- Meta is planning to launch his Stablecoin on Ethereum later this year, with potential for more than 3 billion users to board.

- Tron’s $ 73.8B USDT offering caught up the range of Ethereum, with the total USDT offer on just above $ 150 billion.

The company of Mark Zuckerberg, Meta, considered his supposed intention to raise a stablecoin on Ethereum [ETH] This year. This meant a daring step towards financial decentralization for global companies.

Meta has more than 3 billion users on platforms such as Facebook, Instagram and WhatsApp. This can mean the largest user base in Crypto.

The step follows on the institutional trend to blockchain to lower the settlement costs, increase transparency and bypass the old payment channels.

If it is performed, this can change the activity on the chains, the standard digital settlement surface for Web2 Giants that becomes Ethereum.

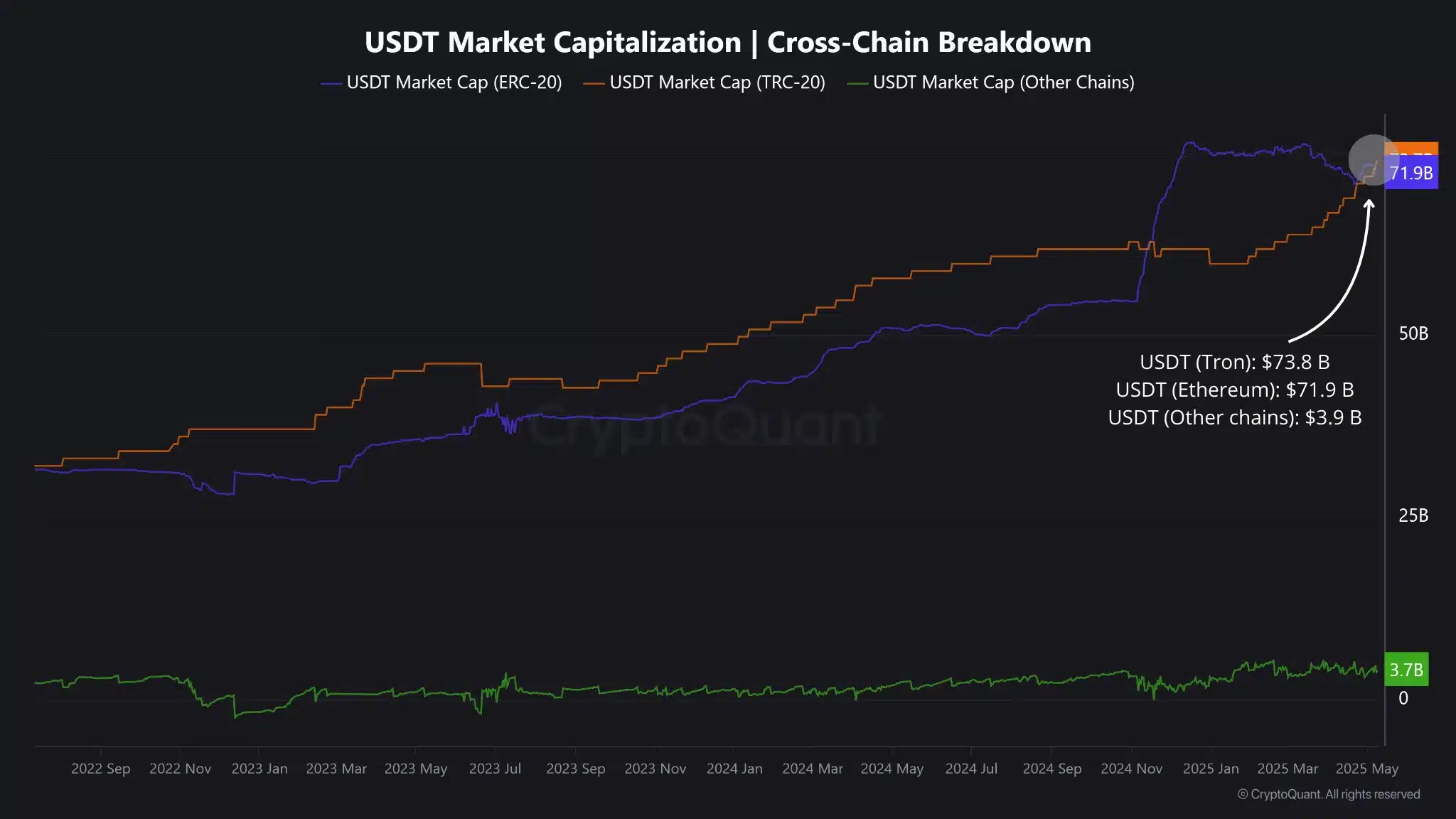

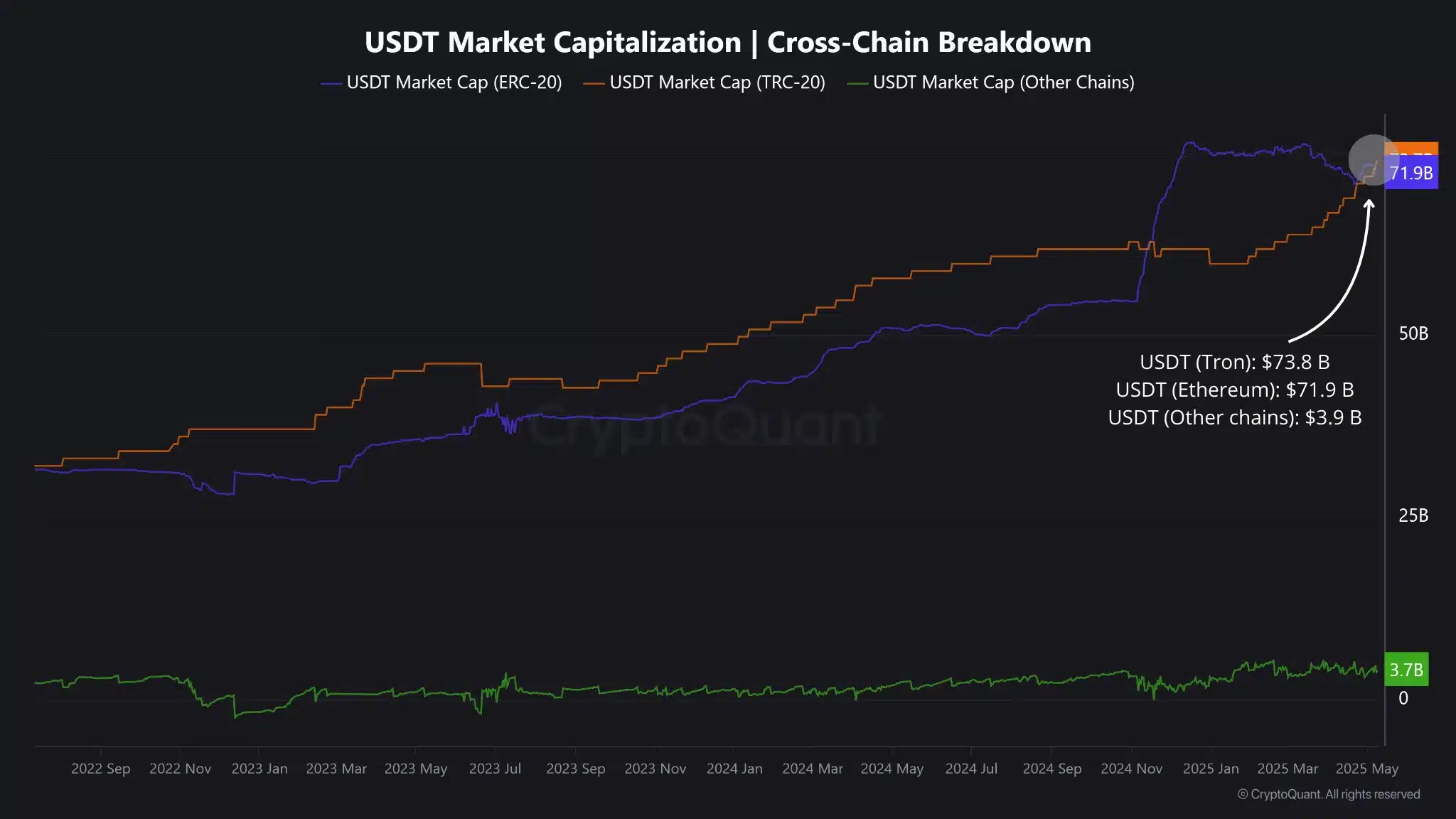

Stablecoin supply on tron vs. ETH Network

The USDT nutrition on Tron [TRX] Ethereum’s officially surpassed, with $ 73.8 billion on the first and $ 71.9 billion on the last. This was a huge transition with regard to the preference of Stablecoin on blockchain networks.

From the beginning of 2023 the records consistently stood up for Tron. In the meantime, the USDT issue of Ethereum accelerated at the end of 2024 but played in 2025. Tron’s turnout showed a stable question, helped by the low costs and stable performance.

At the same time, ETH came under pressure even with enormous Defi activity. This was due to expensive transactions and increasing pressure from Layer-2 solutions.

Source: Cryptuquant

Given the amount of $ 3.9 billion USDT present at other chains, the market seemed to be largely divided between Tron and Ethereum.

Changing positions in terms of liquidity flows-tron emerged as the favorite go-to-to-network for regular Stablecoin transfers, while Ethereum continued to hold its grip on more complicated financial activity.

Looking ahead, the trend can determine how developers and institutions assign liquidity-hungry applications, which changes the architecture of the financial system of crypto.

USDT Supply Surge

In the meantime, there was an increase in USDT market capitalization by $ 6 billion in the last 20 days, which brought the total from Stablecoin to $ 150 billion. In the past, similar peaks were experienced before strong crypto meetings.

Source: Cryptuquant

Bitcoin [BTC] Dominance, however, fell, which meant that the capital injection might find its way to ETH and other altcoins.

This transition is consistent with the expected Stablecoin launch of Meta, which can drive the position of ETH on the market.

If this continues, ETH can regain lost areas, especially if institutions are looking for alternatives to Bitcoin. Nevertheless, patterns from the past indicate that the inflow can also quickly fly back.