- Ethereum price rose to $3,380, marking a 4.6% increase in just 24 hours

- Recent whale deposits on Kraken, along with rising OI, indicated potential near-term price pressure

Ethereum (ETH), the second largest cryptocurrency by market capitalization, continues to show dynamic market trends in early 2025. A giant whale recently deposited 20,000 ETH (valued at $67.6 million) into Kraken, reigniting discussions about large-scale investor activity and associated activities. influence the price movement of Ethereum.

This whale, who once extracted 217,513 ETH from the exchanges in September 2022, has been actively involved in Kraken since March 2024.

Such moves often indicate significant shifts in market sentiment and liquidity, requiring traders to evaluate key indicators and prepare for possible price changes.

A closer look at Ethereum’s market performance

Weaker-than-expected CPI data saw Ethereum price rise to $3,380 after gaining nearly 5% in 24 hours. 24-hour trading volume reached an impressive $26.2 billion, underscoring robust market activity and significant interest from both retail and institutional investors. Likewise, the altcoin’s market capitalization stood at $407.2 billion – a sign of stable investor confidence despite periods of increased volatility.

The aforementioned whale’s latest deposit of 20,000 ETH appeared to be in line with Ethereum’s latest price spike, indicating possible profit-taking or anticipation of a price correction. Historically, large-scale deposits by whales have preceded periods of selling pressure on the price of ETH due to increased liquidity on the sell side. However, this pattern is not always definitive.

External factors such as macroeconomic developments and Bitcoin’s price correlation also play a crucial role in Ethereum’s trajectory. With Bitcoin stabilizing above $95,000, Ethereum traders can anticipate continued bullish momentum. Furthermore, ETH’s stake expansion and EIP-1559’s deflationary effect strengthen its long-term appeal.

ETH’s price action and key indicators

Ethereum’s price has seen significant volatility, shaped by both technical factors and large-scale investor activity. In fact, the price of ETH has risen within a range of $1,500 to $4,500 over the past year, showing both bullish and bearish phases.

Here it is worth pointing out that the whale’s depositional history provides some insight into potential future price movements. Between March 2024 and now, this whale has deposited 146,639 ETH into Kraken at an average price of $3,170 – a sign of strategic profit-taking at higher price levels.

Source: TradingView

Technical analysis also showed that ETH’s recent rally tested a strong resistance level at $3,400. Breaking this level could pave the way for Ethereum to challenge the $3,500-$3,600 range in the near term. Conversely, the inability to maintain momentum could push ETH towards the $3,200-$3,100 support zone.

An examination of the major moving averages also found that Ethereum was trading above its 50 and 200 day moving averages.

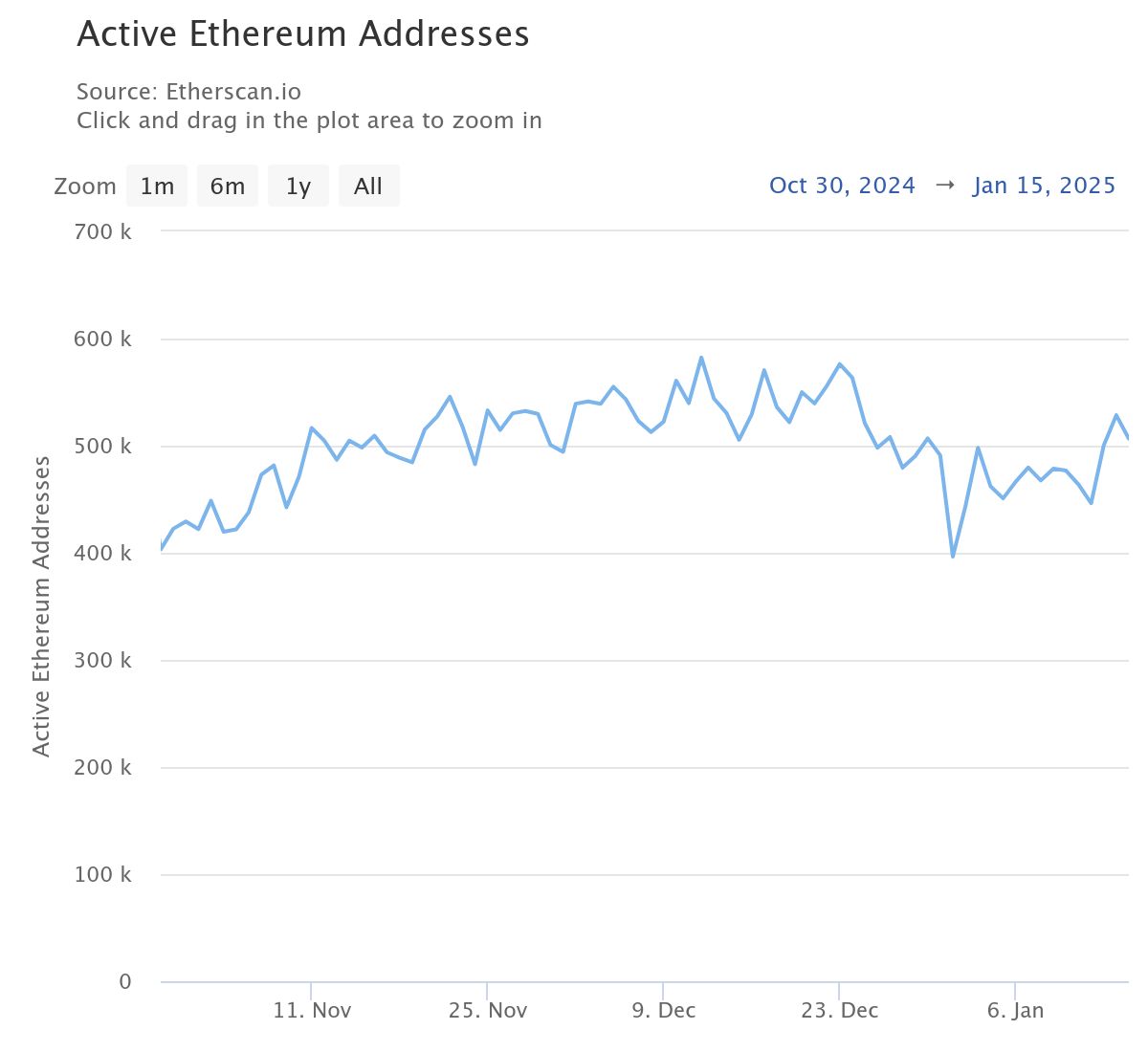

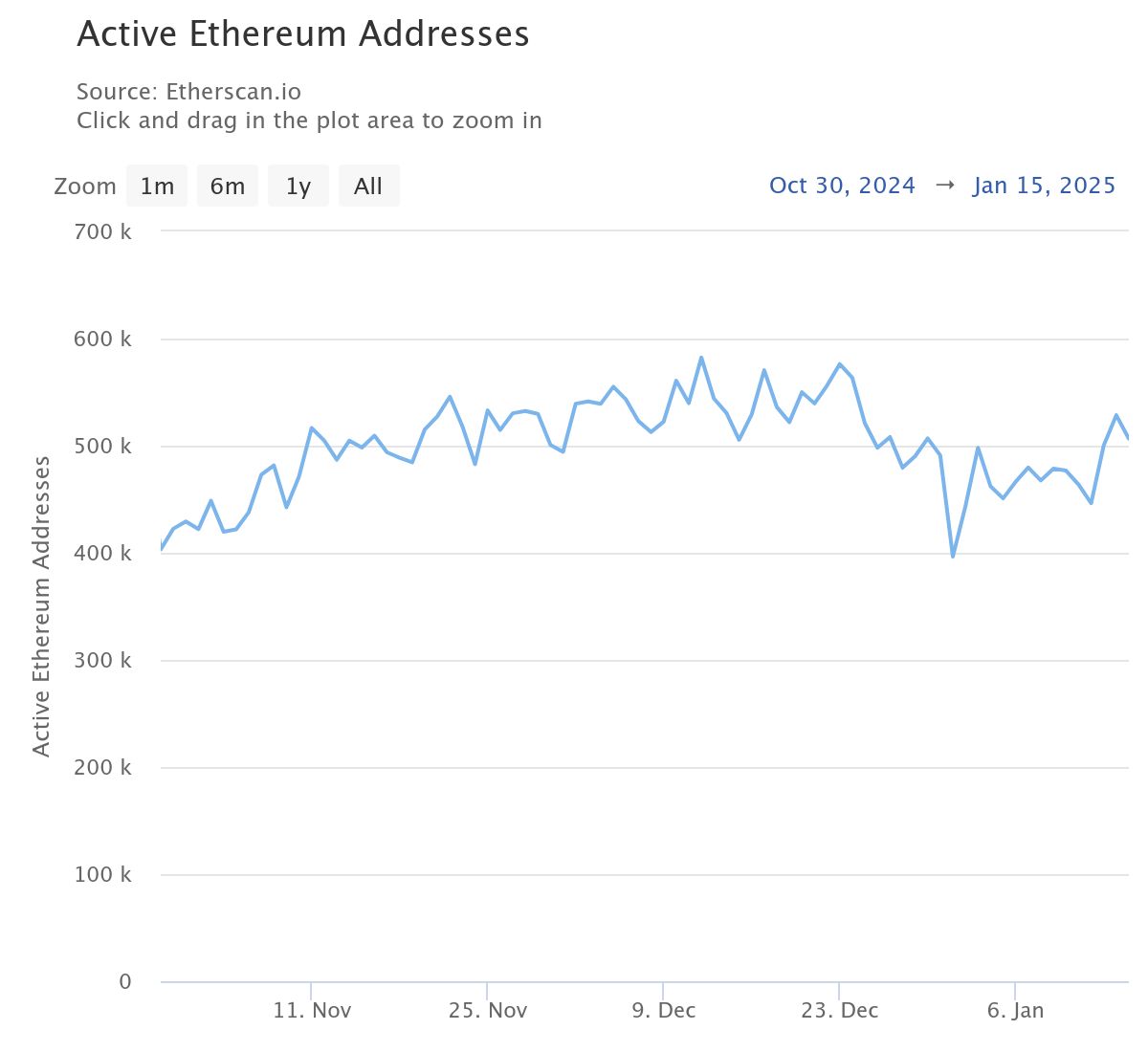

The resilience of Ethereum’s network

Furthermore, Ethereum’s active addresses have seen a steady increase in recent months. In fact, on-chain data showed that the number of active addresses consistently hovered around 400,000 per day, demonstrating strong participation across the ecosystem.

Source: Etherscan

If you analyze the trend further, you can see that periods of rising active addresses often coincided with price increases – a sign of growing demand and network utility. For example, the recent increase in the number of active addresses corresponded with Ethereum’s price increase to $3,380, strengthening the correlation between network activity and market performance.

However, a decline in this metric could mean reduced network activity and potential downward pressure on the price of ETH. In light of Ethereum’s robust developer ecosystem and continued innovation, the network’s activity levels will likely remain a reliable barometer of market sentiment and future price movements.

Signals for Ethereum’s next move

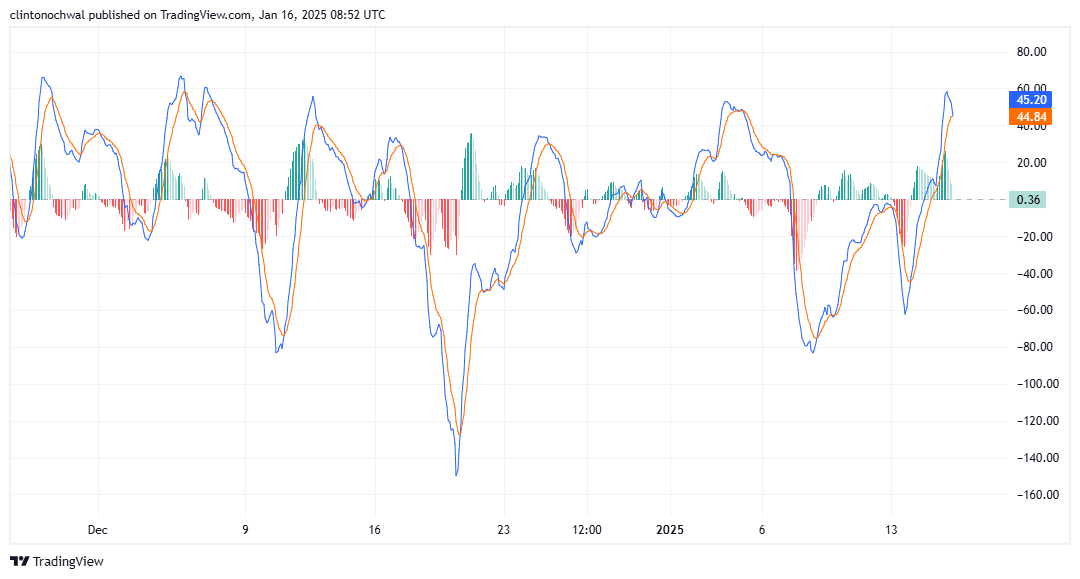

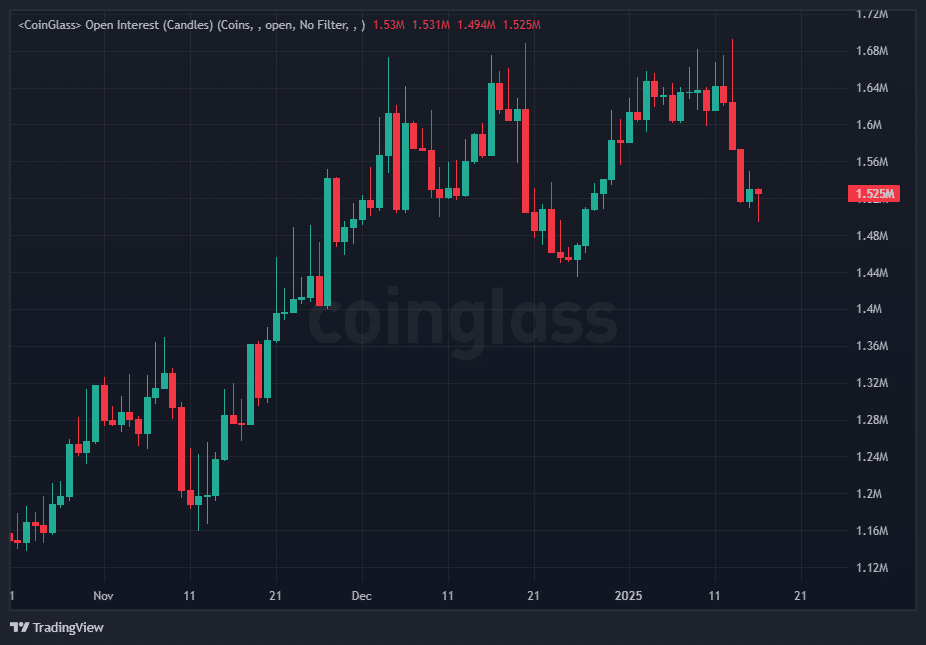

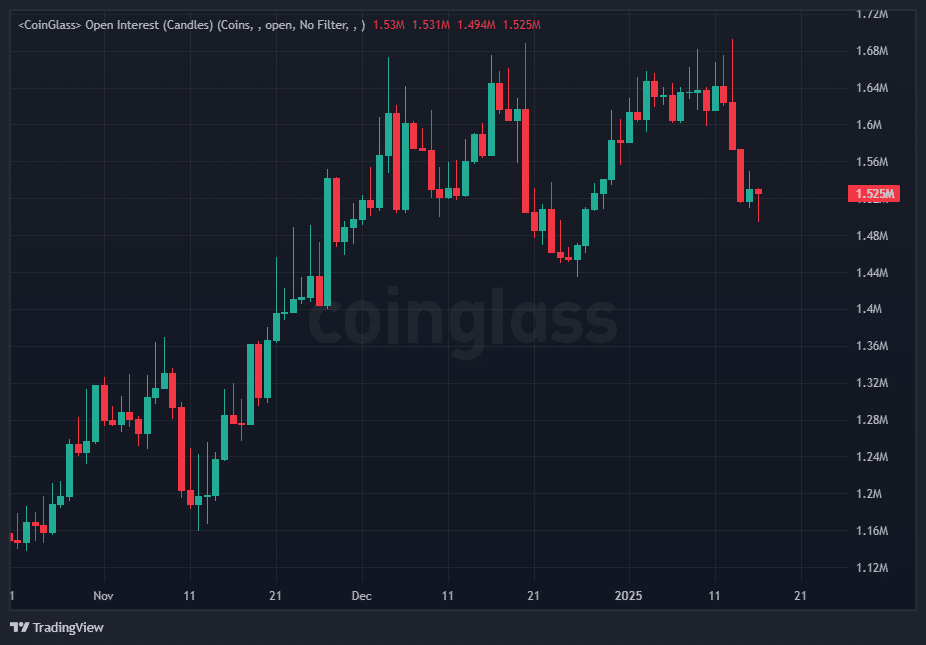

Ethereum’s Open interest (OI) has recently recorded notable fluctuations, indicating increased activity in the derivatives market. At the time of writing, Ethereum’s OI on major exchanges was $1.52 million, following a significant weekly increase. This rise matched ETH’s latest price rise, meaning traders are taking new positions in anticipation of further volatility.

Source: Coinglass

Spikes in open interest often precede significant price movements, as they signal greater participation and influence in the market.

The recent whale deposits on Kraken, along with rising OI, indicated potential near-term price pressure. If the majority of positions are long, a sudden market decline could lead to liquidations, accelerating the decline. Conversely, continued buying pressure could lead to a short squeeze, driving the price of ETH higher.

Measuring Ethereum market sentiment

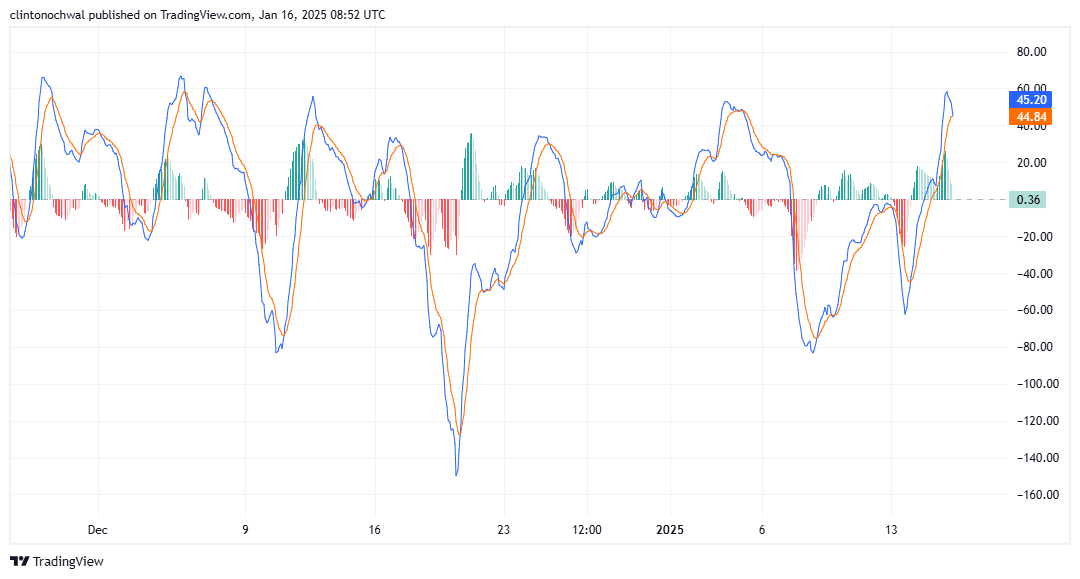

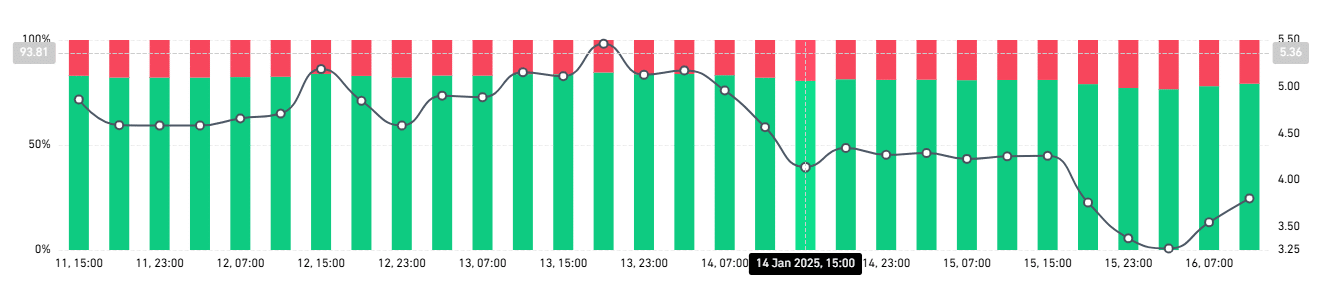

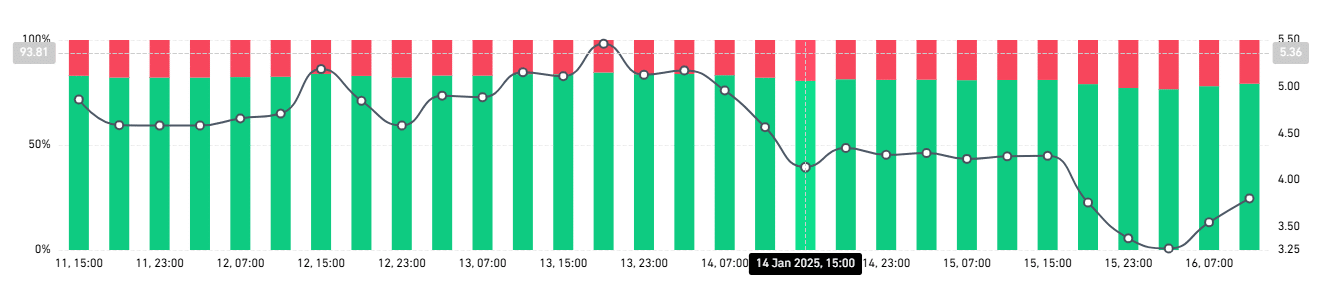

Finally, Ethereum’s MVRV ratio indicated that long-term holders are making significant profits, while short-term holders face tighter margins. This disparity highlighted the bullish sentiment in the market, with long-term holders benefiting from the recent price rise.

Source: Coinglass

When the MVRV ratio for long-term holders peaks, it often signals an impending local price top. Especially because profit taking by these holders can cause selling pressure.

Conversely, a declining MVRV ratio for short-term holders could indicate undervaluation and potential buying opportunities. At the time of writing, Ethereum’s MVRV ratio appeared to be approaching a critical level where long-term holders could start realizing gains, posing a potential near-term correction risk.