- Ethereum may experience increased liquidity as the election cycle comes to a close.

- However, several factors cast doubt on its recovery potential.

With just a week until the election, the crypto market is primed for increased liquidity – a potential catalyst for Ethereum [ETH] to break free from his downward slump. Since ETH is on a favorable greed index, this could be a promising buying opportunity.

However, uncertainty clouds its recovery. If the previous pattern repeats, Solana could once again benefit from Bitcoin’s market spikes, as happened recently with four days of strong daily gains even as BTC pulled back, potentially limiting ETH’s recovery prospects.

As a result, this weekend could be crucial and pave the way for ETH to push for the $3,000 mark, provided market conditions are favorable.

Ethereum’s core metrics are under pressure

This cycle has been particularly challenging for Ethereum. Despite a 40% increase in the number of daily active addresses across the country main net and Layer 2 networks, ETH price has not kept pace, faltering nearly 7% after closing at $2.7K just a week ago.

To compound these problems, Ethereum’s network reimbursements have reached their lowest level and have fallen behind competitors like Solana. This creates an additional challenge for Ethereum; with such low costs, concerns about network security may arise.

Overall, a confluence of factors has prevented ETH from benefiting from Bitcoin’s spikes. Investors are becoming increasingly uncertain about the future of Ethereum, which is why they see greater potential in other blockchains.

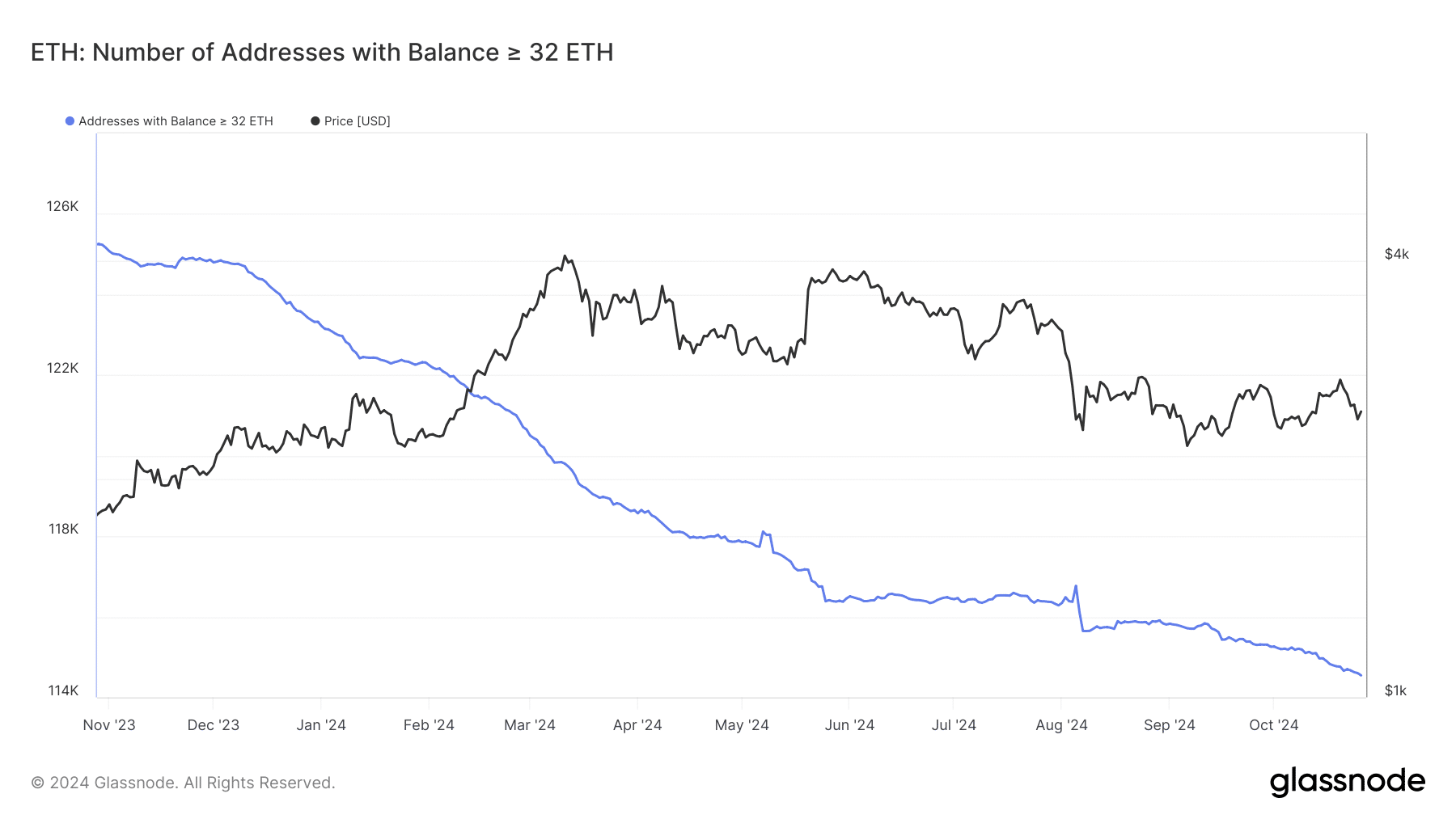

Source: Glassnode

Source: Glassnode

Compounding these challenges, the number of validators on the Ethereum network has dropped significantly, with staked wallets at their lowest level in a year. The proof-of-stake (PoS) consensus mechanism requires a minimum of 32 ETH to stake, and this decrease in validators raises concerns about the overall health of the network.

Delays in transaction validation can lead to network congestion, driving users away. This cycle has seen a notable migration from ETH to SOL, with Solana’s high throughput enabling higher transaction speeds and lower fees.

This trend underlines Ethereum’s struggle to maintain its user base.

Electoral liquidity will not be enough

If the network does not address these challenges, the election buzz may only yield short-term gains for ETH, lacking the strength needed for a real breakout.

Ethereum needs to revive its market dominance, which severely declined in the previous market cycle and currently stands at just 13% – the lowest level against Bitcoin since April 2021.

While high Bitcoin dominance typically signals the start of an altcoin season, ETH may struggle to regain its leading position in the market if this trend does not reverse.

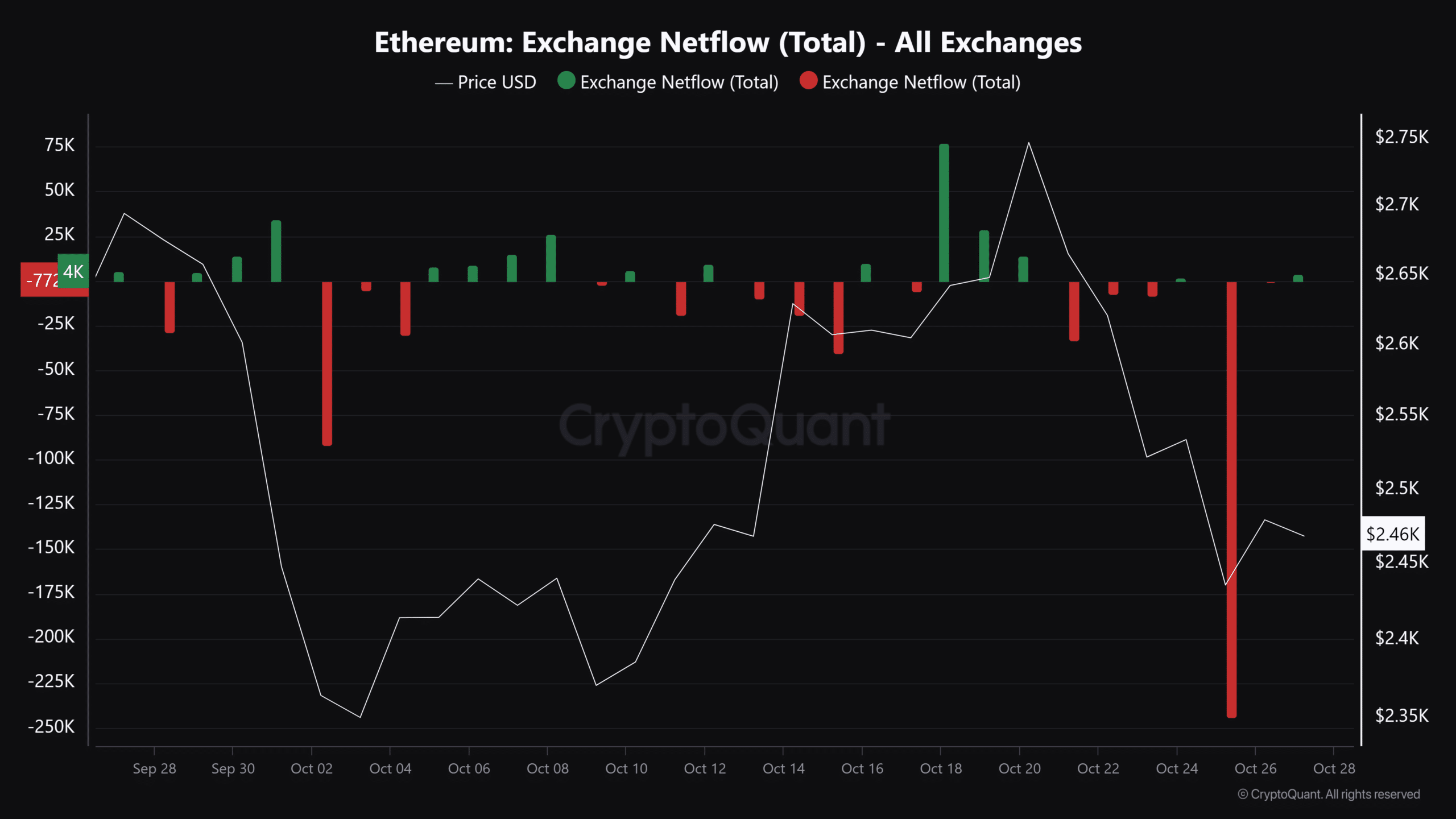

Source: CryptoQuant

Interestingly enough, a spike in ETH outflows occurred just two days ago, with 244,000 ETH being withdrawn from the exchanges. This suggests that investors are viewing the current price as a dip, which could potentially help the bulls hold the $2.4K support line.

However, there was no impact on the price.

Read Ethereum’s [ETH] Price forecast 2024–2025

That said, as the elections near their end, there is a significant chance that ETH will make gains in the near term. This could help reverse the current trend and help bulls control bearish pressure.

However, Ethereum’s prospects for emerging from the crisis remain limited unless it manages to maintain network health. If these issues are not addressed, there is a significant risk that the current underperformance could become a lasting trend, putting ETH’s market position at risk.