- Members of the Ethereum community had varying views on ETH’s value and roadmap.

- The mixed signals from Ethereum leadership could hurt ETH’s sentiment.

The Ethereum [ETH] leadership has made headlines thanks to ETH’s long-term roadmap and vision for value building. One of the members of the Ethereum community, Justin Drake, suggested that ETH was like Nvidia and Apple and could attract billion-dollar valuations based on the fees.

Drake declared,

“Ethereum is like a very big company like Nvidia, Apple. We can generate valuations in the billions purely based on the flows [fees]. And then you know there’s a whole other topic on top of this basic valuation of trillions of dollars for ETH as money, collateral… for decentralized stablecoins.”

Mixed opinions on the value of ETH

However, some builders and founders in the Ethereum ecosystem disagreed with these perceived leadership views. Sam Kazemian, founder of DeFi protocol Frax Finance, was among the critics.

Kazemian believed that comparing ETH to Nvidia or Apple would limit the altcoin’s growth potential compared to Bitcoin. He claimed that this valuation would not be a victory for the altcoin assets.

‘ETH currently has an annual turnover of $1 billion. If we double these revenues 385x to match Apple’s, that means ETH would match Apple’s valuation at 11x. Does this seem like a winning roadmap for ETH?”

He believed that this was a flawed way for the leadership to measure the value of ETH and that it might not compete with BTC.

“Ethereum as a large company whose ‘base valuation’ is measured because its cash flows from fees give it a chance to overtake BTC or ever overtake it?”

He added:

“Apple has annual sales of $385 billion, which is worth $3.3 billion. BTC has no annual revenue and will never have even one dollar in revenue. It is already worth $1.1 trillion.”

Kazemian, like most of the protocol’s founders, advocated that ETH’s primary value should be based on the store of value (SoV) and the DeFi ecosystem.

ETH leadership says…

Contrary to BTC’s ‘digital gold’ slogan, ETH has struggled to have an impactful and unified pitch deck for potential investors. Leaders’ push for ‘programmable money’ and ‘digital oil” has not gained the expected traction.

Ethereum’s DeFi vision has also seen divergent visions from leaders. Vitalik Buterin, for example, has been that skeptical of pure DeFi as the sole crypto growth catalyst.

This was in contrast to other community members, such as Hayden Adams of Kazemian and Uniswap, who believed that DeFi was crucial to the growth of ETH’s value.

According to Coinbase analysts, this is the case deviant vision for Ethereum’s DeFi has made it difficult for new investors to understand the asset and dented market sentiment.

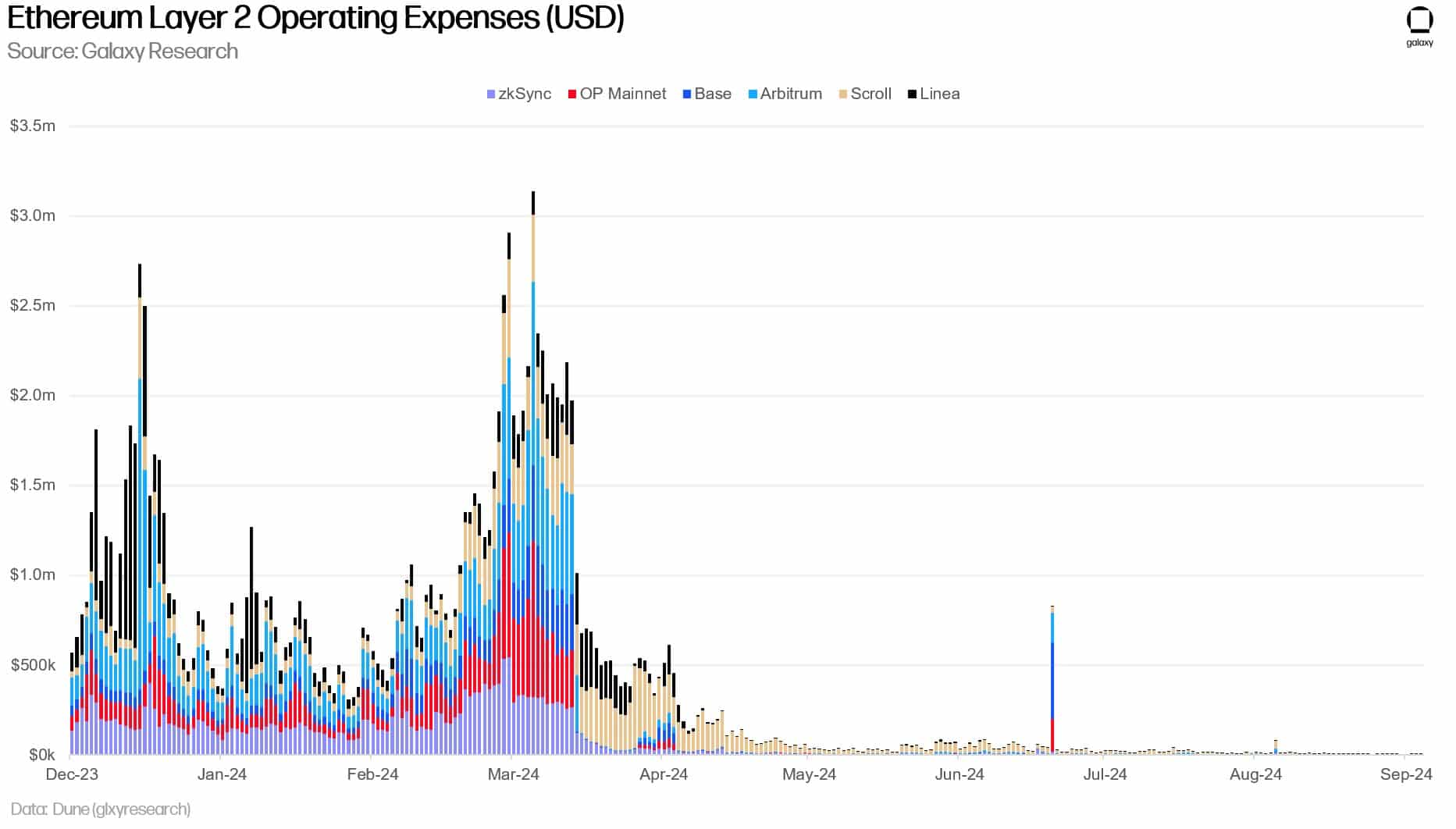

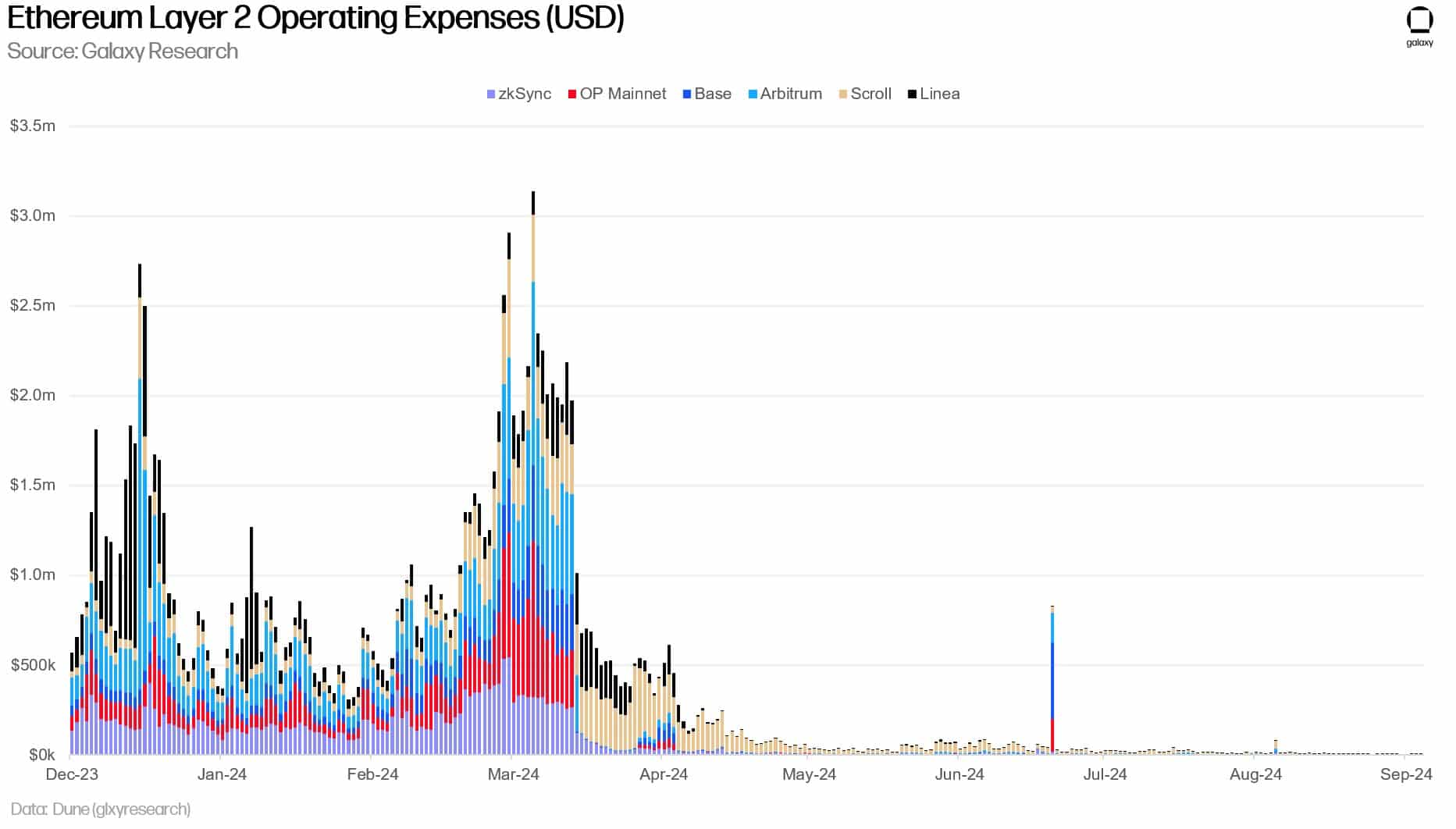

By the way, so is the cost of ETH rejected significantly since the Dencun upgrade in March, as cheap blobs drive users to migrate to L2s.

Source: Galaxy Research

This also has divided the community on whether blob fees should be adjusted to help ETH L1 gain value from L2s, as ETH’s inflation problem becomes even worse after the Dencun upgrade.

The aforementioned community issues have further disrupted investor sentiment surrounding ETH.

That said, ETH has lost ground to BTC. The underperformance was illustrated by a yearly low in the ETH/BTC ratio, which tracks the altcoin’s price performance against BTC. The value of ETH has decreased 44% compared to BTC in the last two years.