Blockchain

Ethereum may be much younger than the traditional payments giants such as Visabut it has shown (again) that blockchain has evolved into a force to be reckoned with in a single decade.

As a payment technology, blockchain has grown to match established players. Recent data from Coingraph showed that Ethereum, for example, processed $3.01 trillion in transactions, as opposed to Visa, which processed $3.08 trillion.

It’s a testament to the growth in mainstream adoption of the nascent technology, which is often – sometimes almost exclusively – viewed as a vessel for scammers, drug dealers and cybercriminals.

Ethereum is the second largest network: its current market cap is $227.8 billion, according to CoinGecko, compared to the number 1 From Bitcoin $538.96 billion and 3rd place from Tether $82.8 billion.

Particularly as the world’s second-largest blockchain, Ethereum is powering numerous financial technology solutions seeking to disrupt the global, traditional financial marketplace. These solutions include decentralized finance (DeFI), staking, loans and payday loans, among others.

It has grown into a rich and versatile environment, with plenty of room for further development – which is also an advantage over traditional financial layers.

Last year, it was reported that Ethereum processed 4.5 times more transactions than Visa by 2021.

Also a report of Ethereum foundationJosh Stark claimed that Ethereum surpassed Visa in 2021 in trading volume. “Ethereum moved about $11.6 trillion USD. That’s more than Visa [$10.4 trillion]and more than double that of Bitcoin,” the report said.

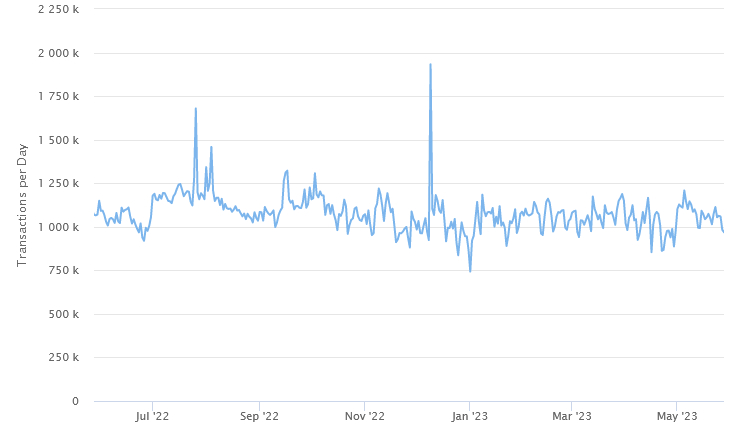

Looking at the latest daily Ethereum transactions, etherscan shows 968,996 on May 28, with an all-time high of 1,932,711 transactions on December 9, 2022.

Ethereum 1-Year Daily Transaction Chart:

Source: etherscan.io

Ethereum has already entered TradFi

The popular blockchain is already the network of choice for many established players looking to use the new technology – including Visa.

In addition to just writing about Ethereum’s economics, as reported in mid-May, Visa used Ethereum’s Goerli testnet to try out transaction-free payments using account abstraction.

It used a smart contract called Paymaster, which allowed the company to take advantage of account abstraction to perform complex tasks on behalf of accounts and manage transaction fees.

“Excited to see Visa deploy our first paymaster smart contract on testnet as we continue to explore and experiment with account abstraction and ERC-4337,” Cuy Sheffield, Head of Crypto at Visa, said at the time.

ERC-4337 is an Ethereum standard that achieves account abstraction without changing the consensus layer, allowing users to pool and automate transactions on the network.

“ERC-4337 offers exciting future opportunities for improving on-chain user payments through a self-custodial smart contract wallet, which in turn has the potential to transform the way users interact with digital currencies and digital assets,” said Visa.

Visa first released a proposal in December last year that would allow Ethereum users to make automated programmable payments without the intervention of a third party.

The company also reiterated its commitment to crypto in March this year, refuting reports that it planned to pause its crypto push due to uncertain market conditions.

“We continue to work with crypto companies to improve fiat on and off ramps, as well as progress on our product roadmap to build new products that can facilitate stablecoin payments in a secure, compliant and convenient manner,” Sheffield said.

He added that the previous crypto crisis has not changed their view of digital assets and that “1685405573 it’s time to build!”

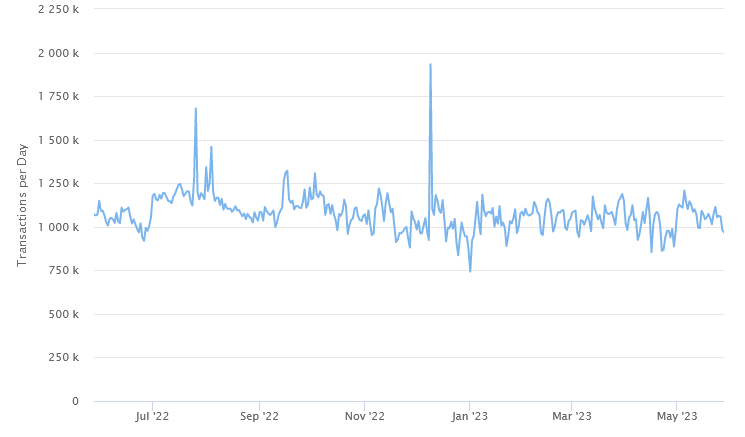

At the time of writing (midday UTC on Monday), ETH was trading at USD 1,898, up 3% in a day and 4.5% in a week.

ETH 7-Day Price Chart:

Source: coinecko.com