Ethereum (ETH), one of the leading cryptocurrencies, is showing remarkable resilience in the face of recent market fluctuations. Despite posting relatively modest gains compared to Bitcoin (BTC) and other major altcoins, ETH has managed to consolidate its position above $1,800.

The big question on everyone’s mind is whether Ethereum can maintain this level or whether it will succumb to the prevailing market sentiment.

In the world of cryptocurrencies, prices are very sensitive to market sentiment. Cryptocurrencies often exhibit dramatic price fluctuations based on the emotions and perceptions of investors and traders. Positive sentiment tends to push prices up, while negative sentiment can lead to sharp declines. In this particular case, the catalyst for market sentiment is the upcoming US Federal Open Market Committee (FOMC).

The Role of FOMC in Influencing ETH and the Crypto Market

The FOMC is a key department of the US Federal Reserve responsible for setting monetary policy in the United States. One of the most important instruments at its disposal is the adjustment of interest rates. When the FOMC meetings take place, the decisions on interest rates can have a significant impact on various financial markets, including cryptocurrencies.

As the FOMC decision tends towards an aggressive stance, implying a rise in interest rates, this could result in a wave of bearish sentiment in the cryptocurrency market. In such a scenario, Ethereum sellers could apply pressure, potentially pushing the altcoin below the $1,700 mark.

Conversely, a dovish or unchanged policy stance could lead to more positive sentiment, allowing ETH to maintain its current position and even experience upward momentum.

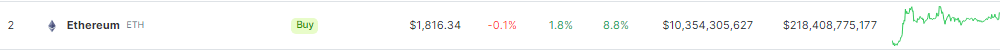

Source: Coingecko

According to the most recent data available at Coin geckoEthereum is trading at $1,816, showing a gain of 1.8% over the past 24 hours and a notable increase of 8.8% over the past seven days. While these gains may seem modest compared to the usual volatility of the cryptocurrency market, they reflect Ethereum’s ability to remain stable in turbulent times.

Ethereum currently trading at $1,826.1 on the daily chart: TradingView.com

Ethereum Layer 2 solutions are breaking records

A notable development in the Ethereum ecosystem is the remarkable performance of Layer 2 (L2) solutions. These scaling solutions are designed to reduce Ethereum’s network congestion and high gas fees.

Recently, L2 solutions have set a new trend all-time high in Total Value Locked (TVL), which briefly topped $12 billion before stabilizing around $11.89 billion. This performance surpasses the previous all-time high of $11.85 billion in April, indicating the increasing adoption of Ethereum’s Layer 2 solutions.

Source: L2Beat.

Because the $1,800 threshold represents a crucial psychological barrier, the ultimate direction of Ethereum’s price movement depends on the delicate balance between market sentiment and the decisions of key financial institutions.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Shutterstock