- Ethereum’s co-founder argued for more privacy functions at the app and general network levels

- Update has no significant speculative interest in the Altcoin

Vitalik Buterin is in the news today after he Ethereum [ETH] Privacy route map to improve the safety of users and anonymity.

According to the Exec, the approach would be ‘light’ on the design of Ethereum L1 design. To begin with, he defended wallet integration with privacy protocols that transaction details such as Railgun and hide Privacypools.

“Wallets must have an idea of a shielded balance, and when you send to someone else, there must be a ‘shipping of protected balance’ option, ideally enabled by default.”

Moreover, he is argued for For further privacy functions at application and network levels by hiding app transactions. Buterin believes that the approach, when it is fully assumed, would ensure that,

“Privacy of onchain payments, partial anonymization of onchain activities in applications, privacy of lectures at the chain, ie RPC calls and anonymization at network level.”

More Ethereum -Upgrades

That said, the ecosystem has a hanging Pectra -upgrade Under test network. Another fusaka, will then be implemented.

The Pectra update is intended to streamline setting and to improve the privacy (including account abstraction) and the overall user experience.

Fusaka, on the other hand, is intended to guarantee cheaper and faster transactions for L2S. Together they would enable the chain to compete with much faster alternative block chains such as Solana [SOL].

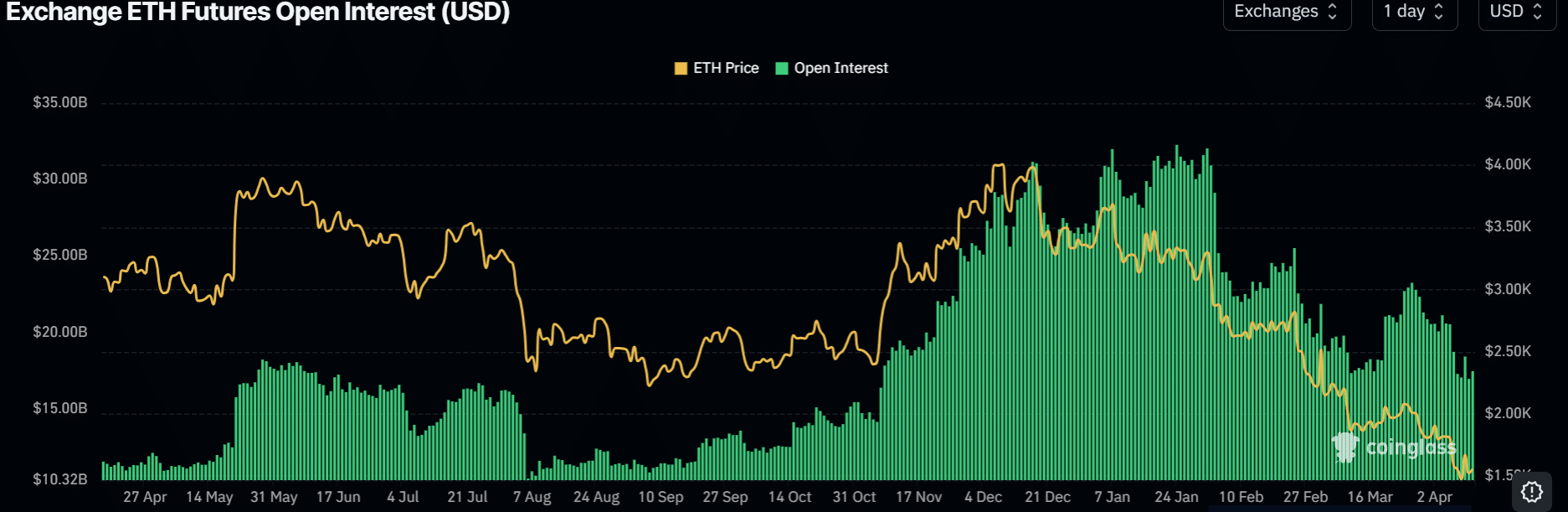

However, it is worth pointing out that the privacy update or planned upgrades have not stimulated significant speculative commercial interests in ETH. According to Coinglass, ETHs open interest (OI) in fact fell by 1.5%in the last 24 hours.

Source: Coinglass

In 2025, ETH’s OI fell by 50% from more than $ 31 billion to $ 16 billion, indicating the muted demand on the derivatives market and a general Bearish sentiment.

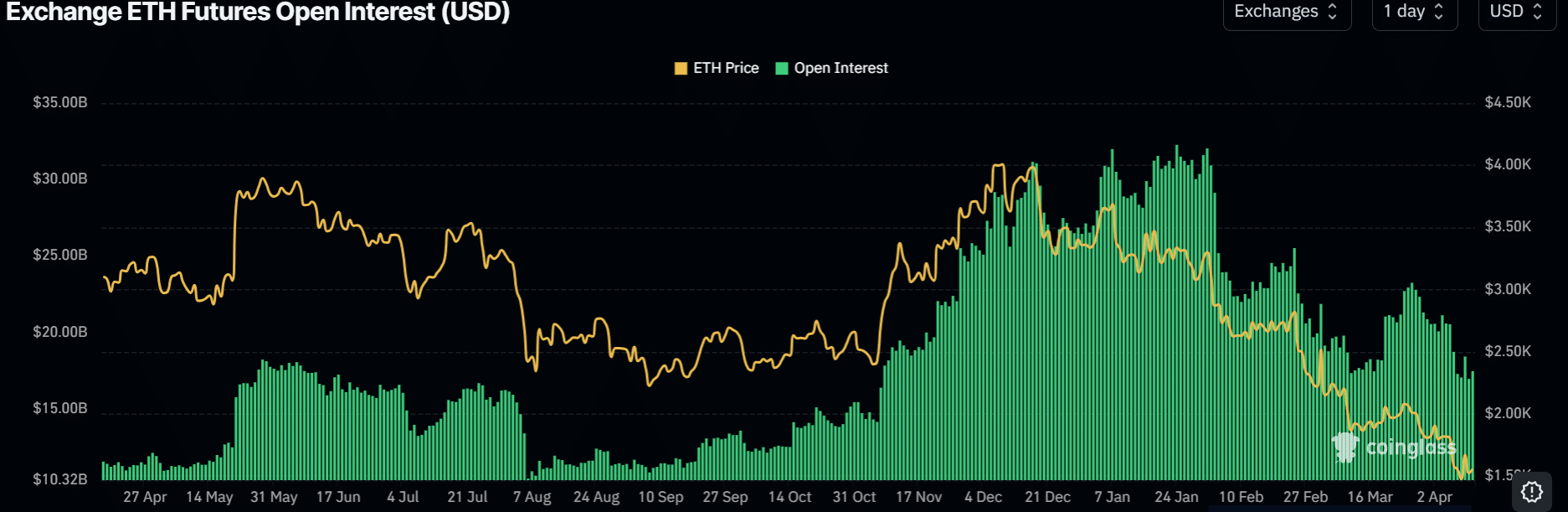

On the price diagram, however, the Altcoin was appreciated at $ 1.5k and formed a bullish RSI divigence on the 12-hour graph.

In most cases, such a training often leads to an upward price reverse. However, this can still be seen for ETH in the midst of the constant macro uncertainty.

Source: Eth/USDT, TradingView