- Ethereum fell 22% despite the approval of Eric Trump and increasing whale activity.

- Buying whales that peaked when large investors positioned themselves against a downward trend.

On February 4, 2025, Eric Trump made waves by endorsing Ethereum’s [ETH] On his X (formerly Twitter) account, he insists on followers to buy Ethereum.

Since then, however, the price of Ethereum has fallen enormously, by 22%. Despite this decline, an increase in whale activity has been registered, in which 110,000 ETH is collected in just 72 hours.

In the midst of mixed signals, people are wondering: Positioning large investors themselves for a rebound, or is the market still in a downward route?

Eric Trump’s approval and subsequent decline

Source: X

The first reaction to Trump’s approval was followed by a short price increase, but the rally was full of fast. Since then the price of Ethereum has been has fallen 22%Which leads to questions about the lasting impact of his approval.

Source: X

Various factors have contributed to the price fall. A significant hack of $ 1.5 billion from the BYBIT exchange on 25 February undermined the trust of investors, causing a wider market sales.

Moreover, the fading of euphoria after the election of President Donald Trump, in combination with unfulfilled expectations for a pro-Crypto Regulatory Framework, has the market feeling.

Worldwide economic uncertainties have also put pressure on Ethereum’s price.

Whale accumulation: a voice of trust or a tactical game?

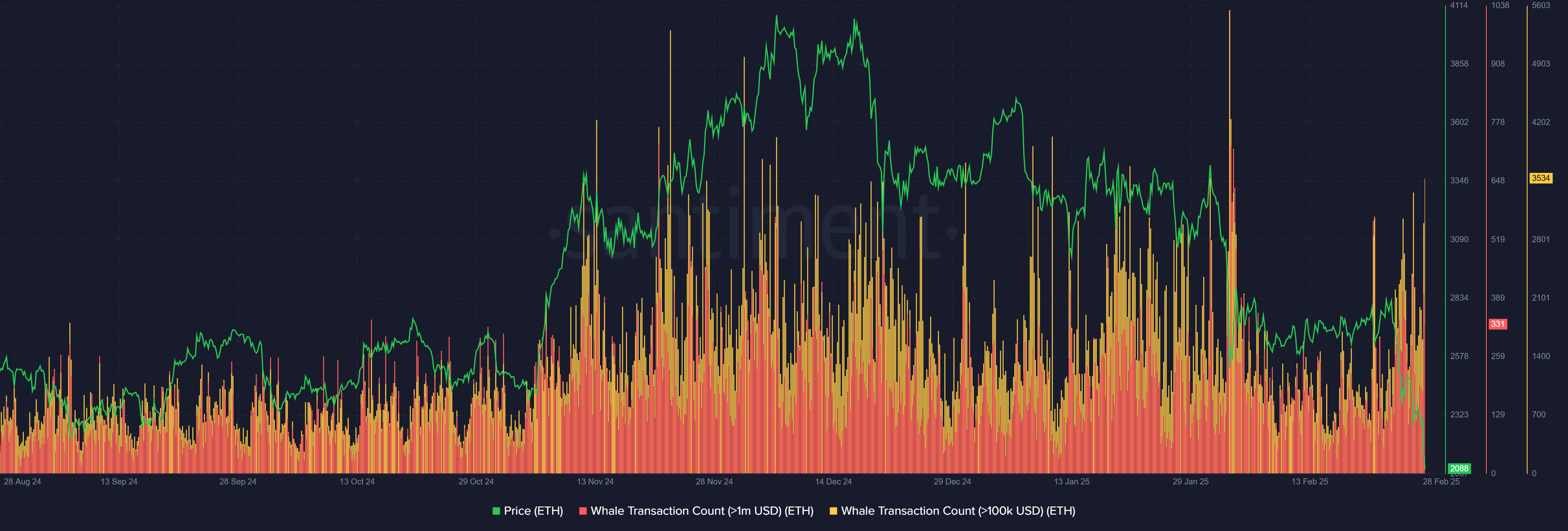

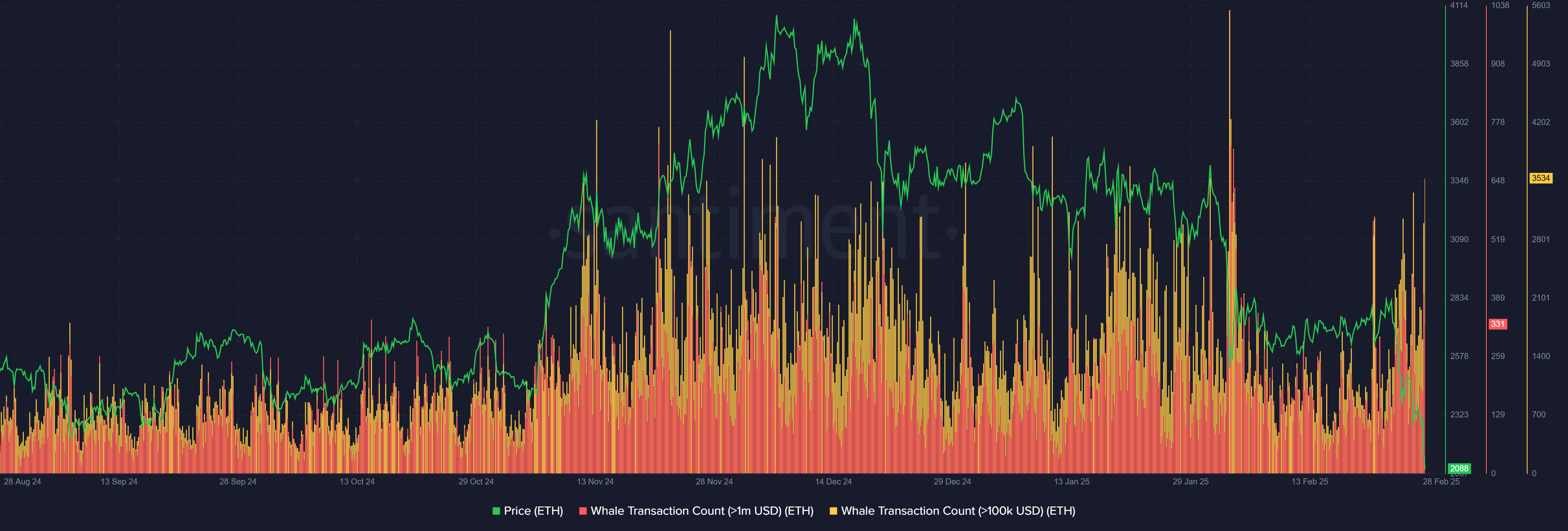

Despite the fall in Ethereum’s 22%, whale activity has risen, with 110,000 ETH collected in just 72 hours. Santiment data emphasizes a strong increase in whale chanties.

This suggests that large investors may position themselves for a rebound or capitalize at reduced prices.

Source: Santiment

Historically, comparable accumulative phases are followed by strong recovery, but not always.

For example, serious whale activity at the end of December 2024 coincided with the peak of ETH, and in mid -January a similar accumulation, which was aligned with a short leap.

If ETH possesses the range of $ 2,100 – $ 2,135, this can strengthen the bullish sentiment. However, a continuing break below this level can suggest that whales secure liquidity before a deeper correction.

Ethereum: Whale confidence versus Bearish Momentum

Ethereum’s RSI transferred at 38.90 and an in -depth MacD Bearish -Crossover indicate a long -term downward trend. The 50-day SMA at $ 2,929 remains considerably above the current price of $ 2,109, which reinforces Bearish.

If whales buy to run a recovery, recovering the $ 2,200-$ 2,300 reach could validate a short-term bounce.

Source: TradingView

Retail investors must remain careful. If ETH does not hold important support, the next large demand zone is around $ 1,900 – $ 2,000.

Buying whales is not always a definitive bullish signal, especially in a market -wide decline. Retail investors must be careful for confirming a trend remark before the whale feeling follows.