- Ethereum liquidity providers have reduced their long positions.

- ETH investors remained optimistic in 2025 despite high speculation.

For almost two weeks Ethereum [ETH] has experienced major fluctuations. During this period, ETH prices fell from $4109 to $3219. This price volatility has caused altcoin trading to go sideways.

These market conditions have analysts talking about Ethereum’s performance in 2025. To this extent, Cryptoquant analyst Sun Moon has suggested a robust performance for ETH in the first quarter of 2025, citing market stability.

Ethereum’s liquidity providers are reducing long positions

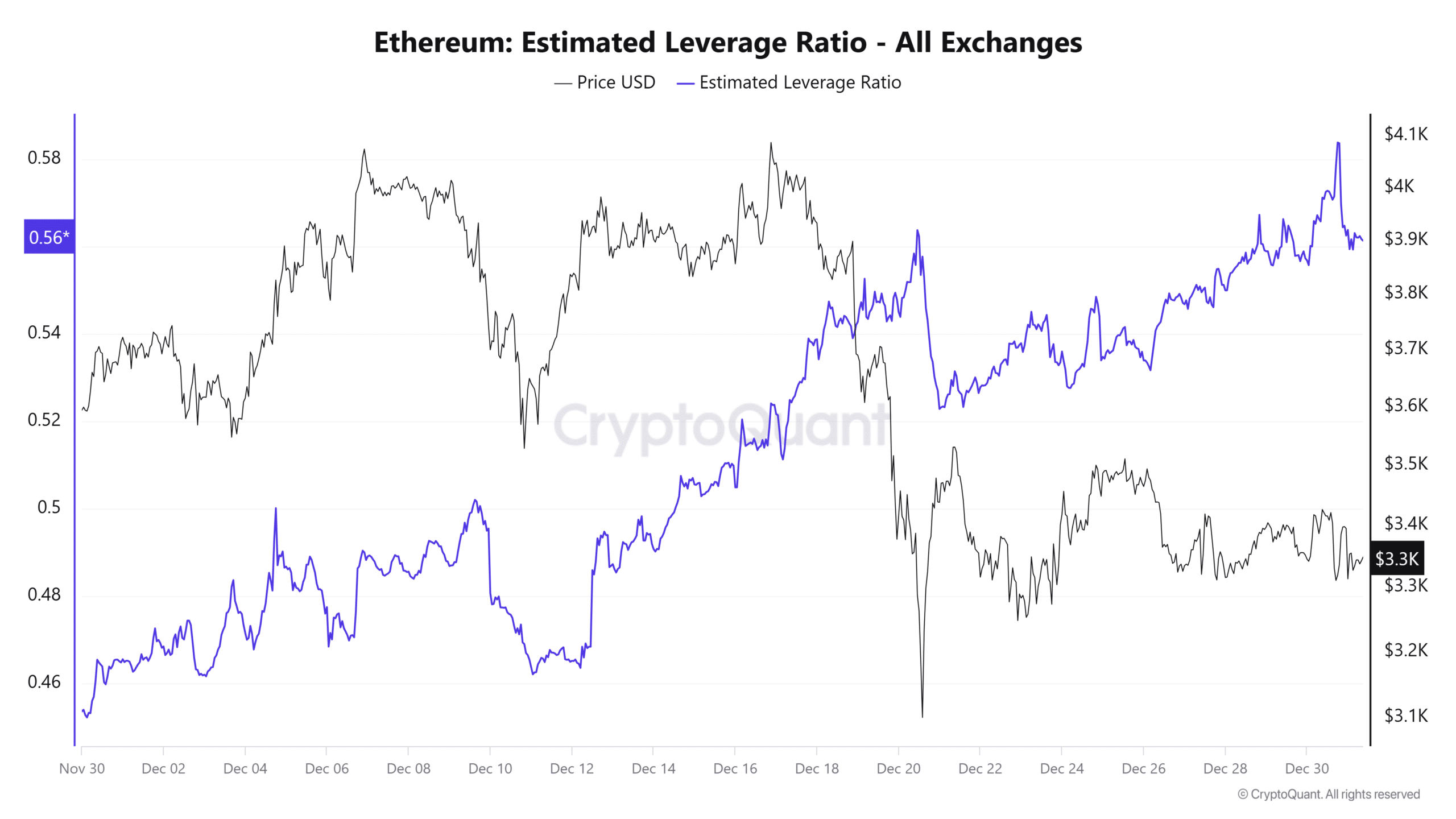

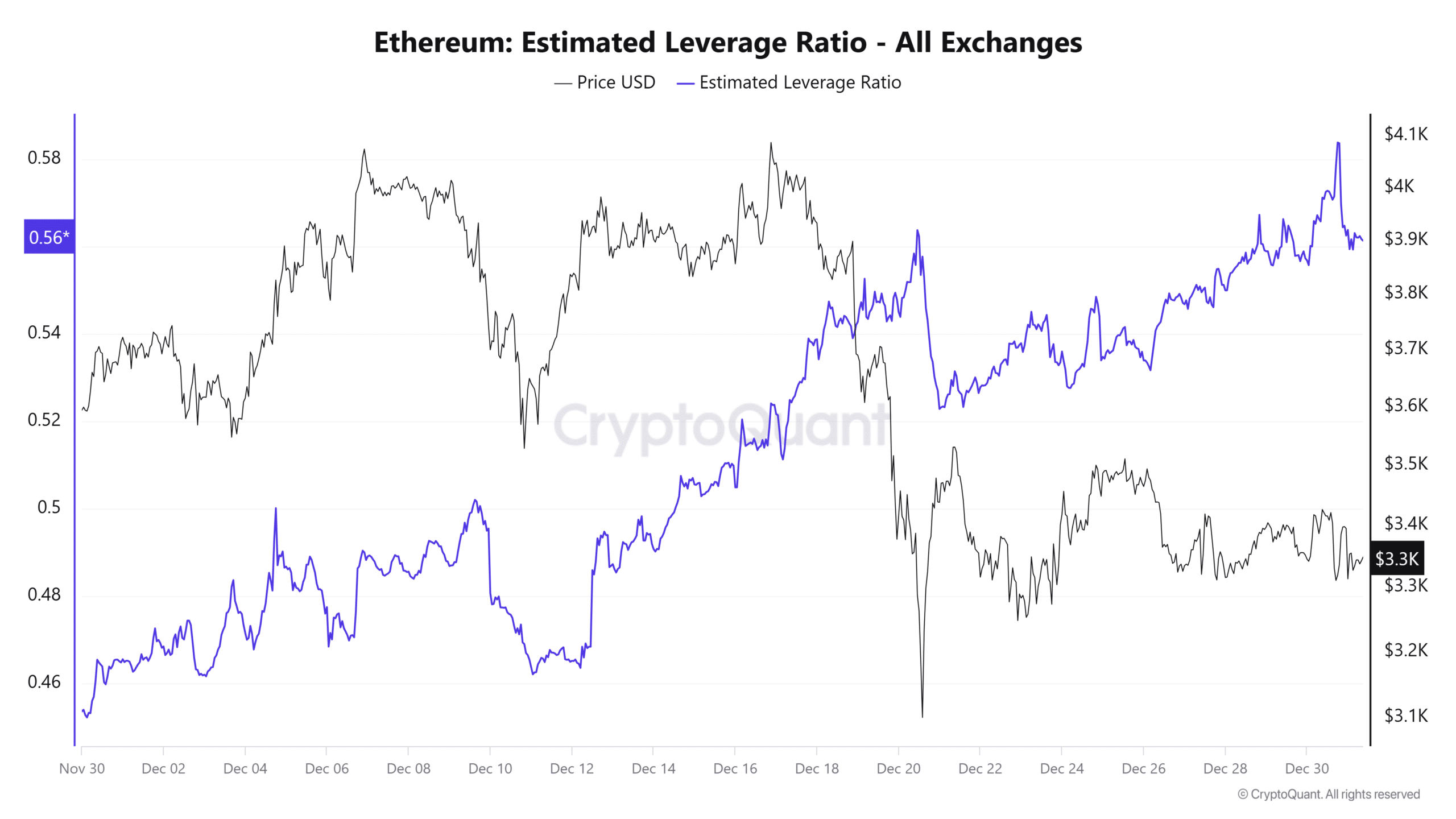

According to CryptoQuantEthereum liquidity providers have reduced long positions. When entities and traders providing capital in ETH reduce their long positions, it signals a shift in sentiment.

If liquidity providers reduce exposure, it may be difficult for the market to maintain bullish momentum without new buying pressure.

Source: CryptoQuant

The analyst further noted that despite the shift in sentiment, Ethereum long liquidations have declined. This absence of widespread liquidations implies that the market is becoming more stable.

So market corrections are less likely to lead to consecutive sell-offs.

Therefore, from 2025 onwards, ETH will follow the same pattern as last year. In December 2023, ETH prices rose from $2045 to $2448 before correcting to $2259 at the end of the year.

From January 2024, prices rose from $2281 to $2717, followed by a two-week consolidation before a sharp rise to $4090.

Therefore, if prices follow the same pattern, and history is something we can follow, ETH prices will see a sharp increase. As the analyst noted, Ethereum’s price will rise significantly in the first quarter of 2025.

What it means for ETH

Despite Ethereum liquidity providers scaling back long positions, ETH is still experiencing significant demand for long positions amid strong speculative activity.

As such, according to AMBCrypto’s analysis, Ethereum is currently seeing a leverage-driven market.

Source: CryptoQuant

To begin with, this is evident from the fact that the estimated leverage ratio has experienced a sustained increase. Over the past month, the ELR has increased from 0.4 to 0.56.

This uptick reflects increased speculation as investors become more willing to take risks with borrowed money to maximize potential gains and losses.

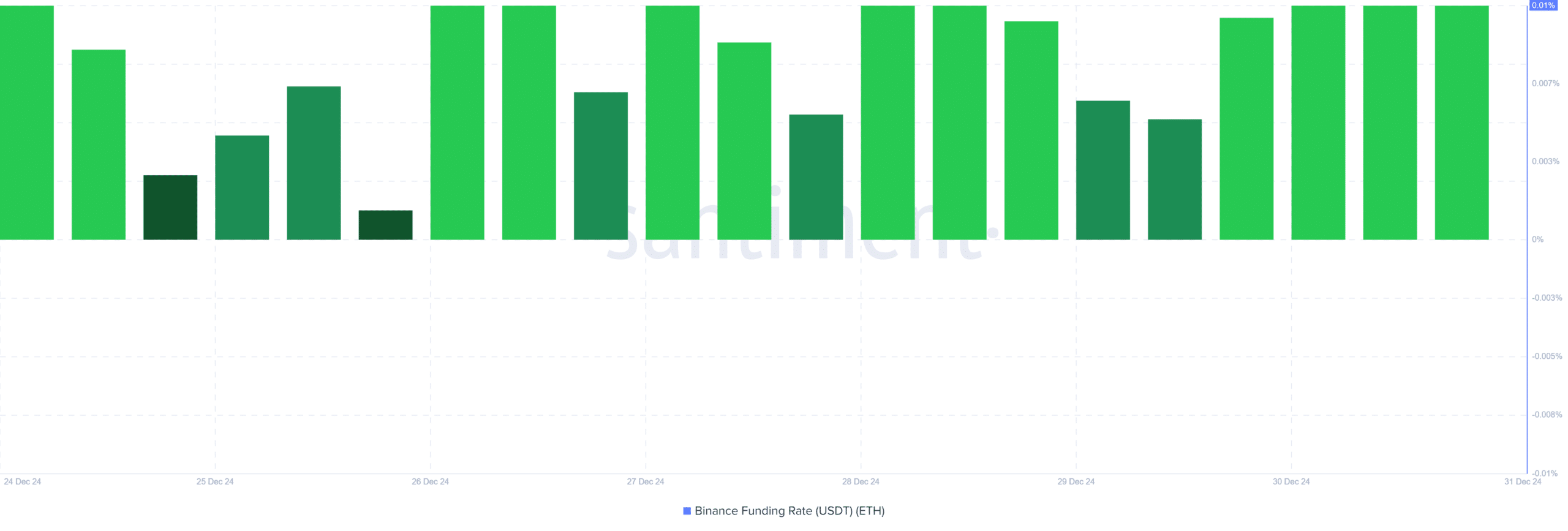

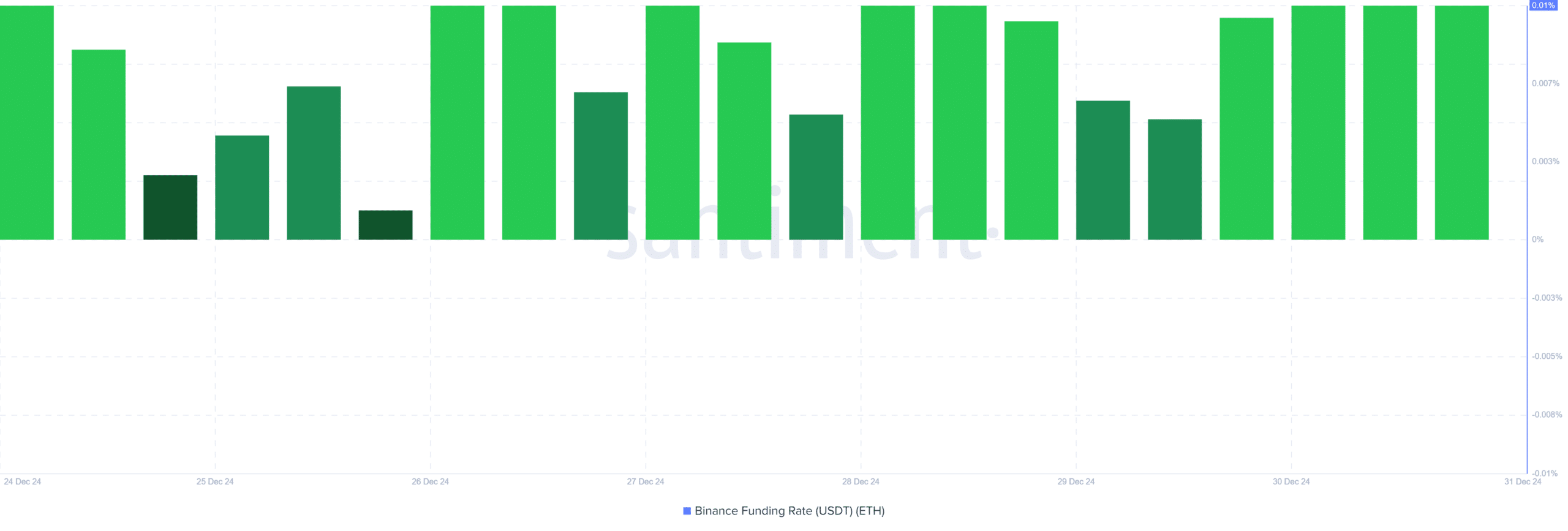

Source: Santiment

Furthermore, the Binance Funding Rate has remained positive over the past month.

This shows that even though liquidity providers are continuously reducing their capital inflows, traders still expect prices to rise and demand for long positions is still high.

ETH, entering 2025

Simply put, even though liquidity providers are reducing their funds, demand for long positions is still high, as noted above. Therefore, ETH continues to see strong speculation activity.

While speculative market activity can cause prices to collapse, it can also push prices up in the short term.

By 2025, the Ethereum market must strengthen its fundamentals and be less dependent on a speculatively driven market, which is sensitive to corrections.

Read Ethereum’s [ETH] Price forecast 2025–2026

Since demand for longs is still high, this suggests that the market is still bullish and ETH is entering 2025 with positive sentiment.

If bullish sentiment holds, ETH will break out of the USD 3500 consolidation range and challenge USD 4000, where it faced multiple rejections. However, if the speculation bubble bursts, ETH could fall below $3000.