- The exchange stock of Ethereum has fallen to the lowest level in nine years.

- Could this delivery SQUeze cause a price increase?

The offer from Ethereum [ETH] On exchanges, the lowest level has fallen since 2016, indicating a liquidity cutting that supports a bullish outlook in the medium term.

With the sale of the sales side and accumulation, rise, Can ETH reclaim the critical resistance of $ 3.5k in the short term?

Key Technicals Flash Bullish

Despite no signs of overheating, Ethereum remains 32% below the peak after the $ 4,016 elections after four consecutive lower lows.

This time, however, the RSI is on the bottom and a Bullish Macd -Crosover takes shape – which suggests that the consolidation of ETH could build up for an outbreak.

Yet historical patterns of caution suggest. Previous recovery did not succeed in breaking in the key resistance, because the demand had difficulty absorbing the sales pressure.

Source: TradingView (ETH/USDT)

Ethereum’s Spot Exchange, however delivery has fallen to a low of 9 years of 8.2 million ETH.

With tightening of the liquidity and potential acceleration, the circumstances are tailored to a supply shock – one that can feed a breaking of the most important resistance levels.

Mapping the next most important resistance zone of Ethereum

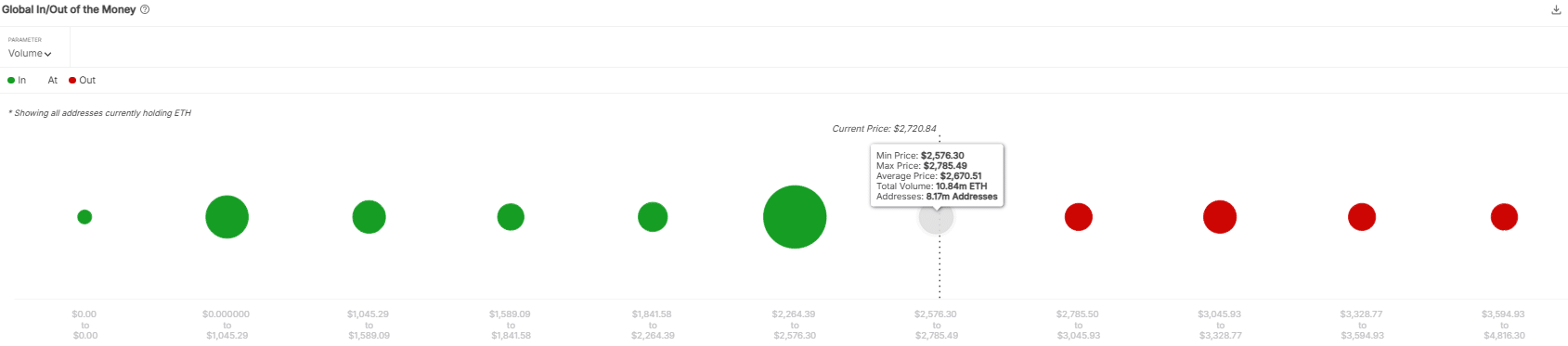

Ethereum is confronted with a critical resistance at $ 2,785, where 8.10 million addresses would turn profitably, which exposed $ 20 billion to potential sales pressure.

Source: Intotheblock

While spot reserves became a lowest layer of 9 months, signaling accumulation, investors unloaded More than 2 million ETH in stock exchanges in February, so that she expressed concern about mounting sales pressure.

Weak question Of the US and Korean investors, the upward momentum also threatens, so that the leverage can be taken care of on the futures market.

If the question does not recover, Ethereum can get a withdrawal to $ 2,264, where 62.38 million ETH is concentrated.