- Ethereum ETFs saw inflows of $84.6 million, but still lag far behind Bitcoin ETF inflows.

- Despite price declines, Ethereum remained above its 50-day moving average, indicating near-term bullish momentum.

The Ethereum [ETH] According to recent data, ETFs have experienced the largest inflows in more than a month.

Despite this, ETH ETF inflows still lag significantly behind Bitcoin[BTC]reflecting a stronger preference for Bitcoin ETFs.

First weekly influx since August

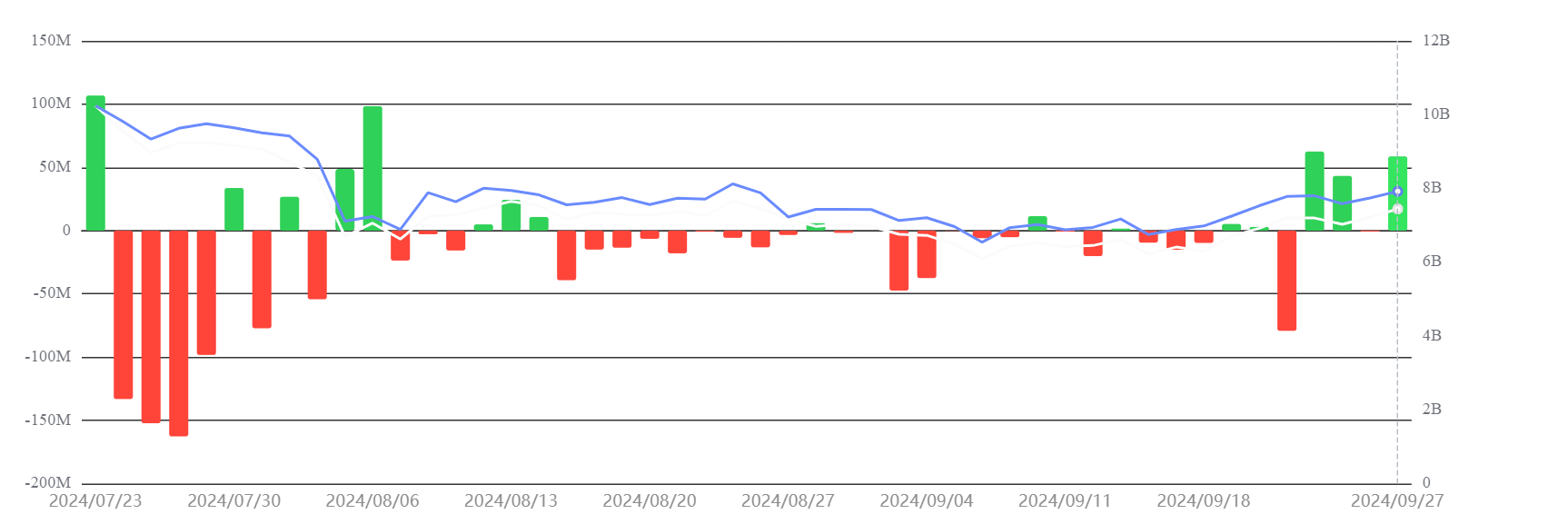

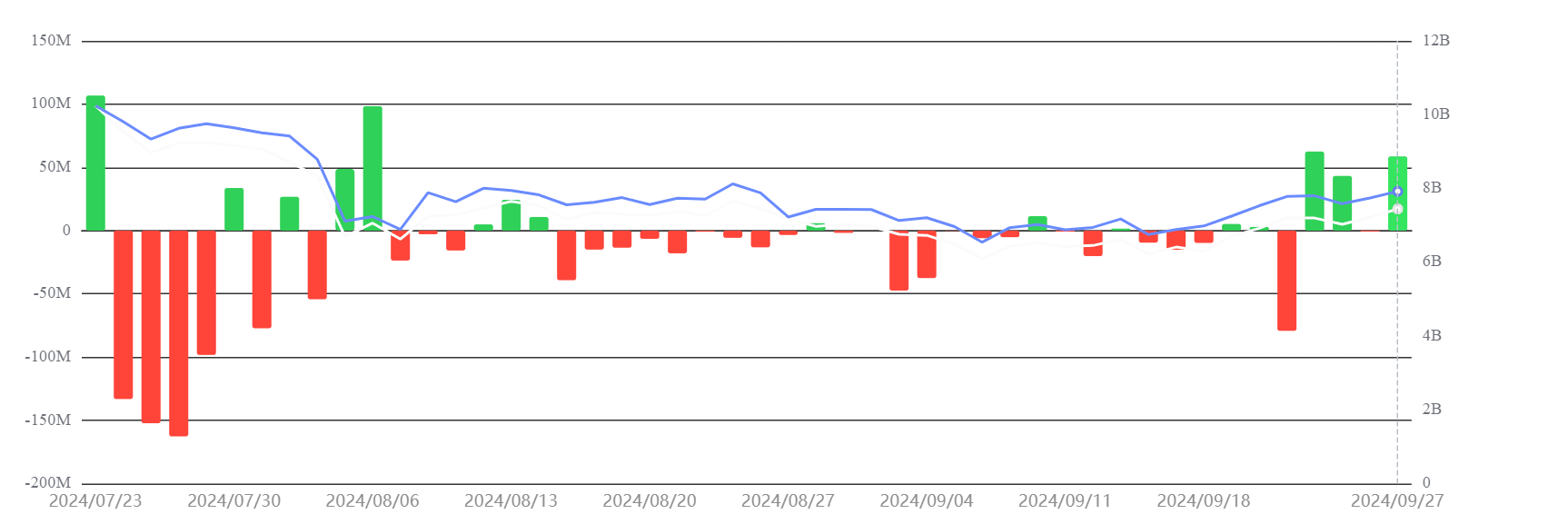

Data from SosoValue shows that Ethereum ETFs saw inflows of over $84.6 million last week, with positive inflows recorded on three out of five trading days.

This is the highest weekly inflow since August 9. However, despite this growth, Ethereum ETF volumes remain well below Bitcoin ETF performance.

Source: SosoValue

In comparison, Bitcoin ETFs recorded inflows of a whopping $1.11 billion in the same week, with inflows occurring every day.

This was the largest weekly Bitcoin inflow since July 19.

Ethereum ETF still lags behind Bitcoin

The Ethereum ETFs began trading in the US on July 23, about six months after Bitcoin ETFs.

In the five weeks following the launch of Ethereum ETFs, the funds saw net outflows of approximately $500 million, while Bitcoin ETFs recorded net inflows of more than $5 billion.

Bitcoin’s first mover advantage is one of the reasons for this disparity.

The excitement surrounding Bitcoin’s ETF launch has generated significant inflows, while ETH’s ETF launch, while promising, has generated less buzz over time.

Additionally, the value difference between the two assets comes into play: Bitcoin owns more than 50% of the crypto market cap, while Ethereum holds about 14%.

The ETH price drops as September ends

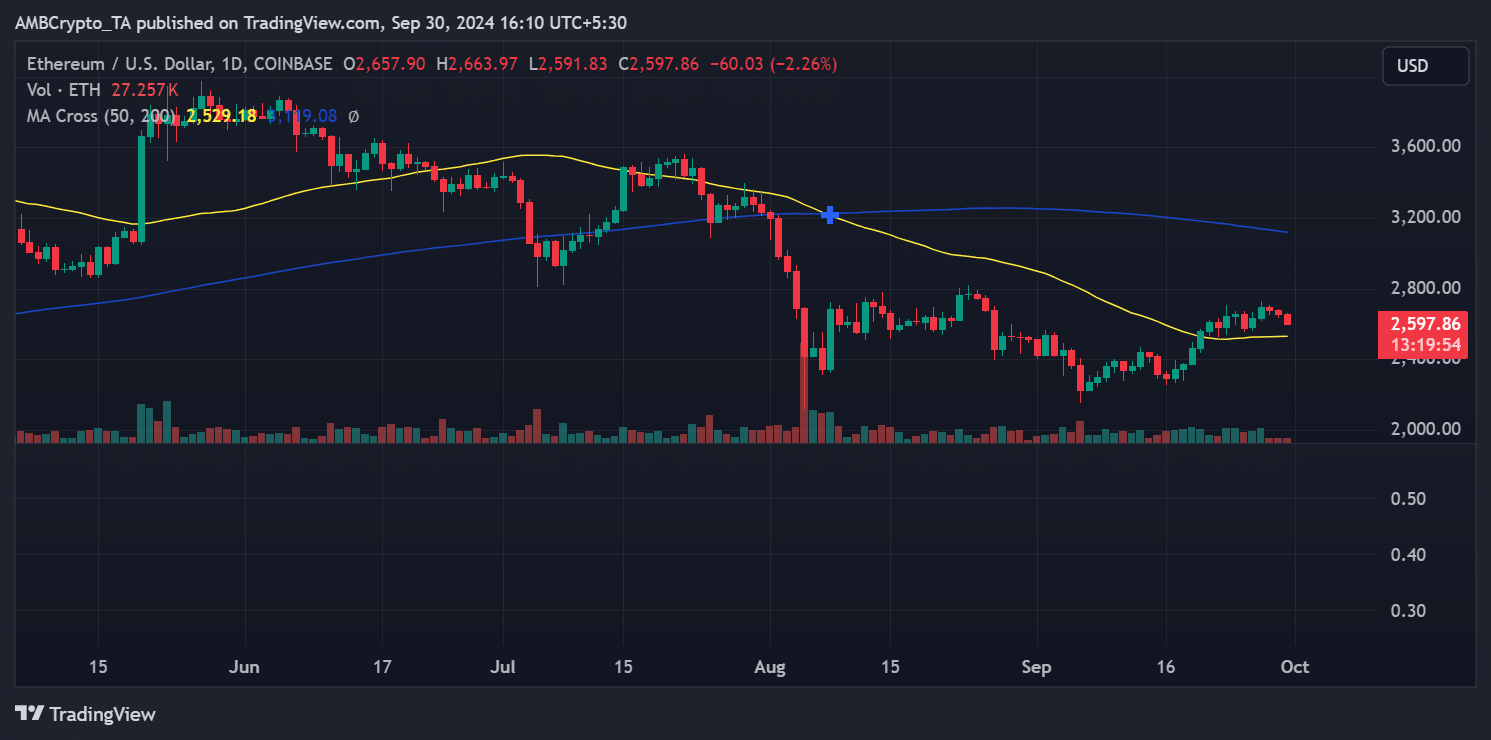

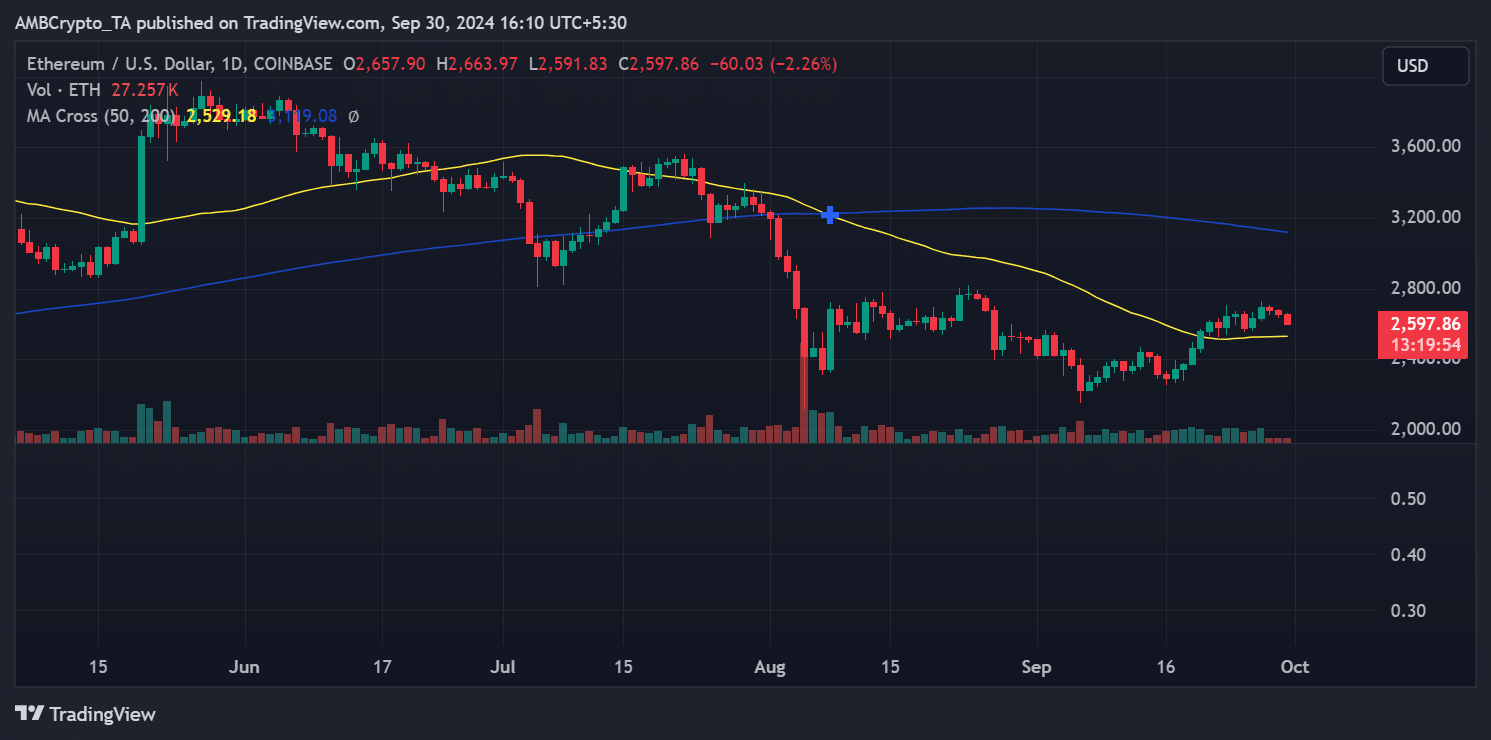

In recent days, the price of Ethereum has fallen below the $2,600 level.

At the time of writing, Ethereum was trading around $2,597, down more than 2%. Despite the decline, ETH remains above its 50-day moving average, indicating a near-term bullish trend.

Source: TradingView

The Relative Strength Index (RSI) stood at around 53, reinforcing the bullish outlook of the moving average.

Realistic or not, here is the ETH market cap in terms of BTC

While the Ethereum ETF has seen notable inflows after a slow period, it continues to lag far behind Bitcoin ETFs in terms of volume and investor interest.

Factors such as Bitcoin’s first mover advantage and market dominance play a key role in this trend. Despite the recent price declines, Ethereum remains in a bullish position and remains above key technical indicators.