- At the time of writing, more than $22 billion worth of cryptos were locked in the Ethereum network.

- Ethereum saw a sharp jump in DEX volumes.

Ethereum [ETH] retained its position as the numero uno smart contracts network over the past week, according to an X (formerly Twitter) post from the blockchain analytics protocol 0xRange.

Is your portfolio green? Check out the ETH profit calculator

Ethereum leads in DeFi

The Proof-of-Stake (PoS) blockchain was the growth engine of crypto Total Value Locked (TVL), attracting more than 75% of all deposited funds for various decentralized finance (DeFi)-related activities.

Note that Ethereum already has a well-developed ecosystem for decentralized applications (dApps) and smart contracts. In fact, it was the first protocol ever to use smart contracts.

According to DeFiLlama, at the time of writing, more than $22 billion worth of cryptos were locked up in Ethereum, more than the combined value of the funds locked up in the next ten networks on the list.

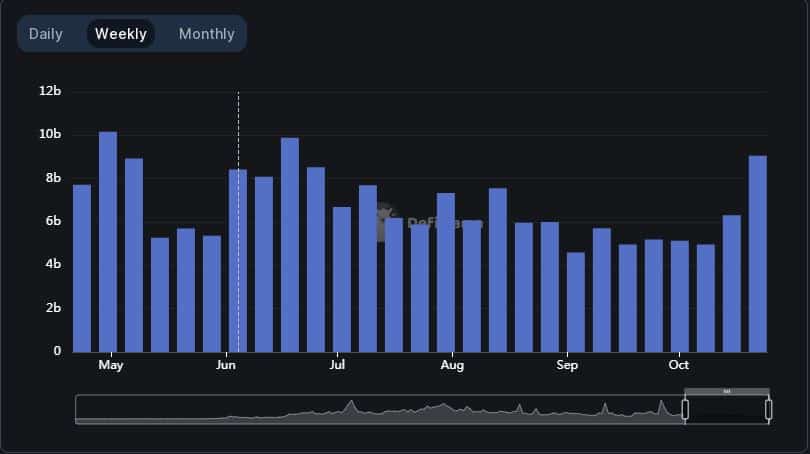

Similarly, Ethereum recorded a sharp jump in decentralized exchange (DEX) volumes. More than $9 billion worth of deals were completed through the network last week, the largest in a single week since mid-June.

Source: DeFiLlama

Network traffic jumps

The increased activity on the Ethereum chain was further evidenced by the dramatic increase in users over the past week. On average, approximately 320,000 users have accessed the network in the past seven days.

Moreover, the rapid influx of users increased the number of transactions, causing transaction costs to rise. On October 25, more than $6 million in fees were collected through the network, the highest in almost two months.

Source: DeFiLlama

Whales positive on ETH?

Meanwhile, a crypto whale showed a great appetite for ETH coins. According to data from Look at chainlent the whale with address czsamsunsb.eth 100 Wrapped Bitcoin [WBTC] of the leading lending protocol Aave [AAVE]. This amount was then exchanged for 1526 in ETH.

Moreover, they withdrew 2374 ETH from crypto exchange Binance. Soon after, they deposited 16,313 ETH, or almost $29 million at market prices, into the best lending protocols to earn interest.

Read Ethereum’s [ETH] Price forecast 2023-24

These moves suggested that the influential whale was betting big on ETH’s next moves.

At the time of publication, the second-largest crypto was exchanging hands at $1,785.62 after posting weekly gains of 5.63%. Although not as big as Bitcoin [BTC]these gains were firmly held by Ethereum.