- The consolidation of Ethereum around $ 2.6k in February offered some hope for recovery

- On-chain statistics revealed that the sellers of the Altcoin are not yet exhausted

The Bybit -Hack saw $ 1.46 billion in Ethereum [ETH] transferred from a cold wallet. The exchange saw an unprecedented amount of recordings, but it was able to process them smoothly. At the time of writing, ETH had fallen by 2.64% in the last 24 hours.

Source: X

Crypto analyst Rough -free noted a pattern that in one Post on X. The range of Q1 2024 still seemed to be in the game and the recent events caused a deviation from the lows. This is also a place where accumulation took place from July-October 2024, before the fast rally in November.

A comparison with Bitcoin [BTC] Making a cycle of lows on the back of Black Swan events such as Covid or the FTX -Crash was also made. This implied that ETH could also make such lows. However, is this too good to be true?

Statistics showed that Ethereum has room to lower

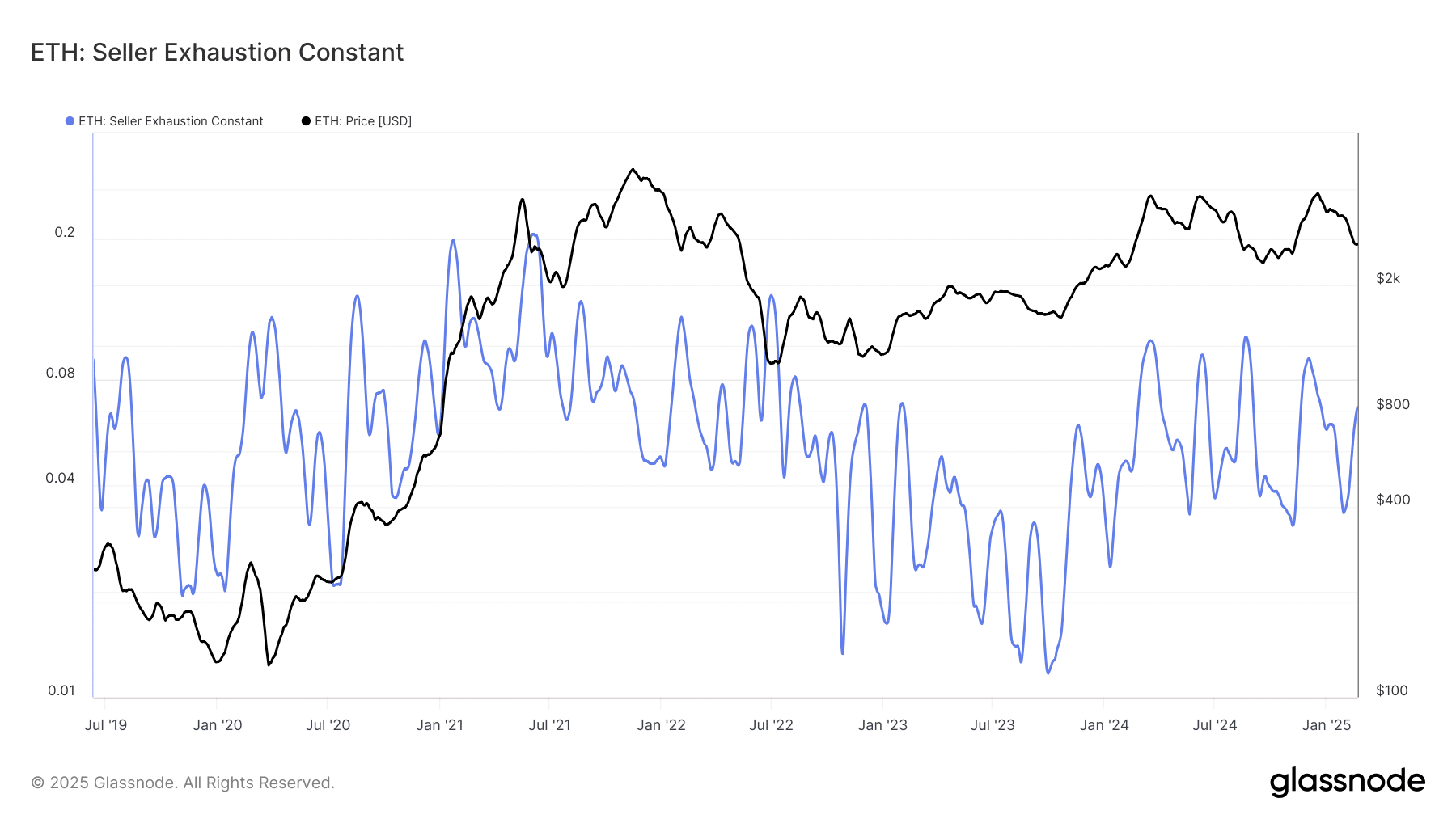

Seller depleting statistics is a product of the percentage of profit authority and the 30-day price volatility. Volatility has been high in recent weeks, while the profit percentage has fallen.

This stated the rise in exhausting statistics. It is used to mark price soils with a low risk when a substantial part of the offer is not in profit and the price is under consolidation. However, the prevailing market conditions do not reflect that, at least not on the higher timetables.

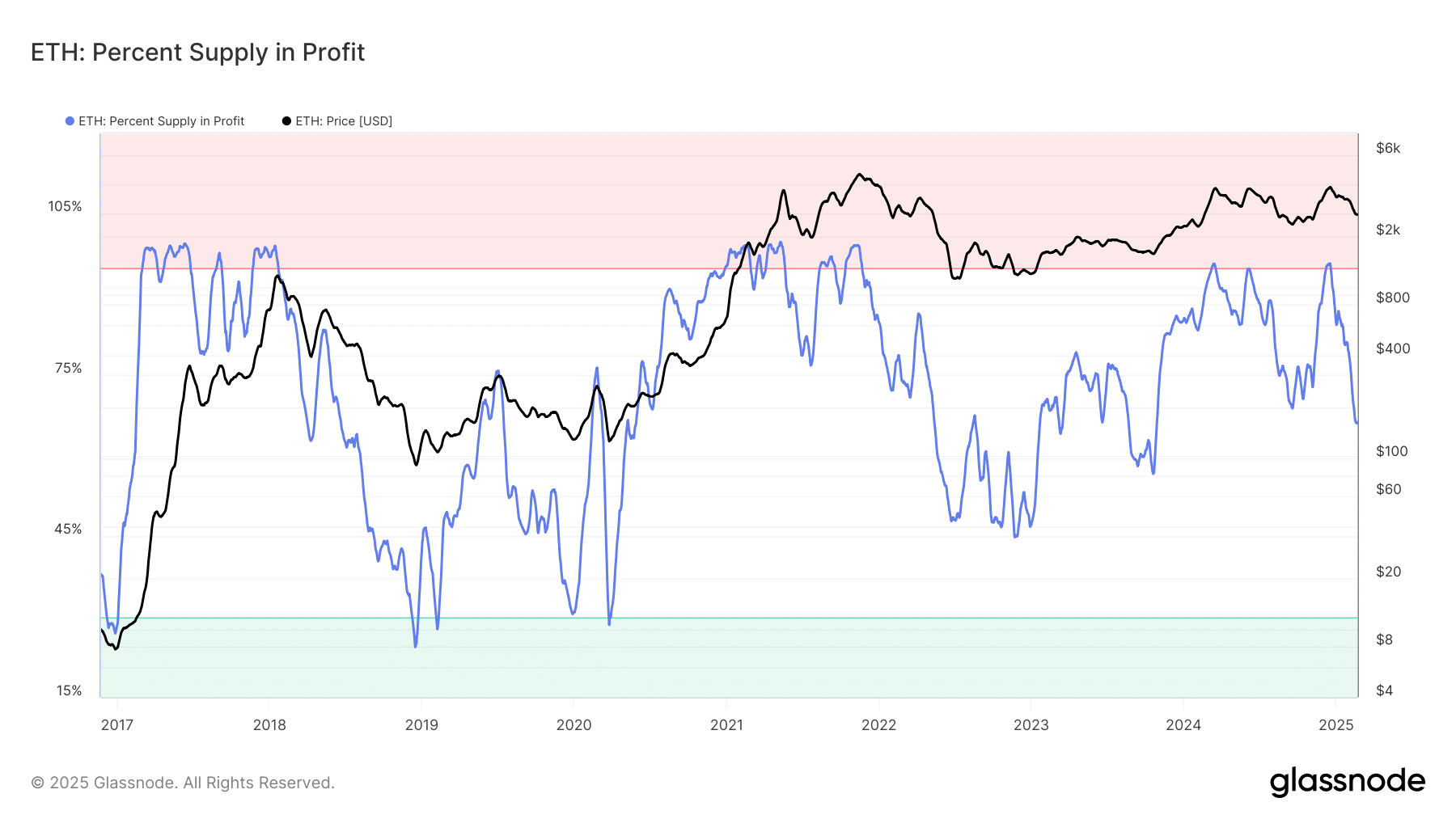

The percentage of profit profit has fallen since the price was confronted with a rejection of $ 4K in December.

At the time of the press, the metric was lower than at any time since October 2023. The weak performance, while Bitcoin was traded near $ 100k, is a source of frustration for holders.

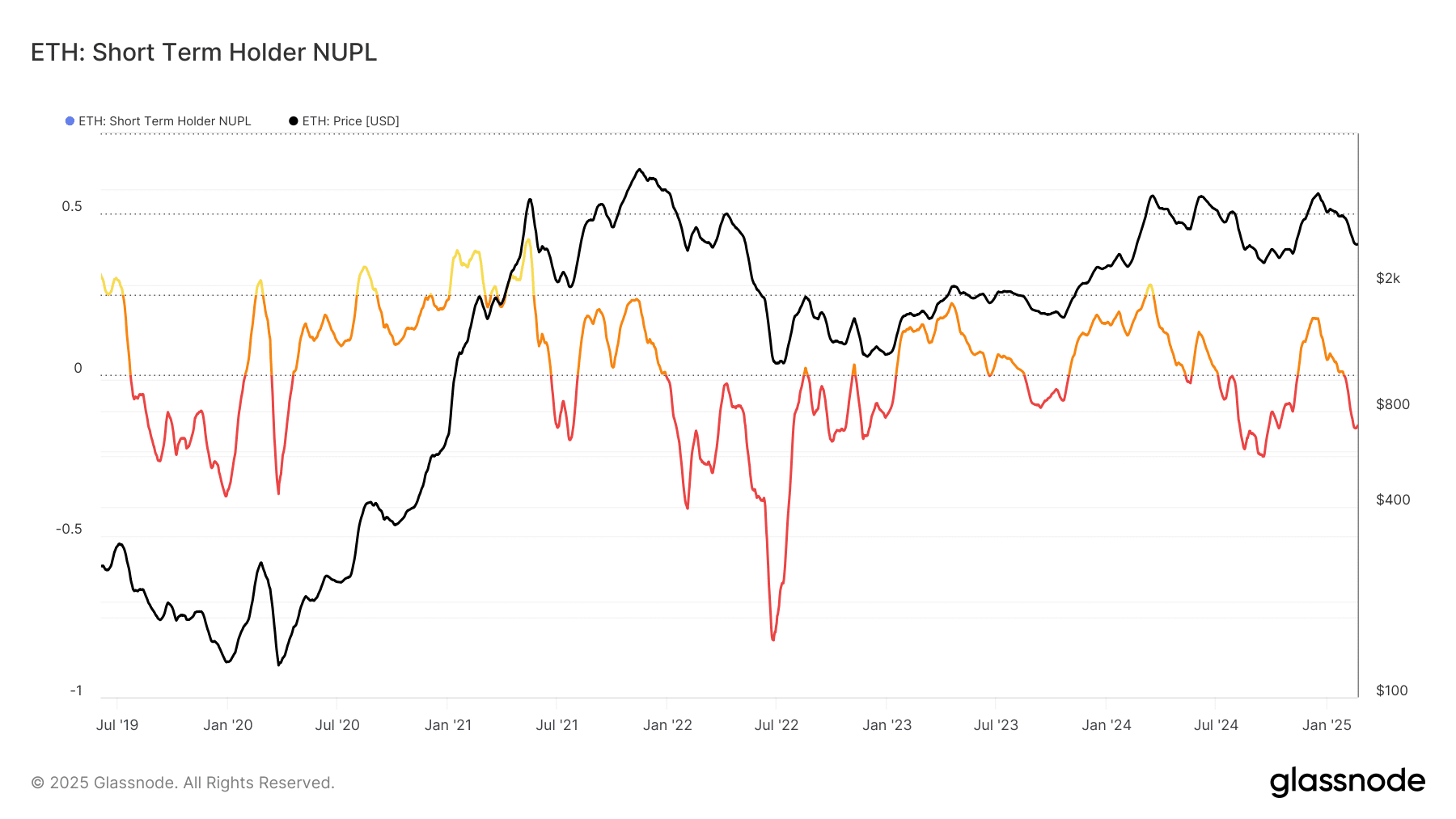

The short-term holder (STH) Net Non-realized profit/loss (NUPL) takes into account transactions younger than 155 days. Values below 0 indicate that STH’s are losses and at the time of the press was the metric at -0.164.

Combined with the previously marked range, it turned out that this could be a good buying for ETH. And yet the NUPL is not automatically the local soils.

In January 2022, for example, the STH NUPL was at -0.018 and fell to -0.4 in February. After a few weeks of price consolidation around the $ 3K level, Ethereum fell in June 2022 to $ 1.1k-Die de Nupl drove deeper.

Although this was an extreme case, it revealed that the statistics should be used contextually. By combining the price promotion with the statistics that has been investigated so far, we can see that there is a chance that the ETH price will fall to $ 2.1k.