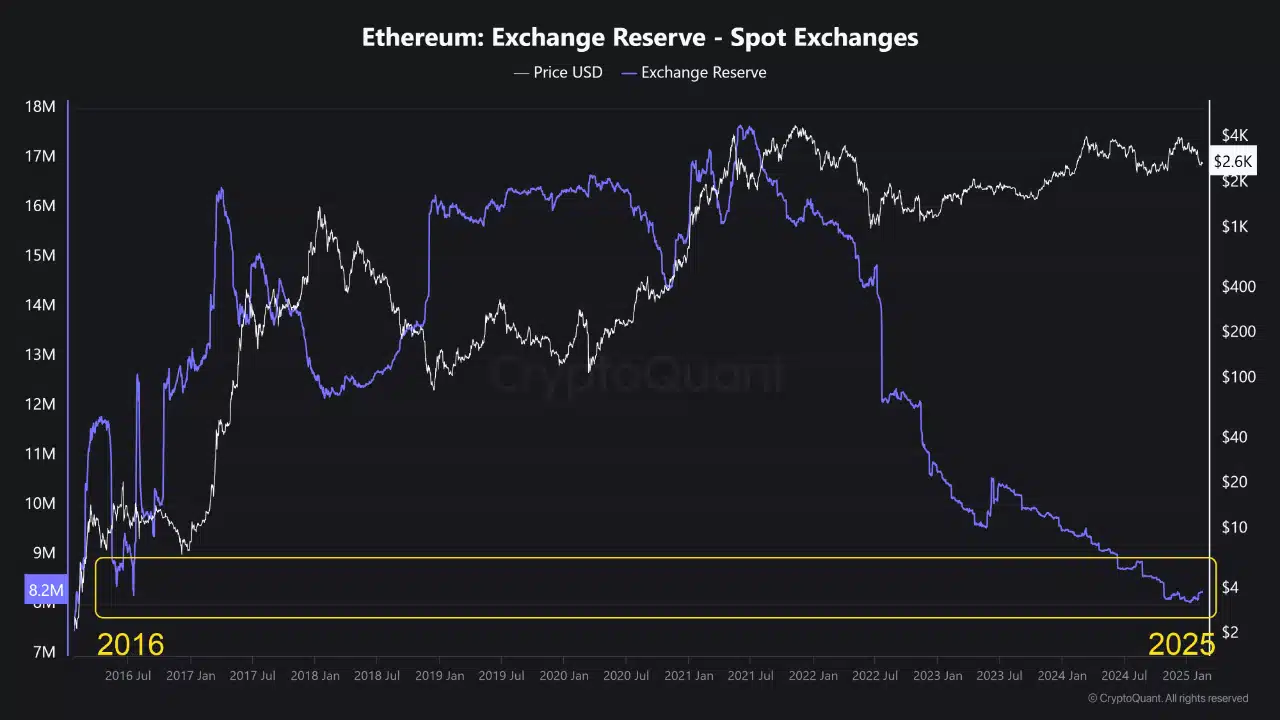

- The range of Ethereum on centralized exchanges has fallen to the lowest levels since 2016.

- Trends on chains and derivatives indicate a strong accumulation, but price consolidation continues.

Ethereum’s [ETH] The range of centralized exchanges has fallen to levels that have not been seen since 2016, so that intense speculation is fueled within the community.

Historically, such supplying crunches have cleared the way for considerable price rallies, because reduced liquidity often limits sales pressure.

As Ethereum’s strike ecosystem expands and the anticipation of potential place ETF’s Momentum gets, investors are curious.

Has ETH been drawn up for another explosive outbreak, or do market participants incorrectly interpret signals in this complex landscape?

Historical context

The price increases from Ethereum often coincide with periods of low exchange rack supply. During the Bull cycle of 2016-2017, the stock of ETH on centralized exchanges decreased when early adopters actively collected it. This pushed its price from less than $ 10 to more than $ 1,400 early 2018.

A similar trend arose during the Defi -Boom from 2020-2021 when investors migrated Eth to decentralized financial platforms. This drove its price to a record high of $ 4,800.

More recently, Ethereum’s Post-Gerge Transition (2022–2023) introduced a deflationary mechanism. Setting up a locking of considerable amounts of ETH in validator nodes, which reduces the liquid supply.

Although historical patterns show that low exchange provision can identify strong price collections, macro -economic conditions and investor sentiment remain critical factors in determining the next outbreak.

Spot and derivative data to support the momentum of ETH

The spot market of Ethereum reflects an important outflow of centralized exchanges, which reaches levels that have not been seen since 2016, as shown in Cryptoquant data.

Source: Cryptuquant

This trend emphasizes the growing preference for investors for self -herb and deportation, which suggests that the trust in the long term in the value proposition of ETH.

At the same time, Coinglass derivatives reveal the increasing open interest in ETH Futures, which indicates increased market participation.

Source: Coinglass

This increase can be a reflection of the bullish sentiment, in which traders positioning for an upward move, or a cautious hedge strategy in the midst of market insecurity.

Financing percentages and perpetual Swaps further signal market expectations of price valuation. Together these trends on mockery and derivatives create a compelling matter for the potential outbreak of Ethereum.

Ethereum: signs of accumulation?

Source: Cryptuquant

The net exchange outlets of Ethereum have remained high in the last three months, which indicates strong accumulation, since investors opt for self-intersection and deportation in the short term trade.

Historically, such trends preceded the most important price increases by reducing the available delivery.

Source: Etherscan.io

Data on chains further support this shift, with daily transactions that consistently indicate more than a million more than a million, which indicates a steadily network use.

Source: Santiment

However, fluctuations in active addresses suggest that although existing users remain involved, new user acceptance does not accelerate at the same pace. This could mean that institutional accumulation, instead of a broad shop demand, stimulates the price action of Ethereum.

Ethereum at a crossroads: breakout or long -term consolidation?

The recent price promotion of Ethereum suggests a phase of consolidation after the previous decline. The daily graph reveals that ETH is currently being traded under 50-day SMAs, indicating that the wider trend remains careful.

However, the RSI floats around 41.49, indicating that neither Eth is neither overbough nor sold over, which could indicate an accumulation phase.

Source: TradingView

Moreover, it remains obvious, which means that the inflow of volume is not significantly weakened despite recent price fluctuations.

If the buying of Momentum enhances, Ethereum could reclaim the most important resistance levels, making it possible to confirm a Breakout scenario.

Conversely, it cannot break from over 50-day SMA leads to long-term sideways movement or even a retest of lower support levels.