- Intraday traders have placed $ 330 million on short positions.

- Despite the Bearish Outlook, a crypto -whale for $ 5.27 million has withdrawn from ETH.

Ethereum [ETH] And other cryptocurrencies came considerable after the rate announcement of US President Donald Trump.

According to recent data, most countries will now be confronted with a rate of 10%, while China, the EU and Japan were hit harder with rates of 34%, 20%and 24%respectively.

This development has caused a sharp decrease in the total cryptocurrency market.

In the meantime, Ethereum has fallen more than 4.50% and acted near the $ 1,800 level, which seemed to be a make-or-break point for the upcoming price levels.

Ethereum pricing and upcoming levels

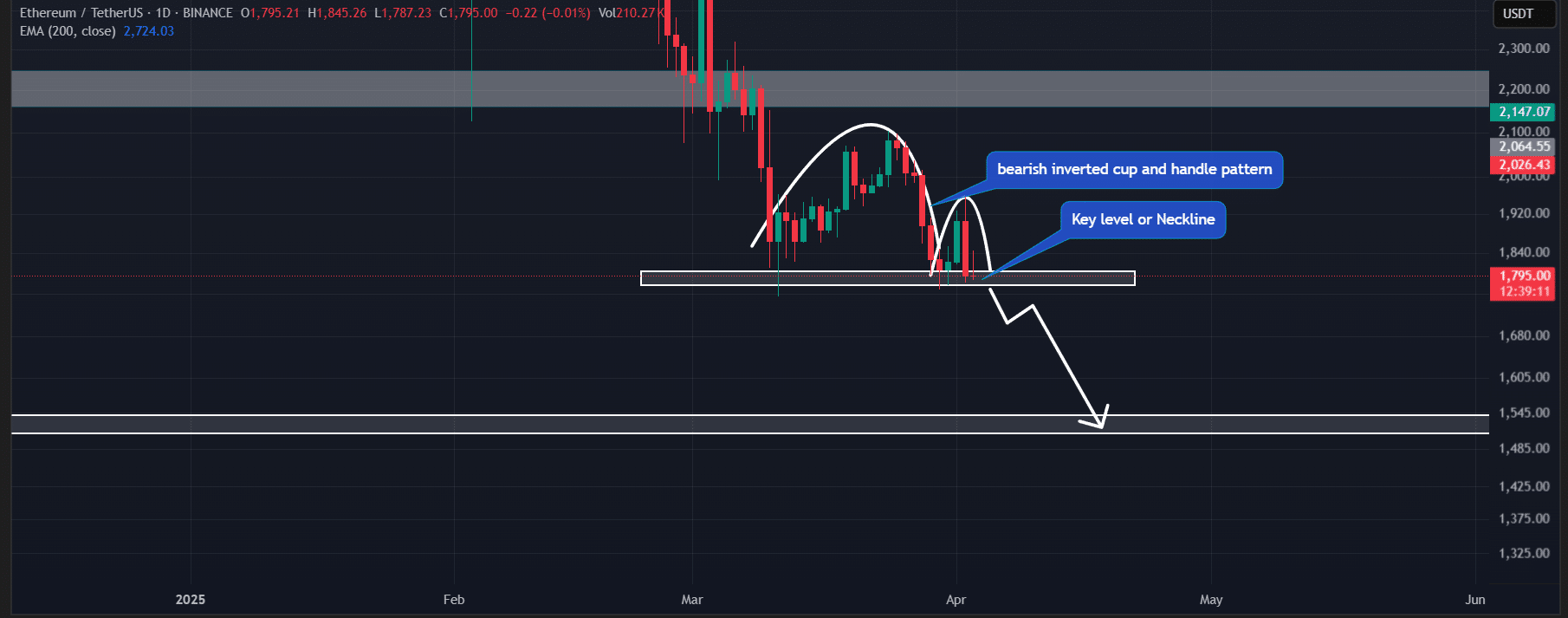

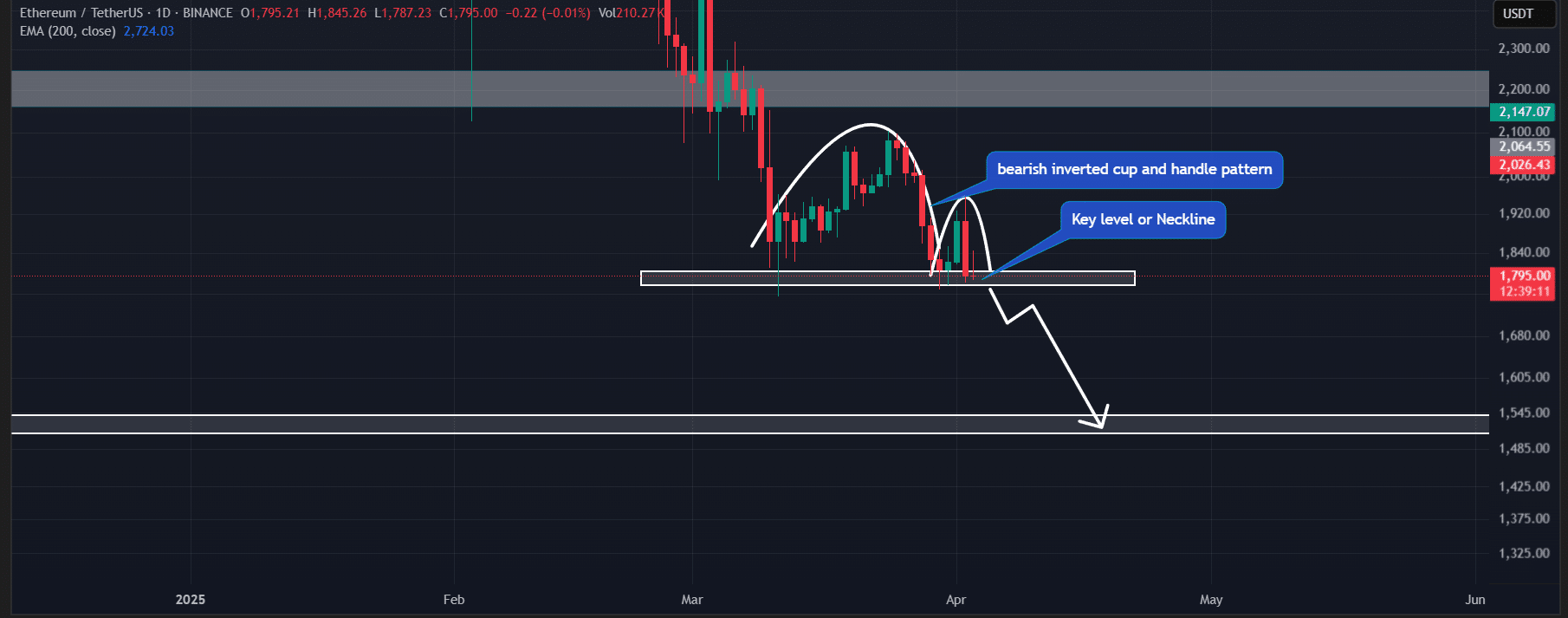

According to the technical analysis of Ambcrypto, Eth Beerarish seemed to be about to have a considerable price decrease.

In the daily period of time it seemed to have formed a bearish cup and lever pattern and was at the neckline.

Based on the historic price momentum, if ETH infringes the neckline and a daily candle closes below $ 1,770 Mark, a huge sale could follow.

The price can fall by 15% until ETH reaches the following support level at $ 1500.

Source: TradingView

ETH was traded on the press average (EMA) under the exponential advancing average (EMA), which indicated a bearish-trend that further strengthened the Bearish front views of the actively.

Whale’s recent activity

In the midst of this price decline and Bearish market sentiment seemed to benefit investors and whales from the dip and she continued to collect tokens.

Recently, blockchain-based transaction tracker Lookonchain revealed on X (formerly Twitter) that a crypto -walvis has withdrawn a significant 2,774 ETH, worth $ 5.27 million, of the Binance Cryptocurrency Exchange.

Moreover, the same whale has withdrawn more than 16,415 ETH, worth almost $ 43.90 million, from Binance at an average price of $ 2,676.

This indicates a “buy-the-dip” strategy, because despite the constant fall in price, the whale seemed to be their ETH companies at lower levels.

Traders’ $ 330 million Bearish bets

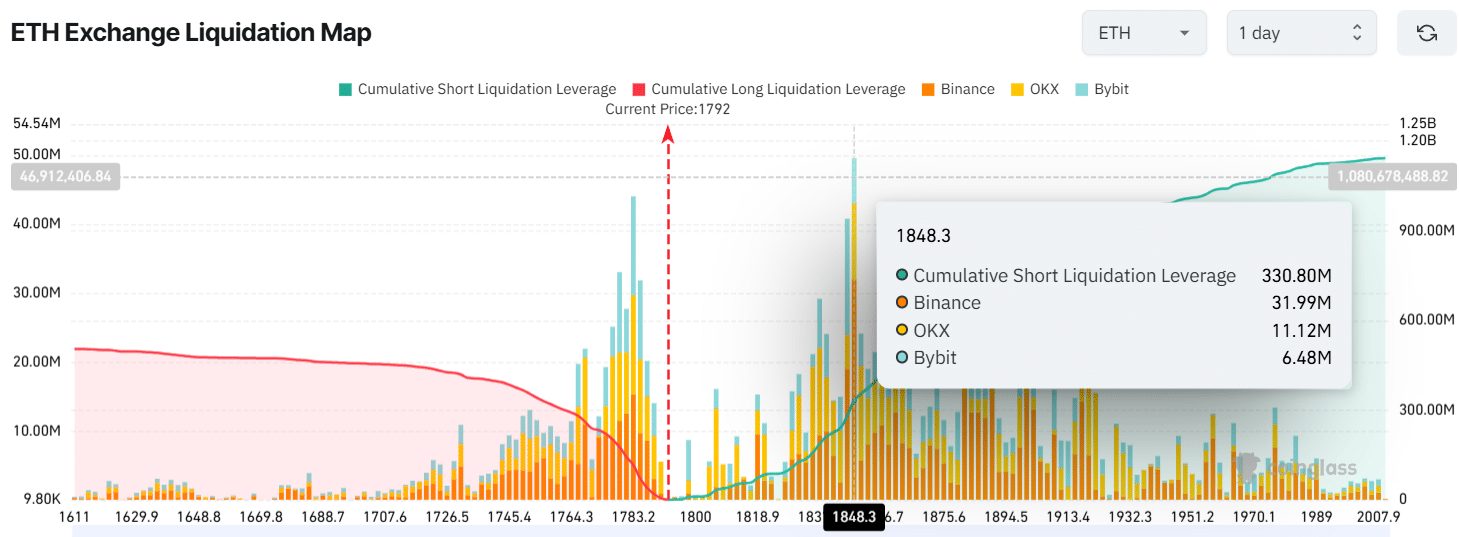

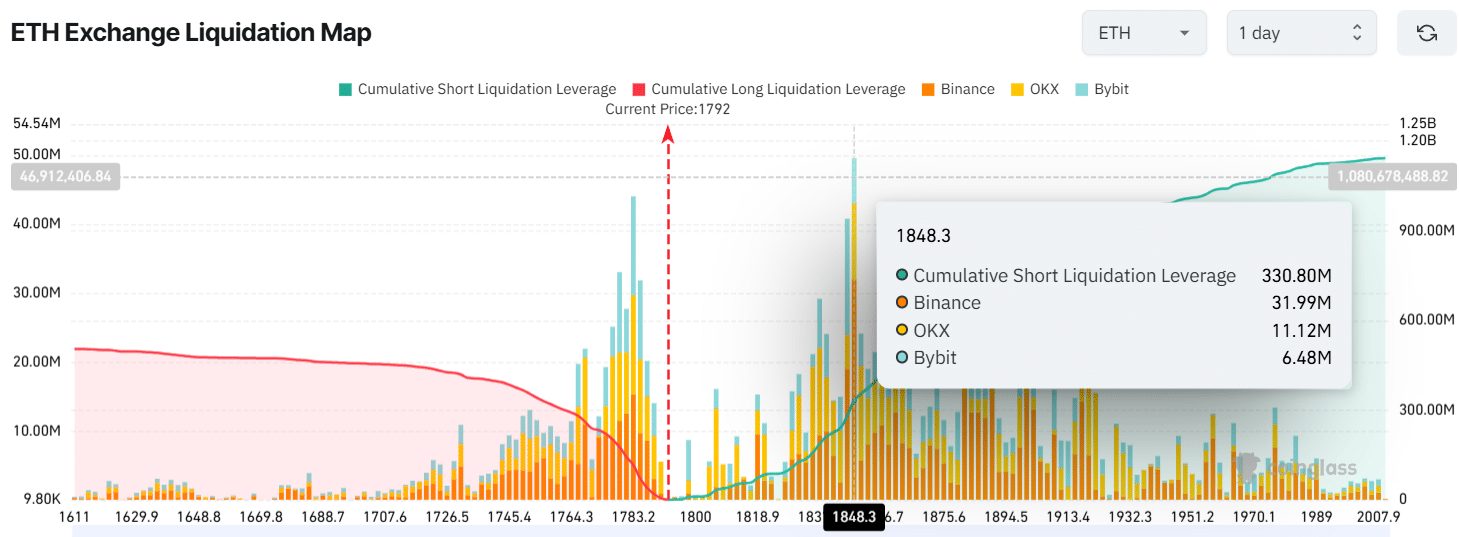

Looking at statistics on-chain, ETH seemed weak and ready for a price crash. From data from the unchain analysis company Coinglass, it showed that intraday traders gambled remarkably on the short side.

Source: Coinglass

At the time of the press, traders were supplied too much at $ 1,783 at the bottom, where they built $ 115 million in long positions, while $ 1,848 is again an over-being level with $ 330 million in short positions.

These enormous over-paste positions reflect the real market sentiment, which seems Bearish.