- ETH network costs have fallen to a low-five-year low, which indicates reduced network activity.

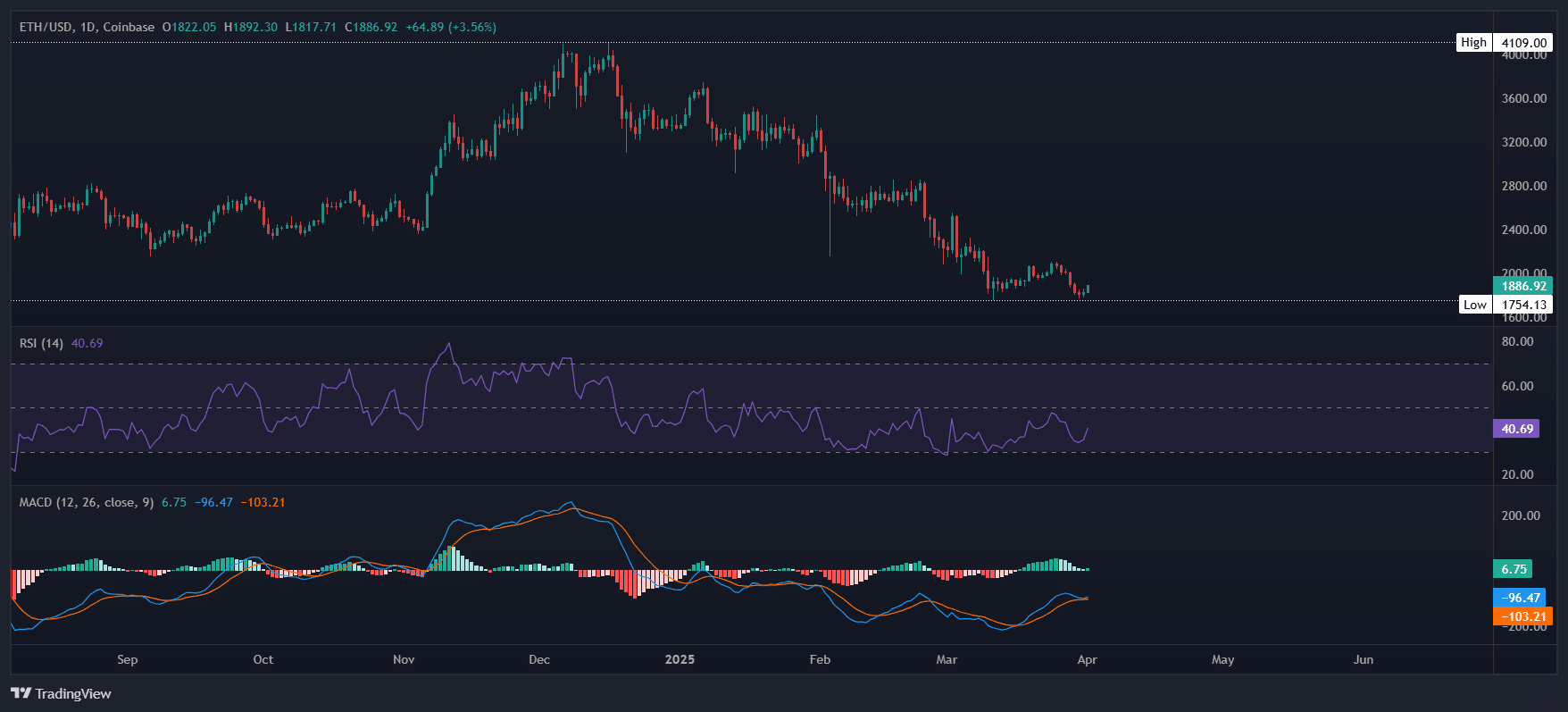

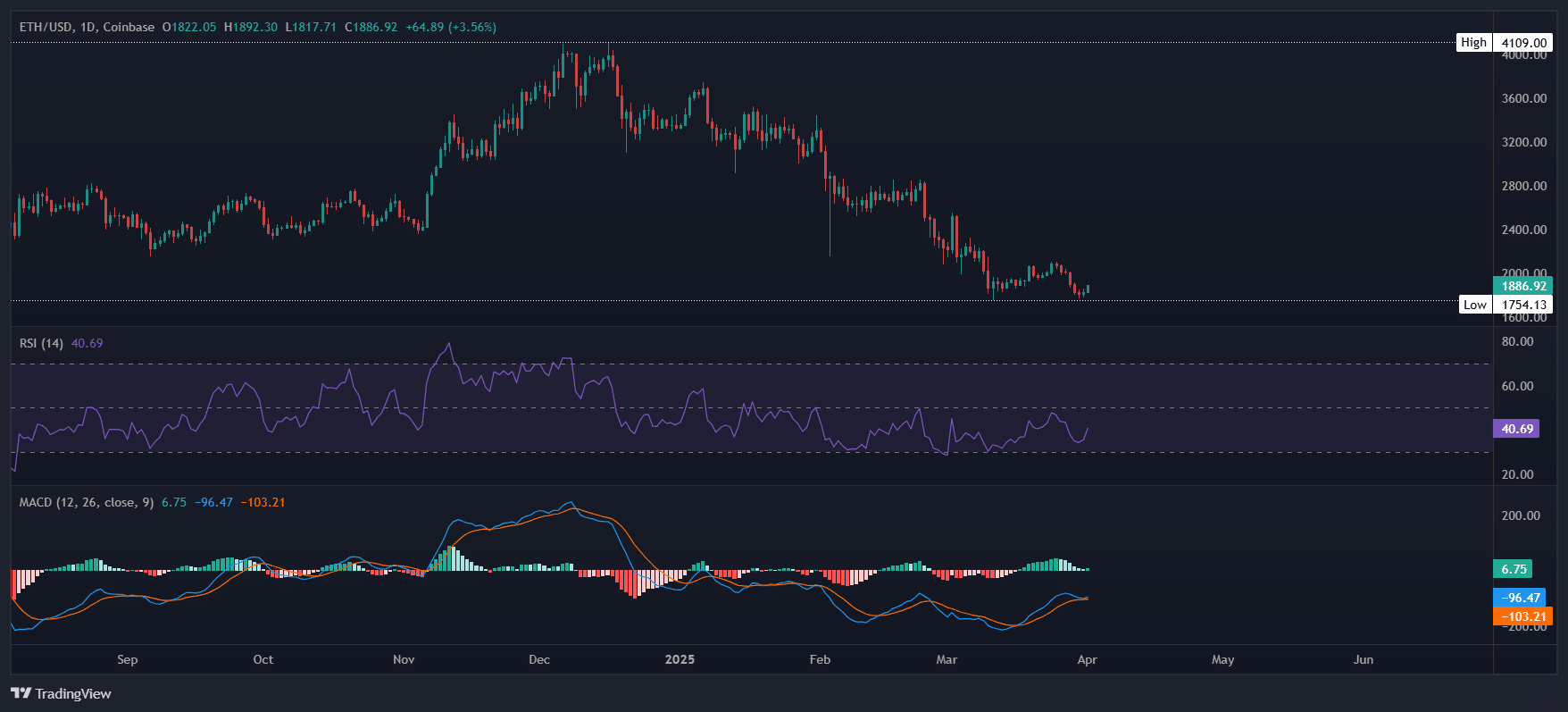

- The RSI shows signs of reversal – can ETH break key resistance and cause a full bull -run?

Ethereum’s [ETH] Network costs have fallen to a low point of five years, which indicates reduced network activity, which can influence the price. Although it is not a direct Bearish signal, the decrease in reimbursement suggests weaker Fundamentals on the chain.

However, the relative strength index (RSI) shows signs of bullish reversal. Can ETH break key resistance and fill a full bull that runs under these circumstances?

Main resistance in the midst of weak basic principles

Ethereum is traded at $ 1,886, an increase of 6% compared to the lowest point in two days, a level that is not seen in more than four months. With an increase of 23.52% in volume to $ 15.64 billion, this can indicate a classic ‘dip-buying’ opportunity.

Technical indicators are bullish: the MACD has turned positively, the RSI moves up, ETH/BTC is in the green, and Buy Orders Dominate Eternal contracts.

These factors suggest that $ 1,750 can be a local soil for ETH, with a strong rebound potential.

Source: Coinalyze (ETH/USDT)

However, a Bull Run is still premature. To enter Fomo, ETH must hold on to this pattern in the coming days. With a high risk sentiment, losing support remains a real possibility.

The network costs of Ethereum have fallen to a low-five-year low of $ 608K, a decrease of $ 18 million during the November 2024 Rally signaling of a weak demand. This is in line with the price decrease of 53% in the same period of 53%.

Of Multiple bearish signals And sharp pullbacks, ETH needs stronger basic principles and a key resistance drop. Without them, keeping the current price can be a challenge.

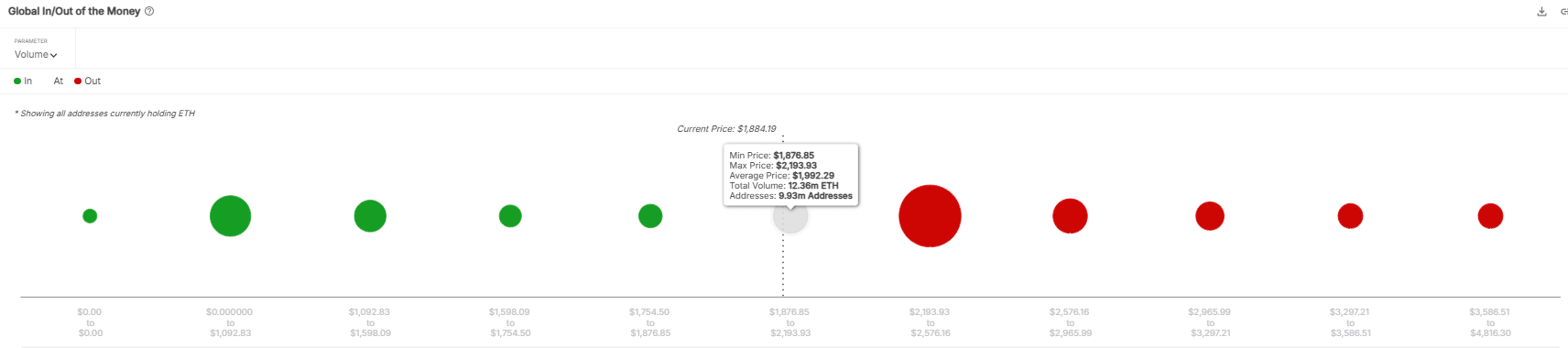

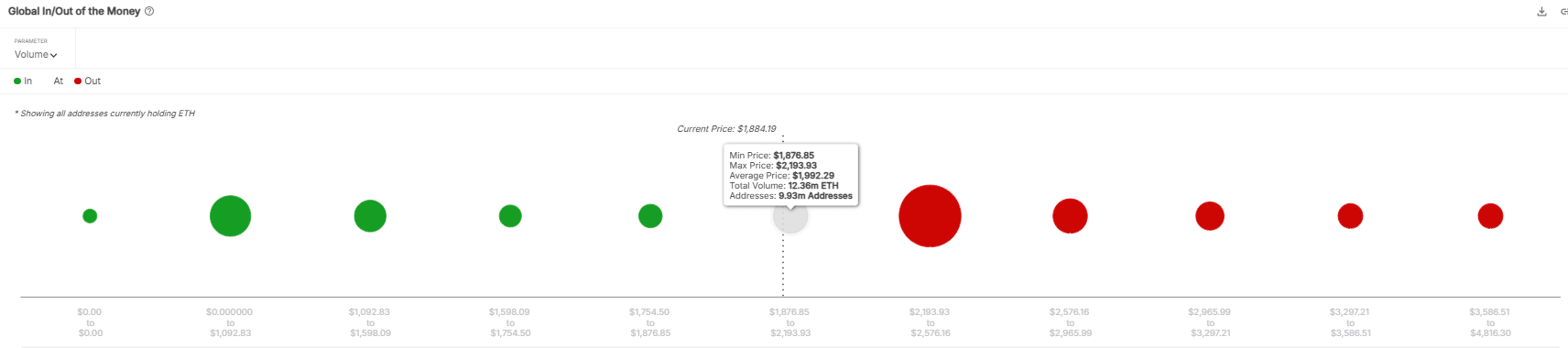

Breaking this level: the security signal for ETH

Analysts modest $ 2,100 as a critical resistance that Ethereum has to reclaim to support a bullish breakout. Not holding this level can cause a deeper correction.

Ambcrypto analysis shows that violating this barrier would push 12.36 million ETH into profit, causing $ 26 billion risk.

Source: Intotheblock

Despite Bullish Technicals, Weak question And the absence of a supply shock makes recovering this level uncertain. In fact, the most important test is not only $ 2,100 – but held above it.