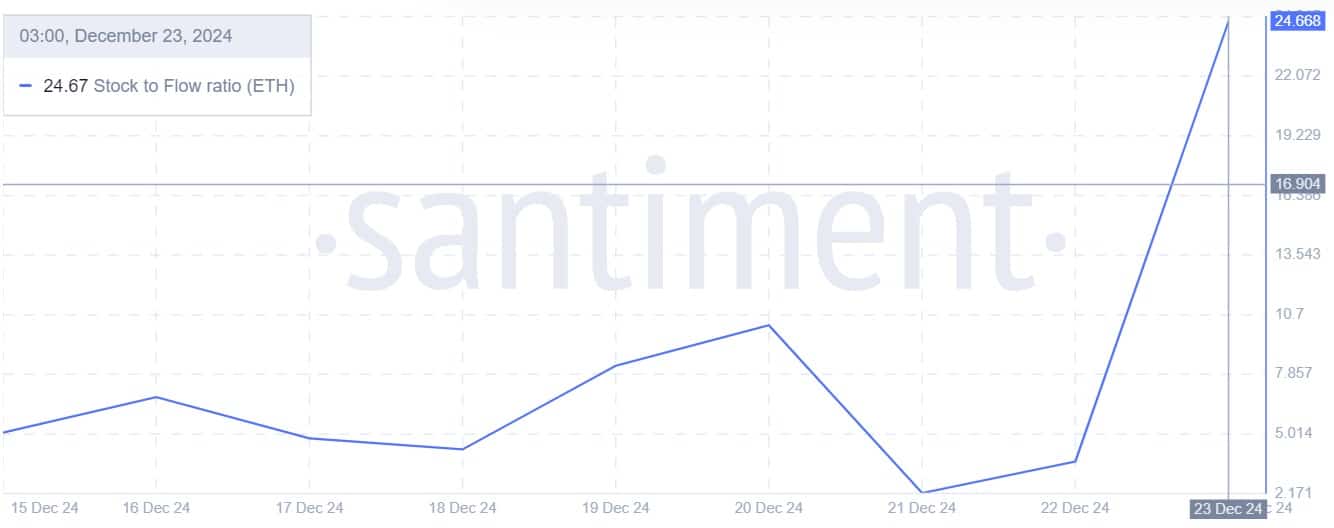

Source: Santiment

For starters, Ethereum’s stock-to-flow ratio has increased from 2.19 to 24.67 over the past week. When the SFR rises, it implies that ETH has become scarcer amid increased accumulation by large holders.

As such, the altcoin has become scarcer. Combined with rising demand, this drives up prices due to supply shortages.

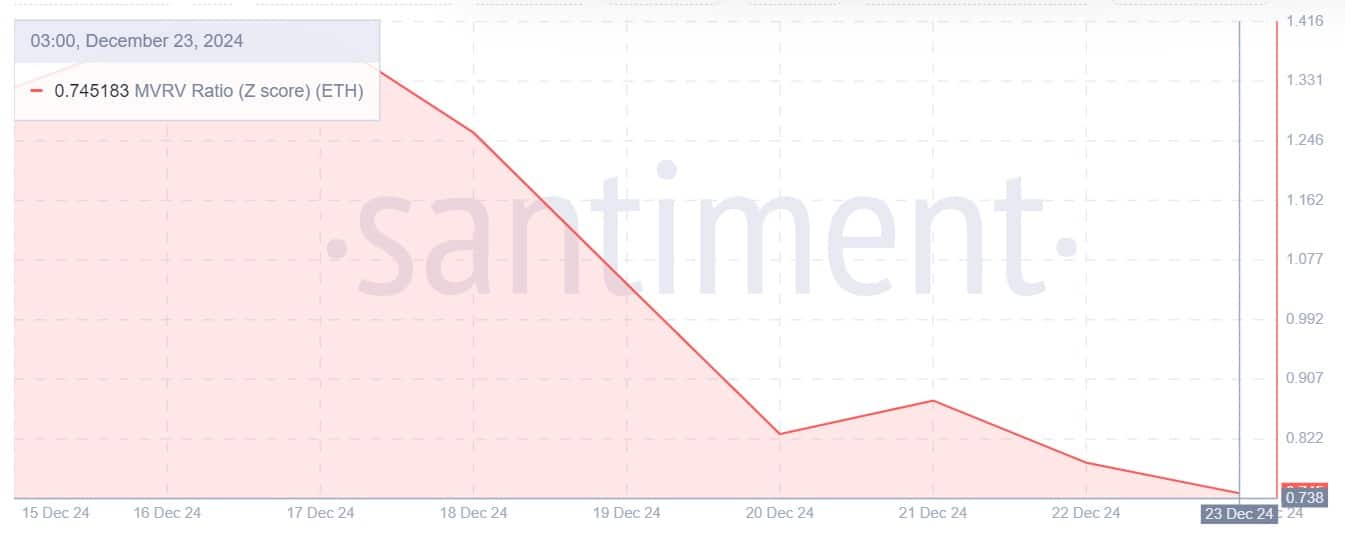

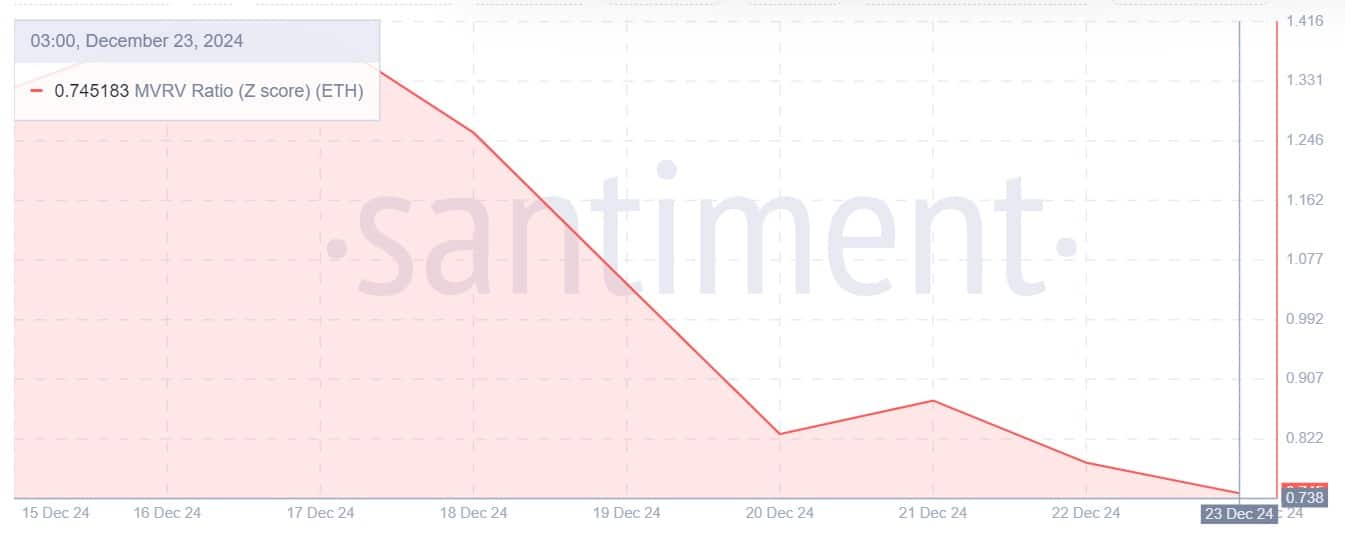

Source: Santiment

Additionally, the Ethereum MVRV Z-score ratio has dropped to 0.745 over the past week. When the MVRV score reaches such low levels, it indicates that ETH is currently undervalued, which is a good signal for accumulation among long-term holders.

This trend has been seen over the past week as whales turned to buy the dip. Greater accumulation generally creates higher purchasing pressure, which puts upward pressure on prices due to high demand.

Source: Santiment

Finally, Ethereum’s Bitmex basis ratio has increased from -0.22 to 0.07 in recent days. When this ratio turns positive, it reflects optimism in the futures market as traders expect prices to rise after the dip.

Is a comeback likely?

As noted above, the futures market is bullish and expects ETH prices to recover. Likewise, spot demand for Ethereum is constantly increasing, creating healthy conditions for price gains.

Read Ethereum’s [ETH] Price forecast 2024-25

Now that the market is bullish, ETH could recover from the $3300 dip and regain higher resistance. If these conditions hold, ETH will reclaim the $3700 resistance.

A move from here could strengthen Ethereum to head towards $3900. However, with the bears still strong, ETH will fall to $3160 if the bulls fail to recapture the market.