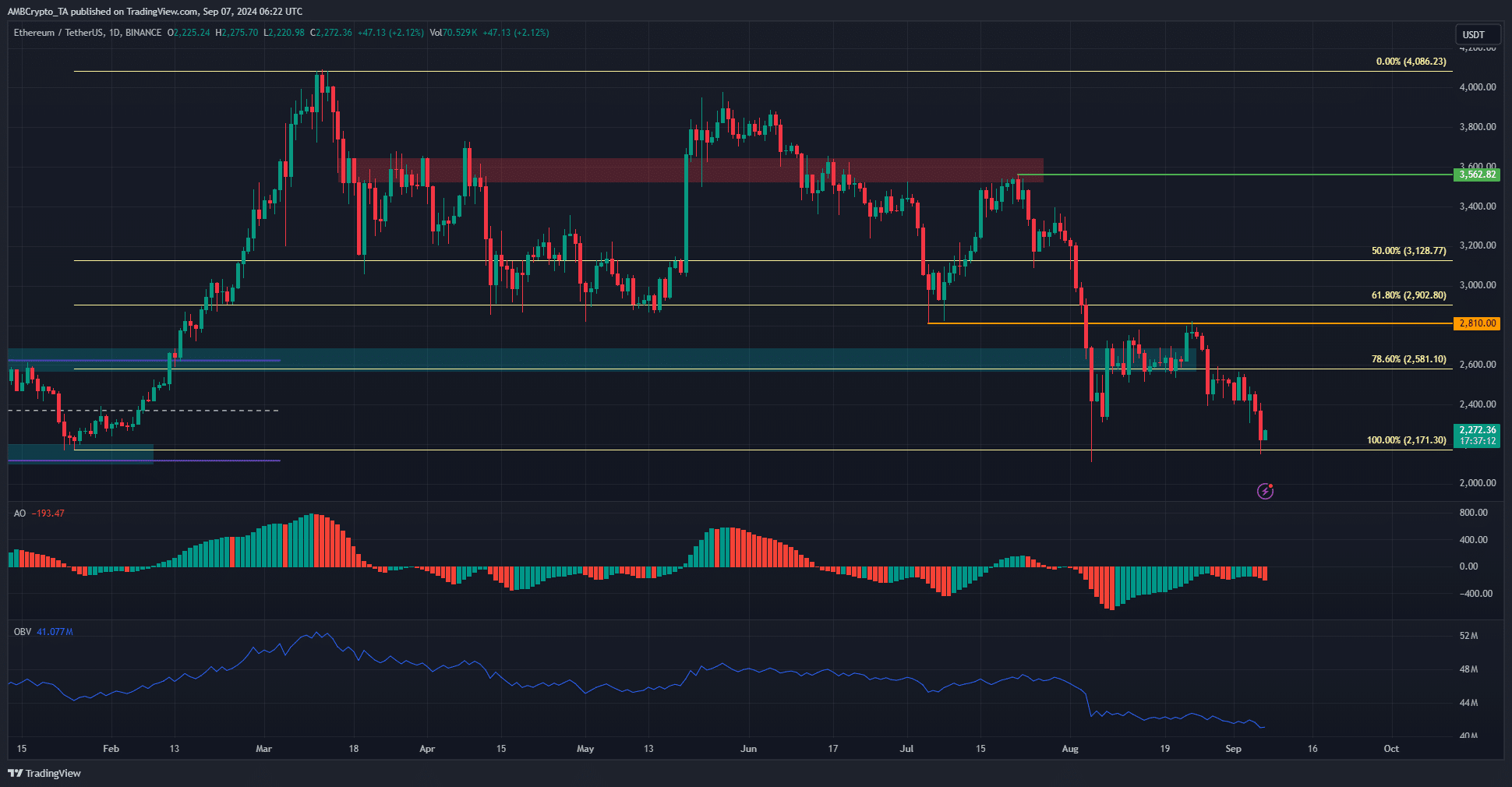

- The $2.6k support zone has been broken decisively over the past two weeks

- The consistent dominance of Ethereum sellers has investors concerned

Ethereum [ETH] formed an ascending triangle pattern on the higher timeframes. The 16.6% drop from Tuesday to Friday was still within this bullish pattern and suggested that long-term investors can be hopeful of a recovery.

Ethereum has not been against Bitcoin [BTC] who traditionally leads the crypto market. This inability to match BTC’s performance is a frustration for investors. The recent sale of 1000 ETH by the Ethereum Foundation has not boosted sentiment either.

Daily fuse from early August is filled

Source: ETH/USDT on TradingView

The February rally has been fully recovered. The losses in the second half of July tested the $2171 zone, and it was tested again on Friday, September 6.

The Awesome Oscillator showed red bars on the histogram below zero to indicate strong bearish momentum. The bearish side has been dominant since early August and has not relinquished its grip.

The OBV also showed a downward trend due to steady selling pressure. Two weeks ago, the price of ETH was above $2.6k and there was some hope that a recovery was near.

Unfortunately, the support zone, which was so high at the beginning of 2024, has since been definitively broken. Given the dominance of the sellers, further losses seemed likely.

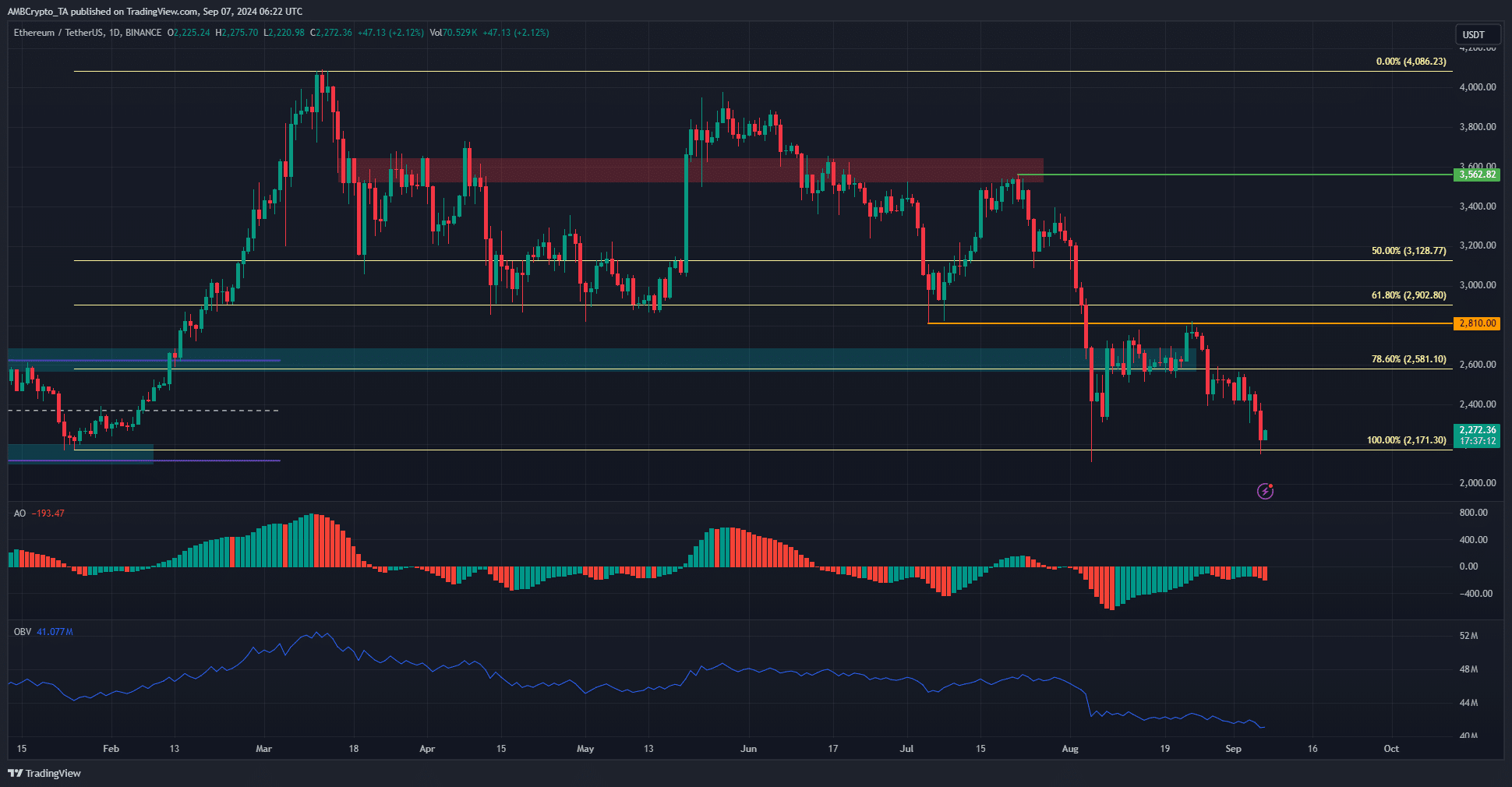

Ethereum vs. Bitcoin also reflected weakness

Source: ETH/BTC on TradingView

The weekly chart of Ethereum versus Bitcoin revealed that the downtrend has been going on since early 2023. The 2022 low of 0.056 was broken in 2024 and ETHBTC continued to slide down the charts.

Read Ethereum’s [ETH] Price forecast 2024-25

Ethereum’s weak performance also raised concerns that the altcoin market could struggle during this period. The older coins in particular will have a hard time attracting the attention of the new capital inflows into the market. Especially if and when a bull run starts.

Disclaimer: The information presented does not constitute financial advice, investment advice, trading advice or any other form of advice and is solely the opinion of the writer