- ETH has fallen by 46% in the past year.

- Ethereum could fall until October 2023 levels of approximately $ 1657 while Bearish keeps sentiments.

In the past month, Ethereum [ETH] has experienced a strong down momentum. ETH even falls by 46.06% on annual graphs.

While other crypto assets such as Bitcoin are over in the past year, ETH does not show any signs of recovery. On the contrary, ETH could decrease further.

Source: TradingView

As such, the Altcoin is broken down in a symmetrical triangle. After the breakdown and a retest, ETH now looks bearish.

This suggests that ETH is in a position for further losses on its price diagrams. A malfunction here suggests that the downward momentum is strong and could even continue.

Source: TradingView

The recent decline is to endanger the market position of Ethereum, with ongoing downward movement that the Altcoin may be weakened against its rivals.

ETH -Dominance forms a falling triangle, a bearish pattern that is usually observed in technical analysis. Although the downward pressure persists, there is potential for ETH -Dominance to take a corrective step to the advantage.

This trend is further supported by a decrease in the dominance of the circulating market of Ethereum, which has fallen from 17.32% to 7.39%. Such an important decline emphasizes ETH underperformance compared to its competitors.

Source: Messari

Therefore, with the cryptomarkt with the exception of Bitcoin, this suggests a strong bearish Momentum at Altcoins. With altcoins that are confronted with strengthening support, we could see ETH more losses and fall further.

What suggests ETH’s data on the chains

According to the analysis of Ambcrypto, Ethereum sees strong bearish sentiments on the charts.

Source: Messari

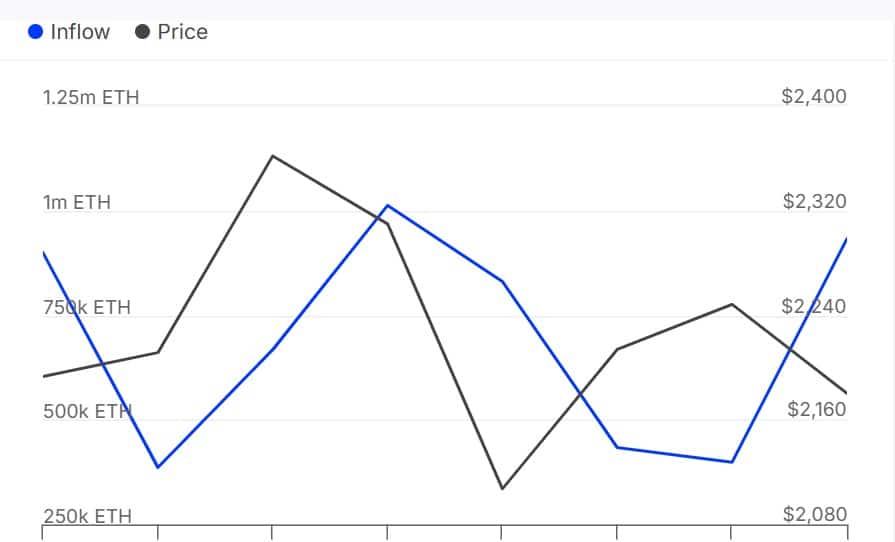

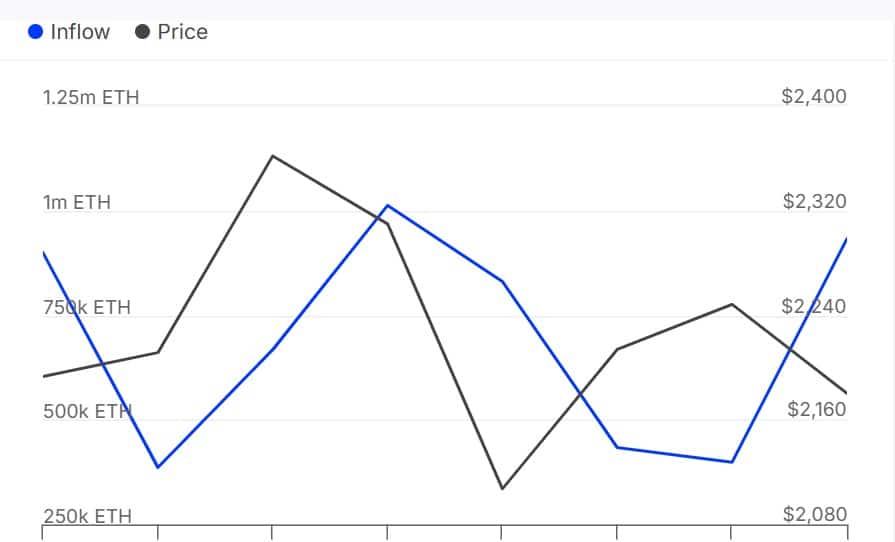

To start with, the futures of Ethereum Buy Volume has fallen to a lowest point in two weeks of 6.17 billion. This is a decrease of 16.25 billion, suggesting that the Altcoin sees fewer buyers on the market.

As such, investors do not buy the crypto, which reflects a strong lack of trust in market conditions.

Source: Intotheblock

This low purchase activity is even more common in the major holders of Ethereum. According to data from Intotheblock, Eth -Walvissen do not buy but they sell.

In fact, the Netflow of large holders in a negative area has fallen and -1.65k. Such a dip suggests that there is more cash outflow of whales in ETH than the inflow.

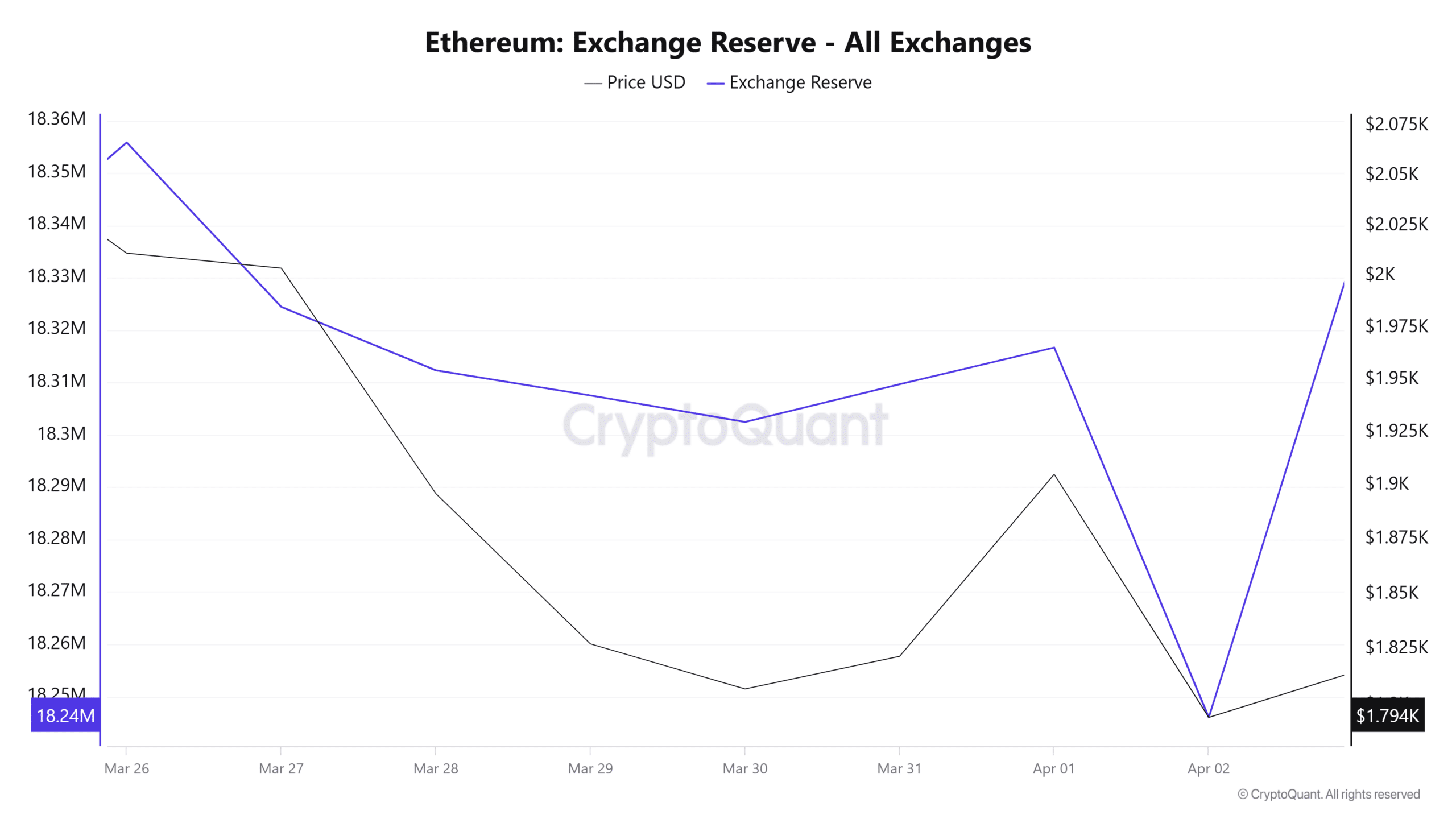

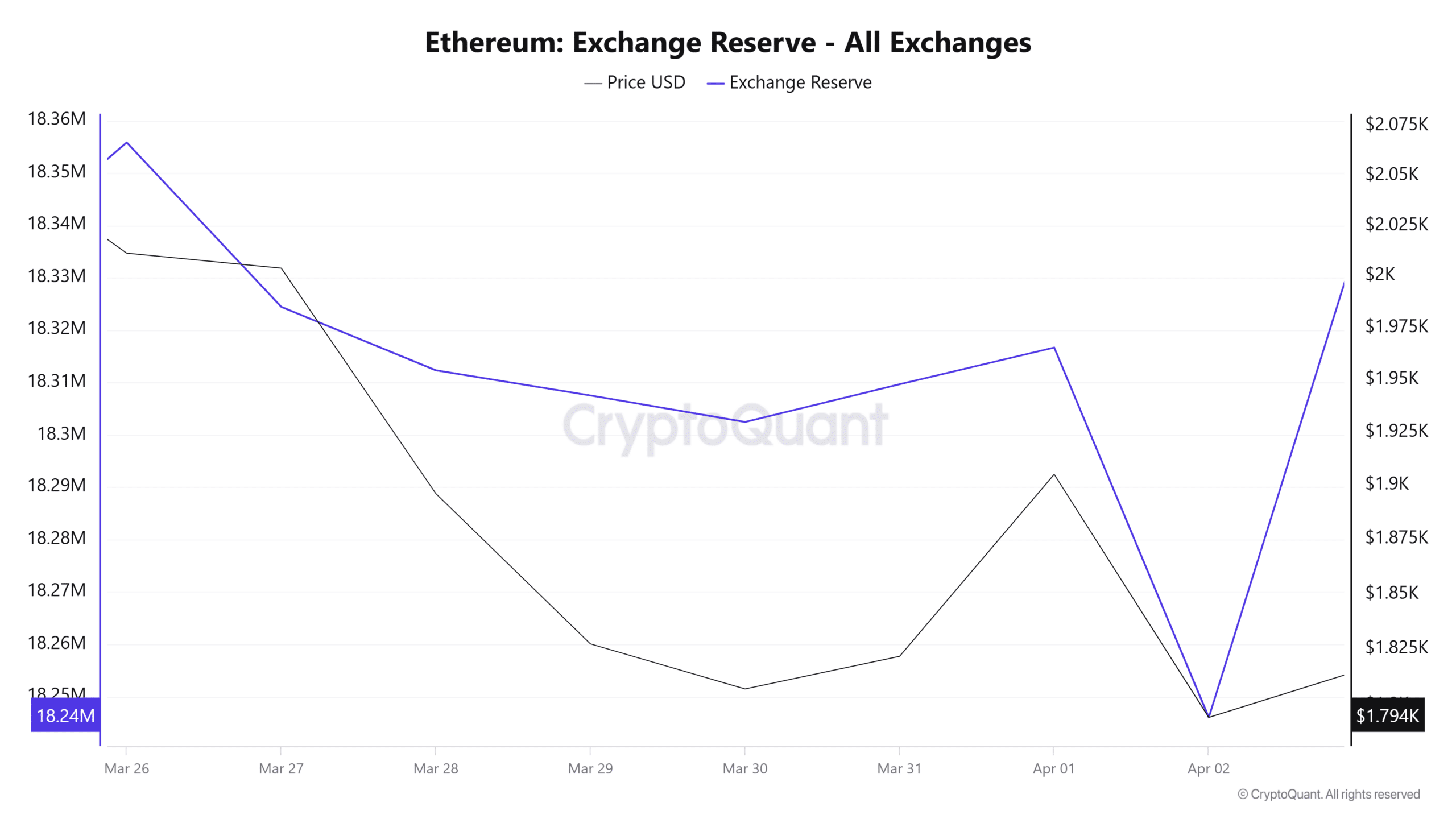

Source: Cryptuquant

The exchange reserve of Ethereum is increasing and reaches 18.4 million – an increase of 200 million ETH tokens in the past day.

This increase in reserves indicates that more ETH tokens are deposited in stock exchanges. It suggests that investors sell their participations to reduce further losses, which reflects a growing bearish sentiment for ETH.

Has Ethereum been set to more losses?

Because the investors of Ethereum are bearish with an increased sales activity and a reduced demand, the Altcoin could see more losses on its price charts.

Source: TradingView

ETH experiences growing downward impulse, as emphasized by the recent Bearish crossover on his stochastic RSI.

The constant decline in the stochastic indicator suggests that further losses can be on the horizon, especially with the RVGI that indicates a bearish trend.

Current market conditions position Ethereum for a potential further disadvantage. With its price that falls to $ 1,788, an infringement at the support level of $ 1,757 ETH could push to October 2023 levels around $ 1,657.

For a bullish reversal, ETH would require a daily close to $ 1,800.