Ethereum (ETH) enthusiasts have found a glimmer of hope in the recent bullish reversal, as the entire crypto market appears to be heading for a recovery. The second-largest cryptocurrency by market cap saw a significant rebound, clawing its way back from last week’s $1,550 support level.

At the time of writing, ETH is trading at $1,655 Coin gecko, with a commendable increase of 5%. This rise has boosted investor confidence, prompting them to set their sights on challenging the overhead resistance trendline.

Fighting the resistance: a crucial moment

Into the current phase Ethereum price dynamics is characterized by a declining resistance trend line. In the past two months, the cryptocurrency has encountered this formidable resistance barrier twice, with both instances resulting in a sharp price drop. This pattern underlines the resurgence of selling pressure as price approaches this elusive limit.

Analysts are watching the situation closely and suggest that if ETH breaks the September 18 low of $1,610, it could open the floodgates for bears to push the asset below the $1,550 floor. Such a scenario could send the trajectory towards $1,460, which represents a potential decline of 9.5%. The battle with overhead resistance remains a pivotal moment for Ethereum, with both bulls and bears on edge.

ETH market cap currently at $195 billion. Chart: TradingView.com

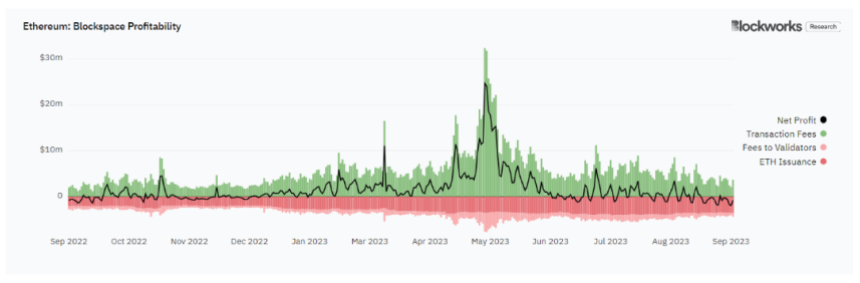

Ethereum: Blockspace Profitability

Activity on the Ethereum network has declined, making September the first month to experience significant losses since the proof-of-stake upgrade. During the month, Ethereum’s blockspace recorded just one day of profitability, with losses rising to as much as $15.9 million as of Monday.

Source: Blockworks Analytics

Meanwhile, this transformation in blockspace profitability corresponds to an expansion of Ethereum’s circulating supply, which increased by approximately 8,900 ETH this month, as reported by ultrasound.money.

Source: Ultrasound.money

Ethereum’s price struggle at the resistance trendline could determine its near-term fate, while the blockspace’s worrying decline in profitability highlights broader challenges for the network.

ETH investors and enthusiasts are keeping a close eye on these developments, hoping for a revival in both price and blockchain activity to regain their confidence in the platform’s future.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image of E-mountain bike magazine