Post Ethereum Poised to Hold $1800 – Will ETH Price Break Above Resistance Line? first appeared on Coinpedia Fintech News

The crypto market has recently collapsed sharply, causing panic selling among investors. The Securities and Exchange Commission (SEC) recently filed lawsuits against two major cryptocurrency exchanges, Binance and Coinbase, leading to a significant downturn in the market. This bearish momentum has created a bloodbath in the crypto arena, with Ethereum (ETH) drawing attention. Despite the negative news, ETH price continues to show positive momentum, leaving investors on the brink of the next price level.

Ethereum’s on-chain data offers bullish confidence

Ethereum whales, or large non-exchange holders, have been steadily acquiring more of the cryptocurrency this year and now own an unprecedented 31.8 million ETH, worth more than $59.6 billion. This trend, spotted by analytics company santiment

On the chain

takes place amid recent market instability due to regulatory action in the US.

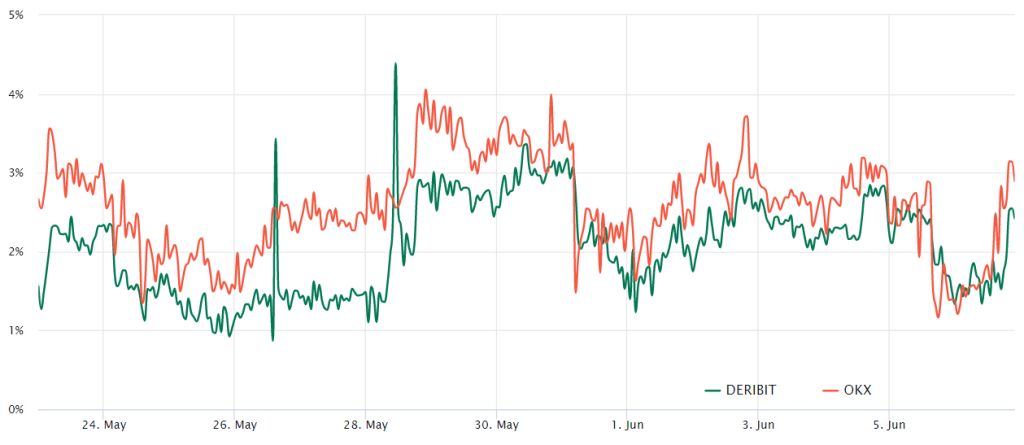

Ether quarterly futures are favored by large investors, known as whales, and arbitrage agencies. These fixed-month contracts usually carry a small premium over the spot markets, suggesting that sellers are charging a higher price for delaying settlement.

Consequently, in a robust market, ETH futures contracts should show a 4 to 8% annualized premium. This condition, also known as contango, is common and not exclusive to cryptocurrency markets.

Based on the futures premium, also known as the base indicator, it appears that professional traders have moved away from leveraged long positions or bullish bets. But even as the price retested the $1,780 mark on June 6, it wasn’t enough to shift the sentiment of these major investors and market makers to a bearish outlook.

Also Read: Will Bitcoin and Ethereum Face a ‘Cruel Summer’? Here are important levels to watch

What to expect from the next ETH price?

Over the past two days, the price of Ether (ETH) fell below the resistance line of the descending wedge pattern, but the bears failed to capitalize on this momentum, pointing to demand at lower price points.

After the bearish breakout, bullish traders pushed the price back above the moving averages, but faced significant selling pressure near the $1,895 level. Currently, sellers are trying to keep the ETH price below the resistance line, and if successful, it could lead to a further drop in the price of ETH to the pattern’s support line.

At the time of writing, ETH price is trading at $1,851, down more than 0.5% in the past 24 hours. Currently, the RSI level is hovering near the 50 level, creating a stable region for Ethereum. However, if ETH price fails to maintain its current trend, it could drop to the immediate support level of $1,760, below which the next support will be at $1,610.

Conversely, if the price breaks above the resistance line, it would imply that the bulls have converted this line into a support level. Ethereum price could then initiate upward momentum towards USD 2,000 and eventually hit resistance at USD 2,115.