- Ethereum showed a steady price promotion with strong support, whale activity and careful investor sentiment.

- Whale accumulation suggests potential for an outbreak, but resistance of around $ 2,250 remains an important obstacle.

Ethereum’s [ETH] Recent price promotion is stable, but far from quiet. Under the surface, the shifting of investor behavior and remarkable movements on chains are beginning to define the current market structure.

Since ETH acts within a tight reach, accumulation patterns, whale activity and exchange flows suggest a market at a bending point – raising questions about whether this significantly signals silent strength or temporary stability.

Support Builds, but the trust remains measured

Ethereum Is on a strong bag of investor support between $ 1,886 and $ 1,944, where more than 3 million addresses have collected 6.12 million ETH.

Source: X

This cluster now represents an important psychological and technical basis – if ETH slips below, it can cause wider sales.

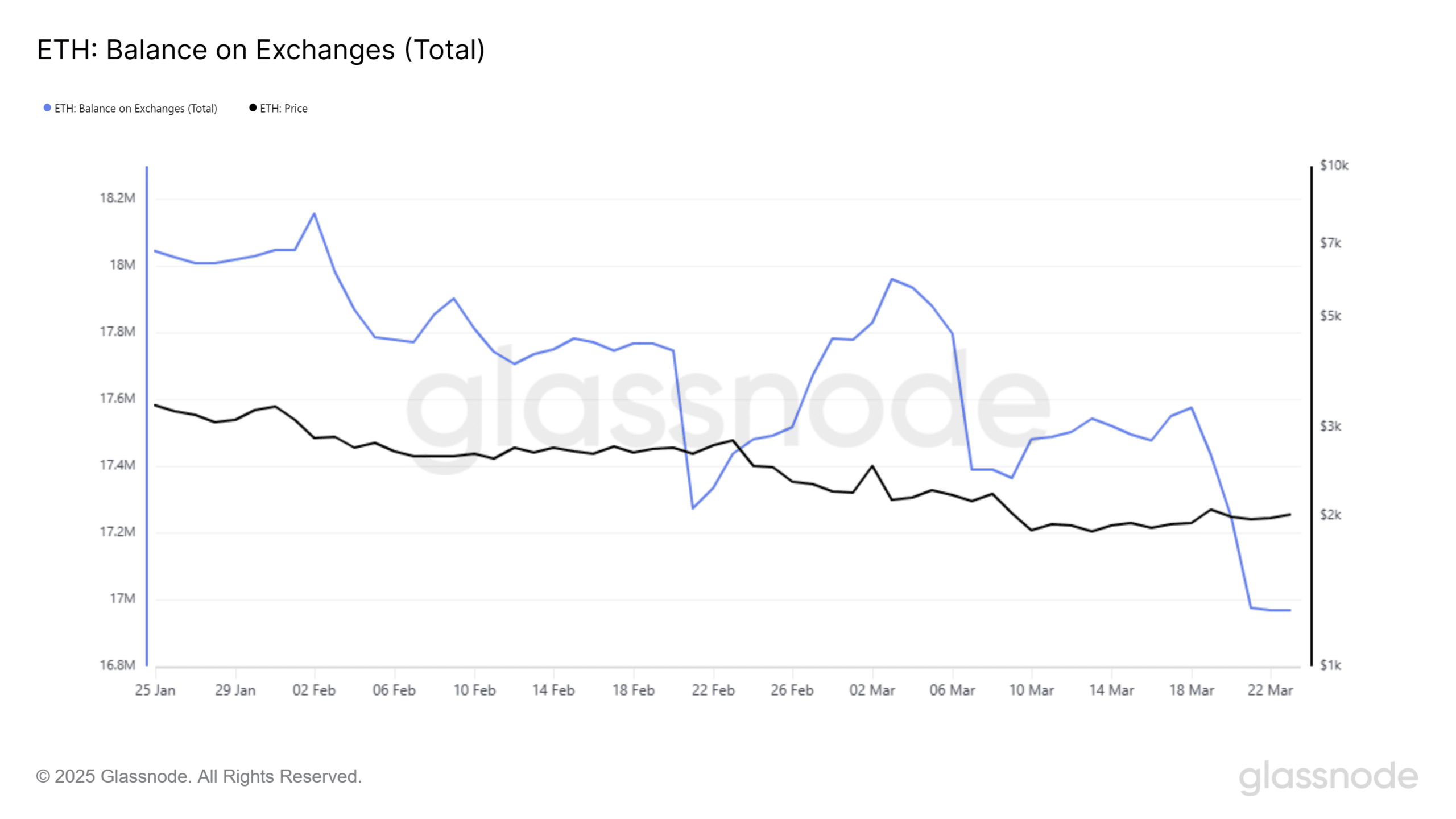

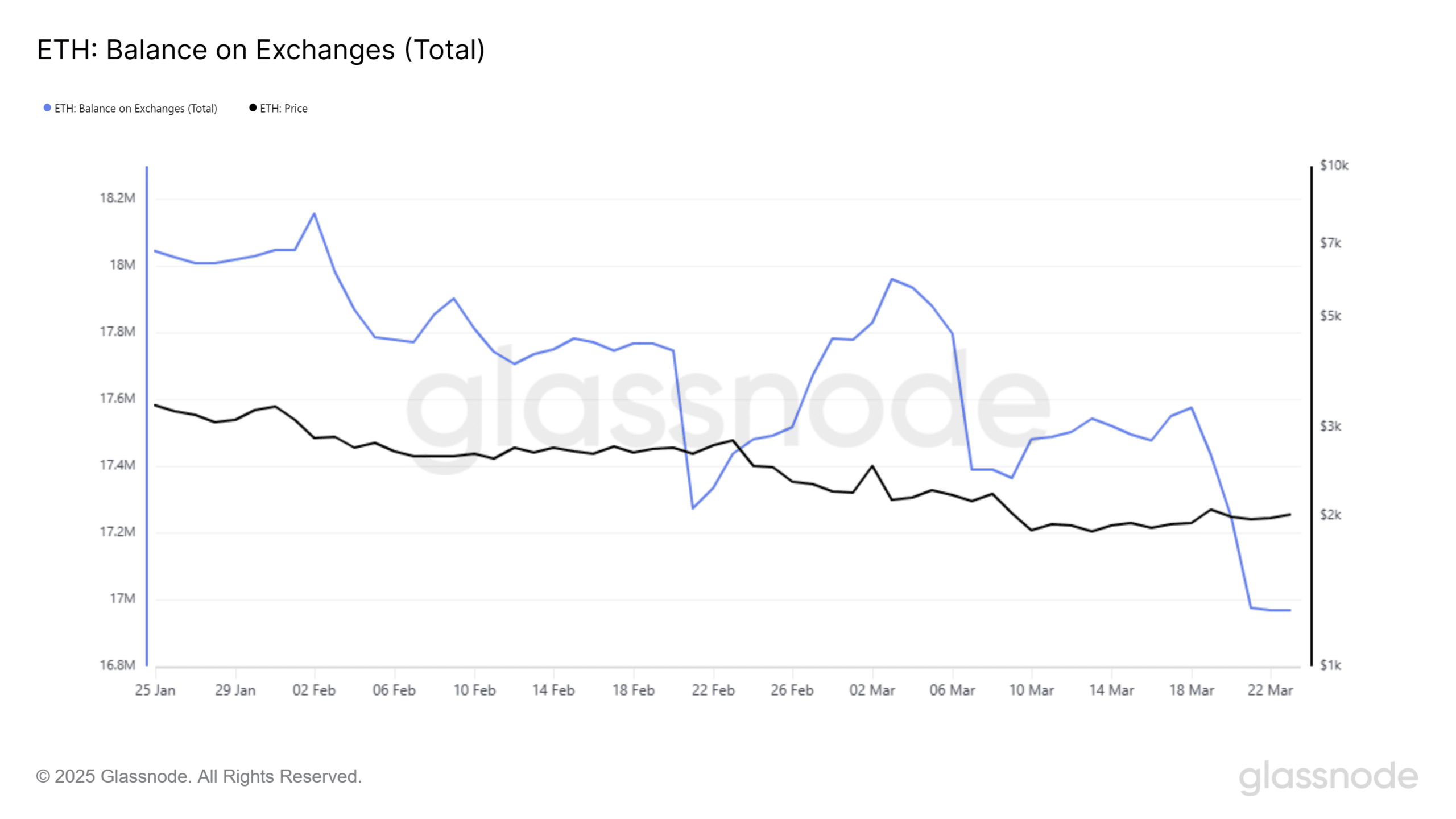

On the supply side, more than 1.20 million ETH has been moved quietly from exchanges in the past 48 days, which suggests that a fall in sales pressure in the short term.

Source: Glassnode

However, the price has remained largely accessible, which implies that even as investors hold, they do not hurry to buy. In this environment, stability can say more about caution than conviction.

Whale accumulation rises as ETH $ 2K crosses

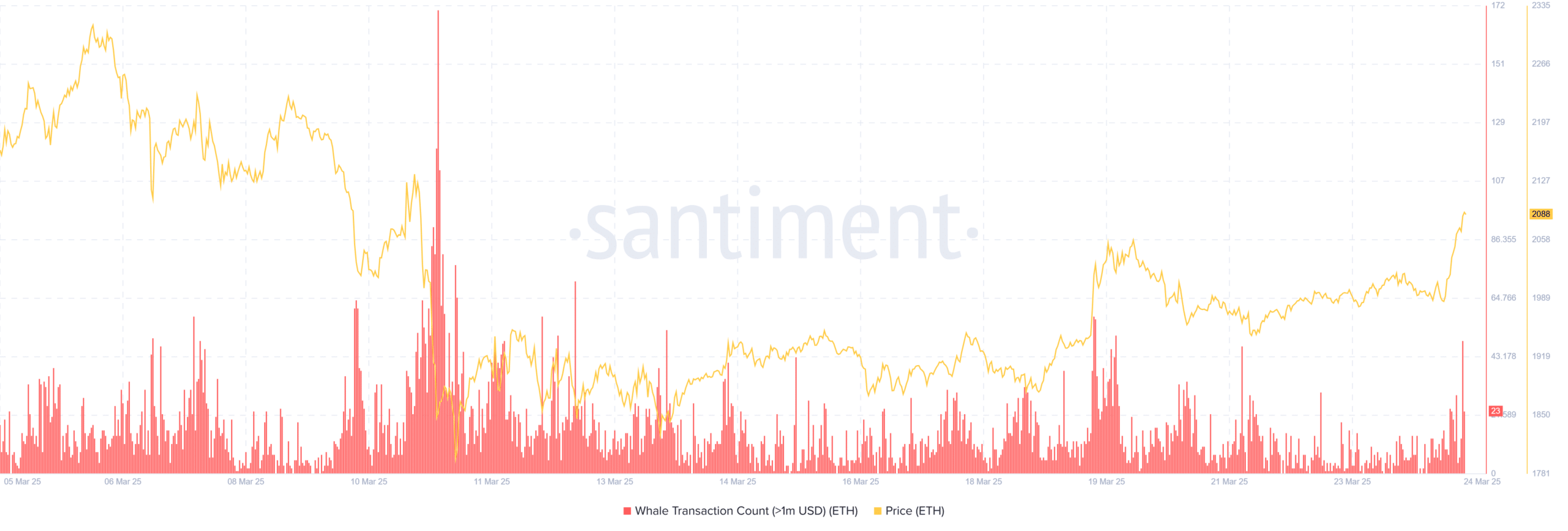

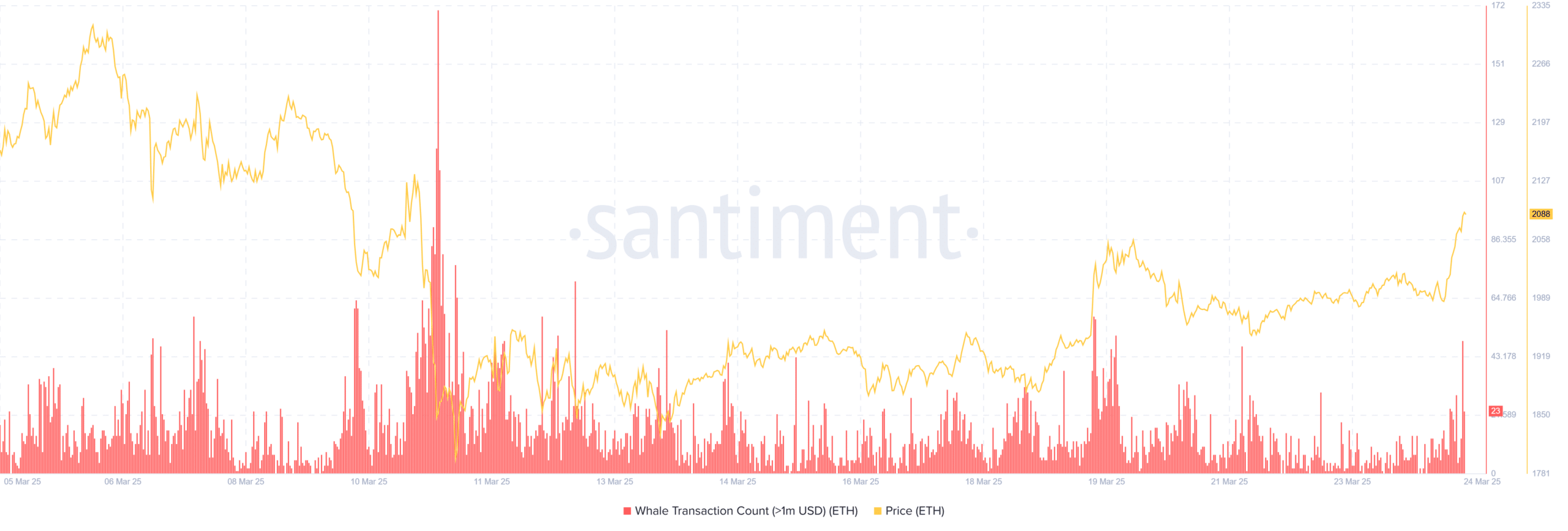

Source: Santiment

Ethereumwalvissen have been performed aggressively and raised nearly 470,000 ETH last week.

This increase in transactions with great value came just when ETH recovered the $ 2,000, which suggests that whales position before a potential outbreak.

Santiment data showed a sharp increase in the number of whale districts from March 19, which adds weight to the idea that institutional and high -quality players see the current price levels as a battery zone, not as a local top.

Ethereum price promotion refers to recovery, but the resistance looms

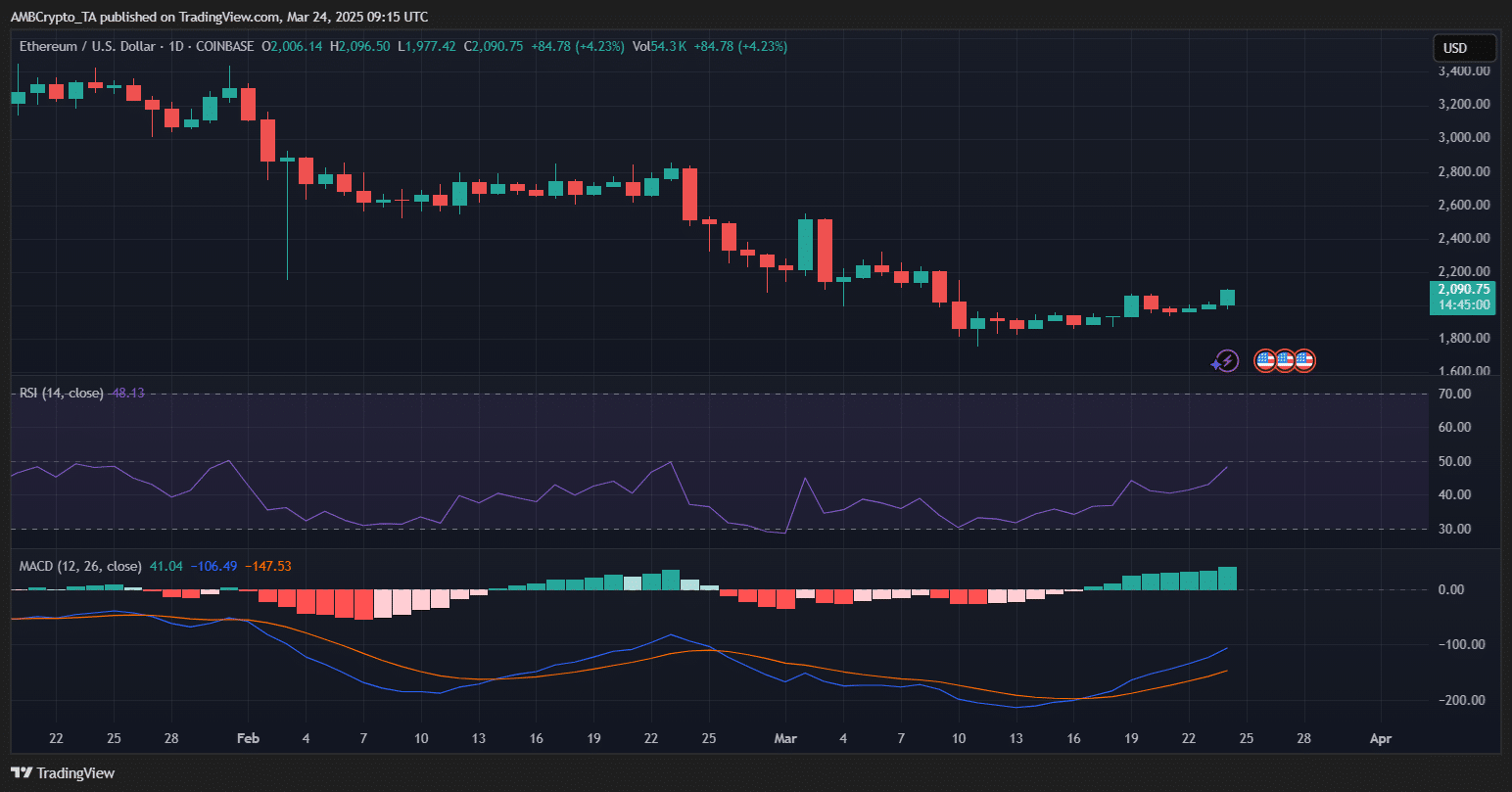

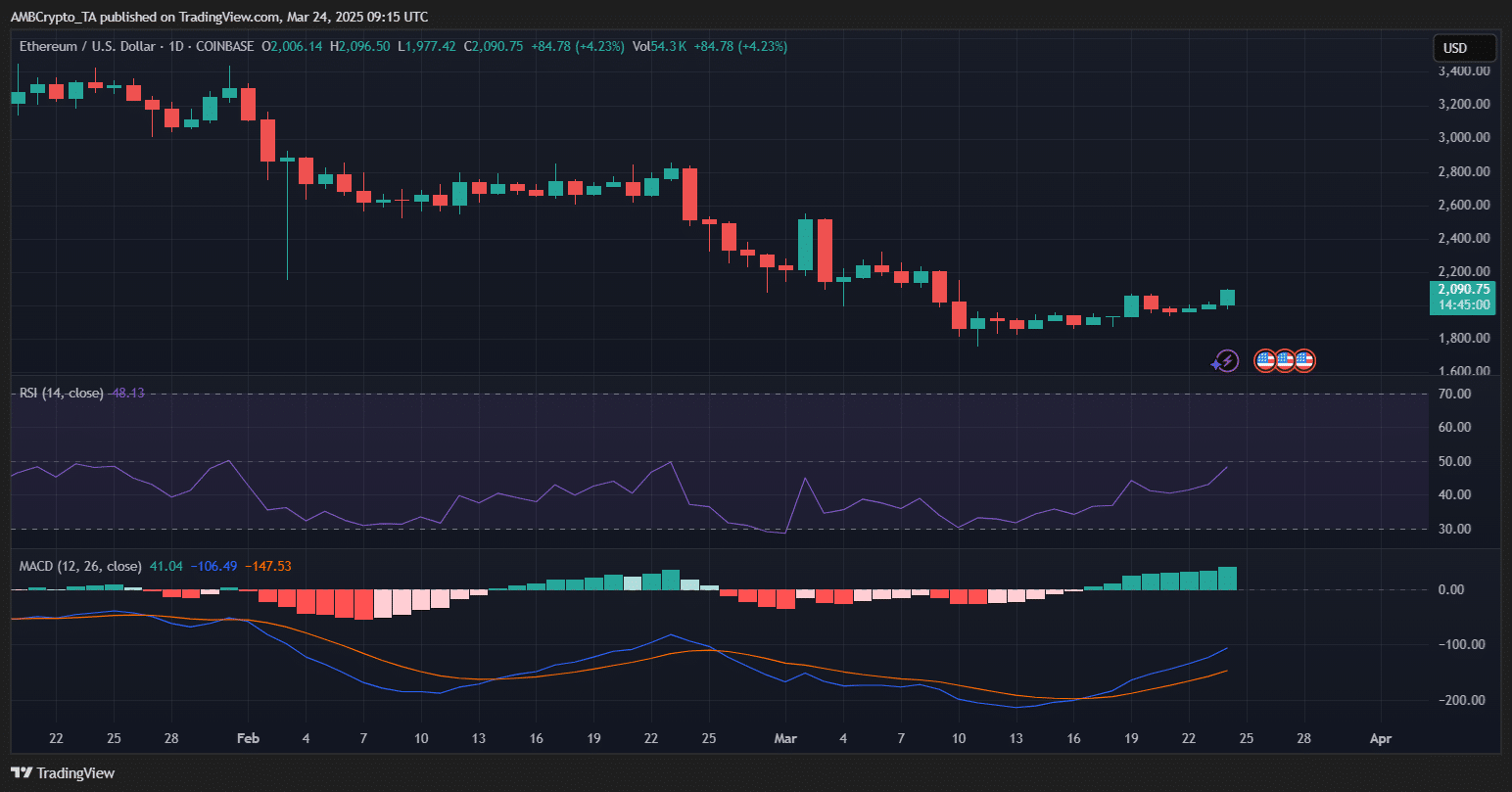

Ethereum achieved a profit of 4.23% to trade around $ 2,090, indicating a potentially short -term recovery.

The daily graph shows bullish signals that are starting to form: the MACD has been turned in the green area, with the MacD line that crosses above the signal line – often seen as a bullish crossover.

Moreover, the RSI has risen to 48.43, as a result of improving the buyer’s strength without overbought conditions.

Source: TradingView

Despite these signs, ETH is still confronted with resistance near the range of $ 2,200- $ 2,250, last considering early March. A successful closure above this zone can open the door for a retest of the level of $ 2,400.

As a momentum, however, ETH can withdraw to re -test $ 2,000 as support.

For the time being, whale accumulation and improvement of the sentiment on the Ethereum chains seem to give the fuel it needs a clean outbreak is still needed to confirm a wider trend remote.