- The user activity of Ethereum fell to the lows until 2025, which indicates the demand for the decreasing demand and potential inflatoid pressure.

- With weak statistics on the chain and growing competition, the position of Ethereum is questioned as a leading blockchain.

User activity on the Ethereum [ETH] Network slips and casts a shadow on the demand for the leading Laag-1 Blockchain.

Recently, ETHs Daily active addresses and new wallet creations reach their lowest levels in 2025. This decrease emphasized reduced involvement in the chain.

The falling user statistics from Ethereum are concerned about his ability to maintain his dominance. Faster and cheaper competitors reinforce the challenge for the position of Ethereum.

Ethereum’s on-chain statistics sink as the network demand decreases

Ethereum experiences a sharp withdrawal of user activity, with important network indicators that have been falling to their lowest levels this year.

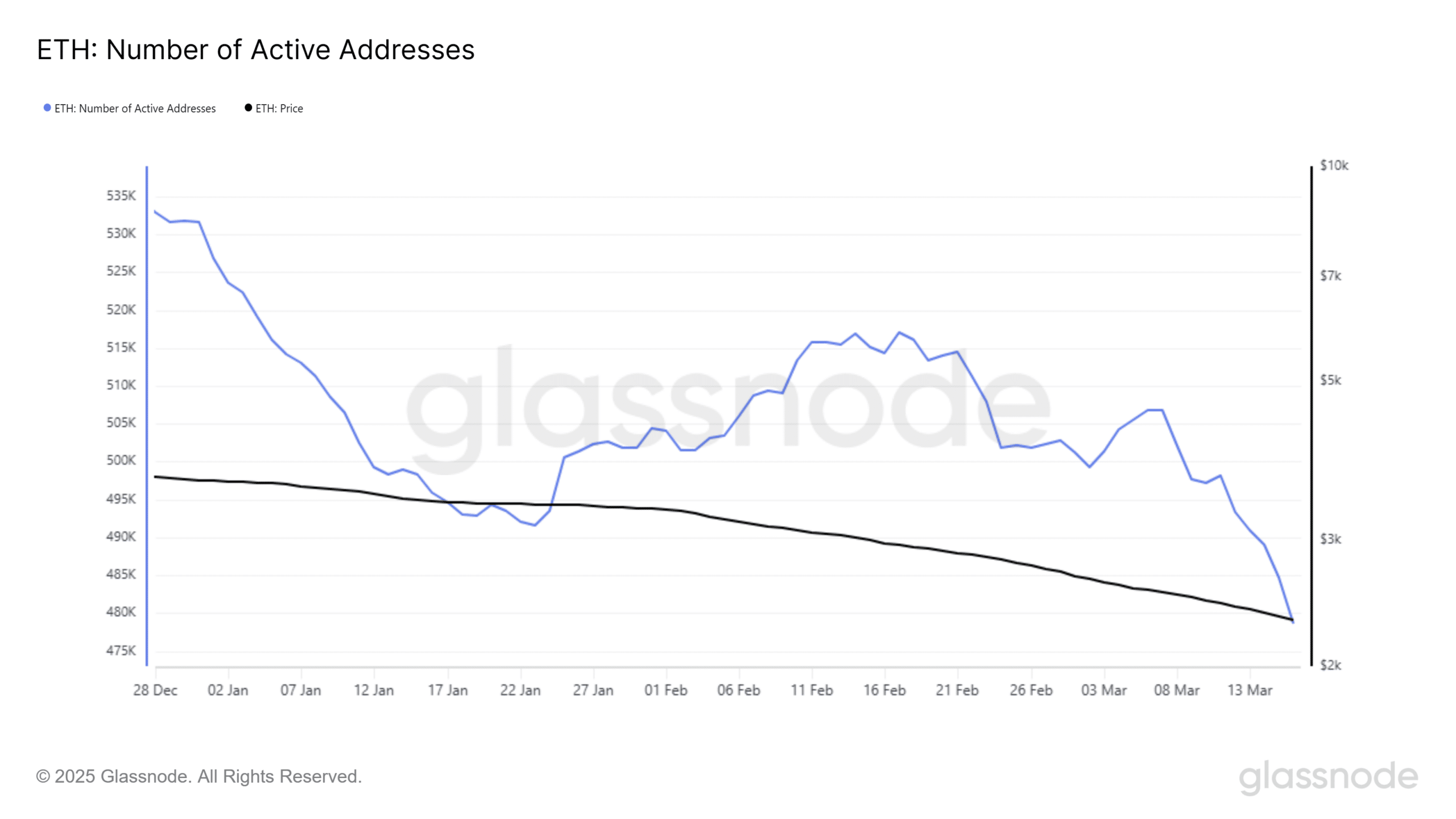

On March 16, the number of active addresses that participated in ETH transactions fell up to 361,078, the lowest day count that has been registered this year this year.

This steep decline emphasizes the weakening of involvement in the chain, a measuring trick that is closely linked to the demand for transactional demand and the generation of reimbursements.

Source: Glassnode

The decrease in active use lowers the amount of ETH that is burned by gas costs, which increases the inflationary pressure of the asset. A weaker deflationary story can hollow the trust of investors.

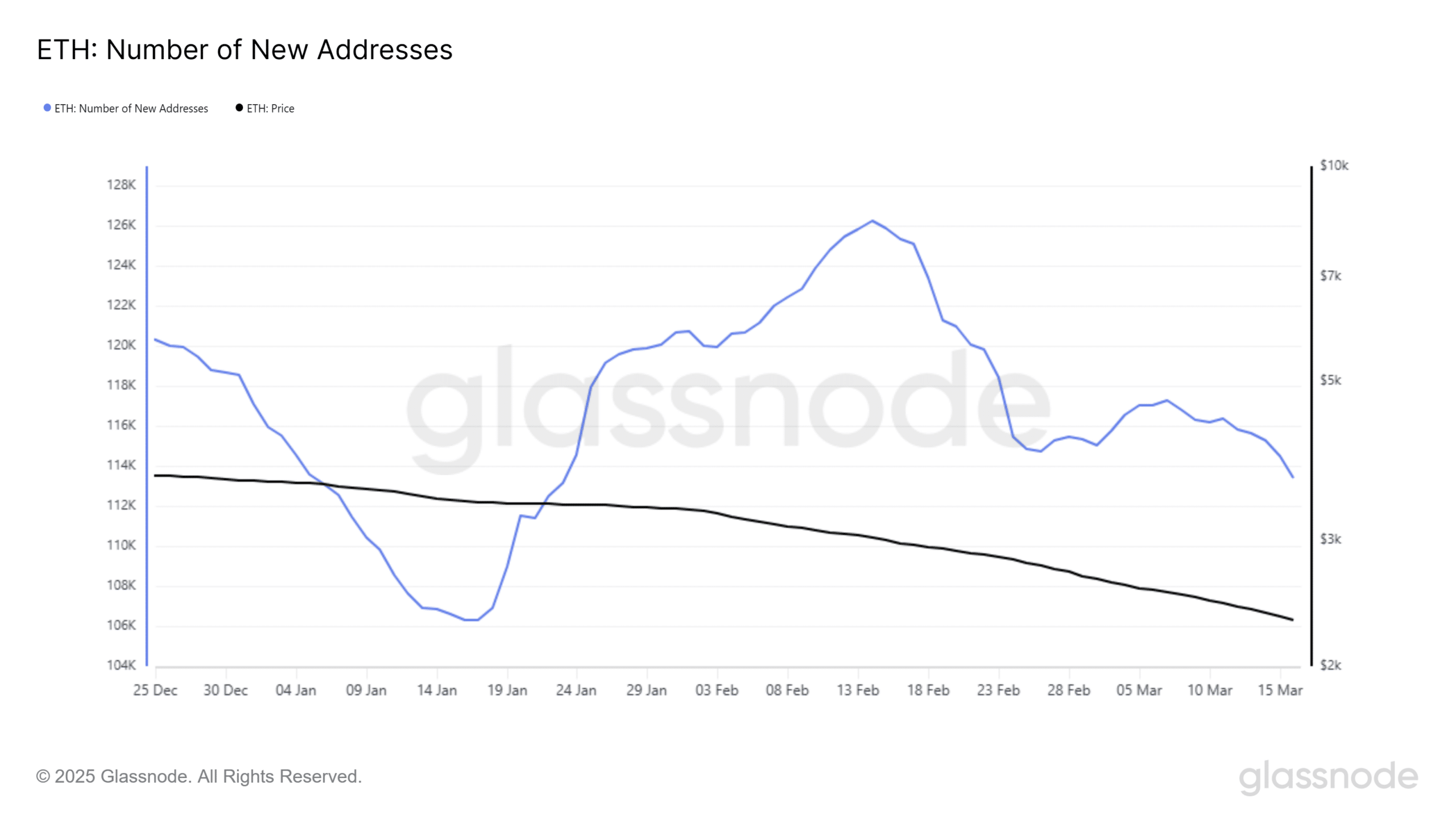

New wallet creation has also fallen sharply. On Sunday, only 86,539 new ETH addresses were created, the lowest this year.

This trend reflects the decreasing speculative interest and reduced organic onboarding to the Ethereum network.

Source: Glassnode

Together, these on-chain statistics suggest a wider cooling in the appetite of the user for Ethereum, because the concerns about inflation and alternative blockchain ecosystems continue to mount.

Impact on the ETH range

With decreasing activity on the chains, the range of Ethereum shifts to inflation. In the past month, more than 71,000 ETH, worth $ 135 million, was added to the circulating stock, which exceeds 120 million ETH.

The decrease in transactions has led to fewer costs being burned, which weakens the deflatory mechanism of Ethereum. Without a strong demand to prevent the increased issue, the surplus offer creates a consistent downward pressure on the price of ETH.

This trend evokes the concern of investors about the long -term value of the network.