Ethereum has taken the brunt of the crypto market’s recent decline, which was fueled by Bitcoin. While the altcoin underwent a successful Shanghai upgrade and showed positive on-chain metrics, it has struggled to maintain momentum and continues to fall below vital support levels. Nevertheless, traders and market experts are optimistic that Ethereum has the potential to initiate a bullish turnaround, offering a glimmer of hope for an upcoming upside.

Ethereum derivatives suggest a slowdown in bearish momentum

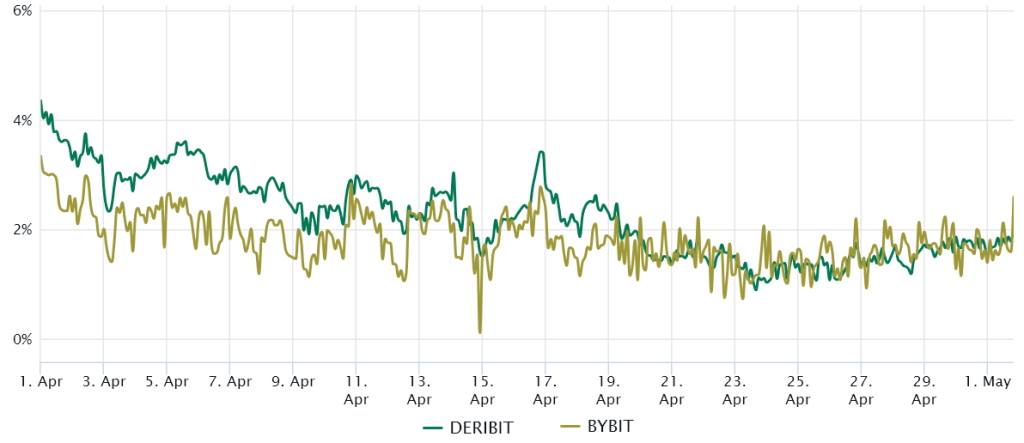

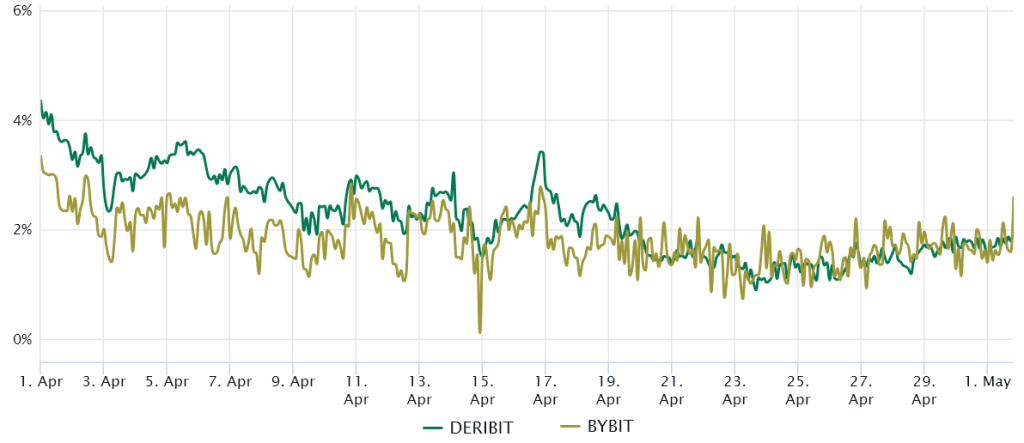

Ether quarterly futures have emerged as a favored instrument among major investors and arbitrage agencies. These forward contracts, which allow for a longer settlement period, often command a modest premium over spot markets due to the higher value sellers place on deferred settlement.

In a well-functioning market, futures contracts can typically be expected to trade at a 5% to 10% annual premium – a phenomenon known as contango. It is important to note that this occurrence is not exclusive to the domain of digital currencies, but is a common feature across markets.

Since April 19, the Ether futures premium has stalled at 2%, showing pros are hesitant to change their stance as ETH hits $1,950 resistance. A lack of demand for leverage longs is no guarantee for price declines, so traders should study Ether options markets to learn how major players predict future price shifts.

Currently, the 25% skew ratio stands at 1, which represents an equal valuation between protective put options and neutral-to-bullish calls. This development serves as a bullish signal, especially given the recent 8% correction in the price of ETH over a six-day period after it failed to break the USD 1,950 resistance.

Crucially, current derivatives stats reveal neither an overwhelming sense of fear nor the presence of excessively leveraged bearish bets, implying that ETH is unlikely to revisit the $1,600 support level in the near future.

What’s next for the Ethereum price?

Ethereum price is stuck between the 20 and 50 days EMA, indicating an intense battle between bulls and bears. At the time of writing, ETH price is trading at $1,861, up more than 1% in the last 24 hours. Currently, ETH price is hovering in a bearish range, with support formed at USD 1,780.

However, bulls quickly gained control near $1,800, pushing the price above the 23.6% Fib level. A break above the immediate resistance level at USD 1,930 will boost upside momentum and Ethereum could float near USD 2K. Since the RSI trendline has risen and is currently trading at the 46 level, it suggests that buyers are trying to increase trading volume and network activity.

On the bearish side, Ethereum could trade near EMA-100 at USD 1,740 if it fails to maintain its current range.