- The Stablecoin offer on Ethereum has reached a new of all time, which indicates strong growth on the network.

- In Ethereum protocols, an extra $ 5 billion extra has been added as transaction activities to new levels.

After a sharp fall of 26% in the past month, Ethereum [ETH] has taken a different path, with 8.44% in the last 24 hours. This upward movement will probably continue, because increasing activity further feeds the market interests.

Currently, important statistics show considerable growth, which suggests that market participants collect ETH, which could stimulate prices higher in the coming weeks. Ambcrypto has analyzed various factors that contribute to the potential meeting of ETH.

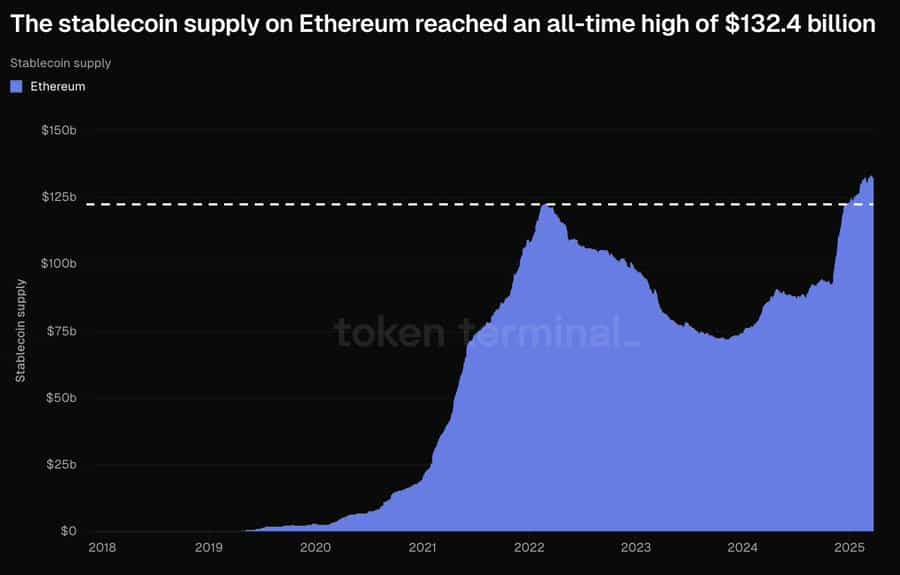

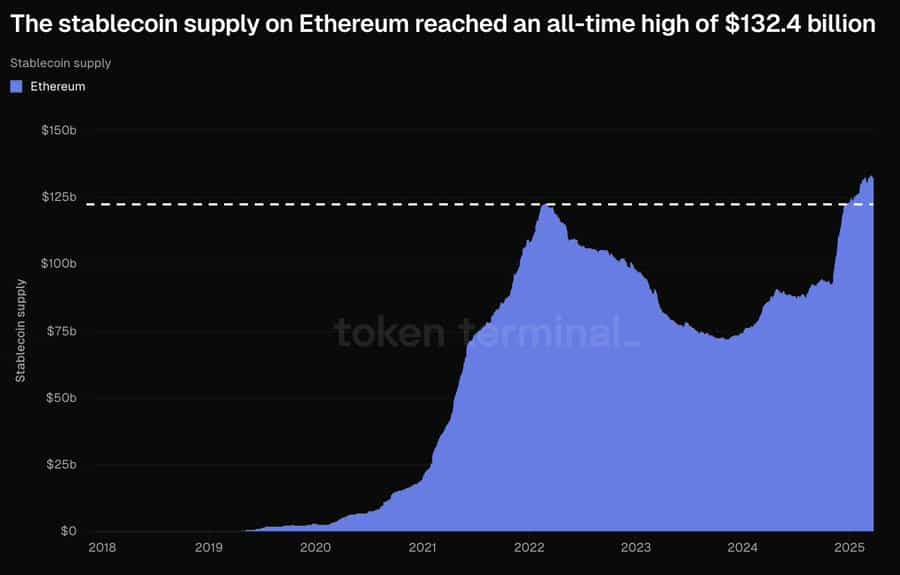

Stablecoin Supply on Ethereum reaches a new high

Ethereum, known for its innovation-friendly ecosystem, continues to put on Stablecoin implementation. The total stablecoin offer recently reached a record high of $ 132.4 billion; The highest level since its founding.

Source: tokenminal

Stablecoins are cryptocurrencies designed to maintain a 1: 1 PEG with assets such as the US dollar, where traders and investors offer a cover against market volatility. They have become a preferred option for storing assets and facilitating cryptocurrency transactions.

An increase in the STABLECOIN’s supply on a blockchain often means the growing demand because traders position themselves for higher purchase activity. Ambcrypto has investigated additional factors to assess their potential impact on these assets.

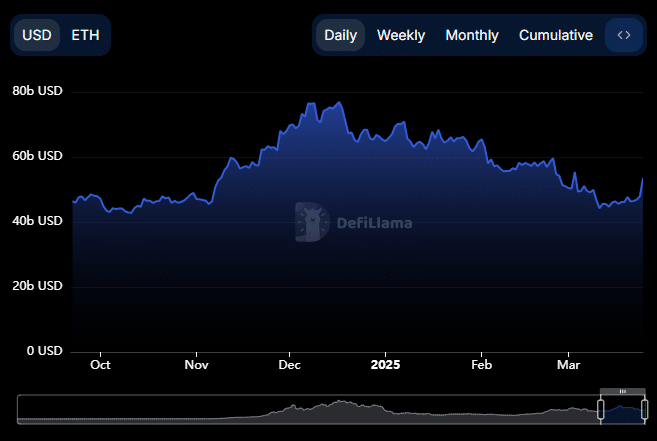

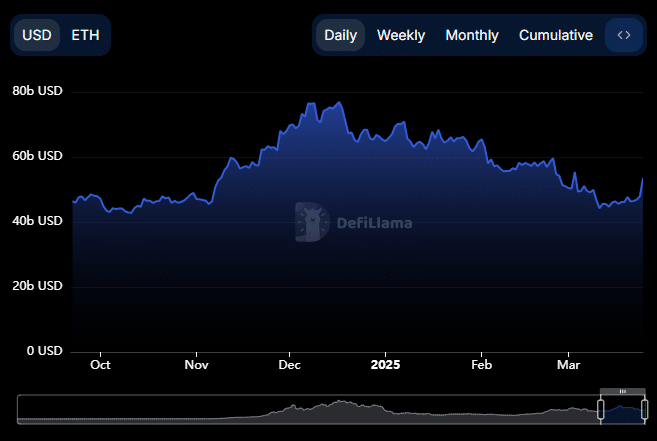

Liquidity inflow to Ethereum Surge

Ethereum has seen a large increase in liquidity inflow after the Stablecoin stock that reaches a record high.

The total value of Defillama Locked (TVL), which assesses the growth of the ecosystem, shows that Ethereum’s TVLEM has risen to $ 53,448 billion in the last 24 hours, an increase of $ 47.92 billion, an increase of $ 5.5 billion.

Source: Defillama

This growth suggests an increased accumulation of Ethereum, whereby the assets is locked over several protocols, which is a reflection of an increased investor’s interest.

Ambcrypto also noticed an increase in the Netflow in Ethereum and ranked it as the second highest chain in liquidity inflow in the last 24 hours, just behind Berachain.

Data from Artemis shows that $ 22.2 million has been added to the Ethereum network, which strengthens continuous positive developments.

ETH in the rise in the long term

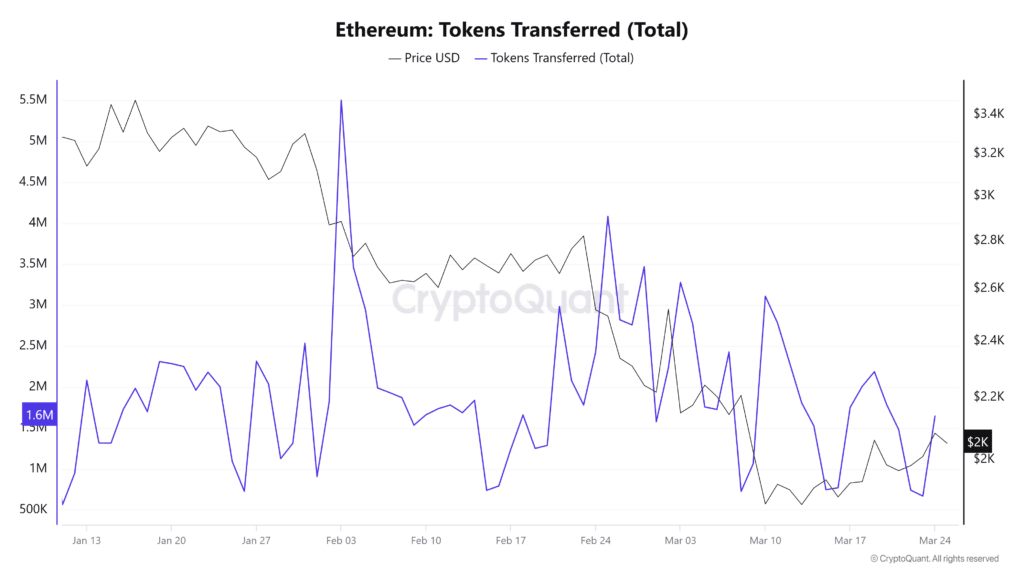

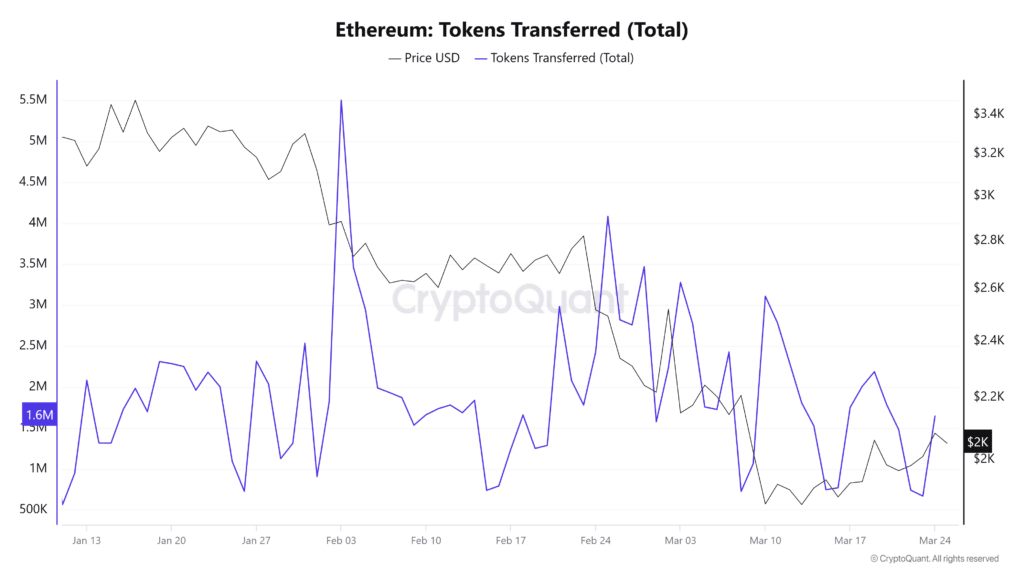

The total token transfer of Ethereum has risen by around 9.33% in the last 24 hours, indicating increased market activity. This movement may indicate the buying or selling pressure.

Source: Cryptuquant

To clarify, Ambcrypto analyzed Ethereum’s exchange reserves and concluded that recent transfers support a positive award ceremony for ETH.

Exchange reserves represent the amount available for trade. Higher reserves usually indicate an increased sales pressure, while lower reserves in the long -term party suggest.

The recent decrease in ETH reserves means that traders are transferred their assets to private portfolios for long-term storage, which can have a favorable impact on the price of ETH over time.