- Crypto speculators remain wary of concerns about profit-taking and price corrections

- There have been no consecutive ETH/BTC green weekly candles since April 2024

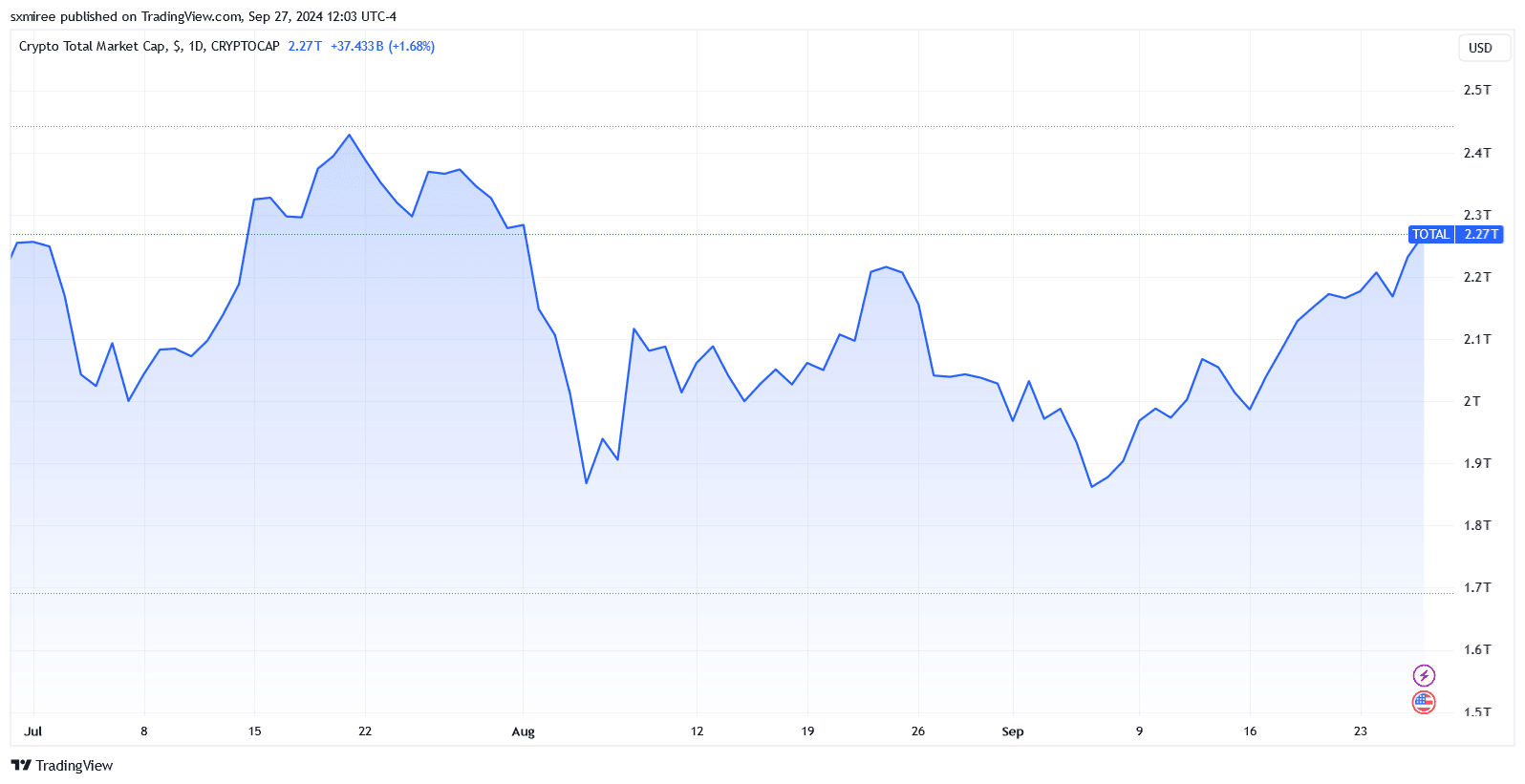

Most cryptocurrencies traded in the green on Friday, after making decent progress between Wednesday and Thursday. In fact, the market-wide gains reversed an early midweek dip that followed a slow start to the week.

Source: TradingView

Ethereum (ETH), which has renewed its strength in recent weeks, was trading at $2,689 at the time of writing, with bulls targeting a close above $2,770 for the first time since August 24.

Here it is worth pointing out that ETH overtook Bitcoin in the second half of the month, posting a gain of 16.34% since September 15.

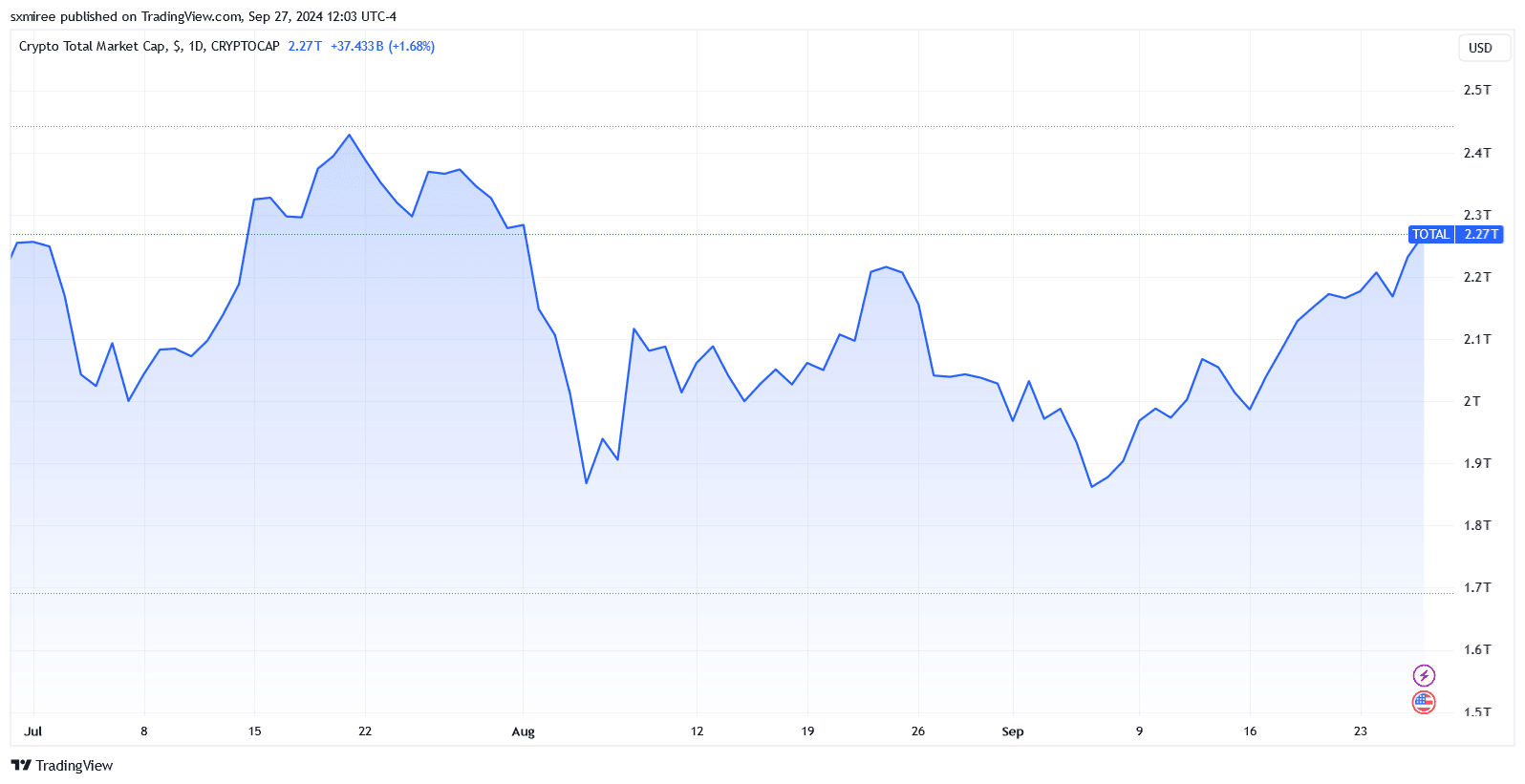

Source: TradingView

However, that’s not all. Mint glass facts revealed that the price of ETH rose 11.26% last week, while BTC registered a 7.38% increase. Although both cryptocurrencies have slowed this week, they remain on track for third straight weekly gains.

Bitcoin bulls are aiming for double-digit monthly gains

However, if we look at Ethereum’s recently rejuvenated operation, it is down 20.75% in the past three months. This decline is especially pronounced given expectations of a rally following the July 23 launch of a US Ethereum Exchange Traded Fund (ETF). The institution-focused offering has failed to live up to the hype and has seen mixed results so far.

With three days to go, Bitcoin leads the flagship altcoin in monthly returns. BTC’s price trajectory has put the company on track to record double-digit monthly gains if it maintains a price above $65,000. On the contrary, Ether is positioned for a 5.70% gain in September at press time price.

BTC and ETH price targets before the fourth quarter

Heading into the weekend, speculators have their eyes on the monthly closes for the respective cryptocurrencies. At the time of writing, Bitcoin was trading in no man’s land around $66,000, while support was around $62,800. Meanwhile, Ethereum held steady above $2,600.

Analysts have set a near-term price target in the range of $68,000 to $70,000 for BTC and in the range of $2,760 to $2,820 for ETH. However, a potential withdrawal, especially as momentum diminishes, caution should be exercised in long positions. Momentum depletion would pave the way for bears to seize the weekend and drag prices down, as was the case in July.

Source: TradingView

Bitcoin retracement downside targets include a return below $62,000, with the possibility of a downturn as high as $57,400. Ether, in turn, was rejected at $2,770 on August 24, before falling back to $2,430 three days later.

The upside potential of ETH price was also pressured by increased ether issuance, which could weigh on spot movement. In fact, data from Ultrasound Money showed that a total of 54,098.4 ETH was added to the supply over the past 30 days, translating into an annualized inflation rate of 0.547%.