- Michigan Pension Fund Unveils Substantial Ethereum ETF Investments.

- ETH continues to struggle under a bearish stronghold.

In a groundbreaking move, Michigan has become the first U.S. state pension fund to invest in a U.S. state pension fund Ethereum [ETH] ETF.

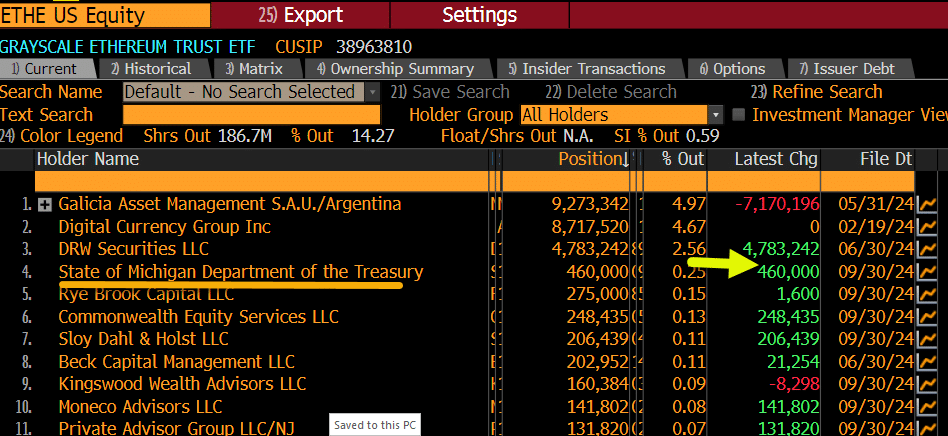

Matthew Sigel, head of digital assets research at VanEck taken against X and shared that the state of Michigan is now among the top five holders of both Grayscale Ethereum Trust Fund ($ETHE) and Grayscale’s Ethereum Mini Trust ($ETH).

Source: Matthew Sigel/X

ETH holdings of Michigan pension fund

According to a recent 13F application Together with the SEC, the Michigan pension fund disclosed that it owned approximately 460,000 shares of the Grayscale Ethereum Trust, worth approximately $10.07 million. Additionally, the fund owned 460,000 shares in the Grayscale Ethereum Mini Trust, worth approximately $1.12 million.

In addition to Ethereum, Michigan has also invested in Bitcoin [BTC]. The fund owns 110,000 shares of the ARK 21Shares Bitcoin ETF, worth approximately $7 million.This strategic investment underscores Michigan’s commitment to diversifying its portfolio with digital assets.

The current landscape of Ethereum ETFs

Specifically ETH ETFs performance was quite disappointing compared to BTC ETFs. In fact: the newest facts from Lookonchain revealed significant net outflows from Ethereum ETFs on November 4, with a reduction of 14,206 ETH worth more than $34 million.

Specifically, Grayscale’s ETHE fund recorded an outflow of 14,673 ETH, amounting to more than $35 million. Nevertheless, at the time of writing, the fund still held a significant 1,576,248 ETH, worth approximately $3.84 billion.

Furthermore, insights from Fraside Investors indicated total cumulative net outflows of more than $500 million, indicating broader caution around Ethereum ETFs despite significant buying by entities like Michigan.

Michigan’s latest move did not go unnoticed by industry experts and executives who shared their insights. Eric Balchunas, Bloomberg senior ETF analyst, marked Michigan’s substantial investment in Ether ETFs compared to Bitcoin ETFs, noting:

“This despite the fact that BTC is a ton and ether is in the gutter. A pretty big win for ether, which could use one.”

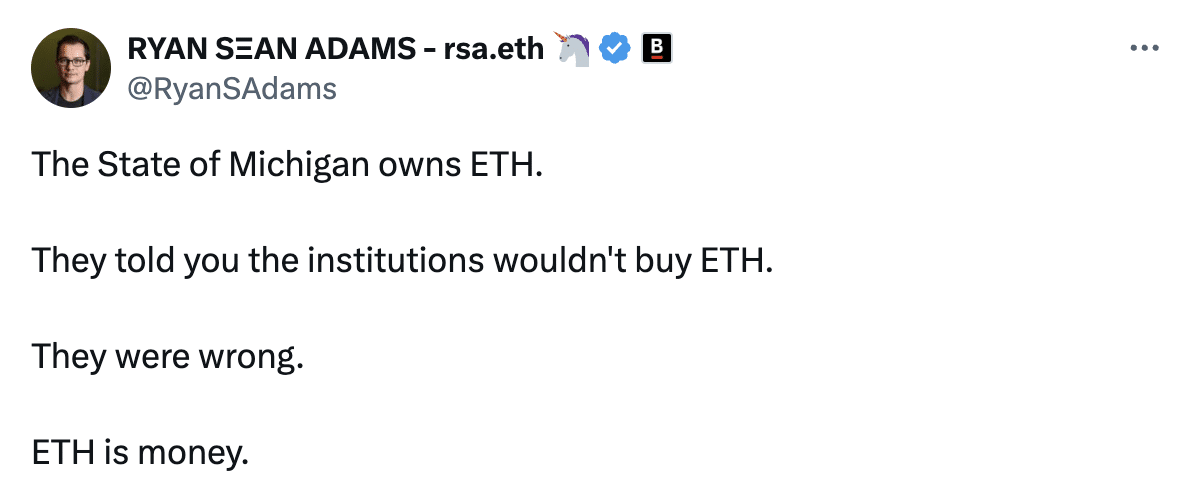

Ryan Sean Adams, co-founder of Bankless and an outspoken ETH supporter, also noted the development and declared:

Source: Ryan Sean Adams/X

His comments highlighted Ethereum’s growing acceptance among institutional investors, challenging skepticism.

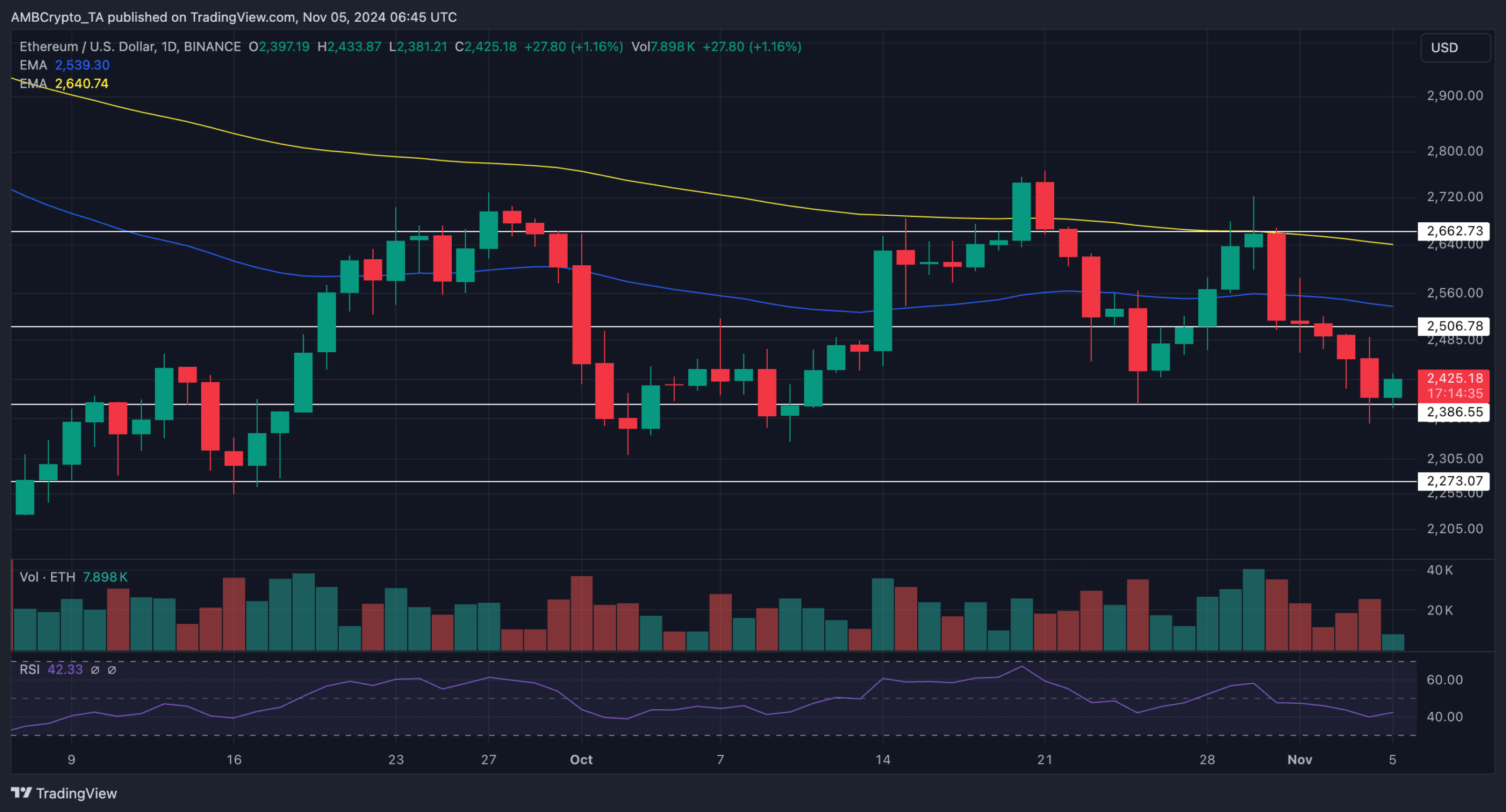

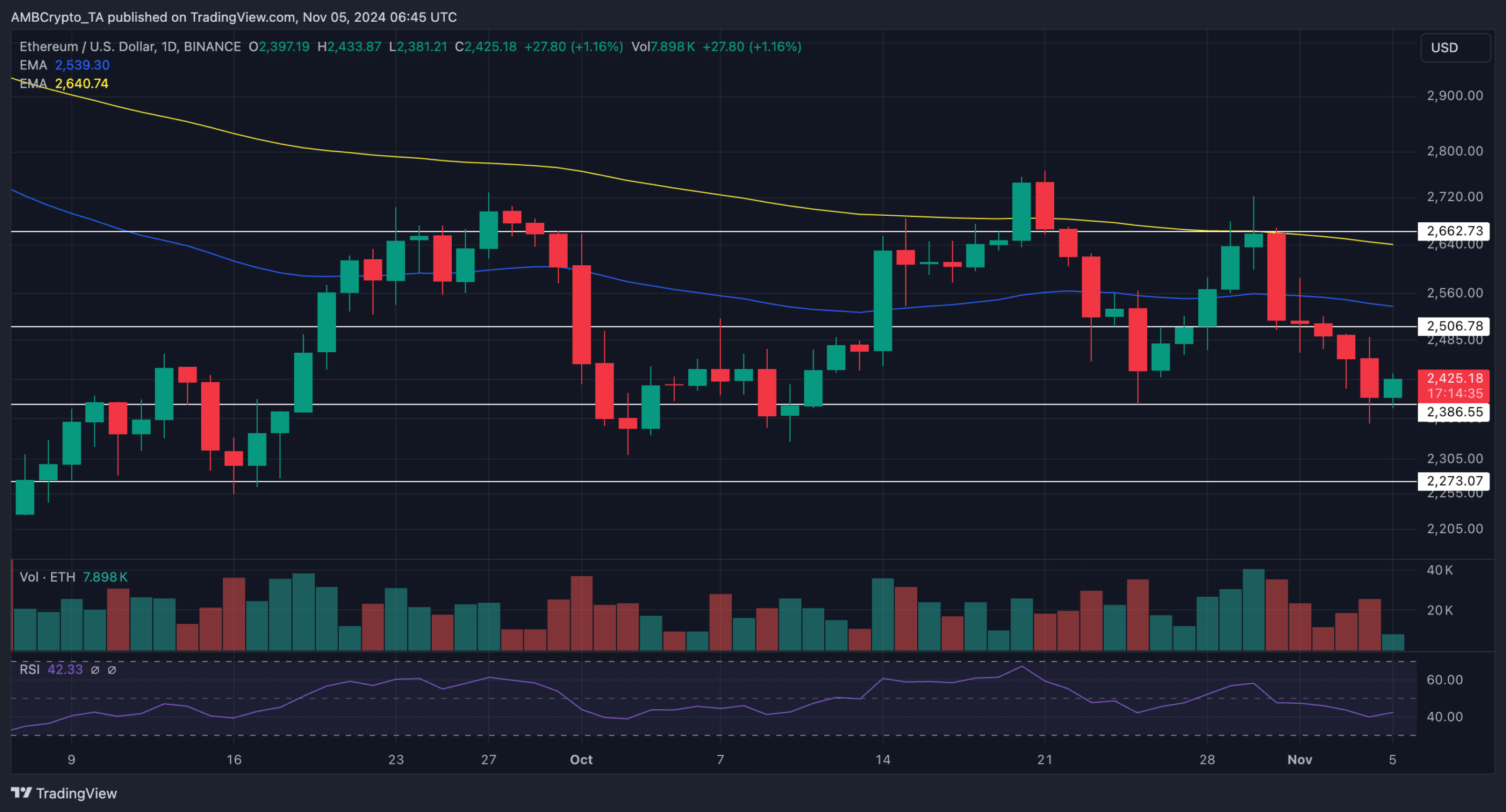

The price performance of ETH

Meanwhile, ETH’s price performance hasn’t exactly been great lately. On the daily chart, the price took a sharp decline after a rejection at the $2,662 resistance level and stabilized at the $2,386 support.

At the time of writing, the altcoin was trading at $2,425, reflecting a drop of over 7% in the past week. Even the annual appreciation was modest: ETH rose about 30%.

Technical indicators confirmed the bearish sentiment, with the RSI at 42.33. The dominance of the 100-day EMA (yellow) over the 50-day EMA (blue) and price reinforced the broader downtrend.

Source: TradingView

For Ethereum bulls, a reversal of the resistance at $2,662 is needed to counter the bearish stronghold. Nevertheless, if the decline continues, a decline to $2,273 would not be surprising.

Read Ethereum’s [ETH] Price forecast 2024–2025

As sovereign wealth funds and other major investors continue to explore the possibilities of cryptocurrency, the landscape for Ethereum ETFs may evolve, potentially leading to greater adoption and stability in the sector.