- ETH and BTC appeared to be at oversold levels on the charts

- Bitcoin has made more gains than ETH over the past two years

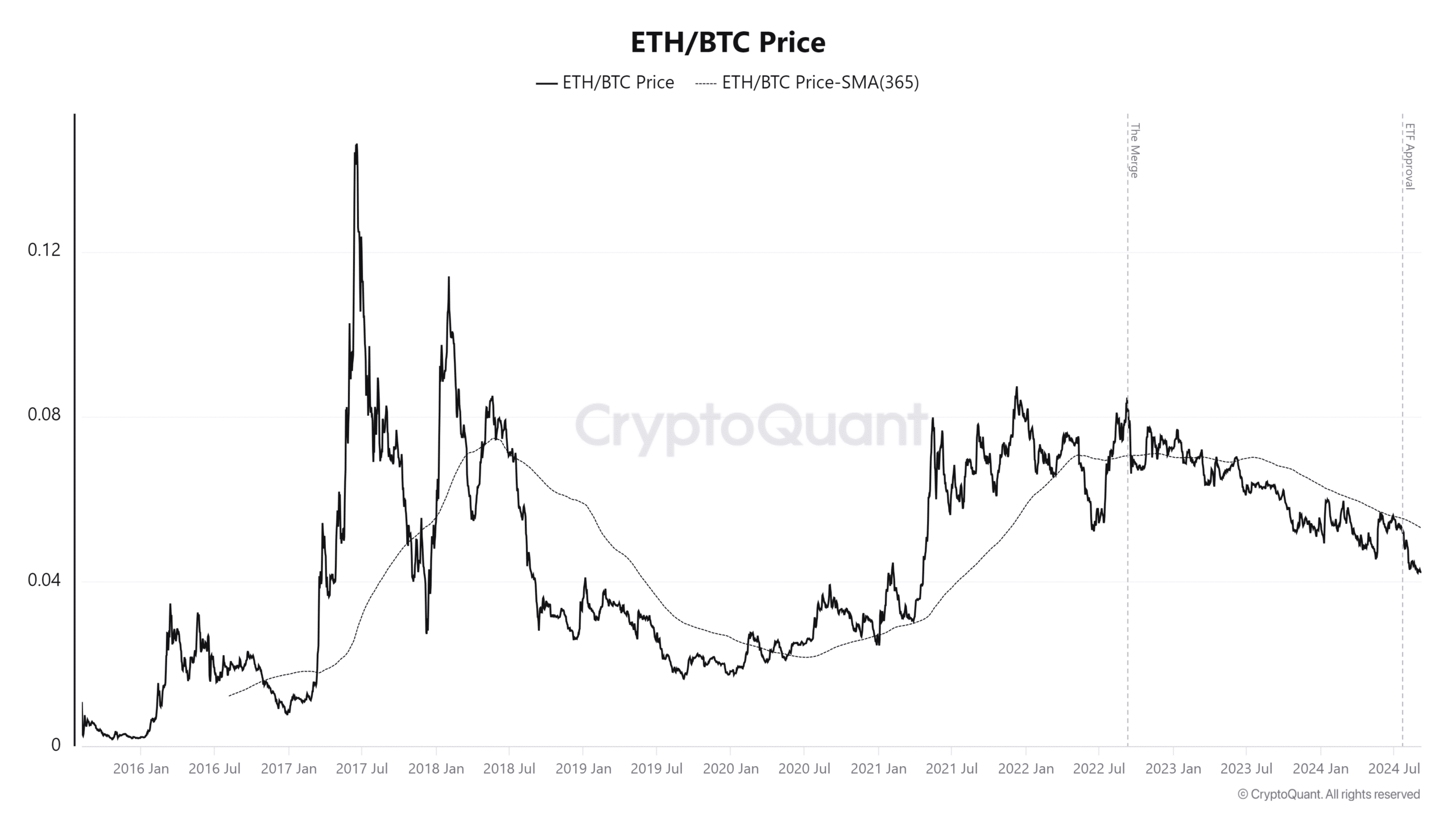

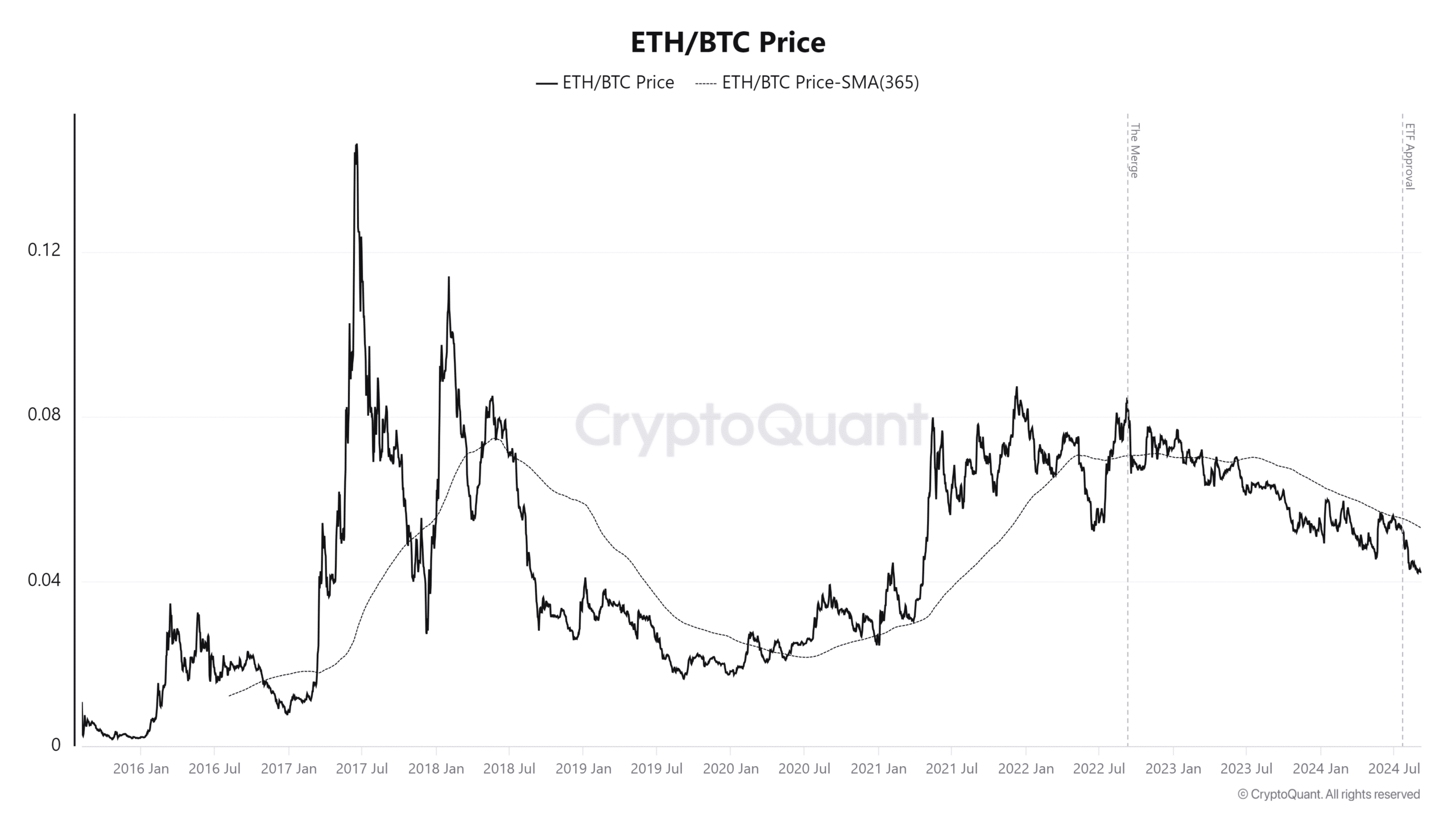

Bitcoin (BTC) and Ethereum (ETH) remain the largest cryptocurrency assets by market capitalization. However, ETH has underperformed BTC over the past two years, despite both assets experiencing significant price fluctuations.

Although both BTC and ETH recently saw the adoption of Spot Exchange Traded Funds (ETFs), this development was not enough to reverse the altcoin’s relative underperformance.

Ethereum is sliding against Bitcoin

According to data from CryptoQuantEthereum has underperformed Bitcoin by 44% over the past two years. The analysis indicated that ETH’s decline against BTC began after The Merge, which changed Ethereum from a Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism.

Since then, Ethereum has struggled to keep up with Bitcoin.

Source: CryptoQuant

The ETH/BTC price stood at 0.0425 at the time of writing, marking the lowest level since April 2021.

Despite the positive news about the approval of Spot ETFs for both assets in 2024 – Ethereum’s ETF is due to be approved in July – the approval has done little to reverse ETH’s lack of performance against BTC.

Some reasons for the disparity between Ethereum and Bitcoin

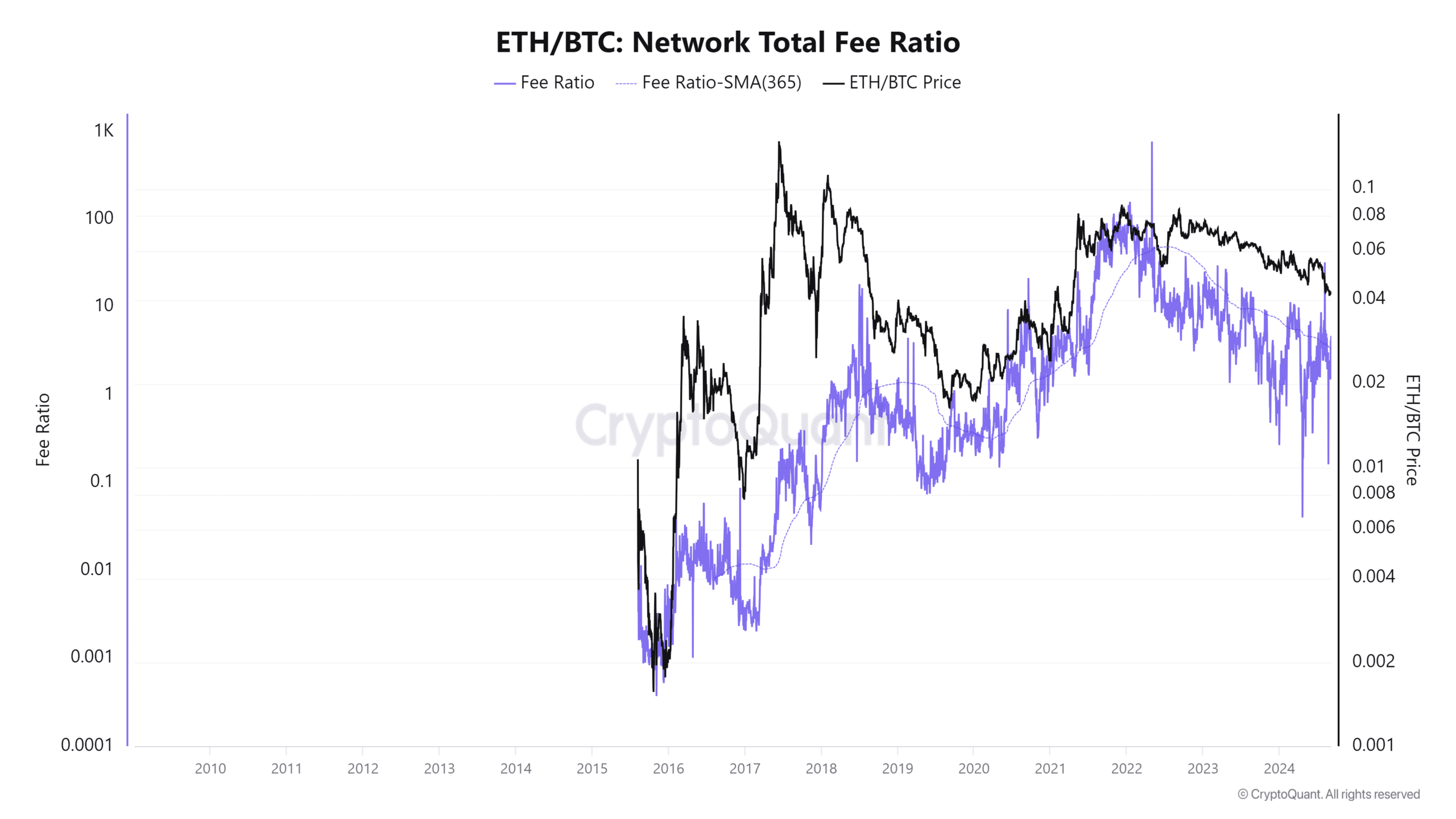

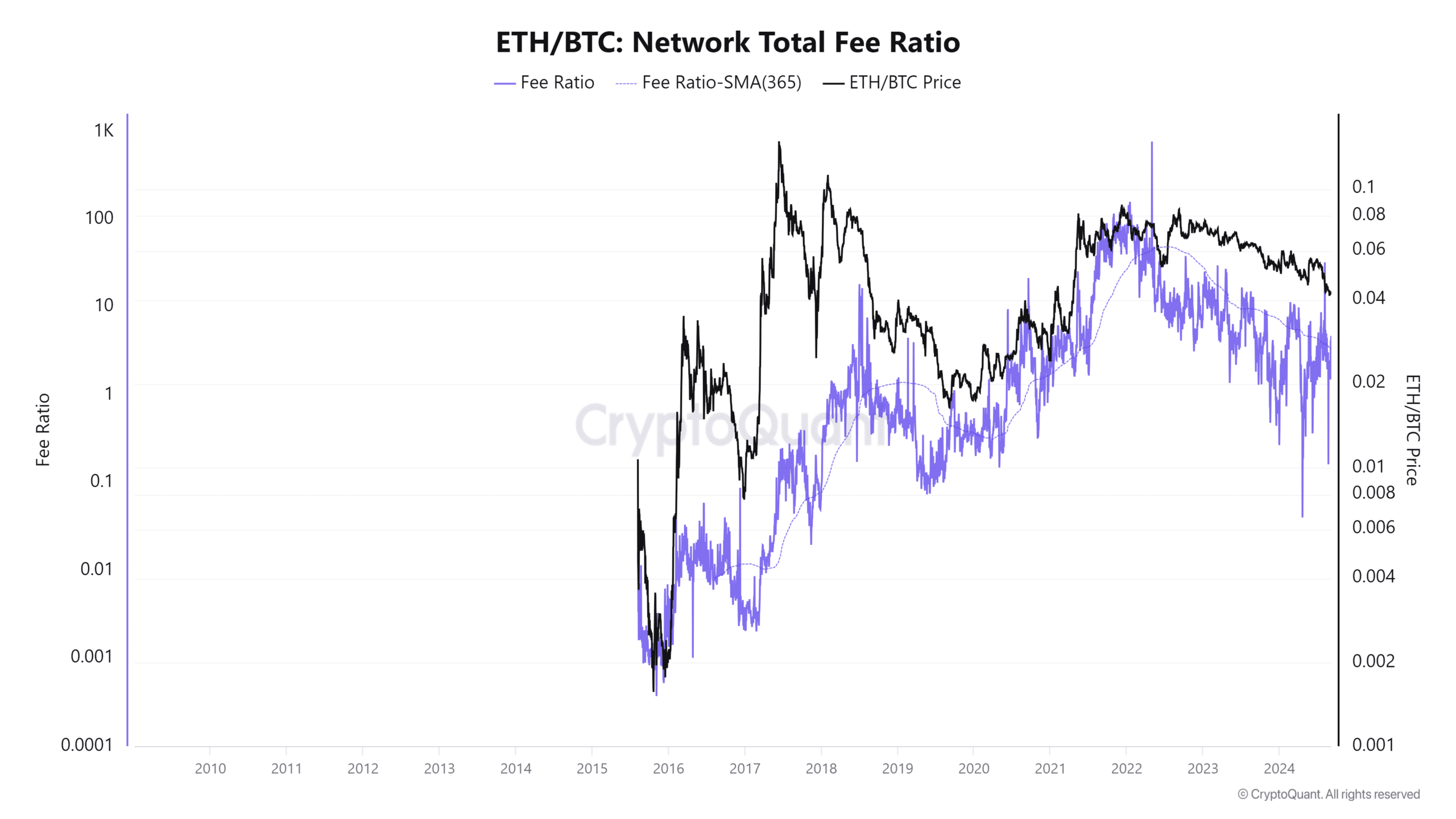

Ethereum and Bitcoin have noticed contrasting trends in network fees and transaction activity in recent months.

In fact, data shows that Ethereum costs dropped after the Dencun upgrade, which contributed to the reduced network activity. Furthermore, the relative number of transactions in Ethereum has fallen significantly, from a peak of 27 transactions per second in June 2021 to just 11 – one of the lowest levels since July 2020.

Source: CryptoQuant

On the contrary, Bitcoin has seen a spike in both fees and transactions in recent months. This is mainly due to the introduction of inscriptions (related to Bitcoin Ordinals) and Runes. These developments have increased the demand for block space, which has contributed to the increase in transaction fees on the Bitcoin network.

The drop in Ethereum fees has also affected the burn rate, linked to the EIP-1559 mechanism. With lower fees, less ETH is burned, reducing deflationary pressure on the network and making Ethereum more inflationary.

This shift contrasts with previous periods where high network fees led to a higher burn rate, causing overall ETH supply to decline.

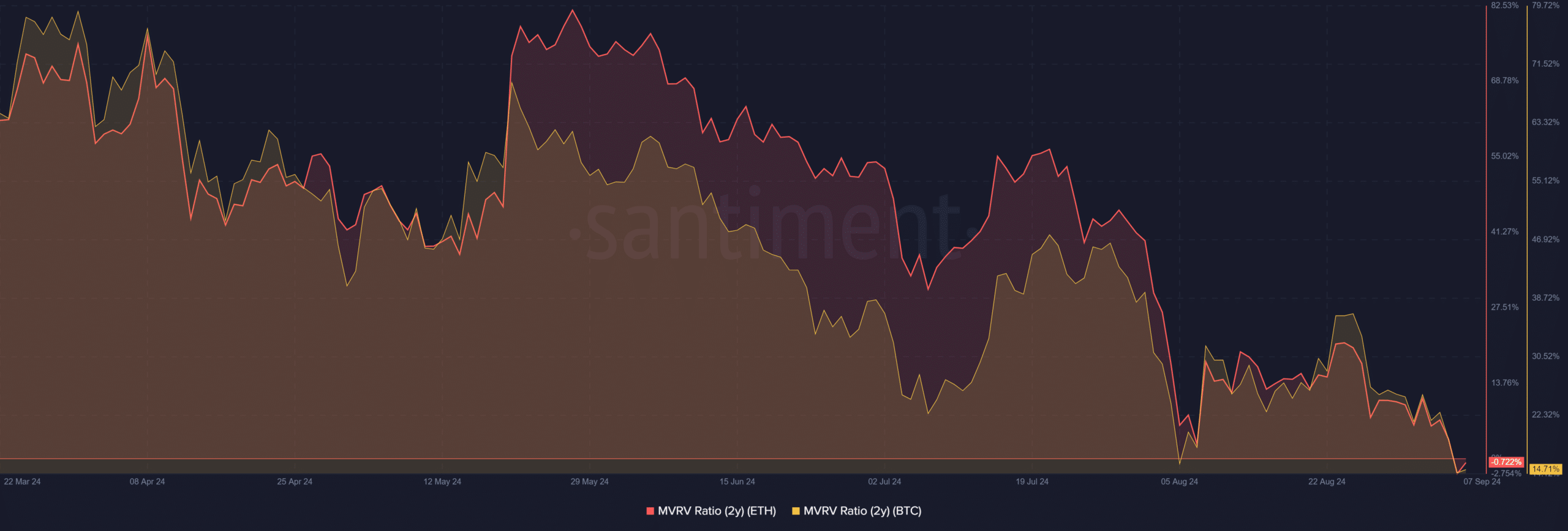

Analysis of the two-year ETH/BTC MVRV

Finally, an analysis of the two-year market value to realized value (MVRV) ratio for Ethereum and Bitcoin has highlighted the growing disparity between the two assets.

At the time of writing, Ethereum’s MVRV was slightly below zero at -1.16%, while Bitcoin’s MVRV was significantly higher at over 14%.

Source: Santiment

– Realistic or not, here is the ETH market cap in terms of BTC

This disparity in MVRV ratios illustrates how much ETH has underperformed compared to BTC.

Here, the MVRV ratio measures the gain or loss of holders based on the difference between the current market value and the realized value of an asset. In this case, BTC holders are at a profit of more than 14%, while ETH holders are at a loss of more than 1%.