- The US government agrees with institutional investors in selling ETH in large quantities, so that downward pressure is added to the price.

- Retailers also participate in the Golf, but this ETH is confronted with the possibility of a steeper market loss.

Ethereum [ETH]Investors are starting to see the Bearish Gulf of the market, because enormous sale is being registered across the board.

In the last 24 hours alone, it has been active by 5.75%, with the possibility of falling even lower.

The analysis of Ambcrypto reveals that a historical trend that supports an ETH breakdown after a sale no longer exists. If market participants continue to sell across the board, losses will increase.

The US government sells en masse, ETH Tart previous catalysts

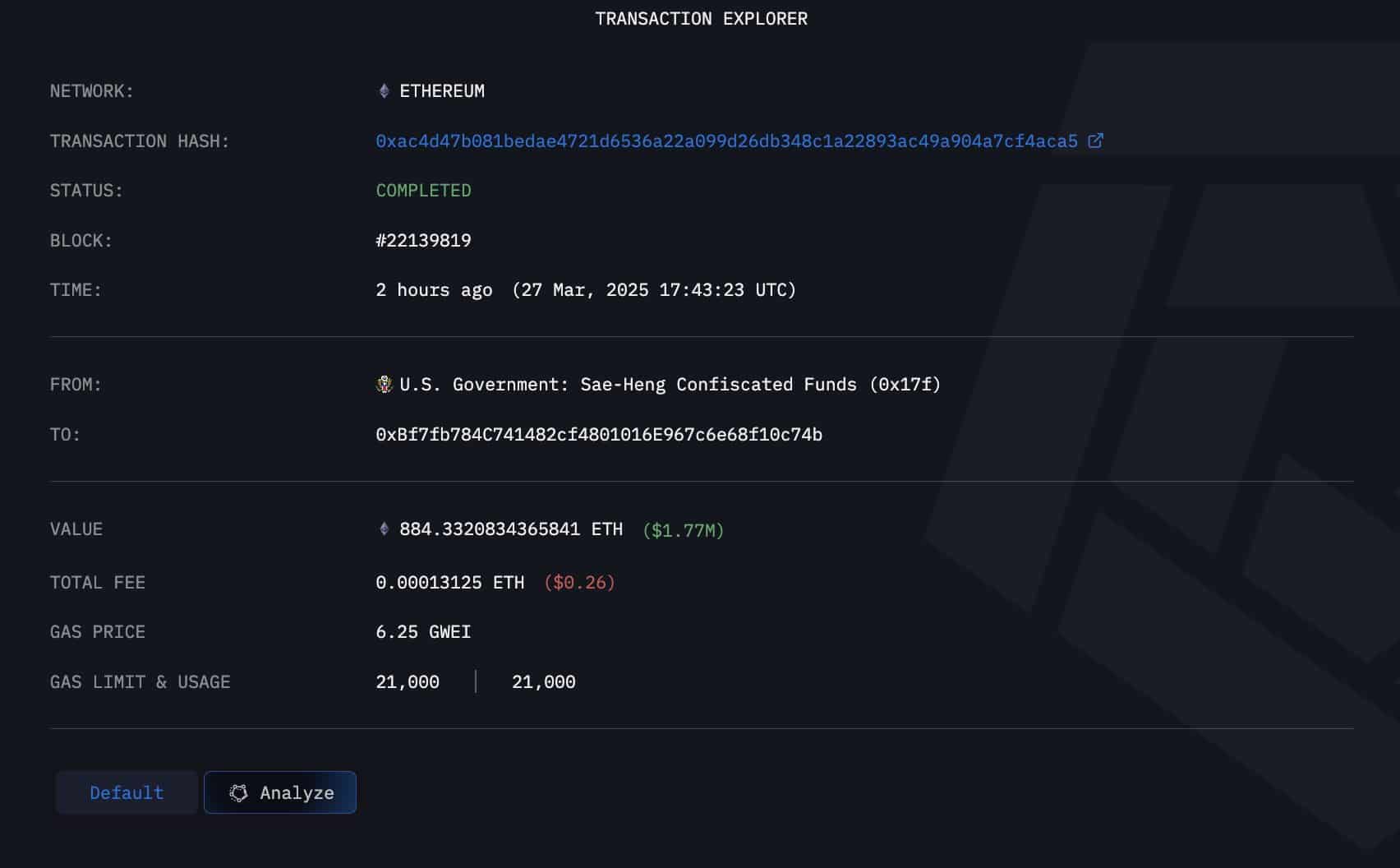

In the last 24 hours, the US government has sold an enormous amount of ETH in the market – 884.33 ETH worth $ 1.77 million at the time of the trade.

A remarkable sale of large investors such as the US government, which owns 59,965 ETH in its balance, usually indicates a lack of confidence in the active and tends to negatively influence the wider market.

Source: Arkham Intelligence

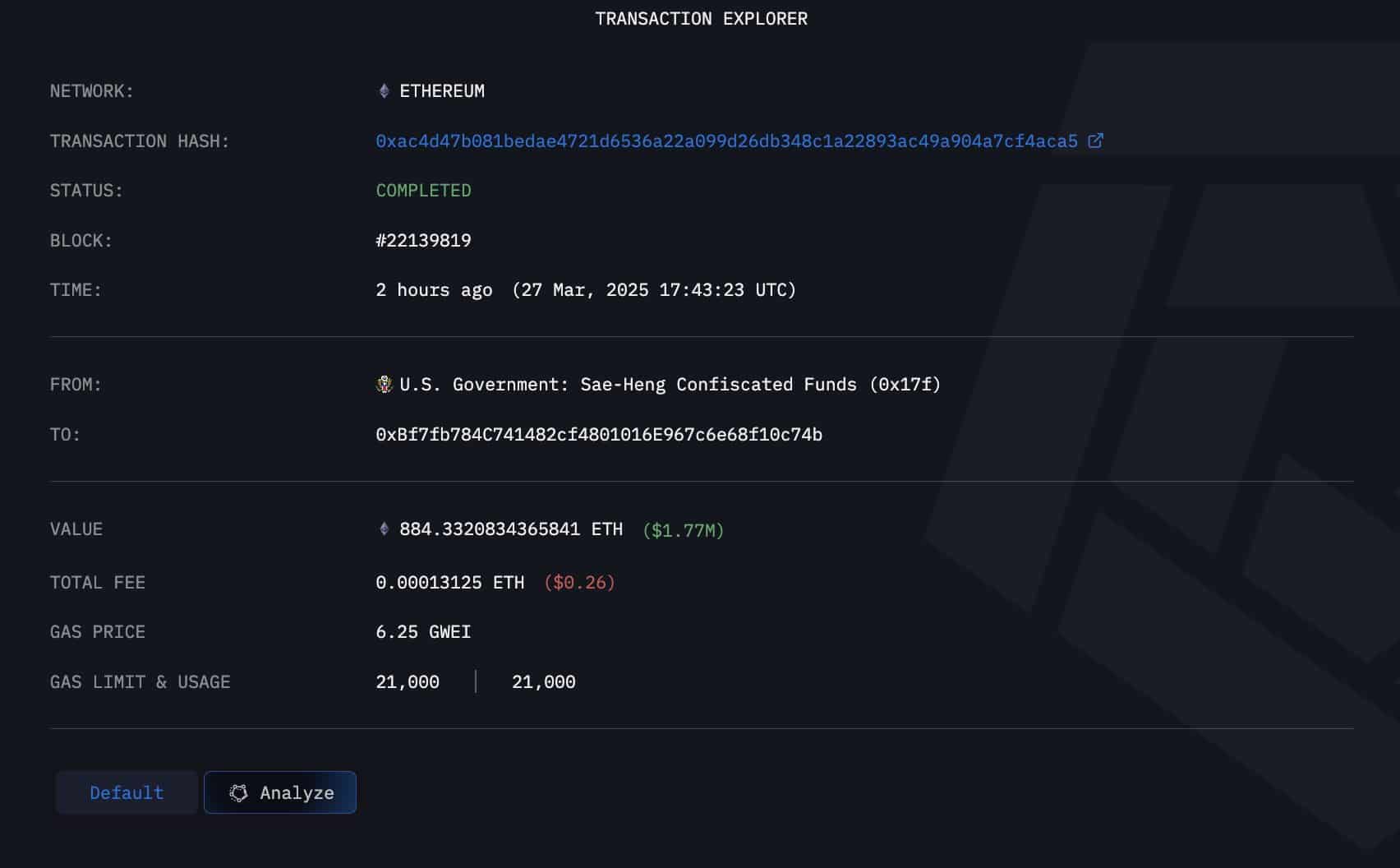

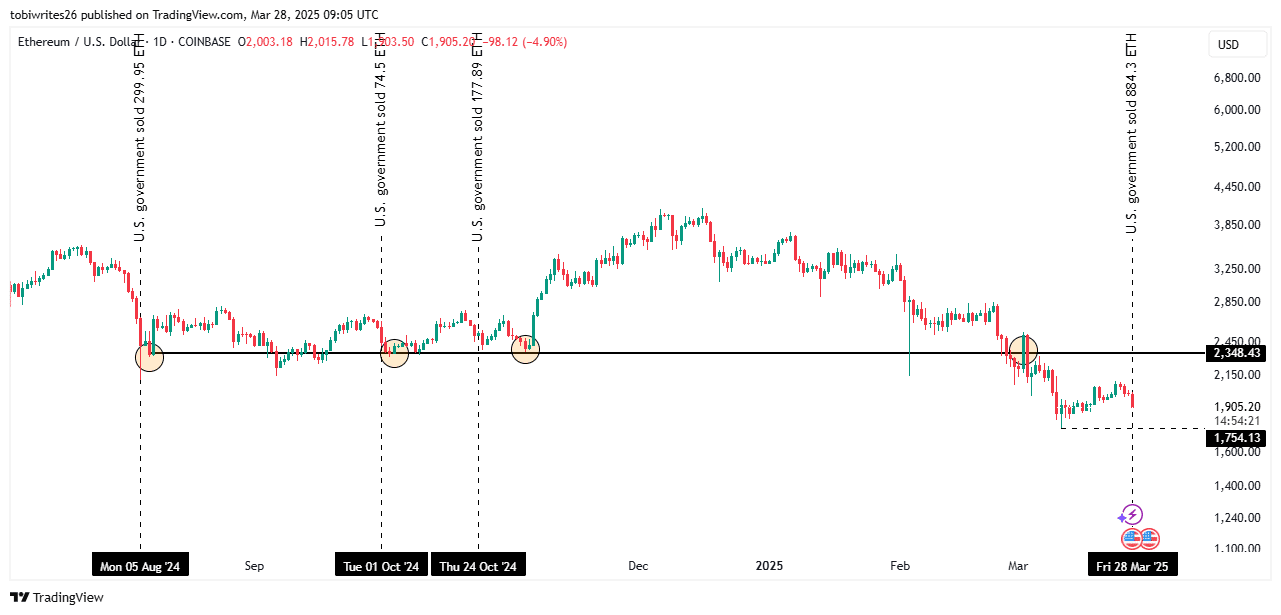

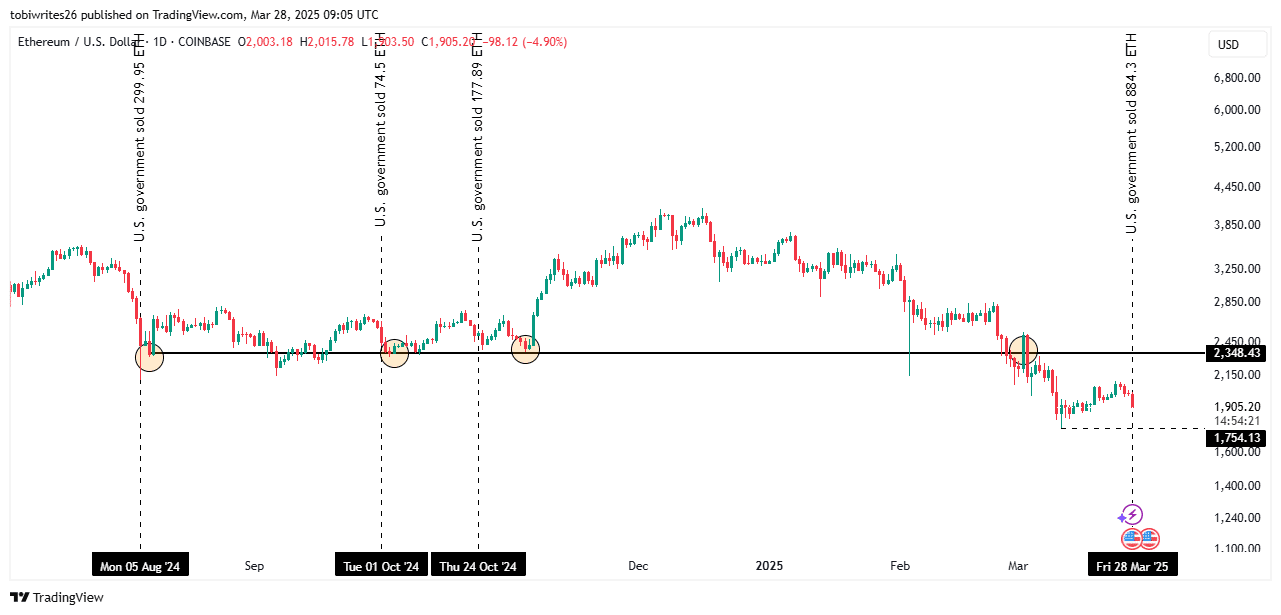

To understand the impact of this, Ambcrypto studied the earlier ETH sale of the US government and their effects on the market.

The US government usually sells when the market is already falling, which is the current case. In contrast to the past, ETH may not see any bouncing.

At three times in the past – August 5, 1 October and 24 October – the US government sold 299.95, 74.5 and 177.89 ETH respectively respectively. Each time it actively fell to an important level of support at $ 2,348.43, which acted as a catalyst for a return.

Source: TradingView

This time, however, is different. ETH is currently trading below this support level and forms a series of lower lows. If sales pressure is increasing, the ETH risks fall under $ 1,754. If it does not bounce back from this level, further decline is probably.

The further analysis of Ambcrypto showed that a continuous decline could be the current market trend, because the retail feeling has reached a new layer against the active – a level that was recently seen a year ago.

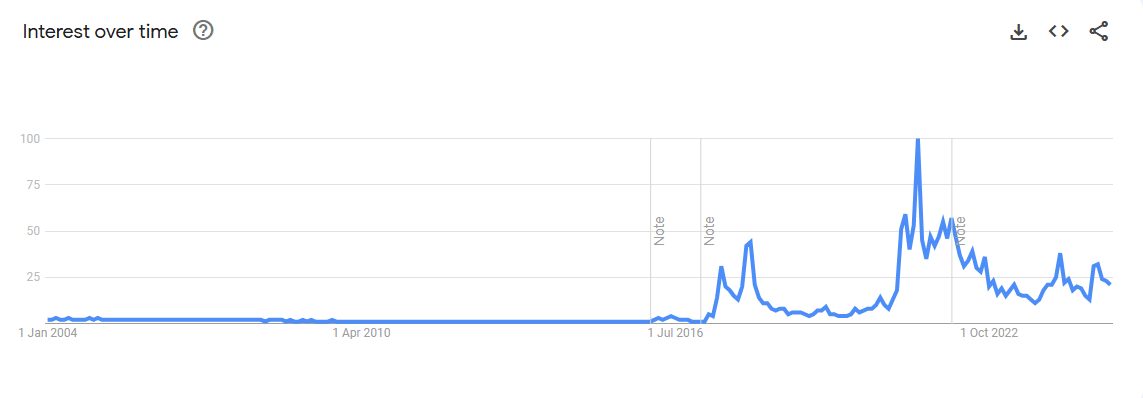

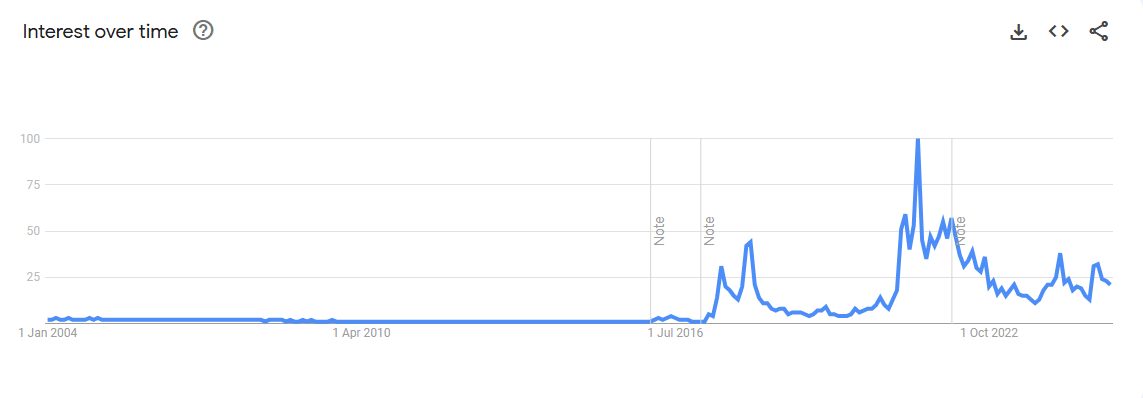

Source: Google Trend

This was confirmed by Google Search Interest in the course of time, which shows that interest in the ETH stores has fallen considerably, a sign that is often attributed to the sale.

Bearish Trends under Retail and Institutional Investors

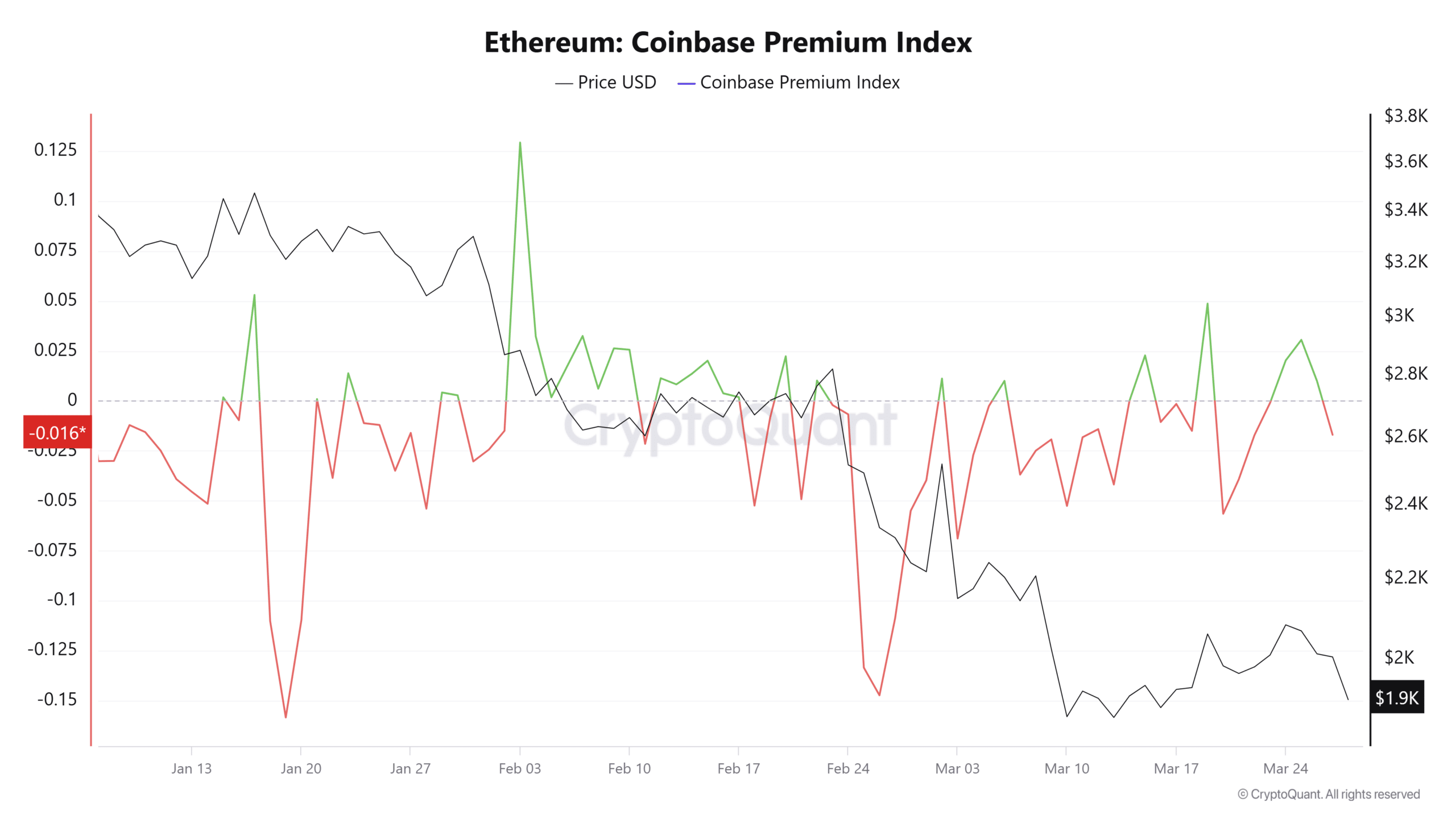

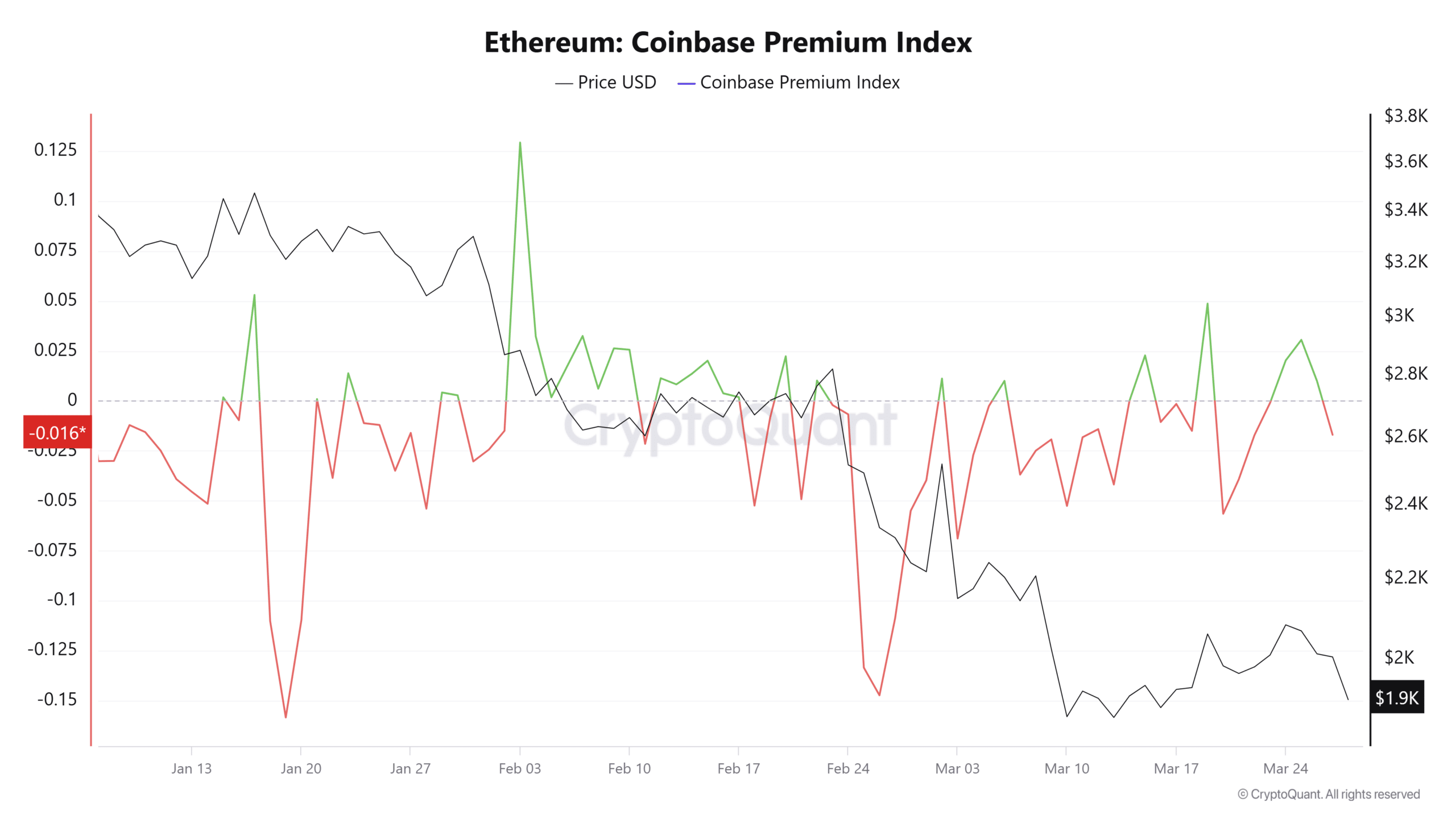

The sale of the US government has forced retailers in the country to sell aggressively. According to the Coinbase Premium Index, which follows this behavior, this is the first time since March 23 that this is selling this cohort of traders.

This is clear when the index is in a negative area. At the time of the press it had a lecture of -0.0016, indicating that the sales pressure is gradually mounted.

Source: Cryptuquant

Institutional investors who have around $ 8.83 billion in Ethereum on Ethereum, because assets in control also continue to sell since the beginning of March, adding downward pressure to the active.

A total of $ 402.6 million was sold to Ethereum between 3 March and now.

If institutional investors continue to sell, ETH could reach the target level of $ 1,754, as indicated on the graph.