The price of Ethereum (ETH) rose sharply today a new 2023 high of $2,250 as the cryptocurrency market continued to rise towards a successful year-end.

The recent one strong upward trend in Ethereum ties in with Bitcoin’s continued attempt to break above $41,000, which it did today. At the time of writing, the price of bitcoin was $41,437.

Analysts say the approval of a BlackRock spot ether instrument would result in an influx of institutional capital into Ethereum, the world’s second-largest cryptocurrency network.

The price increase of Ethereum

The latest charts show an upward trajectory that has many analysts and investors optimistic about the cryptocurrency reaching the coveted $3,000 mark in the coming weeks or months.

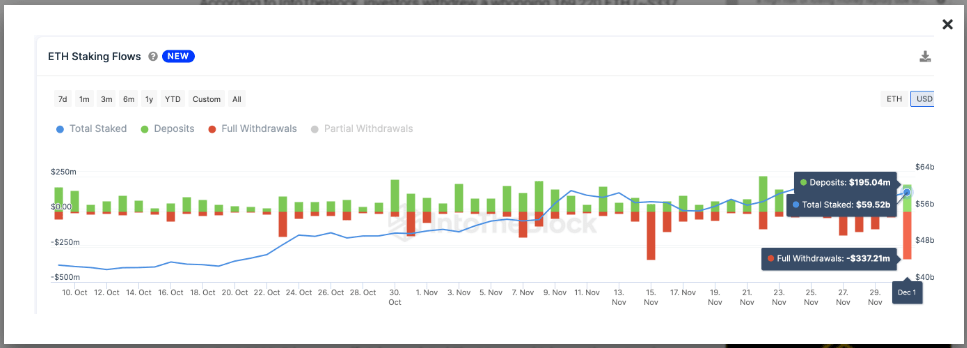

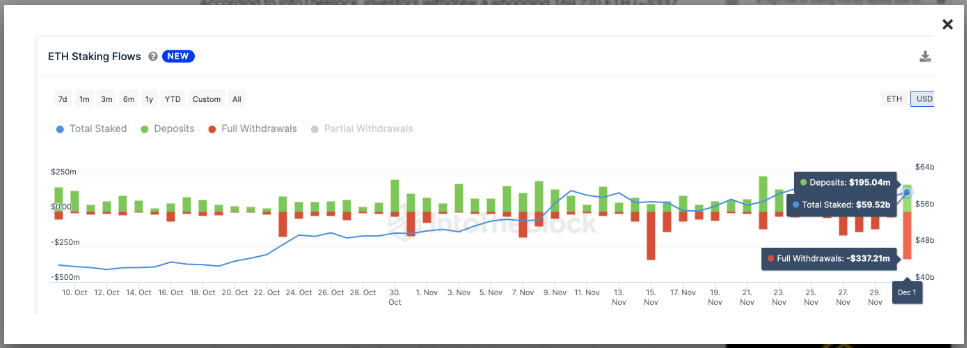

While this was happening, a crucial on-chain trading statistic shows that just 24 hours before the most recent price breakout, Ethereum 2.0 stakers made an unexpected move of $330 million.

ETH Staking Flows. Source: IntoTheBlock

According to IntoTheBlock, on December 2, investors pulled out a whopping 169,220 ETH (approximately $337 million) from ETH 2.0 beacon chain Proof of Stake contracts.

Interestingly, since the Ethereum Shapella Upgrade enabled withdrawals in April 2023, this is the second highest withdrawal amount.

Resilient rebound and bullish market signals

Now that Bitcoin’s price has crossed the coveted $41,000 mark, the cryptocurrency market is starting to feel more bullish again.

ETH’s price recovered from the psychologically critical threshold of $2,000 in response to this positive change, showing a weekly increase of 8% from the current trading price of $2,250.

Ethereum currently trading at $2,244.7 territory on the daily chart: TradingView.com

The classic sign of a bull market is a sequence of higher lows and higher highs, which is what we observe when we look at Ethereum’s daily chart. The 50 and 100 day moving averages served as dynamic resistance, but price has now overcome both.

“Based on the lower yields, cryptocurrency has risen pleasantly, together with gold,” said crypto data company Amberdata in a newsletter on Sunday.

In a note, Lucy Hu, Senior Analyst at Metalpha, stated that market expectations for a rate cut in the coming year are increasing.

Optimism among investors about the potential for Bitcoin ETF applications from major asset managers is also growing.

She claims:

“This is an official declaration of a bull run and there could be more price increases in the coming weeks.”

Meanwhile, laws in the future could also have an impact on Ethereum’s price; While favorable developments can encourage investment, stricter laws can entail risks. Investor sentiment and the state of the economy are also important factors.

It is unclear whether ETH will overtake Bitcoin in terms of market valuation; this will depend on things like adoption rates and network improvements. Currently, Bitcoin is leading the way with a much larger market capitalization.

(The content of this site should not be construed as investment advice. Investing involves risks. When you invest, your capital is subject to risk).

Featured image from Shutterstock