- Whales bought 340,000 ETH worth over $1 billion in the last three days.

- ETH might have completed its correction as the long-term trend directions are strongly bullish.

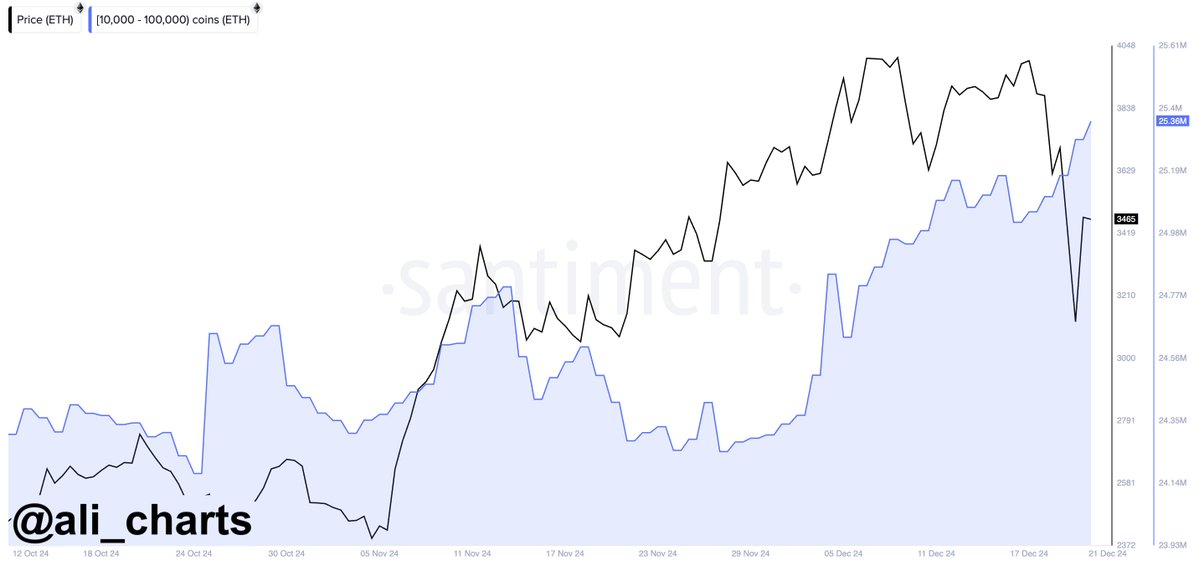

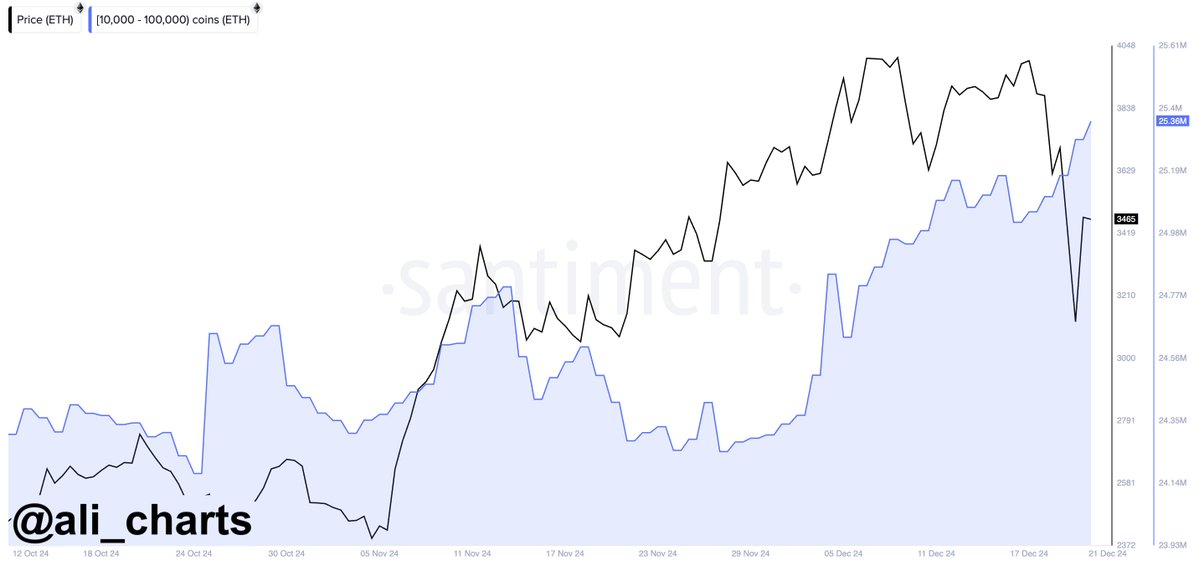

Ethereum ([ETH] Whale activity contrasted with its price, showing significant buying during the recession.

In three days, whales acquired 340,000 ETH, worth more than $1 billion, indicating strategic bulk buying during price drops.

This pattern, against the backdrop of general declines in the cryptocurrency, led to speculation about a possible market recovery.

Source: Ali/X

The activity was consistent with historical patterns in which substantial purchases often precede market recovery. This hinted that ETH could soon experience a price increase if this trend holds true.

Is the correction over if there are long-term trend directions?

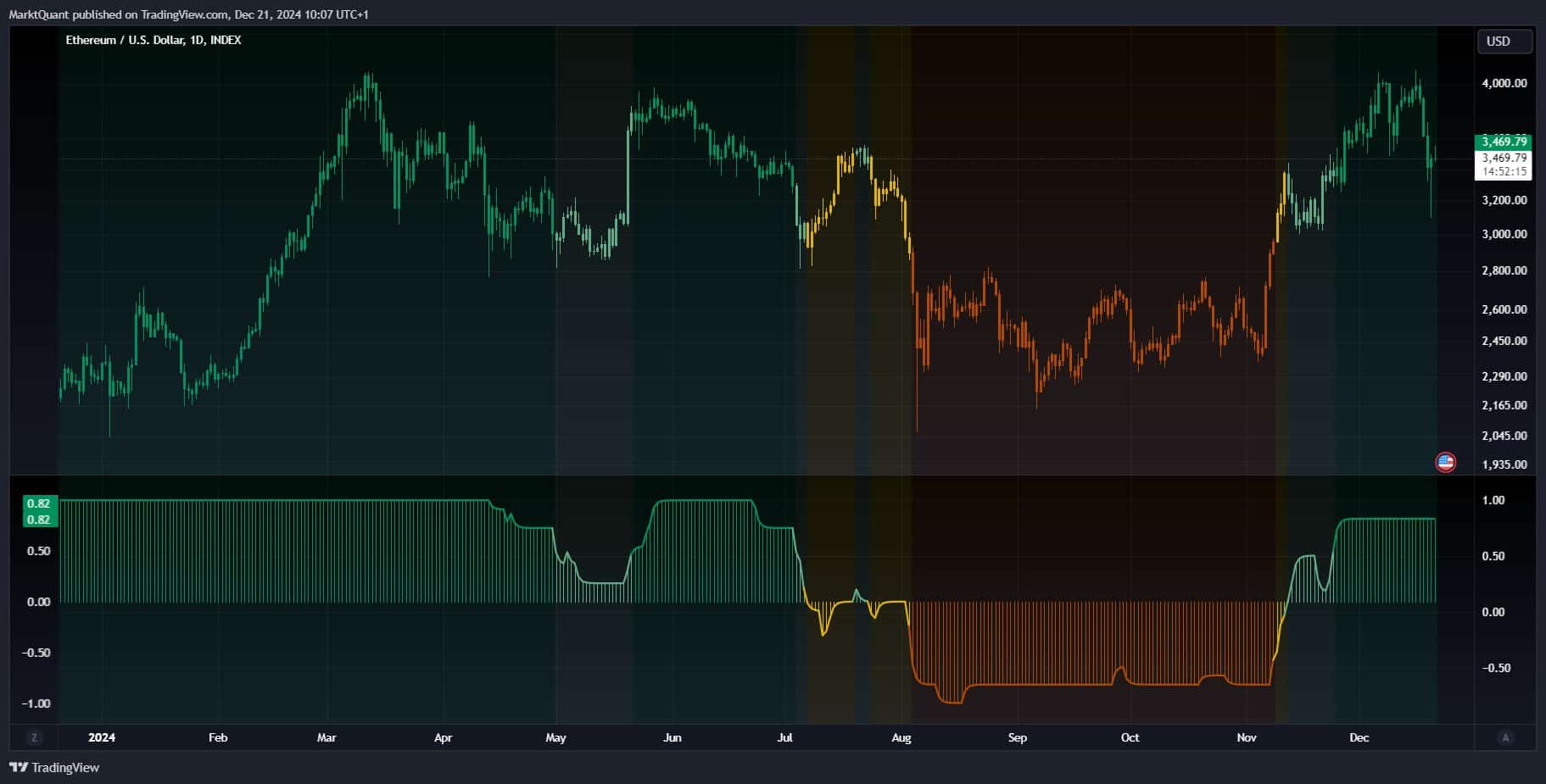

Ethereum’s weekly chart indicated a possible completion of the correction.

The price successively retested the Tenkan and Kijun lines of the Ichimoku Kinko Hyo indicator, suggesting a stabilization.

Further signs of support became apparent when ETH interacted with the Kumo Cloud’s Senkou Span A, which was seen as preliminary resistance turned support.

Source: Titan by Crypto/X

Moreover, the lagging period returned to the Tenkan line, strengthening the resilience of the current price level. Despite these bullish signals, caution remained on a possible retest of Kumo Cloud’s Senkou Span B.

If Ethereum’s price approaches this line, it would likely represent a critical test of market sentiment and strength.

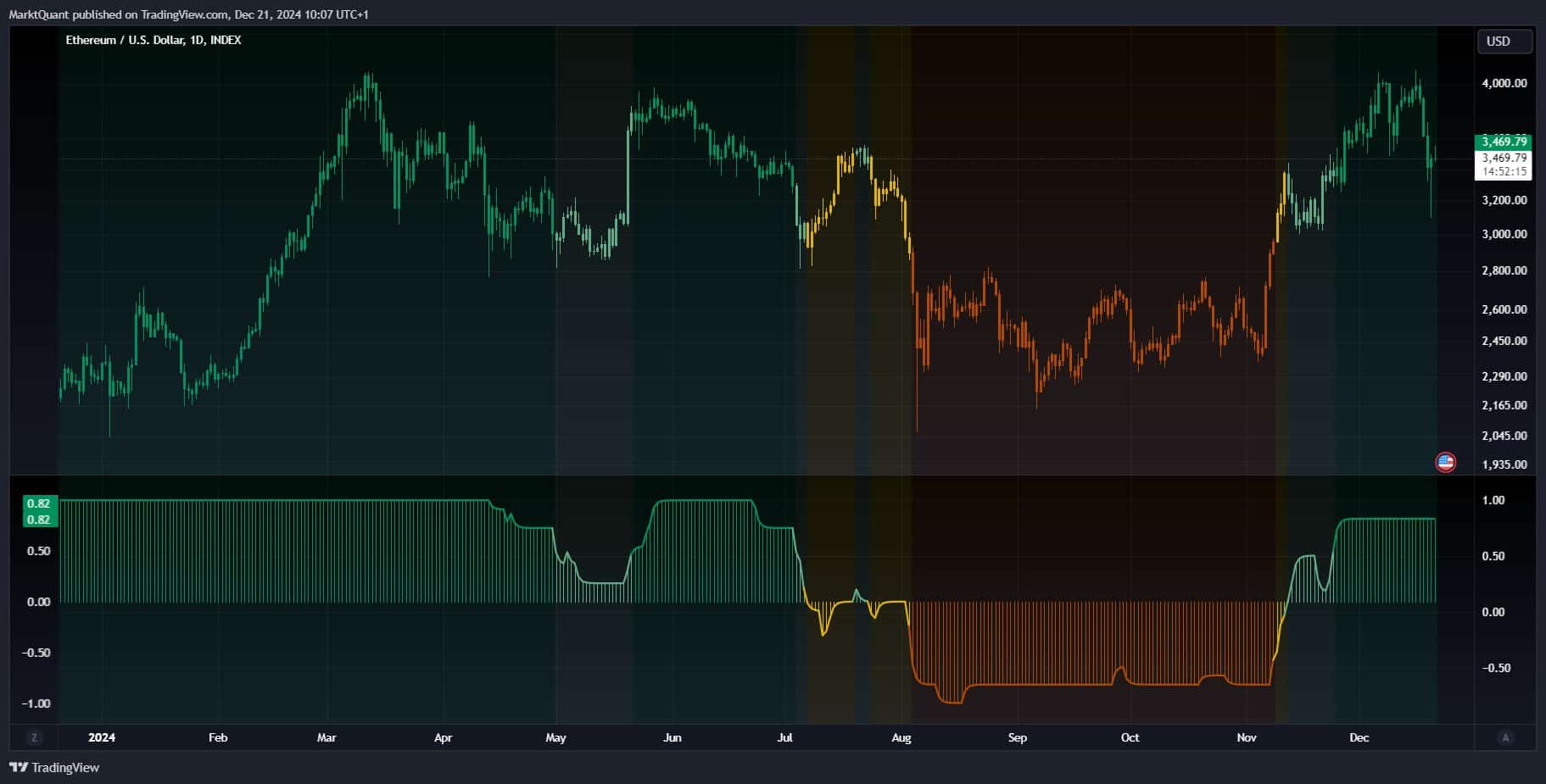

Once again, the Long Term Trend Directions (LTTD) score could end the year at a strongly bullish level of 0.82, indicating a positive long-term outlook.

Despite a brief mid-year dip, the LTTD returned to bullish territory.

Ethereum began a consistent climb, coinciding with an LTTD score remaining above 0.5, indicating continued buyer interest.

Source:

The sharp decline in the LTTD score in July corresponded to a price decline, which indicated a bearish phase in the short term.

However, the rapid recovery of the LTTD in October and a corresponding price increase indicated that the correction phase had ended, and ETH resumed its long-term upward trend.

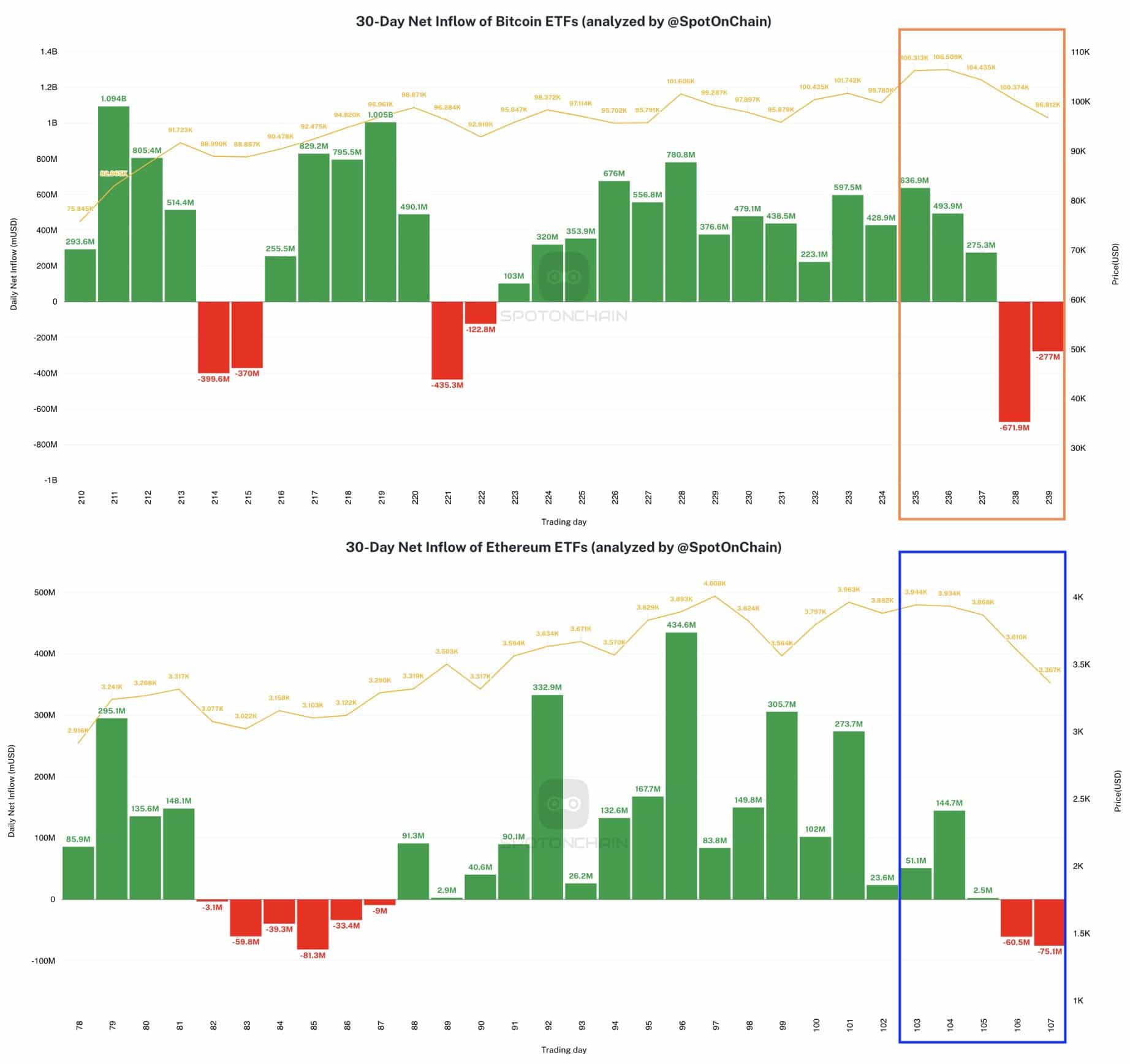

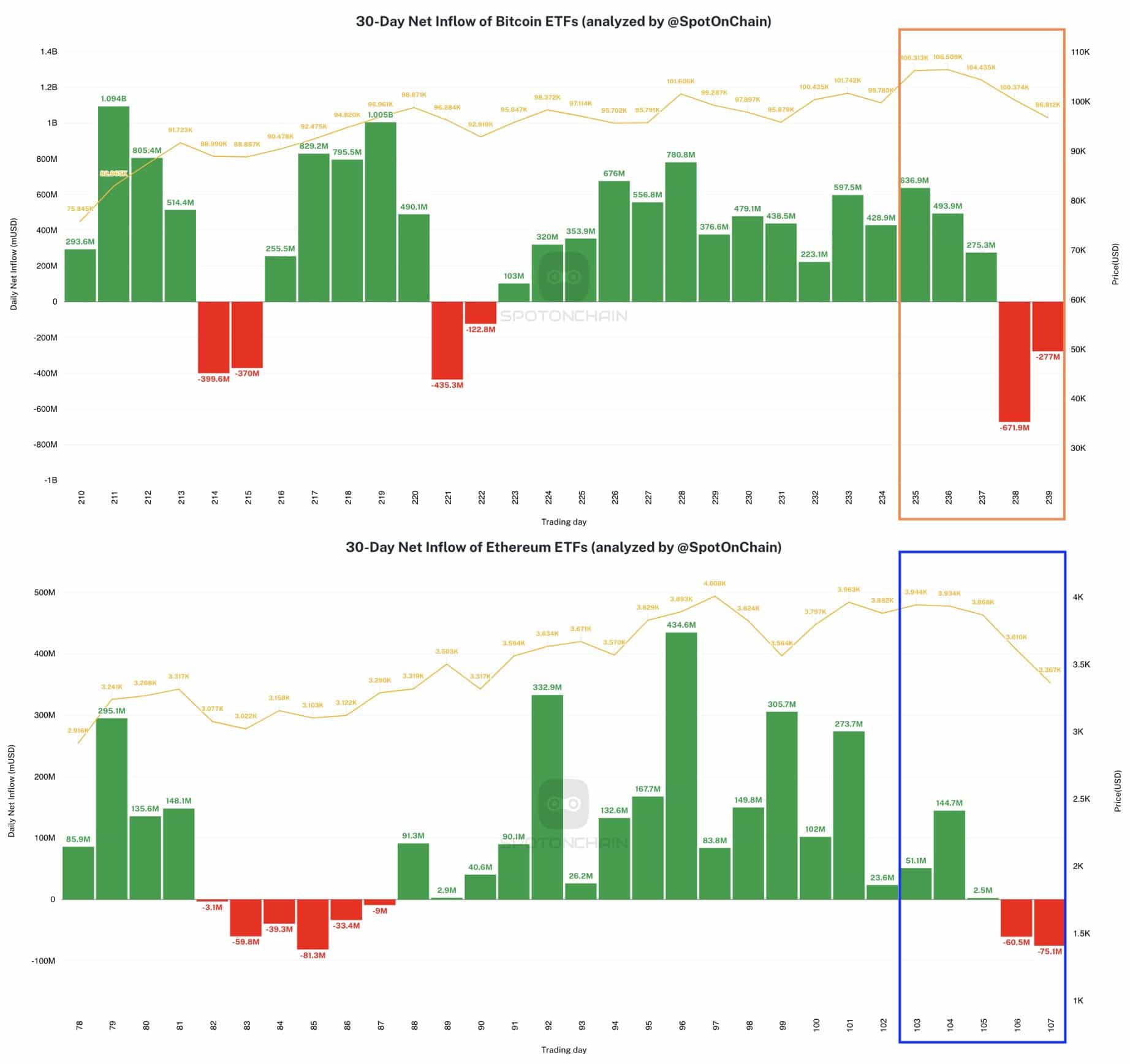

Discover the flow of ETH ETFs

However, Ethereum ETFs experienced notable outflows, with BlackRock’s ETHA seeing the largest ever, at around $103.7 million, during a week marked by market declines.

In contrast, Bitcoin ETFs also witnessed their largest outflows since their inception, totaling approximately $671.9 million.

This reversal ended two straight weeks of inflows for both Bitcoin and Ethereum ETFs.

Source: SpotOnChain

Notably, despite the outflows, BlackRock has built substantial positions, adding 13.7K BTC worth $1.45 billion and 33.9K ETH worth $143.7 million.

These moves indicated significant shifts in ETF dynamics, reflecting broader market sentiment and potentially paving the way for future trends in cryptocurrency investing.